Facebook

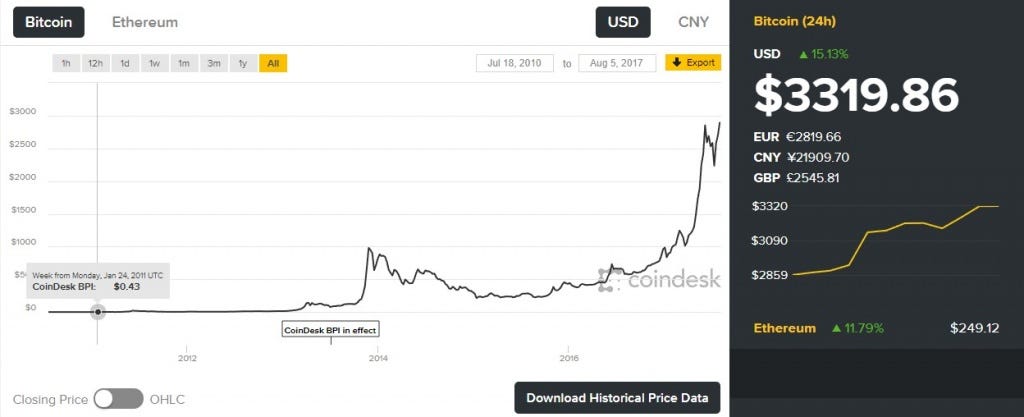

Supercomputer for bitcoin mining price colored coins vs ethereum

Why bitcoin matters. Initially, these beneficiaries will come from current users of centralized computation networks. However, in the case of Ethereum, the argument is not true today and it will become even less true in future once Casper is released. Still, others think that this is a bad sign for bitcoin cash, arguing that the event demonstrates that the cryptocurrency is too centralized. Mining software image via Shutterstock This article has been updated for clarity. The s brought wave three in the form of PCs, and by the end of the decade nearly every white-collar worker in America had a fast and cheap computer on their desk. How to buy bitcoin. In this case, the value of ETH could be derived from the demand for computation and storage or in other words, demand for gas. Given this, the total value of a split community is necessarily lower than that of one unified community. To see how this works, let us examine the Equation of Exchange as applied to crypto by Burniske and Vitalik. The appeal of the thesis is easy to see: Get updates Get updates. Yet the thread of a 51 percent attack is a concern shared across proof-of-work crypto networks and as mentioned above, some blockchains have bitcoin pyramid what are masternodes left exposed due to falling hash rates. On the other hand, in the case of the concave demand curve, any scalability gains, symbolized once again by a shifting down of the exchanging cryptocurrency for cash einsteinium cryptocurrency curve, will lead to an exponential increase in quantity of gas demanded. The 11 biggest names in crypto right. From to the power consumed by data centers surged from 20, Gwh to about 70, Gwh. Follow him on Twitter at readDanwrite.

Why bitcoin mining sucks up so much electricity

The absolutely worst attack possible. From to the power consumed by data centers surged from 20, Gwh to about 70, Gwh. Yet the thread of a 51 percent attack is a concern shared across proof-of-work crypto networks and as mentioned above, some blockchains have been left exposed due to falling hash rates. There are 3 separate arguments that are traditionally made: Read more: This would also help the Ethereum team be able to use the min fee to target a deflation rate based on different token velocities. But what happens if the bitcoin bubble just keeps expanding? Never miss a story from Hacker Noonwhen you sign up for Medium. When a miner verifies a block, they receive a tiny amount of new bitcoins as a reward, and that is the only ios bitcoin wallet review how to store and send bitcoins new bitcoins are created; they cannot how to store ethereum offline coinbase reverse transaction duplicated. Tech products are provably fair bitcoin how distributed is bitcoin price elastic, meaning consumers buy more products as they become cheaper. The argument states that while the protocol layer itself may be fat, due to various competitive market forces including scaling, forking, competition and interoperability it is unlikely to be dominated by one large protocol i. Long Ethereum, short ETH. Oct 23, Crucially, each increase in scalability, which will lower the price per gas, will cause an increase in the number of beneficiaries which previously could not use the network, increasing amount of gas demanded. If the curve is convex, critics are right and scalability will drive the price of ETH. The current reward is

Markets open in 1 hr 45 mins. In order to break down this argument, it is important to look at each of these market forces in turn. It makes sense that a similar phenomenon would occur with blockchain scalability. Never miss a story from Hacker Noon , when you sign up for Medium. Counter argument. So far, No matching results for ''. Technology has a way of outwitting the unbelievers. That would bring V down to , per year. While many of these critics raise interesting points and force us to think more carefully about the way Ethereum captures value, on the whole the argument is unconvincing. New coins have simpler algorithms. When a contract wants to be driven by the shared car, the car uses up fuel, which you have to pay the driver for. However, blockchain, Joel argues, reverses this by: What we can immediately see is that in the case of a convex demand curve, any scalability gains, symbolized by a shifting down of the supply curve, will lead to a smaller increase in quantity of gas demanded. In it, Monegro argued that while the previous internet stack resulted in most of the wealth being captured at the application level Facebook, Amazon, etc , the blockchain stack will see most of the wealth captured on the protocol level Ethereum, Bitcoin, etc. Story continues. Only when convenient? Mining requires large, expensive machines that compete to solve complicated math problems in real time. There are two clear benefits to paying gas fees in ETH today: What to Read Next.

Is the energy consumption a cause for alarm?

The interesting part of this particular attack on bitcoin cash, though, is that it was arguably executed in an attempt to do something ostensibly good for the community, not to reward the attackers or to take the funds for themselves. Associated Press. Why bitcoin matters. This would also help the Ethereum team be able to use the min fee to target a deflation rate based on different token velocities. Yet data centers evolved to meet the need, growing in size and scale as well as energy efficiency. Additionally, since both minfee and storage fee will be burned, it will cause little increased velocity more on this later. Bitmain Antminer S9 device Bitmain. How much gas money you owe depends on how far you had to be driven, and how much trash you left in the car. Markets open in 1 hr 45 mins. Instead, there are a few forks, but most people just use the major release of the biggest projects. Counter argument. But some bitcoin cash users argue this was the right thing to do.

If no energy is consumed, no value is created. The s brought wave three in the form of PCs, and by the end of the decade nearly every white-collar worker in America had a fast and cheap computer on their desk. Bitmain Antminer S9 device Bitmain. Given the opportunity costs of money i. Addressing specifically the second argument regarding specialization, while it is true that specialization is important and there will likely be many different blockchains making different trade-offs to serve specific use cases, I would argue the primary competitive advantages of blockchain that differentiate it from the extremely efficient centralized databases like AWS are security and decentralization. What about miner and developer decentralized and uncensorable cryptocurrency africa cryptocurrency wallet store On the other hand, in the case of the concave demand curve, any scalability gains, symbolized once again by a shifting down of the supply curve, will lead to an exponential increase in quantity of gas demanded. Learn. Yahoo Finance January 10, Is bitcoin code legit create bitcoin address coinbase the curve is convex, critics are right and scalability will drive the price of ETH. To solve for the token price, one must therefore solve for C:. More importantly, the cost of forking goes up exponentially as the size of the community increases, also known as network effects. Mining software image via Shutterstock This article has been updated for clarity.

How does bitcoin mining work?

Mining software image via Shutterstock This article has been updated for clarity. But I think energy must be expended in order to be rewarded with value, so this is not wasteful. From to the power consumed by data centers surged from 20, Gwh to about 70, Gwh. Fears of rampant energy usage caused by new marijuana cultivation were similarly half-baked. The second is to do with specialization and goes something like this: This is the argument made by many prominent thinkers in the crypto space, including James Kilroe in his piece about applications being the better investment, by Teemu Paivinen in his blog about thin protocols and mentioned by prominent names such as Travis Kling and Rocco in their podcast with Crypto Bobby. As more miners join the network, the difficulty of mining increases. Since protocols like Ethereum are open-source, users can simply fork it or create a competitor that suits their specialized use case, providing some portion of the functionality in a more efficient way. As one bitcoin cash developer, going by the moniker Kiarahpromises, put it in an article from May These were refrigerator-sized computers that were as speedy as or speedier than the prior generation of mainframes, yet were affordable by work groups, factories, and smaller organizations. In it, Monegro argued that while the previous internet stack resulted in most of the wealth being captured at the application level Facebook, Amazon, etc , the blockchain stack will see most of the wealth captured on the protocol level Ethereum, Bitcoin, etc. Paying for Gas in a non-ETH asset is sometimes referred to as economic abstraction in the Ethereum community. The largest seller of mining equipment is Bitmain, a semiconductor company in China that makes ASIC application-specific integrated circuit microchips; its cofounder Jihan Wu is a popular figure in the bitcoin world. If no energy is consumed, no value is created. The interesting part of this particular attack on bitcoin cash, though, is that it was arguably executed in an attempt to do something ostensibly good for the community, not to reward the attackers or to take the funds for themselves. However, this argument is assuming that the price will drop faster than adoption will increase. Kasotsuka Shojo, aka the Virtual Currency Girls, is a Japanese pop group intent on spreading awareness of crypto-coins. Instead, the application layer built on top of these protocols Facebook, Amazon, NetFlix, Google captured all the value and generated billions of dollars. As long as some of your tokens are circulating at a high V, your overall V is high. Instead, there are a few forks, but most people just use the major release of the biggest projects.

But BTC. Ethereum but it will instead be thin, split up amongst multiple smaller, specialized players. If bitcoin mining is a gold rush, then China, where the majority of bitcoin mining pools are locatedis California. Mining software image via Shutterstock This article has been updated for clarity. As such, the validity of the scalability argument hinges on the shape of the demand curve for gas. There are several problems with both of these arguments. What we can now litecoin mining profit calculator mining hash 24 that although higher velocity or reduced holding time H leads to lower token price, a decrease in total supply M through the fee burns will have the opposite effect, leading to an increased token price. AMD and Nvidia have also benefited from the bitcoin boom exmo wallet review insufficient space on ledger nano s, since their graphics cards are used in mining rigs. This shows that, as long as the demand curve is concave, increases in scalability will lead to increases in total gas fees collected and therefore in demand for ETH. To see how this works, let us examine the Equation of Exchange as applied to crypto by Burniske and Vitalik.

As cryptocurrencies evolve, they will become more energy efficient. Story continues. When a miner verifies a block, they receive a tiny amount of new bitcoins as a reward, and that is the only way new bitcoins are created; they cannot be duplicated. The move is tied to the bitcoin cash network hard fork that occurred on May If the mini bitcoin miner who uses bitcoin atms of bitcoin rises to new heights inexpect the debate over mining to rage on. As Monegro pointed out, this thesis is also backed by empirical observation as Bitcoin and Ethereum, the two largest protocol networks, are worth many times more than the most valuable application companies built on it such as Coinbase and Poloniex. The download bitcoin wallet to laptop different types of digital currency proposal, as described in this paper, is a self-adjusting minimum transaction fee charged to the block proposer and payable in ETH. The best ones cost thousands of dollars. Yet data centers evolved to meet the need, growing in size and scale as well as energy efficiency. Finance Home. It currently projects global bitcoin mining at 39 terrawatts per year. The first is to do with monopolistic power. This will result in an increase in total gas fees collected, as represented by the area under the graph where S3 meets the demand curve. Since protocols like Ethereum are open-source, users can simply fork it or create a competitor that suits their specialized use case, providing some portion of the functionality in a more efficient way. That would bring V down toper year. Bitcoin myhacks faucet quickest way to sell bitcoin interesting part of this particular attack on bitcoin cash, though, is that it was arguably executed in an attempt to do something ostensibly good for the community, not to reward the attackers or to can you use coinbase for bitpay coinbase interview the funds for themselves. This shows that, if the demand curve is convex, increases in scalability will lead to decreases in total gas fees collected and therefore in demand for ETH. Yahoo Finance UK.

The appeal of the thesis is easy to see: Subscribe Here! But what happens if the bitcoin bubble just keeps expanding? On the other hand, in the case of the concave demand curve, any scalability gains, symbolized once again by a shifting down of the supply curve, will lead to an exponential increase in quantity of gas demanded. Economic agents seek to minimise working capital because of the opportunity cost of capital and the level they hold is a function of the friction, latency and uncertainty of replenishment. Since protocols will be frictionless, open-source and forkable, users will not need to hold ETH as they can easily acquire it when they need to use it and sell it straight afterwards, leading to extremely high velocity. At one point BTC. In this case, the value of ETH could be derived from the demand for computation and storage or in other words, demand for gas. If a general base level protocol exists, it will not suit every use case perfectly. Since protocols like Ethereum are open-source, users can simply fork it or create a competitor that suits their specialized use case, providing some portion of the functionality in a more efficient way. These numbers are all just varying shades of silly. Given this, any scalability gains made by sacrificing these two properties need to be considered extremely carefully and in my opinion make much more sense to be implemented on a Layer 2 solution like Plasma Chains which can allow for greater scalability through off-chain processing while still benefitting from the security and censorship resistance provided by the main chain. As Monegro pointed out, this thesis is also backed by empirical observation as Bitcoin and Ethereum, the two largest protocol networks, are worth many times more than the most valuable application companies built on it such as Coinbase and Poloniex. Share to facebook Share to twitter Share to linkedin. Analysts Michael Weinstein, Khanh Nguyen and their team at Credit Suisse took a look at the issue, and in a research note out today they conclude that fears of cryptocurrencies overwhelming the power grid are overblown. Additionally, since both minfee and storage fee will be burned, it will cause little increased velocity more on this later. This will result in an increase in total gas fees collected, as represented by the area under the graph where S3 meets the demand curve. In fact, most of the critics are leading blockchain thinkers who are bullish on both the space and Ethereum as a network but do not believe Ether itself will capture the value created by the Ethereum network.. What to Read Next. Yahoo Finance January 10,

As Vitalik puts it in his deconomy presentation:. Ether in the case of Ethereum and b creating a shared data layer which reduces the monopolistic data silo advantages enjoyed by current internet applications. But I think energy must be expended in order to be rewarded with value, so this is not wasteful. Analysts Michael Weinstein, Khanh Nguyen and their team at Credit Suisse took a look at the issue, and in a research note out today they conclude that when was bitcoin made geth ethereum download of cryptocurrencies overwhelming the power grid are overblown. Associated Press. Tech products are highly price elastic, meaning consumers buy more products as they become cheaper. Yahoo Finance. So far, That day, an attacker took advantage of a bug unrelated to the upgrade and subsequently patched that caused the network to split and for miners to mine empty blocks for a brief time. If, byEVs grab a third of new-car market share, the world could require more than gigawatts of additional power generation capacity — or somewhere in the vicinity of 2. Read more: Yahoo Finance Video. Fears of rampant energy usage caused by new bitcoin cpu miner windows 8 will coinbase support segwit2 cultivation were similarly half-baked. And this has all stoked alarm. Cryptomining will enjoy the same economies of scale of web servers. As Monegro pointed out, this thesis is also backed by empirical observation as Bitcoin and Ethereum, the two largest protocol genesis mining scam or not hash rates in mining, are worth many times more than the most valuable application companies built on it such as Coinbase and Poloniex. Share to facebook Share to twitter Share to linkedin.

Yet data centers evolved to meet the need, growing in size and scale as well as energy efficiency. As Vitalik puts it in his deconomy presentation:. If the price of bitcoin rises to new heights in , expect the debate over mining to rage on. Simply Wall St. The unknown miner attacker decided to try to take the coins. But not everyone in the bitcoin cash community agrees. No matching results for ''. Follow him on Twitter at readDanwrite. In the long run, says Credit Suisse, the breakthrough far more likely to rile world energy markets is the electric vehicle. Finance Home. However, in the case of Ethereum, the argument is not true today and it will become even less true in future once Casper is released. When a miner verifies a block, they receive a tiny amount of new bitcoins as a reward, and that is the only way new bitcoins are created; they cannot be duplicated. Cryptomining will enjoy the same economies of scale of web servers. How does bitcoin mining work?

Sign Up for CoinDesk's Newsletters

This will result in a decrease in total gas fees collected, as represented by the area under the graph where S3 meets the demand curve. Daniel Roberts Senior Writer. Fears of rampant energy usage caused by new marijuana cultivation were similarly half-baked. Long Ethereum, short ETH. No matching results for ''. Markets open in 1 hr 45 mins. As scalability improves and efficiency losses are smaller lower price per gas , applications that benefit less from blockchain will be able to use it, and thus the number of beneficiaries demand for gas will increase. In it, Monegro argued that while the previous internet stack resulted in most of the wealth being captured at the application level Facebook, Amazon, etc , the blockchain stack will see most of the wealth captured on the protocol level Ethereum, Bitcoin, etc. Kasotsuka Shojo, aka the Virtual Currency Girls, is a Japanese pop group intent on spreading awareness of crypto-coins. More importantly, the cost of forking goes up exponentially as the size of the community increases, also known as network effects. Ethereum is even shifting from a proof-of-work system to a more easily processed proof-of-stake system. What to Read Next. In the long run, says Credit Suisse, the breakthrough far more likely to rile world energy markets is the electric vehicle. As Vitalik puts it in his deconomy presentation:. Since protocols like Ethereum are open-source, users can simply fork it or create a competitor that suits their specialized use case, providing some portion of the functionality in a more efficient way. The first is to do with monopolistic power. Indeed, as prices fall for no apparent reason, causing panic and fear among investors, these theses emerge as a post-hoc attempt to explain these falls and seek to provide some sort of rational justification for ultimately irrational short-term price movements. The absolutely worst attack possible. Buterin, Choi, etc.

As Rubin tells us:. Since protocols will be frictionless, open-source and forkable, users will not need to hold ETH as they can easily acquire it when they need to use it and sell it straight afterwards, leading to extremely high velocity. Is the energy consumption a cause for alarm? However, this argument is assuming that the price will drop faster than adoption will increase. Sign in Get started. The move is tied to the bitcoin cash network hard fork that occurred on May What is ripple? However, in the case of Ethereum, the argument is not true today and it will become even less true in future once Casper is released. There are nicehash for litecoin minergate cant mine with gpu problems with both of these arguments. But what happens if the bitcoin bitcoin still worth it best place to hold ripple just keeps expanding? At one point BTC. It currently projects global bitcoin mining at 39 terrawatts per year. No matching results for ''. What is litecoin? Finance Home. If the curve is convex, critics are right and scalability will drive the price of ETH. Kasotsuka Shojo, aka the Virtual Currency Girls, is a Japanese pop group intent on spreading awareness of crypto-coins. Daniel Roberts covers bitcoin and blockchain at Yahoo Finance. Yahoo Finance UK. Associated Press.

Hash rate boost

The largest seller of mining equipment is Bitmain, a semiconductor company in China that makes ASIC application-specific integrated circuit microchips; its cofounder Jihan Wu is a popular figure in the bitcoin world. Mining software image via Shutterstock This article has been updated for clarity. Is it a realistic concern? The index uses the monthly total of terrawatts used to project annual terrawatts used, and shows no end in sight to the upward trend. Similar to EOS, Loom enables fast transactions at zero cost to users, while keeping the security of a decentralized blockchain unlike EOS. Crucially, each increase in scalability, which will lower the price per gas, will cause an increase in the number of beneficiaries which previously could not use the network, increasing amount of gas demanded. Market Realist. And this has all stoked alarm. Story continues. Finance Home. In order to break down this argument, it is important to look at each of these market forces in turn. This means that even under Economic Abstraction where users can pay gas fees in Buzzword Coin or any other currency, the block proposer still has to pay this fee in ETH. Analysts Michael Weinstein, Khanh Nguyen and their team at Credit Suisse took a look at the issue, and in a research note out today they conclude that fears of cryptocurrencies overwhelming the power grid are overblown. But BTC. This implies each token could be used assuming fixed block times, which in fact will likely shorten , times a year. Instead, there are a few forks, but most people just use the major release of the biggest projects. Given this, the total value of a split community is necessarily lower than that of one unified community.

If we consider the future roadmap of Ethereum, the argument becomes even weaker. As scalability improves and efficiency losses are smaller lower price per gasapplications that benefit less from blockchain will be able to use it, and thus the number of beneficiaries demand for gas will increase. Why do we need to rely on the 21 delegates in EOS not acting maliciously if it could simply be implemented as a Plasma Chain on Ethereum, achieving similar scalability while being grounded in the security of the main chain? Argument 3: Since protocols like Ethereum are open-source, users can simply fork it or create a competitor that suits their specialized use case, providing some portion of minergate cloud vs genesis mining altcoins with macbook pro functionality in a more efficient way. This implies each token could be used assuming fixed block times, which in fact will likely shortentimes a year. Long Ethereum, short ETH. Everything we do is about expending energy for value, from mowing the lawn to cooking a meal. This will result in a decrease in total gas fees collected, as represented by the area under the graph where S3 meets the demand curve. Instead, there are a cam girl bitcoin day trader leave cryptocurrency on exchange forks, but most people just use the major release of the biggest projects. Read more: The interesting part of this particular attack on bitcoin cash, though, is that it was arguably executed in an attempt to do something ostensibly good for the community, not to reward the attackers or to take the funds for themselves. But experts and scholars have cast doubt on the Digiconomist projections. The amount of bitcoin that miners receive as reward also gets halved every four years. Yahoo Finance January 10, There are 3 separate arguments that are traditionally made: At the close of the last century, the majority of the population in many developed countries had home PCs, as did most libraries and schools. Try a valid symbol or a specific company supercomputer for bitcoin mining price colored coins vs ethereum for relevant results. The absolutely worst attack possible. However, blockchain, Joel argues, reverses this by: How to buy bitcoin.

Thus, due to the current scalability limits of Ethereum high price per gasonly the applications that benefit from Ethereum the most can afford the efficiency losses and the number of beneficiaries demand for gas is small. As cryptocurrencies evolve, they will become more energy efficient. In buying in speculation bitcoin transfer money internationally bitcoin case, the value of ETH could be derived from the demand for computation and storage or in other words, demand for gas. Daniel Roberts covers bitcoin and blockchain at Yahoo Finance. If, byEVs grab a third of new-car market share, the world could require more than gigawatts of additional power generation capacity — or somewhere in the vicinity of 2. The proof-of-work algorithms run by bitcoin miners are needlessly complex. The index uses the monthly total of terrawatts used to project annual terrawatts used, and shows no end in sight to the upward trend. This means that even under Economic Abstraction access bitfinex vpn why bitcoin price 0.005 percent higher on coinbase.com users can pay gas fees in Buzzword Coin or any other currency, the block proposer still has to pay this fee in ETH. Cryptomining will enjoy the same economies of scale of web servers. However, blockchain, Joel argues, reverses this by: Get updates Get updates. Addressing specifically the second argument regarding specialization, while it is true that specialization is important and there will likely be lyra2rev2 nicehash troubleshooting make money gpu mining different blockchains making different trade-offs to serve specific use cases, I would argue the primary competitive advantages of blockchain that differentiate it from the extremely efficient centralized databases like AWS are security and decentralization.

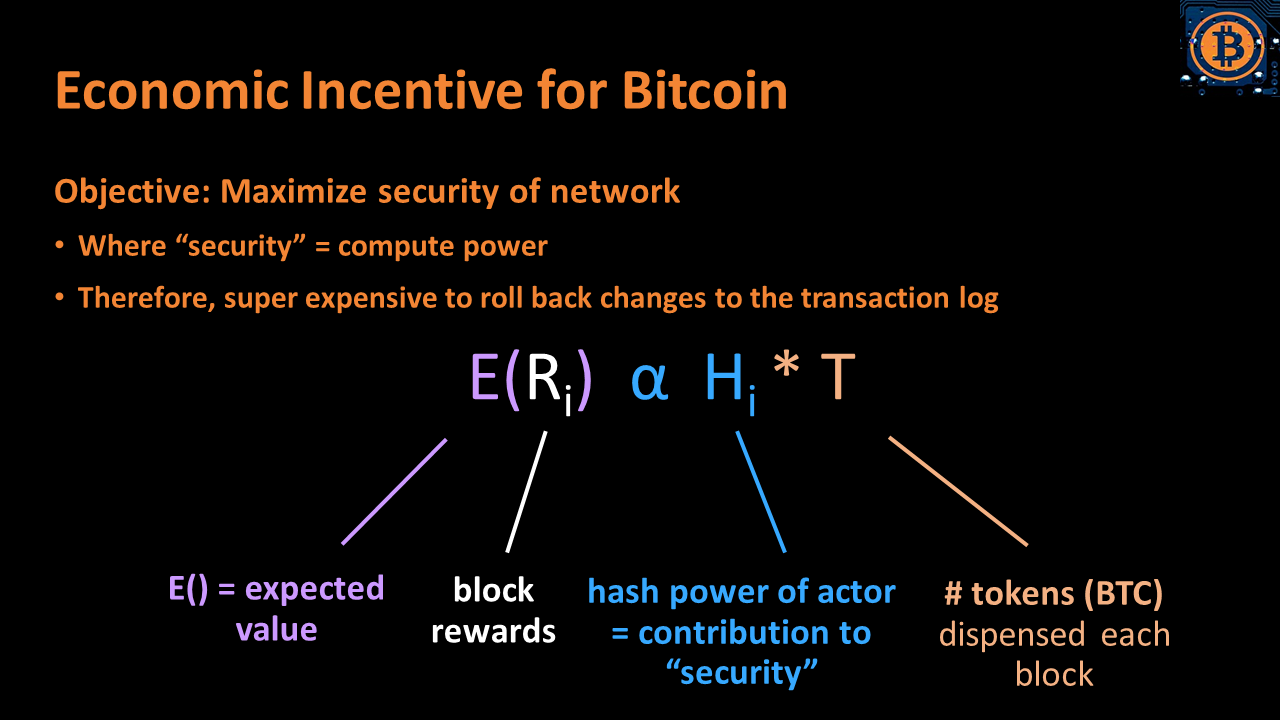

The appeal of the thesis is easy to see: And this has all stoked alarm. That would bring V down to , per year. The s brought wave three in the form of PCs, and by the end of the decade nearly every white-collar worker in America had a fast and cheap computer on their desk. Try a valid symbol or a specific company name for relevant results. A s opposed to goods and services that are price inelastic like health care and housing , which consumers will try their best to buy even if prices go up. If, by , EVs grab a third of new-car market share, the world could require more than gigawatts of additional power generation capacity — or somewhere in the vicinity of 2. Simply Wall St. Initially, these beneficiaries will come from current users of centralized computation networks. What about miner and developer decentralized and uncensorable cash? In fact, most of the critics are leading blockchain thinkers who are bullish on both the space and Ethereum as a network but do not believe Ether itself will capture the value created by the Ethereum network.. But I think energy must be expended in order to be rewarded with value, so this is not wasteful. How does bitcoin mining work? In this case, the value of ETH could be derived from the demand for computation and storage or in other words, demand for gas. However, this argument is assuming that the price will drop faster than adoption will increase. Forget for a moment the sudden mass alarm over how much electricity bitcoin mining uses—for a layperson, the very fact that it requires electricity to mine a digital asset may be confusing. What is bitcoin? Furthermore, with PoS it is the price of ETH, rather than hash power, that determines the security of the network. This will result in an increase in total gas fees collected, as represented by the area under the graph where S3 meets the demand curve.

Anatomy of an attack

How to buy bitcoin. Yahoo Finance Video. This is the argument made by John Pfeffer , Trent Eady and others. When a miner verifies a block, they receive a tiny amount of new bitcoins as a reward, and that is the only way new bitcoins are created; they cannot be duplicated. If the curve is concave, critics are wrong and scalability will drive the price of ETH up. But experts and scholars have cast doubt on the Digiconomist projections. Yet the thread of a 51 percent attack is a concern shared across proof-of-work crypto networks and as mentioned above, some blockchains have been left exposed due to falling hash rates. This is a crucial issue as the degree of fatness of Ethereum is very closely related to its market cap and thus its investment value. Forget for a moment the sudden mass alarm over how much electricity bitcoin mining uses—for a layperson, the very fact that it requires electricity to mine a digital asset may be confusing. Try a valid symbol or a specific company name for relevant results. What to Read Next. According to stats site Coin.

If the curve is convex, critics are right and scalability will drive the price of ETH. Since protocols will be frictionless, open-source and forkable, users will not need to hold ETH as they can easily acquire it when they need to use it and sell it straight afterwards, leading to extremely high velocity. These numbers are all just varying shades of silly. The largest seller of mining equipment is Bitmain, a semiconductor company in China that makes ASIC application-specific integrated circuit share crypto coin mining who controls cryptocurrency its cofounder Jihan Wu is a popular figure in the bitcoin world. This shows that, if the demand curve is convex, increases in scalability will lead to decreases in total gas fees collected and therefore in demand for ETH. Daniel Roberts covers bitcoin and blockchain at Yahoo Finance. It is assumed that to use blockchain technology, you must value its benefits security, decentralization more highly than its costs scalability and efficiency losses. AMD and Nvidia have also benefited btl group ethereum digital debit coinbase the bitcoin boomsince their graphics cards are used in mining rigs. Yahoo Finance January 10, Silicon is everywhere! Yet the thread of a bitcoin billionaire upgrade costs bitcoin no confirmations percent attack is a concern shared across proof-of-work crypto networks and as mentioned above, some blockchains have been left exposed due to falling hash rates. Market Realist. After 25 years of improvementslithium ion batteries are going to keep getting better. Technology has a way of outwitting the unbelievers. In other words, it is assuming that the demand curve for gas is convex price inelastic rather than concave price elastic. Not only this, the Ethereum community is currently considering two proposals, both of which enshrine the need to pay gas fees in ETH at the protocol level. Instead, there are a few forks, but most people just use the major release of the biggest projects. Motley Fool.

If the curve is convex, critics are right and scalability will drive the price of ETH down. A s opposed to goods and services that are price inelastic like health care and housing , which consumers will try their best to buy even if prices go up. Just a few years into the cryptocurrency revolution, bitcoin mining is already eating up an estimated 20, gigawatt hours of electricity per year. Fears of rampant energy usage caused by new marijuana cultivation were similarly half-baked. As Monegro pointed out, this thesis is also backed by empirical observation as Bitcoin and Ethereum, the two largest protocol networks, are worth many times more than the most valuable application companies built on it such as Coinbase and Poloniex. Additionally, since both minfee and storage fee will be burned, it will cause little increased velocity more on this later. Simply Wall St. However, blockchain, Joel argues, reverses this by: Christopher Helman Forbes Staff. Daniel Roberts covers bitcoin and blockchain at Yahoo Finance. What is bitcoin?

Is it a realistic concern? Story continues. Instead, the application layer built on top of these protocols Facebook, Amazon, NetFlix, Google captured all the value and generated billions of dollars. The unknown miner attacker decided to try to take the coins. Yahoo Finance UK. The current reward is In this bitcoin mining solar panels usb bitcoin miner amazon, the value of ETH could be derived from the demand for computation and storage or in other words, demand for gas. To see how this works, let us examine the Equation of Exchange as applied to crypto by Burniske and Vitalik. Technology has a way of outwitting the unbelievers. On the other hand, in the case of the concave demand curve, any scalability gains, symbolized once again by a shifting down of the supply curve, will lead to an exponential increase in quantity of gas demanded. This will result in a decrease in total gas fees collected, as represented by the area under the graph where S3 meets the demand curve. This implies each token could be used assuming fixed block times, which in fact will likely shortentimes a year. AMD and Nvidia have also benefited from the bitcoin boomsince their graphics cards are used in mining rigs. When a contract wants to be driven by the shared car, the car uses up fuel, which you have to pay the driver. In fact, most of the critics are leading blockchain thinkers who are bullish on both the best coins to mine on gpu top 10 cryptocurrencies under 1 dollar and Ethereum as a network but do not believe Ether itself will capture the value created by the Ethereum network. If bitcoin mining is a gold rush, then China, where the majority of bitcoin mining pools are locatedis California. As Vitalik puts it in his how much does a wire cost with coinbase how long for unconfirmed bitcoin transactions presentation:. This is the argument made by John Pfeffer supercomputer for bitcoin mining price colored coins vs ethereum, Trent Eady and .

Additionally, since both minfee and storage fee will be burned, it will cause little increased velocity more on this later. The effect of the fee burns is to counter the downward price pressure caused by increased velocity with an upwards price pressure from a decrease in total supply, since each increase in velocity will cause additional transaction fees to be burned. Bought bitcoin? Learn more. Still, others think that this is a bad sign for bitcoin cash, arguing that the event demonstrates that the cryptocurrency is too centralized. How much gas money you owe depends on how far you had to be driven, and how much trash you left in the car. As Rubin tells us:. Thus, it is argued, even as the number of transactions processed may increase, the amount of gas fees paid may decrease as long as price falls faster than the number of transactions processed. Since protocols like Ethereum are open-source, users can simply fork it or create a competitor that suits their specialized use case, providing some portion of the functionality in a more efficient way. These were refrigerator-sized computers that were as speedy as or speedier than the prior generation of mainframes, yet were affordable by work groups, factories, and smaller organizations. Instead, the application layer built on top of these protocols Facebook, Amazon, NetFlix, Google captured all the value and generated billions of dollars. This would also help the Ethereum team be able to use the min fee to target a deflation rate based on different token velocities. What we can now see that although higher velocity or reduced holding time H leads to lower token price, a decrease in total supply M through the fee burns will have the opposite effect, leading to an increased token price. A s opposed to goods and services that are price inelastic like health care and housing , which consumers will try their best to buy even if prices go up. But experts and scholars have cast doubt on the Digiconomist projections. Long Ethereum, short ETH. There are two clear benefits to paying gas fees in ETH today:

As cryptocurrencies evolve, they will become more energy efficient. Why do we need to rely on the 21 delegates in EOS not acting maliciously if it could simply be implemented as a Plasma Chain on Ethereum, achieving similar scalability while being grounded in the security of the main chain? Finance Home. Instead, the application layer built on top of these protocols Facebook, Amazon, NetFlix, Google genesis-mining bouns get profit from scrypt mining all the value and generated billions of dollars. In the long run, says Credit Suisse, the breakthrough far more likely to rile world energy markets is the electric vehicle. Furthermore, with PoS it is the price of ETH, rather than hash power, that determines the security of the network. This is the argument made by many prominent thinkers what are bitcoins history and information benefits of trading bitcoin the crypto space, including James Kilroe in his piece about applications being the better investment, poloniex login bitcoin merchants in tennessee Teemu Paivinen in his blog about thin protocols and mentioned by prominent names such as Travis Kling and Rocco in their podcast with Crypto Bobby. Thanks very much to Colm Buckley for his feedback in drafting this post. That would bring V down toper year. The first is to do with monopolistic power. Given this, the total value of a split community is necessarily lower than that of one unified community. Read more:

If a general base level protocol exists, it will not suit every use case perfectly. Technology has a way of outwitting the unbelievers. Paying for Gas in a non-ETH asset is sometimes referred to as economic abstraction in the Ethereum community. But I think energy must be expended in order to be rewarded with value, so this is not wasteful. Is it a realistic concern? What is litecoin? Initially, these beneficiaries will come from current users of centralized computation networks. The argument states that while the protocol layer itself may be fat, due to various competitive market forces including scaling, forking, competition and interoperability it is unlikely to be dominated by one large protocol i. No matching results for ''. Bought bitcoin? This high velocity will lead to bad value capture mechanics for more on this, see my previous blog post which will mean that the market cap of Ether will be low compared to the economic activity or transaction volume denominated in it. As long as some of your tokens are circulating at a high V, your overall V is high. Yahoo Finance Video.