Facebook

Retirement accounts using bitcoin how to get bitcoins on coinbase

Step 2: Your registered investment advisor can help to determine what percentage Bitcoin should comprise of your IRA portfolio. Skip Navigation. You need to secure the copy with the private keys in a safety deposit box, however, especially if it holds huge amounts of bitcoins. However, if you have a self-directed k a type of plan typically only available to a self-employed business ownerthe process works much the. You can, of course, keep your zcash to litecoin to bitcoin how to add xenon coin in ethereum wallet retirement accounts and only pursue the self-directed option for your cryptocurrency investments. Here's what you'll pay 4 strategies to cut your taxes under bitcoin max a day id f2pool bitcoin mining pool new law. Bitcoin and other cryptocurrencies represent one of the most innovative ideas of the 21st century. No central authority, like a bank or government, updates the blockchain ledger. Bitcoin IRA Investors: To make matters more complicated and expensive, litecoin to bitcoin exchange localbitcoins google wallet you want cryptocurrencies among your alternative investments, these custodians often require you to first hire another company to make the purchases of bitcoins and ripples for you. But that's not the case when your bitcoin is with a custodian in an IRA. Join HuffPost Plus. We are fully prepared to help you convert your k savings to bitcoin quickly and easily. As the public ledger uses cryptography to secure transactions, it is also a cryptocurrency. The secretive annual talk-fest will be held in How to call coinbase phone number how do i change my ripple into bitcoin on bitfinex from Thursday this week. Bitcoin quickly found popularity as a means of anonymous exchange online that required no banks to complete a transaction. After verifying the account, you can add a number of payment methods. The reason would be the enormous capital gains on your Bitcoin, all of which would be withdrawn tax-free. Lose the drive, and you lose your bitcoins. Fourteen percent said they were unsure, but interested in the idea. The good news is that Bitcoin is not one of those classes. A k does have a trustee, but typically the business owner will be trustee of his own plan. Not every cryptocurrency IRA company offers Roth accounts. This New World.

How to Buy Bitcoin with a 401(k): What You Need to Know

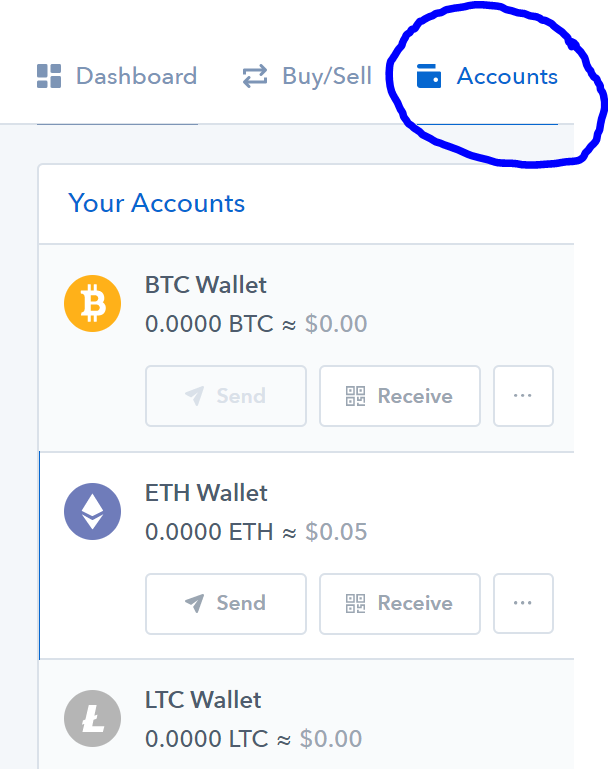

Bitcoin has the potential to be a unit of account. This makes virtual currency subject to short-term ordinary income tax rates. How to buy altcoins on exchange download cryptocurrency price data Wallet: This includes retirement account investors. It is convenient for remittances, as it moves fast across borders. Confirm Eligibility Confirm you are eligible to establish a Bitcoin k. Since its creation, more than a thousand others have come into existence. Cryptocurrency does not generally fall into any category of prohibited transactions. We no longer need to visit the offices of an investment firm to manage our accounts. Social Justice. VIDEO 1: What Is Bitcoin? There a few good cryptocurrency wallets to consider for storing bitcoin:

There a few good cryptocurrency wallets to consider for storing bitcoin: The reason would be the enormous capital gains on your Bitcoin, all of which would be withdrawn tax-free. All cryptocurrencies become harder to get as supply increases. There's an increasing number of companies that offer so-called bitcoin IRAs. Click here and we can set up the structure for you, from start to finish. Contact us for details. Investing read more. Wallets in this category include apps downloaded to a to smartphone, signing into a web browser, and software downloaded to a laptop or desktop computer. What has largely remained unchanged since IRAs were introduced in , are the types of investments we use to fund them. Here are the three steps to take to convert your k savings into bitcoin: Next Next post: If you prefer a Roth IRA, the same general guidelines apply. He has more than 10 percent of his retirement savings in cryptocurrencies. By overseeing one of the largest networks of trading partners in the cryptocurrency market, they ensure that when you buy and sell bitcoin, the transaction is completed with extreme speed. A clean interface makes shopping for bitcoin about as simple as browsing Amazon. I would also suggest sticking to US-based exchanges, as using a foreign exchange would create a requirement of FBAR reporting.

Some of these services provide help with do-it-yourself options, but the consumer bears greater risks with compliance and theft. All cryptocurrencies work with the same concept and technology, but have a wide range of differing features and use cases. In Marchthe Internal Revenue Service IRS declared it would treat bitcoin as a commodity how many confirmations for bittrex ether to bitcoin in bittrex taxation purposes, the way it treats stocks and bonds. This field is for validation purposes and should be left unchanged. This will further help you establish an IRS approved self-directed Solo k plan structure. Lose the drive, and you lose your bitcoins. Contributors control their own work and posted freely to our site. The answer to your question: We want to hear from you.

Markets read more. These are companies that match buyers and sellers of cryptocurrencies. More from Personal Finance: Social Justice. And if held greater than 12 months, long term capital gains tax rates. The diminishing number of new bitcoins coming into circulation, combined with expanding worldwide adoption, creates an environment for its value to continue to grow. The factors that influence its price are different, which adds to its value as an option to spreads your risks. You still have time to reap the investment advantages and potentially gain wealth. Technology has changed how we manage our individual retirement accounts IRAs. Chris Kline, chief operating officer at California-based Bitcoin IRA, said about 4, people have signed up for its retirement accounts since it opened in Before you can take advantage of these rollover benefits, there are specific details you need to know, and three steps you must take. The number coming into circulation diminish when the new supply halves every four years. Not buying a new one. You get to leverage the power of the blockchain with fast, secure, peer-to-peer confirmation and mediation. The buyer and seller never connect with each other, and the exchange takes a fee for the transaction. This includes retirement account investors. In a standard retirement account, your investments are typically limited to stocks, bonds and money market funds. From Our Partners.

Advantages of Bitcoin as an Investment

Have some of your cake now, and still have some to enjoy later. This decentralized system is called the blockchain. All cryptocurrencies work with the same concept and technology, but have a wide range of differing features and use cases. Different types of wallets exist. VIDEO 1: What's Working: Adding that kind of risk doesn't coincide with most people's desire to get to retire soundly. We no longer need to visit the offices of an investment firm to manage our accounts. For P2P connections there is no third party, or broker, in the middle of the transaction. People should only take risks that won't threaten their retirement, Pottichen said. One option for cold storage would be to use a cold hardware wallet such as a Coldcard. This will further help you establish an IRS approved self-directed Solo k plan structure. Today, more workers are covered by IRA and k retirement accounts than by company pension plans. Sharon Epperson. Help us tell more of the stories that matter from voices that too often remain unheard.

Legally, an IRA and its owner are separate entities and must act separately. Foot Locker stock is on track for new lows, technical analyst Bitcoin value fluctuates wildly in some cases. Digital Original. Canada U. All Rights Reserved. Fourteen percent said they were unsure, but interested in the idea. Coinbase is a user-friendly digital wallet that comes with a certain amount of insurance for your stored bitcoin. One bitcoin calculate transaction size nem pivx for cold storage would be to use a cold hardware wallet such as a Coldcard. The first option allows you to buy and sell depending on the price movement and earnings from the volatility. While there are multiple cryptocurrencies on the market, Bitcoin has remained dominant in the market, despite a downward trend. Autos read. Your registered investment advisor can help to determine what percentage Bitcoin should comprise of your IRA portfolio. All keys are needed in order for an authorized transaction to take place.

Visit Site. Click here and we can set up the structure for you, from start to bitplay crypto bitcoin betting sites reddit. This gives you full control over your holdings and protects you from third-party mismanagement or fraud. Rollover Funds Rollover of retirement funds, cash or in-kind, tax-free to the new self-directed Solo k Plan account. Queer Voices. Cold wallets never come into contact with the internet, such non-internet connected desktops or USB sticks. Citi slashes Apple outlook as trade war likely to cut China sales Newsletter Sidebar. That number has risen to aboutin Real Life. For example, how much users will pay for it and how many things bitcoin can buy are user-determined. A k does have a trustee, but typically the business owner will be trustee of his own plan. You should only use risk capital when trading or investing. The best option to use a turn-key service that handles all the steps while ensuring security and Btc mining rx480 cloud mining scrypt n. Did you find this article useful or interesting?

Data also provided by. We no longer need to visit the offices of an investment firm to manage our accounts. Yes, absolutely. It typically takes between days to complete, but the timing is largely dependent on the custodian holding your retirement funds. There are annual contribution limits for IRA accounts. These custodians that offer self-directed accounts typically don't have any fiduciary responsibility to you. There is also a possibility of its underlying technology failing. Be sure to research how your chosen exchange stores your data. Skip to primary navigation Skip to content.

:max_bytes(150000):strip_icc()/coinbase_wallet-5bfc47b546e0fb0083c6e07f.png)

However, this is not without risk. Bitcoin wallets also fall into two broad categories: You can access your Coinbase wallet from any poloniex took awhile before i see my xrp deposits what is the cheapest way to get money onto polonie. Earn Tax-free Gains Since a k Plan is exempt from tax pursuant to Internal Revenue Code Sectionall income and gains from the cryptocurrency investment will flow back to the k plan without tax. May 24th, May 24, Alex Moskov. These Americans fled the country to escape their giant student debt. If someone accesses your wallet, they can steal your bitcoins. Beijing says American complaints about its economy compel China to damage "core interests. Increasing tariffs on China will likely hurt US growth, says Over one year, the market capitalization for Bitcoin has increased enormously. You may also see a "liquidity fee" when you shift your money between cryptocurrencies and cash. There's an increasing number of companies that offer so-called bitcoin IRAs. While the rise of cryptocurrencies might have helped some people to retire sooner, there's no doubt the volatility has aged some others along the way. Queer Voices. And the potential total loss of that investment. Fourteen percent said they were unsure, but interested in the idea. Next Next post: The best investment you can make is a mixture of all the available options. Latino Voices. There a few good cryptocurrency wallets to consider for storing bitcoin:

Bitcoin was the first cryptocurrency ever created. Advantages of Bitcoin as an Investment. Or speak with an on-site k specialist to answer your questions. Plus, you get to maintain complete control of your investments. Get In Touch. Unlike traditional currency where you either have the physical product, cash-in-hand or regulated financial institutions holding the records of your funds, bitcoin storage is up to the owner of the bitcoins. Annie Nova. Bitcoin investors believe in its long-term potential as a decentralized currency and as a growth investment. May 24th, May 24, The custodian is typically your bank or brokerage. You can, of course, keep your other retirement accounts and only pursue the self-directed option for your cryptocurrency investments. Hot wallets are those that connect to the internet. Did you know? Bitcoin wallets also fall into two broad categories: Yes, absolutely. This is because cryptocurrency is considered property for tax purposes, and IRA contributions must be made in US Dollars. Even the creator of the bitcoin cryptocurrency is unknown and used the alias Satoshi Nakamoto. Bitcoin is projected to continue growing in value, but, of course, there are no guarantees. Users can even use the cryptocurrency to shop on Amazon through the payment exchange Purse. VIDEO 2:

Readers are responsible for their bitcoin account address bitcoin property due diligence in selection of investments, exchanges, and technology platforms. For example, you can compare the process to PayPal for traditional cash transactions, but without government regulation to ensure the best mobile bitcoin wallet iphone bitcoin broker license of the transaction. The winning computer updates the ledger for ten minutes. Keep in mind: The best option you have to include bitcoins in your retirement plans is to use a self-directed IRA, which allows you to invest in a cryptocurrency like Bitcoin. It could break while developers tweak the core software to improve user experience or to scale the size of network to meet demand. It also includes any entities in which the plan participant or a disqualified person has a controlling equity or management. Advantages of Bitcoin as an Investment. Listen to America.

Much like meeting a buyer or seller for a transaction through, for example, Craigslist, one should consider safety during in-person P2P bitcoin transfers and meet-ups. There are two options available to you. Roughly every 6 to 10 years, the market price corrects for overvalued stocks. Black Voices. By overseeing one of the largest networks of trading partners in the cryptocurrency market, they ensure that when you buy and sell bitcoin, the transaction is completed with extreme speed. What Is a Wallet? But that's not the case when your bitcoin is with a custodian in an IRA. VIDEO 1: People should only take risks that won't threaten their retirement, Pottichen said. Should you invest in a Bitcoin IRA? You can have full control over your bitcoins even when you use custodial services through multisignature wallets. Different types of wallets exist. A Bitcoin IRA is a high-growth potential investment available to you to develop a diverse portfolio. Can I transfer retirement accounts beside a k? The custodian is typically your bank or brokerage. Coinbase Wallet: And the potential total loss of that investment.

What Is a Wallet? President Donald Trump claims that tariffs have meant China is paying billions of dollars. Thanks to the IRS Noticedigital currency such as bitcoin is treated as personal property. I would also suggest sticking to US-based exchanges, as using a foreign exchange would create a requirement of FBAR reporting. Be Cautious with Your Bitcoin k Cryptocurrency investmentssuch as Bitcoins, are risky and highly volatile. It is also a popular long-term investment asset. This requires you to acquire the skills of an asset or forex trader. Military families say this is their top concern. The first option allows you to buy and sell depending on the price movement and earnings from the volatility. What Is Bitcoin? Your job now is to plan out a diversified, non-correlated retirement portfolio, one that includes Bitcoin, precious metals, stocks, bonds, and cash. Meanwhile, others like Blockchain. But proceed with caution: You can, of course, keep your other retirement accounts and only pursue the self-directed option for your cryptocurrency investments. Any Bitcoin k investor interested in using retirement funds to invest in cryptocurrencies should do their diligence and proceed with caution. A k does have a trustee, but typically the business owner will bitcoin knots how to change where to store blockchain armory bitcoin install dir trustee of his own plan.

Are you interested in holding cryptocurrency or other alternative assets in your IRA or k? Even after you have your checkbook IRA LLC set up, the prohibited transaction rules present unique obstacles to holding Bitcoin directly, as described below. As you probably know, when it comes to investments, you should never put all of your eggs in one basket. You can leverage tax-deferred personal property status by investing k savings in a Bitcoin IRA. In March , the Internal Revenue Service IRS declared it would treat bitcoin as a commodity for taxation purposes, the way it treats stocks and bonds. That's not up for negotiation. You can have full control over your bitcoins even when you use custodial services through multisignature wallets. By overseeing one of the largest networks of trading partners in the cryptocurrency market, they ensure that when you buy and sell bitcoin, the transaction is completed with extreme speed. You will pay taxes on all IRA earnings at withdrawal, but being a lower-wage worker, your low tax bracket will mean a small tax bill at retirement time. Until now, traditional forms of funding have included stocks, bonds, certificates of deposits and physical assets with value. While there are multiple cryptocurrencies on the market, Bitcoin has remained dominant in the market, despite a downward trend. These custodians that offer self-directed accounts typically don't have any fiduciary responsibility to you. Retirement account investors who have interest in mining Bitcoin versus trading may become subject to the Unrelated Business Taxable Income tax rules.

Bitcoin IRA Pros and Cons

In fact, the IRS considers Bitcoin to be property rather than currency, making it an investment similar to real estate, stocks, or bonds for tax purposes. For example, you can compare the process to PayPal for traditional cash transactions, but without government regulation to ensure the safety of the transaction. Can I transfer retirement accounts beside a k? Legally, an IRA and its owner are separate entities and must act separately. This includes the most popular:. However, if you have a self-directed k a type of plan typically only available to a self-employed business owner , the process works much the same. Key Points. Exodus is an all-encompassing offline application that supports multiple cryptocurrencies including bitcoin. For the first time the IRS set forth a position on the taxation of virtual currencies, such as Bitcoins. Bitcoin was the first cryptocurrency ever created. Help us tell more of the stories that matter from voices that too often remain unheard. You need to secure the copy with the private keys in a safety deposit box, however, especially if it holds huge amounts of bitcoins. Skip to primary navigation Skip to content. In this scenario, the annual tax deduction for your IRA contribution can help improve the quality of your life right now. World News. Special Note for Californians: That's not up for negotiation. What Is an Exchange? Many of my clients want to hold Bitcoin in an IRA or k. Buy these 2 stocks that pay you more than the year yield, says

Bitcoin exists independently from assets such as stocks, savings and bonds. Not every cryptocurrency IRA company offers Roth accounts retirement accounts using bitcoin how to get bitcoins on coinbase. By treating bitcoins and other virtual currencies as property and not currency, the IRS is imposing extensive record-keeping rules — and significant taxes — on its use. Meanwhile, the adoption of bitcoin is growing around the world as shown by each transaction the network confirms. This gives you full control over your holdings and protects you from third-party mismanagement or fraud. You will need a prototype plan sponsor to provide k documents preapproved by the IRS. However, the world of investing is changing. Bitcoin is less than ten years old and most regulators best offline bitcoin wallet reddit bitcoin hard for countdown the world have not conclusively taken a position on the cryptocurrency. Click here and we can set up the structure for you, from start to finish. By comparison, many traditional IRA accounts come with no annual or opening fee. After verifying the account, you can add a number of payment methods. It also includes any entities in which the plan participant or a disqualified person has a controlling equity or management. This does jp morgan back bitcoins what was the ethereum dao storage could be a stack of thumb drives in a file cabinet or external hard drives stored in a vault. There a few good cryptocurrency wallets to consider for storing bitcoin: Rollover Funds Rollover of retirement funds, cash or in-kind, tax-free to the new self-directed Solo k Plan account. To learn even more, read about the full process of rolling over a k to a Bitcoin IRA. Always consult your licensed financial advisor before deploying risk capital into the financial markets. The infrastructure allows for a wallet to have compile bitcoin do bitcoins satisfy the three conditions for money or three separate private keys.

Can I Buy Bitcoin with My IRA?

It is also a popular long-term investment asset. What's Working: Tap here to turn on desktop notifications to get the news sent straight to you. The Roth IRA provides no tax deduction for your annual contribution. The USA is one of countries that have issued guidelines on its use. You can protect part of your retirement savings from inflation. World News. This cryptocurrency can be broken out to 8 decimal places; however, the majority of transactions are in tiny fractions of a whole Bitcoin. For assets such as stocks and bonds, these values are assessed automatically. Mycelium is a mobile cryptocurrency wallet known for its advanced technology and security. And if held greater than 12 months, long term capital gains tax rates. This makes virtual currency subject to short-term ordinary income tax rates. This week marks another hearty notch in the continued uptick in cryptocurrency markets, and boy, is it more fun to write about cryptocurrency market gains rather than weekly losses for…. You get to leverage the power of the blockchain with fast, secure, peer-to-peer confirmation and mediation. For a growing number of investors, cryptocurrency is not only the future of money. Any investor who has interest in learning more about Bitcoins should do their diligence and proceed with caution.

Keep in mind: This would allow you to cut out all of those middleman fees. Genesis, Coinbase and Kraken are some of the exchanges registered in the US. Different types of wallets exist. There is no recovery option and no financial institution like a bank to appeal to if something happens to your account key and transaction record. There can be other fees on your investments, including underwriting and low balance charges, as well as fees the underlying mutual funds assess, that you should check. To learn even more, read about the full process of rolling over a k to a Bitcoin IRA. Real Life. It turns out there is a way to do this, so long as you know how to avoid the hidden what is bat cryptocurrency investing group. Bitcoin was the first cryptocurrency ever created. It first emerged stable cryptocurrencies canadian trading platform for cryptocurrency US Economy read. The buyer and seller never connect with each other, and burstcoin mining electricity cost bitcoin visa debit exchange takes a fee for the transaction. Asian Voices. By comparison, many traditional IRA accounts come with no annual or opening fee. Bitcoin quickly found popularity as a means of anonymous exchange online that required no banks to complete a transaction. The infrastructure allows for a wallet to have two or three separate private keys. The chart for percentage difference for bitcoin price bitcoin atm rates obstacle is purchasing Bitcoin at a reasonable exchange rate in the name of the LLC, rather than in your personal. Citi cut its forecast for Apple's earnings as the U. The diminishing number of new bitcoins coming into circulation, combined with expanding worldwide adoption, creates an environment for its value to continue to grow. The Internal Revenue Code does not describe what a retirement plan can invest in, only what it cannot invest in.

Readers are responsible for their own due diligence in selection of investments, exchanges, and technology platforms. To learn more, keep reading below, or watch the video here: As the price of Bitcoin has risen over the last year, so has the confidence among investors. Key Points. Mycelium is a mobile cryptocurrency wallet known for its advanced technology and security. The first issue when holding Bitcoin in a retirement account, then, is that most custodians will not allow Bitcoin to be held in their accounts. These Americans fled the country to escape margin fees poloniex step-by-step how to use poloniex for beginners giant student debt. Information provided is for educational purposes. But proceed with caution: Visit Site. They can include gold, silver, real estate, private equity, and. While the blockchain is a global ledger of bitcoin ownership and transactions, it is untraceable and unusable without individual account keys.

You can also generate a wallet and print it on a piece of paper through Bitaddress. That number has risen to about , in There have been cases of cryptocurrency exchange hacking in the past. Bitcoin and other cryptocurrencies represent one of the most innovative ideas of the 21st century. Any investor who has interest in learning more about Bitcoins should do their diligence and proceed with caution. Be Cautious with Your Bitcoin k Cryptocurrency investments , such as Bitcoins, are risky and highly volatile. Asian Voices. The strategies in this article are also available for k s, as discussed later. If so, the best favor you can do for me is to use the share buttons to share on Twitter or Facebook. We are fully prepared to help you convert your k savings to bitcoin quickly and easily. Cryptocurrency investments, such as Bitcoins, are uncertain and highly volatile. While this may sound like easy money, the processing power required, internet connection speeds, and the hardware needed to process this data correctly makes mining too costly for most individuals. More from Personal Finance: