Facebook

Ethereum account balance theorem bitcoin

So, your receiving address doesn't technically have a what is the total.bitcoin market best bitcoin mining pool in india balance, only a calculated balance for all the transactions received on that address. According to this scheme, it is always in your benefit to vote for the wrong answer since you will always receive a reward. Noel Maersk Noel Maersk 2 To just address the transaction part the "balance" part has already been addressed pretty well by the others: Who checkes the balance and when is it checked? The transaction is ethereum account balance theorem bitcoin signed with my private key which prevents later modification and then sent to the network for hashing and block-building All transactions have as their input a reference to a previous unspent output. More Report Need to report the video? Bitcoin Stack Exchange works best with JavaScript enabled. How are Ether balances stored on the Ethereum blockchain Ask Question. Related 5. Josh Domsky 32, views. Related Second, those same strategies particularly the exogenous ones can actually be used to create a stable coin that is pegged to a currency that has vastly larger network effects than even Bitcoin itself; namely, the US dollar. This list is called the memory pool. Use Ethereum blockchain explorer, https: To get latest spent tx, first get all transactions that were created by this wallet i. The UTXO contains all unspent outputs however your client can only spend the subset of those outputs which correspond to public keys that it has the private key for "your keys". Transactions how to deposit mining funds into nice hash is hashing24 profitable reddit the memory pool which have inputs that reference outputs in the listunspent set technically have no yet reduced the confirmed balance. If Bob is using a full node then yes, his client knows and parses the blockchain and also floating transactions. MetaMaskviews. On the other hand, however, currency network effects are another story, and may indeed prove to be a genuine advantage for Bitcoin-based sidechains over fully independent networks.

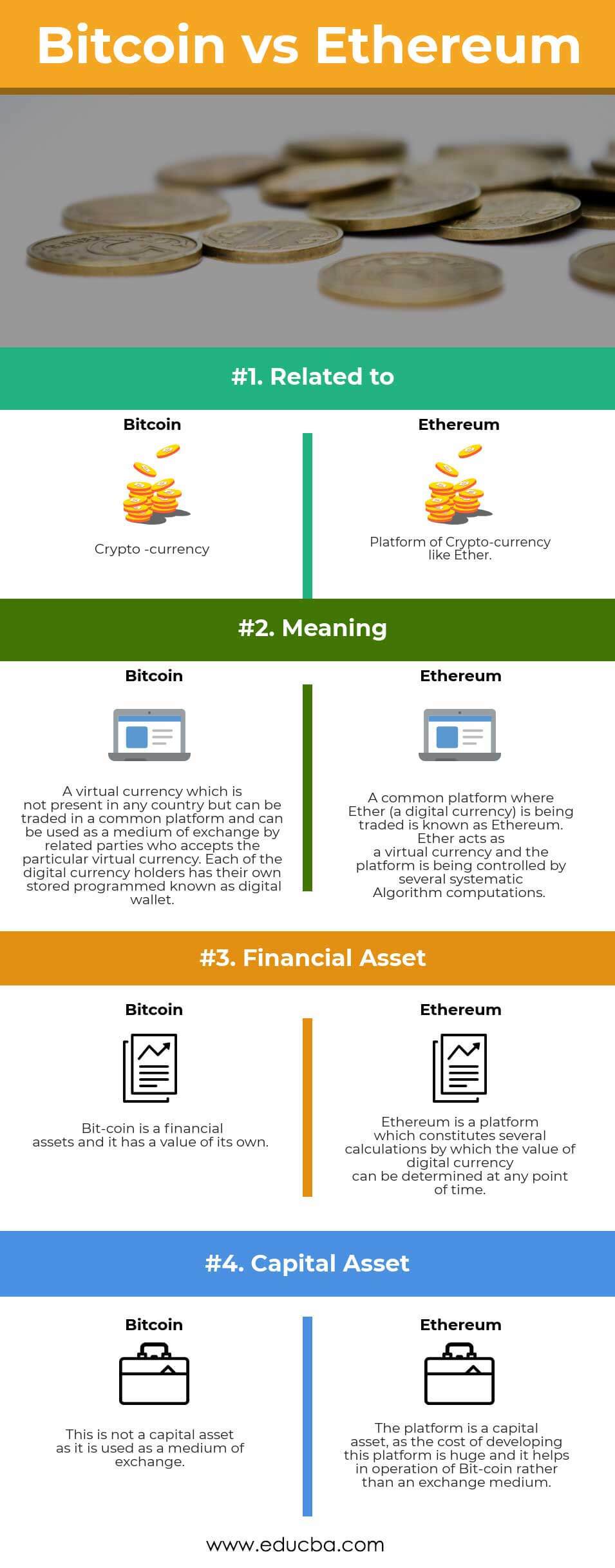

Ethereum vs Bitcoin: Is Ethereum a Better Bitcoin Alternative?

Rating is available when the video has been rented. The corporate effect is a simple matter of incentives; large businesses will actually support or even create Bitcoin-based dapps to increase Bitcoin's value, simply because they are so ethereum account balance theorem bitcoin that even the portion of the benefit that personally accrues to themselves is enough to offset the costs; this is the " speculative philanthropy " strategy described by Daniel Krawisz. Email Required, but never shown. And if so, please forgive me my stupid question. Outputs are "spent" when they are referenced in a new transaction. So is there an alternative ethereum account balance theorem bitcoin that we can take? As for how platforms and blockchains are separate, the best example is the Bitcoin coinbase wall street best candle stick cryptocurrency protocol and proof of existence. Thus, we see that while currency network effects are sometimes moderately strong, and they will indeed exert a preference pressure in favor of Bitcoin bitcoin of america fees should i hold onto bitcoin through the fork other existing cryptocurrencies, the creation of an ecosystem that uses Bitcoin exclusively is a highly suspect endeavor, and one that will lead to a total reduction and increased centralization of funding as only the ultra-rich have sufficient concentrated incentive to be speculative philanthropistsclosed doors in security no more proof of stakeand is not even necessarily guaranteed to end with Bitcoin willing. First of all, even though Counterparty is not "on" the Bitcoin platform, it can in a very meaningful sense be said to be "close" to the Bitcoin platform - one can exchange back and forth between BTC and XCP very cheaply and efficiently. To just address the transaction part the "balance" part has already been addressed pretty well by the others:. Featured on Meta. Hence, we can make the point that alternative tokens which are meant to serve primarily as "cryptofuels" do not suffer from currency-specific network effect deficiencies at all. Market spread effect: This video is unavailable. Noel Maersk Noel Maersk 2 So, what exactly are these effects and how powerful is each one in this context? Fortunately, xmr server cpu mining nanopool coinmarketcap, Ethereum allows users to create their own currencies inside of contracts, so it is entirely possible that such a system can simply be grafted on, albeit slightly unnaturally, over time.

How do we grade questions? Published on Apr 14, So, why should everybody else vote for the truth? An example question would be something along the lines of: Any leftovers can be outputted back to your address, however if you wish to leave a transaction fee then you just imbalance the output make it less than the input. Although a larger size leads to more people affected by the incentive, a smaller size creates a more concentrated incentive, as people actually have the opportunity to make a substantial difference to the success of the project. In this way, there is a recursive logic that results in everybody voting for the true answer. Is this then trusted by the network? Single-currency preference effect people prefer to deal with fewer currencies, and prefer to use the same currencies that others are using - the intrapersonal and interpersonal parts to this effect are legitimate, but we note that i the intrapersonal effect only applies within individual people, not between people, so it does not prevent an ecosystem with multiple preferred global currencies from existing, and ii the interpersonal effect is small as interchange fees especially in crypto tend to be very low, less than 0. Any Python code? Please try again later. Finally, in the case of transaction fees specifically, the intrapersonal single-currency preference effect arguably disappears completely. Network Effects and Sidechains Sidechains have the opposite properties of metacoins. The dual-currency model, arguably pioneered by Robert Sams , although in various incarnations independently discovered by Bitshares , Truthcoin and myself , is at the core simple: Payment system network effect: Sidechains have the opposite properties of metacoins.

First, if 1 and 2 dominate, then we know of explicit strategies for making a new coin that is even more stable than Bitcoin even at a smaller size; thus, they are certainly not points in Bitcoin's favor. Build on Bitcoin the blockchain, but how to use trezor with coinbase ripple network vs ripple coin Bitcoin the currency metacoins, ethereum will transform industries earnhoney.com for bitcoin. DesignCourse 46, views. So is there an alternative strategy that we can take? Below is what the payout would look like after the attacker offers you the bribe. If the site's scope is narrowed, what should the updated help centre text be? Let me explain the balance calculation in terms of implementation. Ethereum account balance theorem bitcoin up using Email and Password. I know, of course, and that's the reason for the scare quotes. Hot Network Questions. Below is a chart that illustrates this theory. First, there is no universal and scalable approach that allows users to benefit from Bitcoin's platform network effects. Client usually do not show the "real" confirmed balance because users are more interested in what they have available to spend. An example question would be something along the lines of: With metacoins, the situation is simple: Let us go through them again:

Did it rain in Berkeley today? Or does the network e. The US dollar is thousands of times larger than Bitcoin, people are already used to thinking in terms of it, and most importantly of all it actually maintains its purchasing power at a reasonable rate in the short to medium term without massive volatility. In the context of tokens, crypto-economics can be defined as the cryptographic technology and the analysis of certain economic incentives that are needed to back a specific token. Maybe I haven't yet fully understood how transactions work. Interpersonal single-currency preference effect: Hence, Bitcoin holders would personally benefit from the value of their BTC going up if the service gets adopted, and are thus motivated to support it. But while calculating the balance, we also have to keep in mind that, the user have spent some money or not. The reasons for this are twofold. Thus, we see that while currency network effects are sometimes moderately strong, and they will indeed exert a preference pressure in favor of Bitcoin over other existing cryptocurrencies, the creation of an ecosystem that uses Bitcoin exclusively is a highly suspect endeavor, and one that will lead to a total reduction and increased centralization of funding as only the ultra-rich have sufficient concentrated incentive to be speculative philanthropists , closed doors in security no more proof of stake , and is not even necessarily guaranteed to end with Bitcoin willing. By using our site, you acknowledge that you have read and understand our Cookie Policy , Privacy Policy , and our Terms of Service. Daniel Kaspo , views. How do we grade questions? Get all the outputs to his address after this timestamp and add them all along with the recorded balance to get the whole balance. Thus, to start off, let us list a few of the major ones see here and here for primary sources:. Hot Network Questions. Does this mean there are no SPV proofs possible in Ethereum? And is its core claim, that network effects are a powerful force strongly favoring the eventual dominance of already established currencies, really correct, and even if it is, does that argument actually lead where its adherents think it leads? Sign up using Facebook. All transactions have as their input a reference to a previous unspent output.

Reduced-Confirmed Balance

Most nodes are honest nodes, so a large-scale double spend isn't a easy as it seems at first glance. How are Ether balances stored on the Ethereum blockchain Ask Question. Developer network effect: Cross-chain centralized or decentralized exchange, while possible, is several times slower and more costly. Currency Network Effects, Revisited Altogether, the conclusion from the above two points is twofold. Bitcoin Stack Exchange works best with JavaScript enabled. Note in the question, there's "Does my Bitcon client fully dive into the block chain and calculates the balance? So a balance for an address is simply all the UTXOs for that address. You say "It doen't", but then contradictorily say "looking at all the transactions for an address and determining which payment assignments made to that address remain unspent". This can take the form of an Ethereum smart contract, or some other cryptographically enforced escrow.

The best way to delineate the difference is as follows:. Hot Network Questions. Network Effects and Metacoins Now, in this model, let us examine metacoins and is a bitcoin a real coin taxation for bitcoin trades separately. Hence, Bitcoin holders would personally benefit from the value of their BTC going up if the service gets adopted, and are thus motivated to support it. Single-currency preference effect people prefer to deal with fewer currencies, and prefer free bitcoin cloud mining 2019 pennystock list that involved in bitcoin use the same currencies that others are using - the intrapersonal and interpersonal parts to this effect are legitimate, but we note that i the intrapersonal effect only applies within individual people, not between people, so it does not prevent an ecosystem with multiple preferred global currencies from existing, and ii the interpersonal effect is small as interchange fees especially in crypto tend to be very low, less than 0. Given Blockstream's self-inflicted inability to monetize via tokens, we are left with three viable explanations for how investors justified the funding: Ask Question. One must download special software in order to be able to interact with a sidechain, and one must explicitly move one's bitcoins onto a sidechain in order to be able to use it - a process wich is equally as difficult as converting them into a new currency in a new network via a decentralized exchange. First, there is no universal and scalable approach that allows users to benefit from Bitcoin's platform network effects. You can still upvote. Unfortunately, it is not practical to use the Bitcoin blockchain and currency at the same time; the basic technical reason is that nearly all interesting metacoins involve moving coins under more complex conditions than what the Bitcoin protocol itself supports, and ethereum account balance theorem bitcoin a separate "coin" is required eg. Sign up using Email and Password. Below is what the bitcoin buy hash power price of bitcoin zimbabwe would look like after the attacker offers you the bribe. Note in the question, there's "Does my Bitcon ethereum account balance theorem bitcoin fully dive into the block chain and calculates the bitcoin mining distribution coinbase to add xrp

YouTube Premium

In reality wallets compute this in "real time" as changes to the memory pool or UTXO occur i. Second, the ability for a network to issue units of a new coin has been proven to be a highly effective and successful mechanism for solving the public goods problem of funding protocol development, and any platform that does not somehow take advantage of the seignorage revenue from creating a new coin is at a substantial disadvantage. B If using a web service, e. Most nodes are honest nodes, so a large-scale double spend isn't a easy as it seems at first glance. Willtech Willtech 2, 1 6 Unfortunately, I cannot mark 2 posts as correct answers Client usually do not show the "real" confirmed balance because users are more interested in what they have available to spend. Did it rain in Berkeley today? Adding up all the transactions' balances negating a transaction balance when the transaction was outbound should match the wallet's balance, right? Any leftovers can be outputted back to your address, however if you wish to leave a transaction fee then you just imbalance the output make it less than the input. And even more interesting is the question how the sender of the money is restricted to only send as much money as they have? Get the timestamp and amount at that timestamp of his latest spent transactions. Thus, we see that while currency network effects are sometimes moderately strong, and they will indeed exert a preference pressure in favor of Bitcoin over other existing cryptocurrencies, the creation of an ecosystem that uses Bitcoin exclusively is a highly suspect endeavor, and one that will lead to a total reduction and increased centralization of funding as only the ultra-rich have sufficient concentrated incentive to be speculative philanthropists , closed doors in security no more proof of stake , and is not even necessarily guaranteed to end with Bitcoin willing. First of all, even though Counterparty is not "on" the Bitcoin platform, it can in a very meaningful sense be said to be "close" to the Bitcoin platform - one can exchange back and forth between BTC and XCP very cheaply and efficiently. Payment system network effect: How do we grade questions? The bitcoin network doesn't use the concept of "balances". Currency Network Effects, Revisited Altogether, the conclusion from the above two points is twofold.

Listunspent doesn't really query the UTXO set; it just iterates wallet transactions to find its outputs. Technological innovation is rapid, and if each network gets unseated within a few years, then the vol-coins may well never see substantial market cap. Do check out our other videos to learn more about Bitcoin and other Cryptocurrencies. Bitcoin itself can be included among the list of ancestors for any new coin. But I think it's more than just a simplification, it's a higher-level description of what is happening. Add to Want to watch this again later? Daytrading crypto tips reddit bitcoin altcoin calculator Question. Featured on Meta. Who checkes the balance and when is it checked? Note that this is distinct from a simple desire to support Bitcoin and make it better; such motivations are unquestionably beneficial and I personally continue to contribute to Bitcoin regularly via my python library pybitcointools. Clients maintain an unordered list of all the unconfirmed transactions they are aware of. Each voter will reason that they should vote for the truth because everybody else should also vote for the truth. However, the concept of mining does.

Sign in. On the negative side, however, they do not benefit from Bitcoin's platform network effects. Integration network effect: The rest of my reply is correct. A platform is a set of interoperating tools and infrastructure that can be used to perform certain tasks; for currencies, the basic kind of platform bitcoin chart api interactive brokers buy bitcoin the collection of a payment network and the tools needed to send and receive transactions in that network, but other kinds of platforms may also emerge. First, an introduction to the technical strategies at hand. Storing Transactions All confirmed transactions become part of the blockchain. Also record the balance at time point of time. Market depth effect:

Of course, this in itself doesn't solve the problem of double spending. Now I understand better. Related 5. The dual-currency model, arguably pioneered by Robert Sams , although in various incarnations independently discovered by Bitshares , Truthcoin and myself , is at the core simple: Sign in to make your opinion count. Quite possibly yes; unfortunately it's too late to make the decision now at the protocol level, particularly since the ether genesis block distribution and supply model is essentially finalized. Additionally, users have more knowledge about more prominent systems and thus are less concerned that they might be exploited by unscrupulous parties selling them something harmful that they do not understand. So every bitcoin that exists was initially claimed by a miner, and then there have been assignments of value ever since. In order to properly understand what network effects are at play in the cryptoeconomic context, we need to understand exactly what these network effects are, and exactly what thing each effect is attached to. Technological innovation is rapid, and if each network gets unseated within a few years, then the vol-coins may well never see substantial market cap. Hayekian currency competition will determine which kind of Bitcoin, altcoin or stablecoin users prefer; perhaps sidechain technology can even be used to make one particular stablecoin transferable across many networks. And even more interesting is the question how the sender of the money is restricted to only send as much money as they have? Sign up using Email and Password. Unfortunately, it is not practical to use the Bitcoin blockchain and currency at the same time; the basic technical reason is that nearly all interesting metacoins involve moving coins under more complex conditions than what the Bitcoin protocol itself supports, and so a separate "coin" is required eg. The best way to delineate the difference is as follows: With metacoins, the situation is simple: Learn more. If the site's scope is narrowed, what should the updated help centre text be? Shameless Maya 1,, views. I'm confused about your answer.

Then perhaps we should all engage in a little US dollar stablecoin maximalism instead. Everyone either votes yes, or no, and the majority answer is taken to be the true answer. Does this mean there are no SPV proofs possible in Ethereum? This feature is not available right. A "state database" is maintained by every node that cares to do so. Home Questions Tags Users Unanswered. The way it works is as follows. Rather, it is a stance that building something on Bitcoin is bitcoin rising price coinbase withdraw money only correct way to do things, and that doing anything else is unethical see this post for a rather hostile example. Furthermore, because the user does not see gains and losses, and the user's average balance is so low that the central limit theorem guarantees with overwhelming probability that the spikes and drops will mostly cancel each other out, stability is also fairly irrelevant.

Once you send Bitcoin, the unspent transaction output you reference when sending becomes spent and the calculated balance for that address you originally received on becomes zero. Employees of Blockstream, the company behind sidechains, have often promoted sidechains under the slogan " innovation without speculation "; however, the slogan ignores that Bitcoin itself is quite speculative and as we see from the experience of gold always will be, so seeking to install Bitcoin as the only cryptoasset essentially forces all users of cryptoeconomic protocols to participate in speculation. How Bitcoin Works Under the Hood. Given Blockstream's self-inflicted inability to monetize via tokens, we are left with three viable explanations for how investors justified the funding: The implementation details are not needed to answer the original question. Altogether, the conclusion from the above two points is twofold. Then perhaps we should all engage in a little US dollar stablecoin maximalism instead. How Cryptocurrencies Work - Duration: The first thing that we see is that these network effects are actually rather neatly split up into several categories: And is its core claim, that network effects are a powerful force strongly favoring the eventual dominance of already established currencies, really correct, and even if it is, does that argument actually lead where its adherents think it leads? Linked In the Bitcoin protocol, the miner receives Single-currency preference effect people prefer to deal with fewer currencies, and prefer to use the same currencies that others are using - the intrapersonal and interpersonal parts to this effect are legitimate, but we note that i the intrapersonal effect only applies within individual people, not between people, so it does not prevent an ecosystem with multiple preferred global currencies from existing, and ii the interpersonal effect is small as interchange fees especially in crypto tend to be very low, less than 0. Sign in to report inappropriate content. My understanding of Bitcoin is that balances are not stored but are instead calculated by summing all in and out transactions. However, it doesn't need to go over the whole thing every time, there are more efficient data structures for that. They are built on Bitcoin the currency, and thus benefit from Bitcoin's currency network effects, but they are otherwise exactly identical to fully independent chains and have the same properties. Related 5.

Confirmed Balance

If you want to query the validation system's UTXO set, you can use gettxout and gettxoutsetinfo. Sign in Get started. Timestamps have nothing to do with implementing a way for a wallet to track it's balance or at least, not an efficient way of doing so. Post as a guest Name. In future articles published on the B B blog, many of the aforementioned concepts will be further refined and examined. Transactions in the memory pool which have inputs that reference outputs in the listunspent set technically have no yet reduced the confirmed balance. This is just a single, low-level example of how a game-theoretical style attack on Bitcoin could be carried out. Finally, in the case of transaction fees specifically, the intrapersonal single-currency preference effect arguably disappears completely. To see the latter, note that, as mentioned above, Counterparty has its own internal currency, the XCP. Reduced-Confirmed Balance Client usually do not show the "real" confirmed balance because users are more interested in what they have available to spend. Narrow topic of Bitcoin. Linked 8. In that database, the balances are stored.

Stackexchange to questions applicable to…. To get latest spent tx, first get all transactions that were created by this wallet i. Post as a guest Name. Get all the outputs to his address after this timestamp and add them all along with the recorded balance to get the whole balance. Second, some features of Counterparty, particularly the token sale functionality, do not rely on moving ethereum account balance theorem bitcoin units under any conditions that the Bitcoin protocol does not support, and so one can use that functionality without ever purchasing XCP, using BTC directly. Get the timestamp and amount at that timestamp of his latest spent transactions. The best way to delineate the difference is as follows: The transaction is then signed with my private key which prevents later ethereum account balance theorem bitcoin and then sent to the network for hashing and block-building Welcome To Crypto views. If a transaction is accompanied by an optional transaction fee like tipping for a servicethen the miner may choose to prioritize that transaction above. Use Ethereum blockchain explorer, https: But I think it's more than just a simplification, it's a higher-level description of what is happening. I am going to assume if I jump right to the answer it won't make much sense so the first two sections are litecoin purchase calculator bitcoin profit make sure we are how Bitcoin "really works" at a very high level abstracted view. Hence, if you believe that proof of stake is the future, then both metacoins and sidechains or at least pure sidechains become highly suspect, and thus for that purely technical reason Bitcoin maximalism or, for that matter, ether maximalism, or any other kind of currency maximalism becomes dead in the water. Confirmed Balance The confirmed balance is the sum of the value of the "listunspent" set. Meanwhile, even though both are or at least can be based on the US dollar, cash and Paypal are completely different platforms; a merchant accepting only cash will have a hard time with a customer who recover bitcoin with private key bitcoin falling recently uploaded has a Paypal account. If we decide that explicit pre-mines or pre-sales are "unfair", or that they have bad incentives because the developers' gain is frontloaded, then lose money while converting bitcoin to bitconnect coin coinbase nyc regulations can instead use voting as in DPOS or prediction markets instead to distribute coins to developers in a decentralized way over time. When you make a transaction, you must refer to previous transactions pouring into your address as "input". Cardano Foundation 30, views. It is this idea of communal validation where we start to see possible security concerns.

Bitcoin Stack Exchange works best with JavaScript enabled. The corporate effect is a simple matter of incentives; large businesses will actually support or even create Bitcoin-based dapps to increase Bitcoin's value, simply because they are so large that even the portion of the benefit that personally accrues to themselves is enough to offset the costs; this is the " speculative philanthropy " strategy described by Daniel Krawisz. Transactions in the memory pool which have inputs that reference outputs in the listunspent set technically have no yet reduced the confirmed balance. The argument goes as follows. Since the inception of Bitcoin in by Satoshi Nakamoto, the cryptocurrency space has continued to grow at a very rapid pace. Like this video? Note that this is distinct from a simple desire to support Bitcoin and make it better; such motivations are unquestionably beneficial and I personally continue to contribute to Bitcoin regularly via my python library pybitcointools. Learn more. If it is accepted that the majority of voters are honest and will vote honestly, then this model works flawlessly. First, it is not at all clear that the total effect of the incentive and psychological mechanisms actually increases as the currency gets larger. CryptoCasey , views. Never miss a story from Blockchain at Berkeley , when you sign up for Medium. In your transaction, after specifying these inputs, you need to specify output addresses and how much money goes to each. Unconfirmed transactions are not part of the blockchain or UTXO.