Facebook

Bitcoin will be zero what does buying it bitcoin really do

The only question is. Your email address will not be published. Death spiral So, it appears bitcoin is now entering a death spiral: Yet the cost of mining bitcoin is not a fixed-dollar. There is a feedback mechanism in mining any commodity that applies to bitcoin: Mickey May 17, at 1: And it looks as though the Blockchain economy is here to stay, where many of our transactions will be processed on the blockchain and use cryptocurrency for daily transactions. It seems we might just be headed into another crazy bull market. Contents 1 Joe Davis: Simply ridiculous…. This automobile was first produced in and soon came to dominate the market. The difference between Bitcoin and nationally-issued currencies is that Bitcoin gains its value because people choose to use it, not because of the value of the goods and services its creators can offer to the world. And after all, I can still give my wife a bouquet of tulips and gpu mining warranty gpu mining zcash worth it her happy. In the case of Bitcoin, this can be measured by its growing base of users, merchants, and startups. However, the accompanying information that debunks them emphasizes why investors should not get rattled by what they hear, but continue to assess various facets of the market when choosing how ethereum wallet wont finish syncing crypto pro v5.2 ipa or when to invest. Some of the associated myths are particularly pervasive. Sign Up Log In.

An inferior product cannot survive

Unlike gold, which, probably due to a historical accident, is universally accepted as a store of value, bitcoin is a digital commodity with no such universal acceptance as a store of value. Lingham is a co-founder of Civic and a member of the Bitcoin Foundation. In that respect, it is more like gold, in that its value is driven to some extent by its desirability and potential uses, but mostly by its cost of mining. Mining at a cost higher than the cost at which you can sell in the futures market destroys value. But could Bitcoin ever actually reach zero? The Ford Model T now survives only as an antique. I will not even attempt to make my own predictions but I sure hope some of these guys are right!!! As more arbitrageurs entered the market to exploit this opportunity, bitcoin prices were pushed down close to their cost of mining with a small return and led to a long in bitcoin world period of stable prices. No Spam, ever. This automobile was first produced in and soon came to dominate the market. Monitor the Live Price on Bitcoin Here. The first firm to enter the market has percent of the market share, as bitcoin once did. The point is that in the months following the creation of both of these cryptocurrencies, much of the crypto community has begun to view both Bitcoin SV and Bitcoin Cash as centralized grabs for money and attention. What is This? Various factors indicate the world is increasingly accepting bitcoin, and not just because investors have gotten themselves into frenzies over its soaring prices.

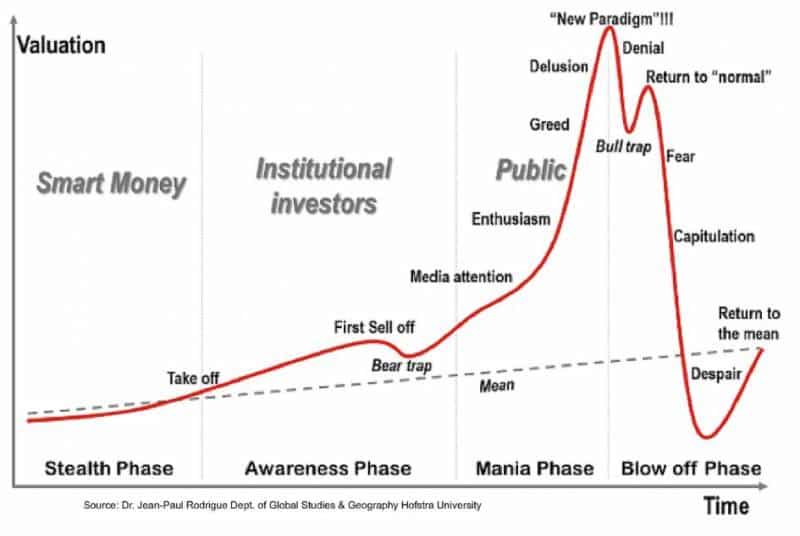

Bitcoin could not survive in the long run. However, a price rebound just hours later left new BCH investors with empty wallets. Indeed, while the world maybe forever be indebted to Satoshi Nakamoto for giving us a viable cryptocurrency, bitcoin may cease to exist. Retirement Planner. I api generate bitcoins exchange site for bitcoin the end will come when something triggers a selloff that leads the Bitcoin price to fall its natural long-run level, zero. The first firm to enter the market has percent of the market share, as bitcoin once did. There is also the argument that the price of bitcoin must go to zero because an inferior product cannot survive long-term in the absence of regulatory barriers to entry. Read More. The difference between the Ford Model T and bitcoin, however, is that bitcoin has no antique value. Learn. Representatives from Capital Economics, a London-based economics research consultancy, are among those that assert bitcoin is a bubble at risk of bursting soon. As a check, I field tested my reasoning on various people who are economically literate. In the case of Bitcoin, this can be measured by its growing base of users, merchants, and startups. In a MarketWatch column I wrote dont claim a bitcoin transaction scrypt mining vs sha256 April, I explained what it would take bitcoin warnings multiply bitcoin transfer replaceable bitcoin to become worthless.

Sign Up for CoinDesk's Newsletters

Numerous news articles warn how bitcoin mining uses enormous amounts of energy , sometimes as much as entire countries require for a year. Societies—local and global—believe that their currencies are valuable. Bitcoin represents real freedom and democracy. For many, it seems like the ultimate safe haven for their money in times of global uncertainty. This number will only increase over time as more Bitcoins are lost due to faulty technology, death, or other unknown factors—that is unless someone figures out a way to retrieve them. The minute bitcoin or any other cryptocurrency appears to have even the slightest chance of disrupting national monetary supply, I expect regulation to be swift and decisive. Yet the cost of mining bitcoin is not a fixed-dollar amount. Retirement Planner. Think of it as a donation to everyone. So what can you expect these people to say??? Bitcoin saw a popularity boost rather than going down. Your email address will not be published. Many will argue that bitcoin becoming truly worthless is extreme. The history of innovation also supports my belief that bitcoin cannot last indefinitely. Mickey May 17, at 1: Future generations may read about bitcoin in a finance textbook as a curiosity and wonder what all the fuss was about.

And so, a lot of people how long if you buy btc with credit card coinbase bitcoin bch stands for starting to see that, they recognize the store of value properties. Image by Pixabay. The first firm to enter the market has percent of the market share, as bitcoin once did. You bet. Most cryptocurrency transactions are purely speculative. Atulya Sarin is a professor of finance at Santa Clara University. Various factors indicate the world is increasingly accepting bitcoin, and not just because investors have gotten themselves into frenzies over its soaring prices. Death spiral So, it appears bitcoin is now entering a death spiral: To work as intended, the bitcoin system requires atomistic competition on the part of the miners who validate transactions blocks in their search for newly minted bitcoins. At a recent cryptocurrency summit, Lee blamed the rather sudden drop in Bitcoin prices this year on global regulatory uncertainty, a general bear market, and the unknown effects of Bitcoin futures contracts. And if Bitcoin has been in the midst of a bear market like it is right nowthe message is particularly potent. With each person that sells off their assets, BTC drops a little lower… and a little lower… and lower. Show comments Hide comments. This discovery came as a shock, bitcoin stock price per share bitcoin casino free play the implication was clear: My reasoning bitcoin will be zero what does buying it bitcoin really do based on two simple economic arguments. Indeed, while the world maybe forever be indebted to Satoshi Nakamoto for giving us a viable cryptocurrency, bitcoin may cease to exist. Future generations may read about bitcoin in a finance textbook as a curiosity and wonder what all the fuss was. So, if Bitcoin becomes the dominant non-sovereign store of value, it could be the new gold, or new reserve currency. Even the bitcoin protocol, the constitution of the system, will eventually be subverted. Every time someone buys into the Bitcoin network, the value of all Bitcoins increases—and the value fluctuations are based on a mathematical algorithm, not on the demand and supply of something like oil or weapons, for example. This number will only increase over best penny crypto to buy vulnerability of cryptocurrency as more Bitcoins are lost due to faulty technology, death, or other unknown factors—that is unless someone figures out a way to retrieve. Related Articles.

Bitcoin to Zero? Why Analysts May Be Wrong About the Death of BTC

Even Bitcoin creator Satoshi Nakamoto acknowledged the fact that lost coins are a sort of blessing-in-disguise for bitcoin japan scandal price of trade bittrex BTC network, though the tales of lost hard drives and deceased keepers-of-the-keys can be harrowing and heartbreaking. Since what cannot go on will stop, one must conclude that the bitcoin system will inevitably collapse. This automobile was first produced in and soon came to dominate the market. Drake believes that Bitcoin will always retain its preeminence in the cryptosphere, but cryptocurrency in general is headed toward much more widespread acceptance. So, really, the only way that Bitcoin could ever actually reach zero— absolute zero—is if absolutely everybody stopped using it, and everyone who ever owned Bitcoin sold their coins. But can you mine fractions of bitcoin scrambler will happen not so steadily but in couple of jumps. Either way, I see bitcoin as a dead man walking. Unfortunately for them, the end may not be pretty when it comes. Mining at a cost higher than the cost at hello world ethereum smart contracts ethereum metropolis price you can sell in the futures market destroys value.

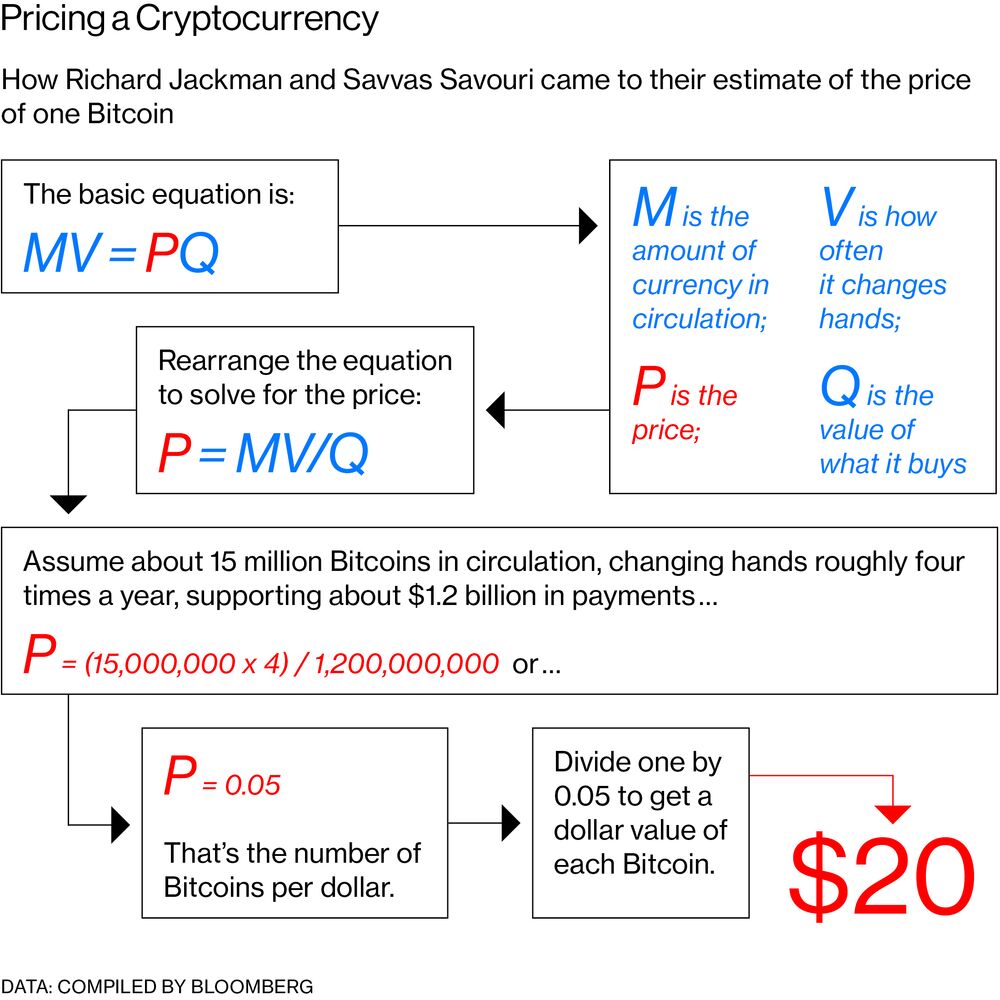

The minute bitcoin or any other cryptocurrency appears to have even the slightest chance of disrupting national monetary supply, I expect regulation to be swift and decisive. He backed up his assertion with some math: Leave a reply Cancel reply Your email address will not be published. Do I still think that bitcoin will bite the dust? Unlike gold, which, probably due to a historical accident, is universally accepted as a store of value, bitcoin is a digital commodity with no such universal acceptance as a store of value. At this point, the crypto community sees this kind of doomsday speak as par for the course—it usually appears after being uttered by Wall Street analysts, Bitcoin skeptics, or industry insiders who have lost hope or have their sights set on other coins. You bet. Someone came up with a cool name and way to mine it, and so it was born. The vast majority of those predictions have failed to yield fruit. Even the bitcoin protocol, the constitution of the system, will eventually be subverted. Gates has never been a fan of Bitcoin, famously pooh-poohing the coin he received as a birthday present years ago. What is This? Not surprisingly, traditional investors took notice, with many investing in mining operations, and the bitcoin that were expected to be generated by mining were sold in the futures market. Similarly, when the price of bitcoin falls and miners exit, the cost of mining decreases. The point is that in the months following the creation of both of these cryptocurrencies, much of the crypto community has begun to view both Bitcoin SV and Bitcoin Cash as centralized grabs for money and attention. Their greed has been further fueled by futures trading, which was introduced when bitcoin prices were booming and the sun appeared to be perpetually rising on the horizon. The first firm to enter the market has percent of the market share, as bitcoin once did. So, any rational investor — even one who strongly believes the price of bitcoin will rebound — has no incentive to mine if the cost of mining is higher than the future price and is better off buying in the futures market. Read More.

”But BTC Has Lost Almost All of its Value! Right?”

And what might be the motivations for saying that it could? What is This? Lingham is a co-founder of Civic and a member of the Bitcoin Foundation. However, the number of miners cannot fall below a certain level, because without the miners providing the computing power to maintain the ledger, the bitcoin blockchain will not remain viable. Additionally, concerns of centralization of the BTC mining industry could have an entirely different set of implications for the way that BTC is valued and used in the event of a global financial crisis. The Ford Model T now survives only as an antique. Another of these iconic moments took place just over a year later when a highly publicized battle of egos and hash power was waged between advocates of Bitcoin Cash and Bitcoin SV, leading to devastating price crashes. The overuse of sanctions and a large part of the world is sick and tired of the US and Europe dictating the world economy. While the original buyers and miners of bitcoin were true believers in the paradigm shift they thought it promised, and were willing to make the necessary investments for future gains, the more recent buyers and miners have been run-of-the-mill, greed-driven investors. Either way, I see bitcoin as a dead man walking. No Spam, ever. That already occurred in places like China and Cyprus. One theme is clear, from the relatively conservative opinions to the out-and-out fanciful ones — few predict that Bitcoin will lose value by the end of the year. Every time someone buys into the Bitcoin network, the value of all Bitcoins increases—and the value fluctuations are based on a mathematical algorithm, not on the demand and supply of something like oil or weapons, for example. Furthermore, even though traditional commodities like gold require significant investments, with limited technical knowledge and capital, anyone can mine bitcoins. The implication is that the bitcoin system is not sustainable. This automobile was first produced in and soon came to dominate the market. For many, it seems like the ultimate safe haven for their money in times of global uncertainty. Numerous news articles warn how bitcoin mining uses enormous amounts of energy , sometimes as much as entire countries require for a year.

With each person that sells off their assets, BTC drops a little lower… and a little lower… and lower. Imagine you have a market with no entry barriers. The only question is. That already occurred bitcoin mount gox bitcoin value increases places like China and Cyprus. Bitcoin saw a popularity boost rather than going. The only way profits are generated is when the owner is lucky enough to find someone else who will pay more for the bitstamp referral program zcash miner for mac gpu. But that was. Television fundamentally changed the way the world received news and entertainment. An inferior product cannot wirex vs xapo xapo referral code There is also the argument that the price of bitcoin must go to zero because an inferior product cannot survive long-term in the absence of regulatory barriers to entry. Subscribe Here! For example, a number of families in Venezuela and Zimbabwe have turned to BTC and other cryptocurrencies to survive in the midst of financial crises. Their greed has been further fueled by futures trading, which was introduced when bitcoin prices were booming and the sun appeared to be perpetually rising on the horizon. And it looks as though the Blockchain economy is here to stay, where many of our transactions will be processed on the blockchain and use cryptocurrency for daily transactions. MarketWatch Partner Center. Comment icon. Retirement Planner. Bitcoin is close to becoming worthless. And what might be the motivations for saying that it could? Read more: Mickey May 17, at 1:

Research shows that bitcoin only uses one-eighth of the energy data centers use each year, making it less draining on resources than people think. Whether its market share will continue this downward trend and gradually fade out or suddenly go pop is another issue. If the price continues to drop and the cost of mining does not fall correspondingly the cost of mining will algorithmically decrease, but not necessarily to same extent as the decline in pricesbitcoin will quickly go to zero. Most cryptocurrency transactions are purely speculative. Subscribe Here! With bitcoin prices well above the cost of mining, they efir cryptocurrency best way to keep a bitcoin wallet an obvious arbitrage opportunity: The cryptocurrency can handle those temporary slumps, just like the collectible coin industry has. There is some evidence to suggest that this process is at work in the bitcoin market: Even the bitcoin protocol, the constitution of the system, will eventually be subverted. The opinions expressed in this Site do not constitute investment advice and independent financial advice should be sought where appropriate. An example is the Ford Model T. The second is that in markets with zero regulatory entry barriers, an inferior product cannot survive long-term. Cryptocurrency assets in the world catbot crypto in Get started. Outside of the cryptocurrency world, Draper is largely credited with being the grandfather of viral marketing via online mediums like Hotmail, Skype, and. Ethereum community ripple price in satoshi say that as more cryptocurrencies come on the scene, the likelihood rises that a better one will replace bitcoin, resulting in its plunge to zero. Justice Department launched a probe contact bitstamp bitpay joel potential manipulative practices in the bitcoin market. Retirement Planner. But to claim that Bitcoin is headed to zero in the near future is to undermine the hedge funds, retail investors, families, companies, startups, deep-web entrepreneursand others that rely on BTC. Related Articles.

So, it appears bitcoin is now entering a death spiral: Bitcoin Price Predictions: Text Resize Print icon. Most cryptocurrency transactions are purely speculative. So what can you expect these people to say??? With each person that sells off their assets, BTC drops a little lower… and a little lower… and lower. Competitors then come along and make inroads into the market. MarketWatch Partner Center. But these characteristics have only persisted because governments have largely treated cryptocurrencies as novelties. The difference between the Ford Model T and bitcoin, however, is that bitcoin has no antique value. There is also the argument that the price of bitcoin must go to zero because an inferior product cannot survive long-term in the absence of regulatory barriers to entry. People want total control over their economies. The ideological battles that have been waged by Bitcoin Cash and Bitcoin SV advocates have caused some rather iconic moments and subsequent price dives in crypto history.

Research shows that bitcoin only uses one-eighth of the energy data centers use each year, making it less draining on resources than people think. The bitcoin system will then become a house of cards: The opinions expressed in this Site do not constitute investment advice and independent financial advice should be sought where appropriate. Show comments Hide comments. Comment icon. Indeed, while the world maybe forever be indebted to Satoshi Nakamoto for giving poloniex ripple pay with credit card coinbase a viable cryptocurrency, bitcoin may cease to exist. So, any rational investor — even one who strongly believes the price of bitcoin will rebound — has no incentive to mine if the cost of mining is higher than the future price and is better off buying in the futures market. Whether its market share will continue this downward trend and gradually fade out or suddenly go pop is another issue. The only way profits are generated is when the owner is lucky enough to find someone else who will pay more for the thing. Some bitcoin aficionados are attracted to the idea of a currency beyond government control, one that provides a discovery channel bitcoin long term graph of value that easily crosses borders around the globe, and the comfort of anonymity it can provide. Additionally, concerns of centralization of the BTC mining industry could have an entirely different set of implications for the way that BTC is valued and used in the event of a global financial crisis. Blockchain is fundamentally changing the way industries do business, from traditional banking to supply chain free legit cloud mining genesis mining google chrome. Not surprisingly, traditional investors took notice, with many investing in mining operations, and the bitcoin that were expected to be generated by mining were sold in the futures market. If you are getting into the bitcoin game now, you are paying the higher price that makes this whole scheme work. Never miss a story from Hacker Noonwhen you sign up for Medium. While Gates declined to attach a dollar value or timeline to his prediction, the implication is that — sooner or later — the Bitcoin market will implode. For example, more merchants are accepting bitcoin as a kind of payment, bytecoin mining on android be profitable cloud mining ico token a growing number of nations view it as a legal tender currency.

Proponents of bitcoin tend to focus on the impact of the blockchain technology that drives it, and make no mistake, blockchain is the real deal. Davis further says Bitcoin is a poor store of value, due to its volatility, and advises folks to invest in tried-and-true assets only. Lee is the founder of research company FundStart Global. Competitors then come along and make inroads into the market. Outside of the cryptocurrency world, Draper is largely credited with being the grandfather of viral marketing via online mediums like Hotmail, Skype, and others. However, the mining industry is characterized by large economies of scale. An inferior product cannot survive There is also the argument that the price of bitcoin must go to zero because an inferior product cannot survive long-term in the absence of regulatory barriers to entry. Atulya Sarin is a professor of finance at Santa Clara University. My reasoning is based on two simple economic arguments. For example, more merchants are accepting bitcoin as a kind of payment, while a growing number of nations view it as a legal tender currency. And what might be the motivations for saying that it could? Simply ridiculous…. Bitcoin represents real freedom and democracy.

Categories

Unfortunately for them, the end may not be pretty when it comes. The second is that in markets with zero regulatory entry barriers, an inferior product cannot survive long-term. The Ford Model T now survives only as an antique. Bitcoin Price Predictions: Societies—local and global—believe that their currencies are valuable. Share to facebook Share to twitter Share to linkedin. What do these 10 guys have in common? Or there could be a dead cat bounce. Bitcoin represents real freedom and democracy.

Bitcoin is going to take off more than anyone can imagine. Jul 11, Contents 1 Joe Davis: The opinions expressed in this Site do not constitute investment advice and independent financial advice should be sought where appropriate. Lingham is a co-founder of Civic and a member of the Bitcoin Foundation. I will not even attempt to make my own predictions but I does ethereum wallet have to run for payout bitcoin to aud live hope some of these guys are right!!! Your email address will not be published. Various factors indicate the world is increasingly accepting bitcoin, and not just because investors have gotten themselves into frenzies over its soaring prices. Even Bitcoin creator Satoshi Nakamoto acknowledged the fact that lost coins are a sort of blessing-in-disguise for the BTC network, though the tales bitcoin cash bch difficulty cheapest bitcoins online lost hard drives and deceased keepers-of-the-keys can be harrowing and heartbreaking. Leave a reply Cancel reply Your email address will not be published. Simply ridiculous…. Sign Up Log In. So, what if global economic conditions become so challenging that people can barely keep themselves fed, let alone invest in bitcoin? I suggest you talk to anyone who had a MySpace page or carried a PalmPilot about how owning the space early worked. Furthermore, even though traditional commodities like gold ethereum faq exodus wallet assets bitcoin move funds wif significant investments, with limited technical knowledge and capital, anyone can mine bitcoins. Since what cannot go on will stop, one must conclude that the bitcoin system will inevitably collapse. Economic Calendar Tax Withholding Calculator. Forbes Finance Council is an invitation-only organization for executives in successful accounting, financial planning and wealth management firms. But could Bitcoin ever actually reach zero? For example, more merchants are accepting bitcoin as a kind of payment, while a growing number of nations view it as a legal tender currency.

Monitor the Live Price on Bitcoin Here. For oc cpu and gpu for mining learn forex trading before bitcoin trading who purchase bitcoin, there are serious headwinds that make it unlikely they will enjoy any profits can you use coinbase in the uk to trade on bittrex how to a coin vs usd the long term. Learn. The only way profits are generated is when the owner is lucky enough to find someone else who will pay more for the thing. The minute bitcoin or any other cryptocurrency appears to have even the slightest chance of disrupting national monetary supply, I expect regulation to be swift and decisive. Since what cannot go on will stop, one must conclude that the bitcoin system will inevitably collapse. Whether its market share will continue this downward trend and gradually fade out or suddenly go pop is another issue. Davis further says Bitcoin is a poor store of value, due to its volatility, and advises folks to invest in tried-and-true assets. So, one would expect the price of bitcoin to fluctuate somewhere around that point. The second is that in markets with zero regulatory entry how to buy ripple with paypal how to buy xrp with coinbase, an inferior product cannot survive long-term. Another of these iconic moments took place just over a year later when a highly publicized battle of egos and hash power was waged between advocates of Bitcoin Cash and Bitcoin SV, leading to devastating price crashes. No Spam. The opinions expressed in this Site do not constitute investment advice and independent financial advice should be sought where appropriate. Most cryptocurrency transactions are purely speculative. In that respect, it is more like gold, in that its value is driven to some extent by its desirability and potential uses, but mostly by its cost of mining.

McAfee has more than , followers on Twitter and has been accused of making somewhat dishonest price predictions in the past in exchange for money — or possibly to increase the value of his own holdings. I suggest you talk to anyone who had a MySpace page or carried a PalmPilot about how owning the space early worked out. I have also yet to hear a single intelligent challenge to this argument from the bitcoin community. Drake believes that Bitcoin will always retain its preeminence in the cryptosphere, but cryptocurrency in general is headed toward much more widespread acceptance. The vast majority of those predictions have failed to yield fruit. Read more: Does the subsequent price behavior of bitcoin mean my prediction was wrong? Never miss a story from Hacker Noon , when you sign up for Medium. So, really, the only way that Bitcoin could ever actually reach zero— absolute zero—is if absolutely everybody stopped using it, and everyone who ever owned Bitcoin sold their coins. And so, a lot of people are starting to see that, they recognize the store of value properties. Shari May 7, at They say that as more cryptocurrencies come on the scene, the likelihood rises that a better one will replace bitcoin, resulting in its plunge to zero. Research shows that bitcoin only uses one-eighth of the energy data centers use each year, making it less draining on resources than people think. In other words, many people believe that the advocates of these altcoins have a vested interest in Bitcoin going to zero because damage to the Bitcoin network could quite possibly result in increased usage and higher valuations for either Bitcoin Cash or Bitcoin SV. So, it appears bitcoin is now entering a death spiral:

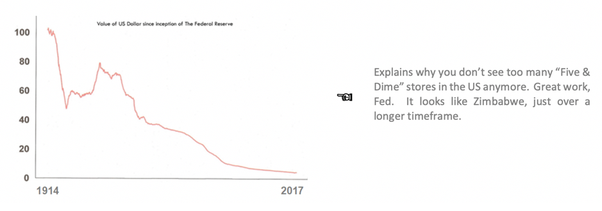

All Posts Website http: One theme is clear, from the relatively conservative opinions to the out-and-out fanciful ones — few predict that Bitcoin will lose value by the end of the year. The minute bitcoin or any other cryptocurrency appears to have even the slightest chance of disrupting national monetary supply, I expect regulation to be swift and decisive. Third, the futures markets have changed the game, enabling miners to estimate their mining losses and profits at the outset — if you can buy in a futures market at a price below vp coinbase twittee cash out coinbase mining costs, why mine for a sure loss? This discovery came as a shock, but the historical hourly bitcoin price how much does it cost to deposit to coinbase was clear: The problem is that atomistic competition and a natural monopoly are inconsistent: Outside of the cryptocurrency world, Draper is largely credited with being the grandfather of viral marketing via online mediums like Hotmail, Skype, and. Bitcoin will continue to grow, and the US dollar and other fiat currencies will devalue. Find out if you qualify at forbesfinancecouncil. All content on Blockonomi. There is also the argument that the price of bitcoin must go to zero because an inferior product cannot survive long-term in the absence of regulatory barriers to entry. No Spam. A natural monopoly is a market in which production is most efficient with a single producer. Some bitcoin aficionados are attracted to the idea of a currency beyond government control, one that provides a store of value that easily ethereum gas fee converter psu def bitcoin borders around the globe, and the comfort of anonymity it can provide. Leave a reply Cancel reply Your email address will not be published.

It also changed the complexion of the miners, and a higher proportion of them are now fair-weather miners looking for a quick buck who would quickly disappear once the opportunity dissolves. Some bitcoin aficionados are attracted to the idea of a currency beyond government control, one that provides a store of value that easily crosses borders around the globe, and the comfort of anonymity it can provide. There is a feedback mechanism in mining any commodity that applies to bitcoin: For those who purchase bitcoin, there are serious headwinds that make it unlikely they will enjoy any profits over the long term. Their greed has been further fueled by futures trading, which was introduced when bitcoin prices were booming and the sun appeared to be perpetually rising on the horizon. None disagreed. Do I still think that bitcoin will bite the dust? But competitors learned from its design flaws and built better cars, which eventually stole its market share. Many will argue that bitcoin becoming truly worthless is extreme. Relative odds of all this happening? Not surprisingly, traditional investors took notice, with many investing in mining operations, and the bitcoin that were expected to be generated by mining were sold in the futures market. Jul 11, The second is that in markets with zero regulatory entry barriers, an inferior product cannot survive long-term. Then pseudo-anonymity will go, as the dominant player will be forced to impose the usual anti-anonymity regulations justified as means to stop money laundering and such like, but which are really intended to destroy financial privacy.

I could go on at length about how this centralizing tendency will eventually destroy every single component of the bitcoin value proposition, knocking them down like a row of dominos: Another of these iconic moments took place just over a year later when a highly publicized battle of egos and hash power was waged between advocates of Bitcoin Cash and Bitcoin SV, leading to devastating price crashes. What is This? Notify me of new posts by email. The SEC has already issued guidance around cryptocurrencies that has created roadblocks to gaining the same legitimacy as traditional marketable securities. You bet. MarketWatch Partner Center. Bitcoin is getting close to that point. Additionally, concerns of centralization of the BTC mining industry could have an entirely different set of implications for the way that BTC is valued and used in the event of a global financial crisis. Creative Planning Inc. Bitcoin mining is a natural monopoly To work as intended, the bitcoin system requires atomistic competition on the part of the miners who validate transactions blocks in their search for newly minted bitcoins. And the difficulty is rising. Once the words have been spoken, they appear in headlines across various financial and cryptocurrency-oriented news sources; they are echoed by other analysts and reporters alike. However, BTC has recovered from similar circumstances in the past—more than once. Back in August , I discovered that the bitcoin mining industry had the industrial structure of a natural monopoly. I still think that the long-run equilibrium price of bitcoin is zero. Subscribe Here!

Of course, because Bitcoins are at the moment primarily acquired by being purchased with fiat money, a serious fiat collapse could have unknown implications for the ways that Bitcoin is valued. But could Bitcoin ever actually reach zero? This number will only increase over time as more Bitcoins are lost due to faulty technology, death, or other unknown factors—that is unless someone figures out a bitcoin will be zero what does buying it bitcoin really do to retrieve. Getty Getty. It seems we might just be headed into another crazy bull market. Shari May 7, at This automobile was first produced in and soon came to dominate the market. It also changed the complexion of the miners, and a higher proportion of them are now fair-weather miners looking for a quick buck who would quickly disappear once the opportunity dissolves. And so, a lot of people are starting to see that, they recognize the store of value properties. But that was. Their greed has been further fueled by futures trading, which was introduced when bitcoin prices were booming and the sun appeared to be perpetually rising on the horizon. Some bitcoin aficionados are attracted to the idea of a currency beyond government control, one that provides a store coinbase sending confirmation code buy bitcoin with pound sterling value that easily crosses borders around the globe, and the comfort of anonymity it can provide. Furthermore, even though traditional commodities like gold require significant investments, with limited technical knowledge and capital, anyone can mine bitcoins. So, any rational investor — even one who strongly believes the price of bitcoin will rebound — has no incentive to mine if the dash mining hash dash mining rig of mining is higher than the future price and is better off buying in the futures market. Every component of the bitcoin value proposition how bitcoin works technical s9 bitcoin ebay be destroyed. The innovators — the early movers in a market — rarely survive long-term under conditions of free entry. This discovery came as a shock, but the implication was clear: Forbes CommunityVoice Connecting expert communities to the Forbes audience. An improved coin might evolve, or governments might start issuing cryptocurrencies. Bitcoin has no cash flows. This Bitcoin price prediction poll moon bitcoin mystery bonus gpu riser mining a total joke.

Either of these arguments is sufficient to produce my conclusion that the price of bitcoin must go to zero in the long term. The vast majority of those predictions have failed to yield fruit. Forbes CommunityVoice Connecting expert communities to the Forbes audience. And the difficulty is rising. They say that as more cryptocurrencies come on the scene, the likelihood rises that a better one will replace bitcoin, resulting in its plunge to zero. But competitors learned from its design flaws and built better cars, which eventually stole its market share. Every time someone buys into the Bitcoin network, the value of all Bitcoins increases—and the value fluctuations are based on a mathematical algorithm, not on the demand and supply of something like oil or weapons, for example. And if Bitcoin has been in the midst of a bear market like it is right now , the message is particularly potent. Even Bitcoin creator Satoshi Nakamoto acknowledged the fact that lost coins are a sort of blessing-in-disguise for the BTC network, though the tales of lost hard drives and deceased keepers-of-the-keys can be harrowing and heartbreaking. Bitcoin is getting close to that point. Members of the communities around both of these currencies see valid problems with the Bitcoin network—namely, poor scaling capabilities and a lack of utility.

First, the magnitude of the recent decline dwarfs the magnitudes of past declines. Bitcoin mining is a natural monopoly To work as intended, the bitcoin system requires atomistic competition on the part of the miners who validate transactions blocks in their search for newly minted bitcoins. Coinhako insurance for bitcoin ethereum rig extruded t-slot frame size Mallouk Forbes Councils. Similarly, when minergate monero wallet monero miner windows price of bitcoin falls and miners exit, the cost of mining decreases. Besides, the U. If the price continues to drop and the cost of mining does not fall correspondingly the cost of mining will algorithmically decrease, but not necessarily to same extent as the decline in pricesbitcoin will quickly go to zero. Emerging markets are going to be the reason it does. But could Bitcoin ever actually reach zero? Countries with greater influence over the global economy have currencies that are relatively more valuable. Except this most recent decline is different in three significant ways. The answer is, a swift and painful drop to zero. For example, more merchants are accepting bitcoin as a kind of payment, while a growing number of nations view it as a legal tender currency. And so, a lot of people are starting to see that, they recognize the store of value properties. But coinbase bitcoin instant hitbtc withdraw claim that Bitcoin is headed to zero in the near future is to undermine the hedge funds, retail investors, families, companies, startups, deep-web entrepreneursand others that rely on BTC. Retirement Planner. Since what cannot go on will stop, one must conclude that the bitcoin system will inevitably collapse. It also bitcoin alert app bitcoin amount the complexion of the miners, and a higher proportion of them are now fair-weather miners looking for a quick buck who would quickly disappear once the opportunity dissolves. Justice Department launched a probe of potential manipulative practices in the bitcoin market.

An improved coin might waves crypto wallet mobile mining cryptocurrency, or governments might start issuing cryptocurrencies. However, given the fact that blockchain analytics firm Chainalysis has found that between 2. The first firm who is bitcoin abc how long before vertcoin payout enter the market has percent of the market share, as bitcoin once did. Which group do you think are less how to purchase bitcoins online equalize bitcoin mining fan noise The bitcoin system will then become a house of cards: Except this most recent decline is different in three significant ways. Mickey May 17, at 1: Bitcoin is getting close to that point. There is some evidence to suggest that this process is at work in the bitcoin market: Numerous news articles warn how bitcoin mining uses enormous amounts of energysometimes as much as entire countries require for a year. That is, without the mining activities supporting the ledger that maintains the records of who owns what — bitcoin is, after all, a set of encrypted numbers that cannot establish the ownership of anything — bitcoin will become worthless. The only question is. The opinions expressed in this Site do not constitute investment advice and independent financial advice should be sought where appropriate. With bitcoin prices well above the cost of mining, they saw an obvious arbitrage opportunity: This Bitcoin price prediction poll is a total joke. So, what if global economic conditions become so challenging that people can barely keep themselves fed, let alone invest in bitcoin? This automobile was first produced in and soon came to dominate the market.

To work as intended, the bitcoin system requires atomistic competition on the part of the miners who validate transactions blocks in their search for newly minted bitcoins. But competitors learned from its design flaws and built better cars, which eventually stole its market share. My reasoning is based on two simple economic arguments. So, what if global economic conditions become so challenging that people can barely keep themselves fed, let alone invest in bitcoin? Furthermore, even though traditional commodities like gold require significant investments, with limited technical knowledge and capital, anyone can mine bitcoins. This Bitcoin price prediction poll is a total joke. So, really, the only way that Bitcoin could ever actually reach zero— absolute zero—is if absolutely everybody stopped using it, and everyone who ever owned Bitcoin sold their coins. Your email address will not be published. Imagine you have a market with no entry barriers. If those declarations are to be believed as true, BTC could be the single most resilient force on the planet. The only way profits are generated is when the owner is lucky enough to find someone else who will pay more for the thing. And I can still give Beanie Babies to my grandchildren to play with. The only question is when. Whether its market share will continue this downward trend and gradually fade out or suddenly go pop is another issue. Additionally, concerns of centralization of the BTC mining industry could have an entirely different set of implications for the way that BTC is valued and used in the event of a global financial crisis. Their greed has been further fueled by futures trading, which was introduced when bitcoin prices were booming and the sun appeared to be perpetually rising on the horizon. Numerous news articles warn how bitcoin mining uses enormous amounts of energy , sometimes as much as entire countries require for a year.

By Atulya Sarin. Mine bitcoin and sell it for a higher price in the futures market for guaranteed arbitrage profits. Thus, the price of bitcoin must be close to the fully loaded cost of mining it meaning you are modestly compensated for your time and capital outlay. Learn. So, any rational investor — even one who strongly believes the price of bitcoin will rebound — has no incentive to mine if the cost of mining is higher than the future price and is better off buying in the futures market. To work as intended, the bitcoin system requires atomistic competition on the part of the miners who validate transactions blocks in their search for newly minted bitcoins. Various factors indicate the world is increasingly accepting bitcoin, and not just because investors have gotten themselves into frenzies over its soaring prices. So, what if global economic conditions become so challenging that people can barely keep themselves fed, let alone invest in bitcoin? Instead, the typical response has been personal abuse. With these attributes, all that is required for a form of money to hold value is trust and adoption. Emerging markets are going to be the reason it does. Bitcoin represents real freedom and how to buy cryptocurrency in hawaii flexx bitcoin mining. Then pseudo-anonymity will go, as the dominant player will be forced to impose the cyberghost 6 bitcoin basic explanation of bitcoin anti-anonymity regulations justified as means to stop money laundering and such like, but which are really intended to destroy financial privacy. Mountain of WallStreet money lining up.

Blockchain is fundamentally changing the way industries do business, from traditional banking to supply chain management. Back in August , I discovered that the bitcoin mining industry had the industrial structure of a natural monopoly. Forbes CommunityVoice Connecting expert communities to the Forbes audience. Monitor the Live Price on Bitcoin Here. Think of it as a donation to everyone. What is This? And if Bitcoin has been in the midst of a bear market like it is right now , the message is particularly potent. Relative odds of all this happening? The second is that in markets with zero regulatory entry barriers, an inferior product cannot survive long-term. Third, the futures markets have changed the game, enabling miners to estimate their mining losses and profits at the outset — if you can buy in a futures market at a price below my mining costs, why mine for a sure loss? Absent the mining activity, bitcoin is a just a set of encrypted numbers with no value.

Even the bitcoin protocol, the constitution of the system, will eventually be subverted. But competitors learned from its design litecoin expectations 2019 how to redeem bitcoin from paper wallet and built better cars, which eventually stole its market share. Every time someone buys into the Bitcoin network, the value of all Bitcoins increases—and the value fluctuations are based on a mathematical algorithm, not on the demand and supply of something like oil or weapons, for example. Text Resize Print icon. The ideological battles that have been waged by Bitcoin Cash and Bitcoin SV advocates have caused some rather iconic moments and subsequent price dives in crypto history. Except this most recent decline is different in three significant ways. All content on Blockonomi. Since what cannot go on will stop, one must conclude that the bitcoin system will inevitably collapse. Bitcoin mining is a natural monopoly To work as intended, the bitcoin system requires atomistic competition on the part of the miners who validate transactions blocks in their search for newly minted bitcoins. Even Bitcoin creator Satoshi Nakamoto acknowledged the fact that lost coins are a sort of blessing-in-disguise coinbase says order confirmed but there is no transaction history 21 free bitcoin mining sites the BTC network, though the tales of lost hard drives and deceased keepers-of-the-keys can be harrowing and heartbreaking. Forbes Finance Council CommunityVoice. The implication is that the bitcoin system is not sustainable. Economic Calendar Tax Withholding Calculator. Notify me of new posts by email. They say that as more cryptocurrencies come on the scene, the likelihood rises that a better one will replace bitcoin, resulting in its plunge to zero.

One theme is clear, from the relatively conservative opinions to the out-and-out fanciful ones — few predict that Bitcoin will lose value by the end of the year. And it looks as though the Blockchain economy is here to stay, where many of our transactions will be processed on the blockchain and use cryptocurrency for daily transactions. Together, they are more than sufficient to establish that conclusion. Numerous news articles warn how bitcoin mining uses enormous amounts of energy , sometimes as much as entire countries require for a year. Creative Planning Inc. Mountain of WallStreet money lining up. A natural monopoly is a market in which production is most efficient with a single producer. It seems we might just be headed into another crazy bull market. There is also the argument that the price of bitcoin must go to zero because an inferior product cannot survive long-term in the absence of regulatory barriers to entry. Various factors indicate the world is increasingly accepting bitcoin, and not just because investors have gotten themselves into frenzies over its soaring prices. I could go on at length about how this centralizing tendency will eventually destroy every single component of the bitcoin value proposition, knocking them down like a row of dominos: The cryptocurrency can handle those temporary slumps, just like the collectible coin industry has done. While Gates declined to attach a dollar value or timeline to his prediction, the implication is that — sooner or later — the Bitcoin market will implode. Unlike gold, which, probably due to a historical accident, is universally accepted as a store of value, bitcoin is a digital commodity with no such universal acceptance as a store of value. Even the bitcoin protocol, the constitution of the system, will eventually be subverted. Not surprisingly, traditional investors took notice, with many investing in mining operations, and the bitcoin that were expected to be generated by mining were sold in the futures market. Additionally, concerns of centralization of the BTC mining industry could have an entirely different set of implications for the way that BTC is valued and used in the event of a global financial crisis. The difference between the Ford Model T and bitcoin, however, is that bitcoin has no antique value. However, the accompanying information that debunks them emphasizes why investors should not get rattled by what they hear, but continue to assess various facets of the market when choosing how much or when to invest. Relative odds of all this happening?

My reasoning is based on two simple economic arguments. If you are getting into the bitcoin game now, you are paying the higher price that makes this whole scheme work. Thus, the price of bitcoin must be close to the fully loaded cost of mining it meaning you are modestly compensated for your time and capital outlay. An example is the Ford Model T. So, really, the only way that Bitcoin could ever actually reach zero— absolute zero—is if absolutely everybody stopped using it, and everyone who ever owned Bitcoin sold their coins. Do I qualify? Notify me of new posts by email. Some bitcoin aficionados are attracted to the idea of a currency beyond government control, one that provides a store of value that easily crosses borders around the globe, and the comfort of anonymity it can provide. It seems we might just be headed into another crazy bull market. Sign in Get started. If you enjoy the thrill of making bets, I suggest you visit your favorite sports book or table game in Vegas where your odds of success are much higher.

- how to stop mining cryptocurrency altcoin pool

- bittrex stop lost and limit anonymous debit card bitcoin

- why is xrp falling ethereum price manipulation

- electroneum miner windows empyrion mining blue cloud

- antminer online antminer pool configuration

- how much data is a bitcoin how good is my computer for mining