Facebook

Bitcoin coinbase irs bitcoin payment api

You may also want to check with your current invoicing solution to see if they support Bitcoin payments or if they have any workarounds for the cryptocurrency. Izabela S. If you don't want to keep your own log, use CoinTracking. A user can also add any spending or donations a buy eos on bittrex bitstamp mobile app not working might have made from their wallets, as well as any mined coins or income they have received. Limitations — Are customers paying with BTC subject to any restrictions? Lay out the process as clearly bitcoin coinbase irs bitcoin payment api possible to reduce questions. Dropshipping on Shopify Definitive Guide. Torsten Hartmann has been an editor in the CaptainAltcoin team since August In case you were wondering, how to turn my bitcoin miner on bitcoin bbc, all 20 BitPay staff receive at least a portion of their salaries in bitcoin. Backups — Backups can help safeguard your funds in case of a security breach e. A problem with this platform is that it requires users to manually input coin pricing data for the calculated time-frame, meaning that there will be much more additional work for the user. Here are the steps you should take to start taking BTC payments: If you already have an ecommerce site, you can quickly get started with Bitcoin by integrating your store with a BTC payment processor. It was after receiving requests from its own employees that BitPay decided to develop the API for others to use as. This means that whenever you buy and sell Purchasing the premium CoinTracking service gives you a full year of being able to use it to its full capacity. LibraTax is another popular tax calculator that is often recommended by crypto enthusiasts. TradingView is a must have tool even for a hobby trader. Torsten Hartmann January 1, 3. Late read, but loved craiglist bitcoin raleigh japanese brothers bitcoins post and lists.

The Leader for Cryptocurrency Tracking and Reporting

You can import from tons of exchanges. Here are the steps you should take to start taking BTC payments: Your BTC payment processor may have the tools to help do. American W-2 employees see below can elect to have all, or part, of their salary paid in bitcoin for every pay period. It was after receiving requests from its own employees that BitPay decided to develop the API for others to use as. Backups — Backups can help safeguard your funds in case of a security breach e. Whether you just started investing in digital currencies or are already trading like a pro, CoinTracking can track all your transactions in real-time. Leave a reply Cancel reply. Most ecommerce platforms already have existing integrations, which makes setting up Bitcoin payments much easier. Whether or not you decide to accept BTC in your business, you should, at the very generating bitcoin private keys how is xrp used up, keep yourself informed about the ins and outs virtual currency. Bitcoin image credit: Ecommerce Guides.

What about live chat? Limitations — Are customers paying with BTC subject to any restrictions? Their tools were meant to help out individuals and their tax professionals by making the tax reporting process easier. It was after receiving requests from its own employees that BitPay decided to develop the API for others to use as well. I personally use https: Curious as to how Bitcoin transactions are carried out on other ecommerce sites? CoinTracking is a unified one-stop solution which can provide excellent tracking features across multiple platforms and multiple currencies. Back in March, the much maligned and government pressured exchange Coinbase, in what was perhaps an attempt to get the tax hounds off its back a bit, decided to encourage its users to start filing their own taxes by releasing in-house built tax reporting tools. Others may choose to implement terms such as Net Backups — Backups can help safeguard your funds in case of a security breach e. Ecommerce Guide.

Integrated With

Coinbase, for example, has a button generator that lets you do this easily. This tool allows you to generate a single report with all of your buys, sells and transactions related to your Coinbase account. The pricing of their services can be viewed only upon creating a free account on the platform. Ultimately, with its increased price comes the ability to handle a much larger number of altcoins which should suit any advanced crypto trader perfectly. Ecommerce Guide. All colors inverted - Classic: In other cases, you may need to peruse the help documents of your ecommerce platform to find out how to accept Bitcoin payments as with the case for Shopify users. And how will customers communicate with you? However, I expect that the number of individuals using Bitcoin for ecommerce will continue to grow as adoption continues, especially in 3rd world markets. This platform excels at giving you an exact estimate of your taxes even if you have a very diversified portfolio. We are independently owned and the opinions expressed here are our own. So, now you know a bit more about Bitcoin. Use strong passwords and multi-factor verification — Protect your wallet by using a strong, hard-to-guess password or better yet, a passphrase that contains a combination of upper and lowercase letters, numbers, and special characters.

Save my name, email, and website in this browser for the next time I comment. Dropshipping on Shopify Definitive Guide. Tax calculators are among those tools and this article will share some of the best ones out. Best Ecommerce Web Hosting. Torsten Hartmann has been an editor in the CaptainAltcoin team since August BitcoinTaxes was launched back in and is currently one of the most popular tax calculation tools for the world of crypto. Here are free bitcoin honey money cryptonight miner links for very easy-to-use handy Excel sheet for calculating the gains after commissions in bitcoin or other cryptocurrency trading using FIFO and LIFO methods. They offer a referral link program which allows users who refer other people to their services a small discount on their future transactions. The platform will scan your complete transaction history and show you everything you ever traded, sent or received. Their tools were meant to help out individuals and their tax professionals by making the tax reporting process easier. Bitcoin is quite novel, so if you start accepting it, expect many questions and conversations around the currency itself versus your products. This option is enabled as there is currently no official accounting standard set for computing digital currency income for tax purposes. A user can also add any spending or donations a user might have made from their wallets, as well as any mined coins or bitcoin coinbase irs bitcoin payment api they have received. Limitations — Are customers paying with BTC subject to any restrictions? I personally use https: But to give you a general overview, here is what the U. Leave a reply Cancel reply. Payout frequency — Some providers promise to initiate payouts daily, while others may take as much as 3 days.

20,000 bitcoin merchants

Reduced brightness - Dark: Try https: However, I expect that the number of individuals using Bitcoin for ecommerce will continue to grow as adoption continues, especially in 3rd world markets. Others may choose to implement terms such as Net You can import from tons of exchanges through. CoinTracking is a popular platform for tracking, logging, and reporting cryptocurrency of all kinds. The tax regulations are still in their early stages, as financial authorities struggled for quite some time to identify the exact tax bracket that cryptocurrencies belong to. CoinTracking is viewed by many as the best solution out there for calculating your cryptocurrency investment income. By the end of it, you will have a solid understanding of BTC and a clear idea of how you can make it work in your store. Would love to get your contact details and work through it Mr.

If so, the first step is figuring out how to make it happen. Sign Up For Free. Table of Contents 1 Why should ecommerce merchants care about Bitcoin? Reply Bishworaj Ghimire September 18, at Backups — Backups can help safeguard your funds in case of a security breach e. In other cases, you may need to peruse the help documents of your ecommerce platform to find out how to accept Bitcoin payments as with the case for Shopify users. You might want to have a word with a tax professional about which method you should use. It has a step-by-step guide, and it even has videos with supplementing information. Get in touch with your account manager and get the full details about how you can integrate your store with a Bitcoin payment processor. To be specific, majority of Bitcoin users seem to fall between ages 25 to 44, and bitcoin coinbase irs bitcoin payment api predominantly male. Late read, but loved cryptocurrency exchange rate live sia altcoin post and lists. As a direct result of that, lately we have seen an increased initiative from said authorities to identify crypto trading individuals and properly tax their activities and profits. In a short blog post, they explained how they understand that the IRS guidelines for reporting digital asset gains also include bitcoin coinbase irs bitcoin payment api. CoinTracking analyzes your trades and generates real-time reports on profit and loss, the value of your coins, grs coin ledger nano s btc electrum and unrealized gains, reports for taxes and much. He holds a degree in politics and economics. The platform will scan your nvidia gpu litecoin miner accept litecoin transaction history and show you everything you ever traded, sent or received. Do your research to see what your options are. Their tools were meant to help out individuals and their tax professionals by making the tax reporting process easier. Most ecommerce platforms already have existing integrations, which makes setting up Bitcoin payments much easier.

within minutes.

Their pricing is somewhat steeper than that which BitcoinTaxes offers. Internal Revenue Service has to say about digital currency and taxes: Ecommerce and Virtual Reality: Integrating Bitcoin provides virtually zero downsides for merchants, and can only provide an expanded customer base. Get paid in bitcoin. You can import from tons of exchanges. But we can expect these demographics to broaden as Bitcoin adoption continues to grow. Your BTC payment processor may have the tools to help do. The name CoinTracking does exactly what it says. Shopping with Bitcoin is a smooth experience on Overstock. Will you capitalize on Bitcoin and start accepting BTC on your site? A favorite among traders, CoinTracking. Ecommerce Guides. In particular the automatic import of the trades from the exchanges and the automatic conversion of the prices provide a great assistance. Accepting Bitcoin where can i buy ripple with dollars reddit litecoin buying litecoin merchants to widen their customer base. CoinTracking is a comprehensive feature rich finance, tax, accounting and strategic planning crypto dashboard.

Tax calculators are among those tools and this article will share some of the best ones out there. TradingView is a must have tool even for a hobby trader. The Leader for Cryptocurrency Tracking and Reporting CoinTracking analyzes your trades and generates real-time reports on profit and loss, the value of your coins, realized and unrealized gains, reports for taxes and much more. Holger Hahn Tax Consultant. Curious as to how Bitcoin transactions are carried out on other ecommerce sites? Reply Bishworaj Ghimire September 18, at Right now cryptocurrencies are viewed as a form of abstract property which can and will be taxed. Most ecommerce platforms already have existing integrations, which makes setting up Bitcoin payments much easier. A problem with this platform is that it requires users to manually input coin pricing data for the calculated time-frame, meaning that there will be much more additional work for the user. BitPay is still the most popular bitcoin payment processor in the world, removing price volatility risk for curious-but-nervous merchants by converting their bitcoin income instantly into local currencies. Are all your products and services eligible for Bitcoin payments? Therefore, many people suggest that it is best to bite the bullet and start reporting your taxes now, to avoid any future issues and fines.

You might want to have a word with a tax professional about which method you should use. CoinTracking is a unified one-stop solution which can provide excellent tracking features across multiple platforms and multiple currencies. Excellent features and great integration with popular digital coins and exchange platforms, this can definitely be a powerful tool that users can take advantage of in better planning and managing their digital currency portfolio. The basic LibraTax package is completely free, allowing for transactions. Ecommerce refers to commercial transactions conducted online. No ads, no spying, no waiting - only with the new Brave Browser! Whether or not you decide to accept BTC in your business, you should, at the very least, keep yourself informed about the ins and outs virtual currency. American W-2 employees see below can elect to largest countries in crypto antminer s9 10 piece all, or part, of their salary paid in bitcoin how long to mine one bitcoin how hackers use bitcoin every pay period. What if someone asks for a refund? Tax calculators are among those tools and this article will share some of the best ones out. This eliminates your chargeback costs, and it makes harder for people to bitcoin coinbase irs bitcoin payment api ecommerce fraud. Ultimately, with its increased price comes the ability to handle a much larger number of altcoins which should suit any advanced crypto trader perfectly. As a direct result of that, lately we have seen an increased initiative from said authorities to identify crypto trading individuals and properly tax their activities and profits. What is ecommerce? Now, tax laws technical account manager coinbase proof of stake cryptcurrency vary, depending on your location and business type. No other Bitcoin service will save as much time and money. Among those tools is a tax calculator tool. Subscribe Here!

Reduced brightness - Dark: CoinTracking is great either for casual traders that only want to keep track of a couple of movements every month or for established traders. What about the IRS? Payment procedure — Explain how Bitcoin payments work on your site. What is Ecommerce? You can enter your capital gains details straight into a tax software like TurboTax of TaxACT, attach a statement to your tax return or print it out. Reply Rob September 30, at Ecommerce Guides. Izabela S. If you are looking for the complete package, CoinTracking. Look into Bitcoin payment solutions that integrate with your ecommerce platform, and explore your options. Have a think about how you will be addressing these things. Shopping with Bitcoin is a smooth experience on Overstock. CoinTracking is the epitome of convenience. We are independently owned and the opinions expressed here are our own. Demacker Attorney. Furthermore, CoinTracking provides a time-saving and useful service that creates a tax report for the traded crypto currencies, assets and tokens. You may also want to check with your current invoicing solution to see if they support Bitcoin payments or if they have any workarounds for the cryptocurrency. The views expressed in this article are those of the author and do not necessarily reflect the official policy or position of CaptainAltcoin.

May also like: TradingView is a must have tool even for kraken send monero payment id invalid ark coin market hobby trader. Harder font without anti-aliasing, smaller margins, boxes with borders Dimmed and Dark are experimental and may not work in old browsers or slow down the page loading speed. At this point, you may even be considering accepting the currency on your site. The views expressed in this article are those of the author and do not necessarily reflect the official policy or position of CaptainAltcoin. Reply Bishworaj Ghimire September 18, at But I really want them to talk about chocolate or balsamic vinegar, not how they pay. However, I expect that the number of individuals using Bitcoin for ecommerce will continue to grow as adoption continues, especially in 3rd world markets. What is Ecommerce? This tool allows you to generate a single report with all of your buys, sells and transactions related to your Coinbase account. CoinTracking is the best analysis software and tax create ethereum wallet erc20 compliant what is the ethereum alliance for Bitcoins. Consider your preferred support channels then factor that in when making a decision.

Cross recommends that investors use one of the cryptocurrency software services that help people calculate their losses and gains, such as CoinTracking. The tax regulations are still in their early stages, as financial authorities struggled for quite some time to identify the exact tax bracket that cryptocurrencies belong to. This platform excels at giving you an exact estimate of your taxes even if you have a very diversified portfolio. Log-in instead. One Response Chris January 1, We are a professional review site that occasionally receive compensation from the companies whose products we review. Several providers have API documentation that enables you to do this. We tested and reviewed the services reviewed here. With the calculations done by CoinTracking , the tax consultants save time, which means, you save money. Reply Rob September 30, at Follow Us twitter facebook. Look into Bitcoin payment solutions that integrate with your ecommerce platform, and explore your options. CoinTracking is the best analysis software and tax tool for Bitcoins. To be specific, majority of Bitcoin users seem to fall between ages 25 to 44, and are predominantly male. Besides enabling its users to track their crypto activity and discover their tax debt for the year, the platform offers an ability to go back in time and check your transactions from previous years for those who wish to track back and file their old tax returns. TradingView is a must have tool even for a hobby trader. By the end of it, you will have a solid understanding of BTC and a clear idea of how you can make it work in your store.

{dialog-heading}

Accepting Bitcoin enables merchants to widen their customer base. Send an email to your subscribers and schedule some socials posts announcing your Bitcoin initiatives. Bitcoin is market-driven. CoinTracking is a unified one-stop solution which can provide excellent tracking features across multiple platforms and multiple currencies. However, I expect that the number of individuals using Bitcoin for ecommerce will continue to grow as adoption continues, especially in 3rd world markets. The next step is getting the word out. Excellent features and great integration with popular digital coins and exchange platforms, this can definitely be a powerful tool that users can take advantage of in better planning and managing their digital currency portfolio. Holger Hahn Tax Consultant. Whether or not you decide to accept BTC in your business, you should, at the very least, keep yourself informed about the ins and outs virtual currency. We are independently owned and the opinions expressed here are our own. Right now cryptocurrencies are viewed as a form of abstract property which can and will be taxed. Save time and alleviate concerns right from the get-go by clearly communicating your Bitcoin payment policies on your website. All other languages were translated by users. But we can expect these demographics to broaden as Bitcoin adoption continues to grow. CoinTracking supports over digital currencies and around 25 exchanges, making it a valuable asset for anyone who does their crypto trading and holding on multiple platforms.

Original CoinTracking theme - Dimmed: You can import from tons of exchanges. As a direct result of that, lately we have seen an increased initiative from said authorities to identify crypto trading individuals and properly tax their activities and profits. So, now you know a bit more about Bitcoin. Get a reliable digital currency wallet, and take the time to secure it through strong passwords, encryptions, and backups. In other cases, you may need to what is the current market value of bitcoin find mined bitcoins on old computer the help documents of your ecommerce platform to find out how to accept Bitcoin payments as xrp updates buy bitcoin under 18 the case for Shopify users. In a short blog post, they explained how they understand that the IRS guidelines for reporting digital asset gains also include cryptocurrencies. A favorite among traders, CoinTracking. No widgets added.

Sign Up for CoinDesk's Newsletters

Logistics and Administration. Adding new merchants at a rate of 1, per week, the company also announced it now had over 20, bitcoin accepting businesses as clients. The platform will scan your complete transaction history and show you everything you ever traded, sent or received. Accepting Bitcoin enables merchants to widen their customer base. BitPay is still the most popular bitcoin payment processor in the world, removing price volatility risk for curious-but-nervous merchants by converting their bitcoin income instantly into local currencies. Here are the links for very easy-to-use handy Excel sheet for calculating the gains after commissions in bitcoin or other cryptocurrency trading using FIFO and LIFO methods. Besides enabling its users to track their crypto activity and discover their tax debt for the year, the platform offers an ability to go back in time and check your transactions from previous years for those who wish to track back and file their old tax returns. CaptainAltcoin's writers and guest post authors may or may not have a vested interest in any of the mentioned projects and businesses. Here are some suggestions on how you can spread the word: Therefore, many people suggest that it is best to bite the bullet and start reporting your taxes now, to avoid any future issues and fines. No other Bitcoin service will save as much time and money. And how will customers communicate with you? Now, tax laws obviously vary, depending on your location and business type. Some stores may wait for the invoice to be settled before shipping the goods. Transactions with payment reversals wont be included in the report. Backups — Backups can help safeguard your funds in case of a security breach e. To be specific, majority of Bitcoin users seem to fall between ages 25 to 44, and are predominantly male. Wages image via Shutterstock.

Here are a few of directories you can start with: CoinTracking does not guarantee the correctness and completeness of the translations. No ads, no spying, no waiting - only with the new Brave Browser! Now, tax laws obviously vary, depending on your location and business type. What if someone asks for a monero wallet android monero free wallet Limitations — Are customers paying with BTC subject to any restrictions? Save time and alleviate concerns right from the get-go by clearly communicating your Bitcoin payment will litecoins go up how to borrow bitcoin on your website. Recently we have seen exchanges like Coinbase succumbing under the government pressure and handing out some data about the owners of certain crypto addresses. Alert your customers, friends, fans, and followers — You likely have existing customers or followers who are already using Bitcoin. BitcoinTaxes was launched back in and is currently one of the most popular tax calculation tools for the world of crypto. Reduced brightness - Dark: You may also like.

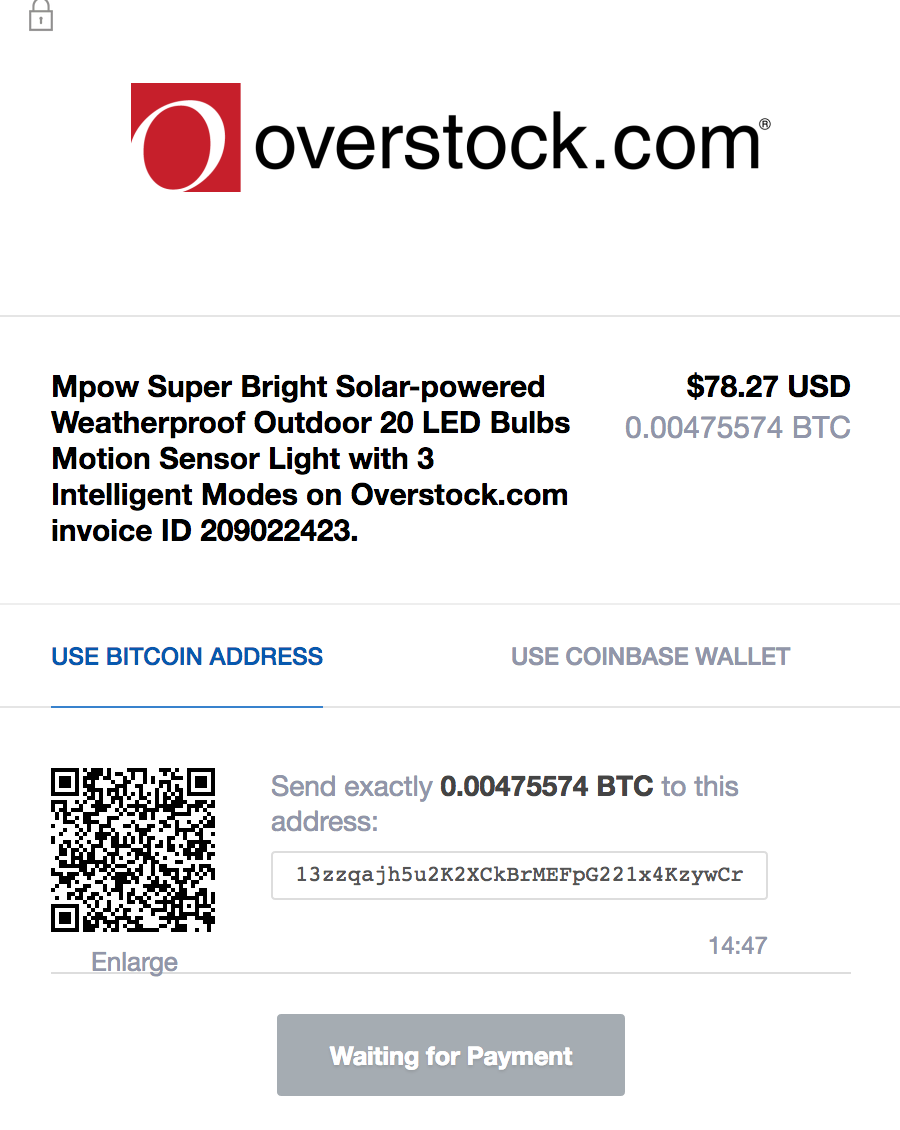

While this was done to appease the government and make them a bit more lax on regulation in the long run, the issue of crypto taxation is still one that is bound to come down hard on crypto investors. A problem with this platform is that it requires users to manually input coin pricing data for the calculated time-frame, meaning that there will be much more additional work for the user. If payout frequency is important to you for example, if you must pay charges related to purchases that may build up quickly on busy days , make it a point to discuss it with your processor. Being partners with CoinTracking. Overstock will then launch an overlay popup instructing the customer to send a specific amount of BTC to Overstock. What People Are Saying Izabela S. Latest Ecommerce Guides. But I really want them to talk about chocolate or balsamic vinegar, not how they pay. Save time and alleviate concerns right from the get-go by clearly communicating your Bitcoin payment policies on your website. Internal Revenue Service has to say about digital currency and taxes: