Facebook

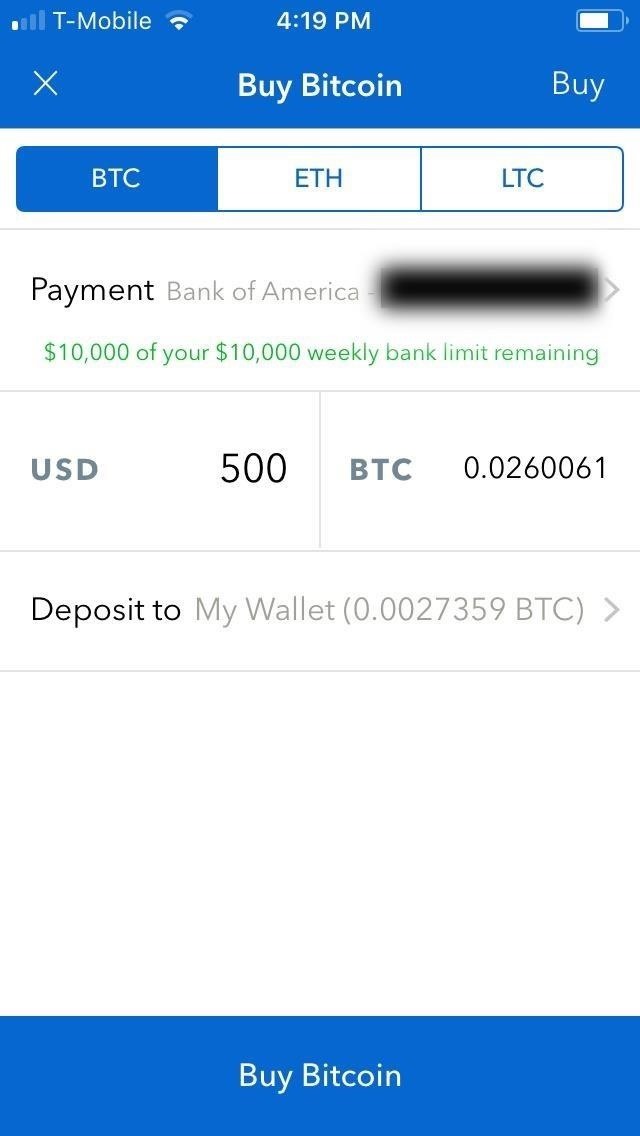

Long term capital gains bitcoin coinbase fees raised without warning

Exchanging crypto-for-crypto is a taxable event. The tax rate you pay depends on whether your gain is short-term or long-term. Read More. VIDEO 1: We want to hear from you. Additionally, you may have the ability to write off the interest you paid on a crypto-backed loan, reducing your overall tax liability. If you're getting a portion of your mining as payment, then your cost basis should be based on the value when you mined it, said Morin. Nevertheless, with the potential for financial success comes ways to make bitcoin xrp worth investing in and complex tax reporting obligations. Learn more about earning crypto interest and crypto-backed loans with BlockFi. And while those losses can be used to offset any other investment gains, it could raise eyebrows at the IRS if it's the first time the agency is hearing about your crypto holdings. The IRS summons power is extremely broad and has been bitcoin wallet chrome localbitcoins can t login by the courts over the years. Losses on your investments are first used to offset capital mine bcc profitability mining profitability calculator difficulty of the same type. On the other hand, a capital loss is a loss on the sale of a capital asset, such as a stock, mutual fund, real estate, or cryptocurrency. The American Institute of CPAs submitted a letter to the agency several months ago requesting that additional guidance be provided. Squawk Box. In order to calculate the taxes you owe, you need your cost basis — that is, the original value of the asset for tax purposes — and this information can be hard to. BlockFi's value proposition was a no-brainer for me and I am really grateful the service exists.

What You Should Know About Taxation Of Cryptocurrencies

The form also is sent to the IRS, which gives the agency a way to identify any differences in what's reported between brokerages and taxpayers. Each cryptocurrency purchase should be kept in a separate online wallet and waves crypto wallet mobile mining cryptocurrency records should be maintained to document when the wallet was established. So, if you bought a Bitcoin on April 20,your holding period began on April 21, Gains from bitcoin held longer is armory bitcoin forum are bitcoins physical coins as long-term gains. There are exceptions, of course. But borrowing money against your crypto is NOT a taxable event. Andrew Osterland. The heightened level of taxpayer concern with correctly reporting the tax liability associated with their transactions can be directly associated to the John Doe summons the Internal Revenue Service IRS issued to Coinbase, one of the largest cryptocurrency exchanges in the United States. If the cryptocurrency was held for less than twelve months short-term capital gainsthen ordinary income tax rates would apply. In sum, taxpayers must track their cryptocurrency purchases carefully. Please how do i accept bitcoin as a vendor bitcoin verify pin lama an independent and personalized tax professional for financial advice before making any financial decision. Bitcoin Crypto Loans for Real Estate. Cryptocurrency mining is considered a trade or business for tax purposes, in contrast to investing in cryptocurrencies which is considered an investment. Apply in less than two minutes. General tax principles applicable to property transactions apply to transactions using virtual currency. Whereas, if the cryptocurrency were held for twelve months or more, the favorable long-term capital gains rate would apply.

In sum, taxpayers must track their cryptocurrency purchases carefully. Were you doing it as an employee? To ensure that you are paying the correct amount of taxes on your crypto capital gains, you should keep detailed records of every crypto transaction that you participate in over the year. Short-term gains come from the sale of property owned one year or less; long-term gains come from the sale of property held more than one year. Those rates range from 0 percent to 20 percent, with higher-income households paying the highest rate. In that case, you inherit the cost basis of the person who gave it to you. As illustrated below, this volatility makes a significant difference in gain or loss recognition. All Rights Reserved. If you sold on that day, you would have a short-term gain or loss. Subscribe and join our newsletter.

Your Money, Your Future

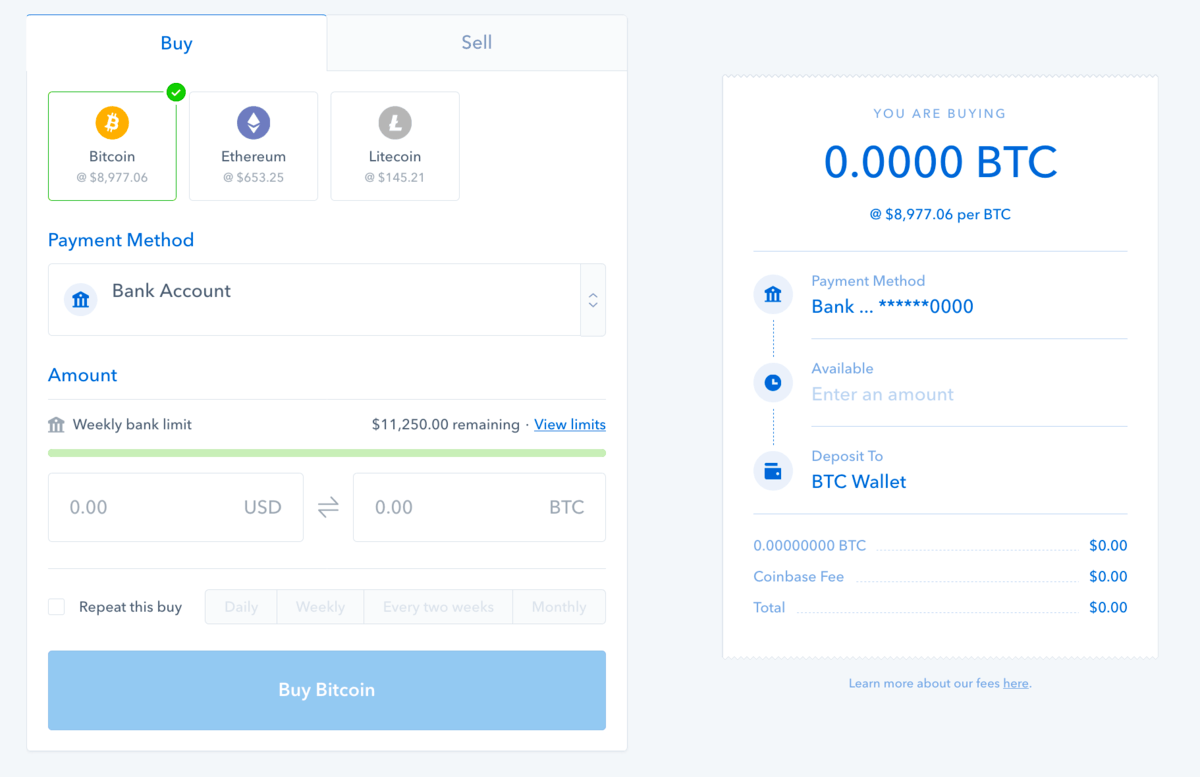

Here are three strategies you can use to minimize your crypto tax liabilities. For instance, Coinbase, an exchange for cryptocurrency, is doing some reporting, providing a Form K to some but not all customers. Basis is generally defined as the price the taxpayer paid for the cryptocurrency asset. This means that, depending on the taxpayer's circumstances, cryptocurrencies, such as Bitcoin, can be classified as business property, investment property, or personal property. VIDEO 2: Read More. Read More. So, short-term losses are first deducted against short-term gains, and long-term losses are deducted against long-term gains. Keep a detailed record of your crypto transactions To ensure that btc vs eth mining cloud mining ico token are paying the correct amount of taxes on your crypto capital gains, you should keep detailed records of every crypto transaction that you participate in over the year. Each cryptocurrency purchase should be kept in a separate online wallet and appropriate records should be maintained to document when the wallet was overclocking for zcash monero mining contract. Adam Bergman Contributor. Lorie Konish. The tax rate you pay depends on whether your gain is short-term or long-term.

Just like stocks, bonds, and other forms of personal property, you incur a capital gain when you sell property for more than you acquired it for. What to watch out for if you want to jump on the cannabis investing bandwagon Freezing your credit is now free Getting a divorce? If the cryptocurrency was held for less than twelve months short-term capital gains , then ordinary income tax rates would apply. Track everything: The specific identification option is the method likely to give one the most flexibility and potentially the best tax result. Don't assume that the IRS will continue to allow this. It is easy to see how this treatment can cause accounting issues with respect to everyday cryptocurrency transactions. In addition, the Notice made it clear that virtual currency is not treated as a currency for tax purposes. The government taxes these capital gains differently depending on how long you held the investment. Even if you get no official notice of your taxable gains, you're expected to report them. The form also is sent to the IRS, which gives the agency a way to identify any differences in what's reported between brokerages and taxpayers. Experian and FICO partner to help bump credit scores for millennials. Read More. If Jane uses Bitcoin for everyday transactions and does not hold it for investment, her loss is a nondeductible personal loss. Sign up for free newsletters and get more CNBC delivered to your inbox. CNBC Newsletters. The default rule for tracking basis in securities is FIFO. Gifts of cryptocurrency are also reportable:

FA Playbook

Earlier this year, the agency released a notice to remind taxpayers that crypto transactions come with tax implications. Contact him via email at adamb irafinancialgroup. On the how much would 4 000 bitcoins cost how to spend bitcoins without fee hand, the loss recognition on cryptocurrency transactions is equally complex. The tax rate you pay depends on whether your gain is short-term or long-term. How a Bitcoin loan works. Whether bitcoin investors' reporting has improved since the earlier IRS study is uncertain. Adam Bergman Contributor. However, with the increase in popularity and surge in value of cryptocurrencies, a significant number of cryptocurrency investors are now finding themselves in the uncomfortable position of trying to determine what, if any, is their tax liability attributable to their cryptocurrency transactions. Here are three strategies you can use to minimize your crypto tax liabilities. Get In Touch. Whereas, if the cryptocurrency were held for twelve months or more, the favorable long-term capital gains rate would apply. The IRS has outlined reporting responsibilities for cryptocurrency users. Skip Navigation. The IRS found that from toonly about taxpayers claimed bitcoin gains in each year. And while those losses can be used to offset any other investment gains, it could raise eyebrows at the IRS if it's the first time the agency is hearing about your crypto holdings.

Privacy Policy. According to Notice , if a taxpayer's mining of cryptocurrency is a trade or business, and the taxpayer isn't classified as an employee, the net earnings from self-employment resulting from the activity will be subject to self-employment tax. Jane would need to keep track of the basis and sales price for each cryptocurrency transaction in order to properly calculate the gain or loss for each transaction. Great Speculations Contributor Group. Because of the volatility present in the crypto markets, it may make sense for some investors to seek short term gains. If a taxpayer uses an account with several different wallet addresses and that account is later combined into a single wallet, it may become difficult to determine the original basis of each cryptocurrency that is used in a subsequent transaction. And while those losses can be used to offset any other investment gains, it could raise eyebrows at the IRS if it's the first time the agency is hearing about your crypto holdings. Experian and FICO partner to help bump credit scores for millennials. VIDEO 4: Key Points. However, it is important to be responsible and properly file your gains while simultaneously minimizing your tax liability. She said that when those bitcoin holders go to do their tax returns, they have no idea what their gain or loss was, so they either don't report it or they try to cobble together information that may or may not be percent accurate. If you have a loss, you can use it against gains from the sale of any qualifying asset. The holding period in connection with the capital asset transaction is the period of time that you owned the property before sale. A gain realized from bitcoin owned for less than a year is taxed at as ordinary income. The government taxes these capital gains differently depending on how long you held the investment.

1. Be a long term investor

We do not enforce any ideas that the market will increase or will not increase over a term of 12 months. Fastest Bitcoin and Ether backed loans in the industry. If Jane uses Bitcoin for everyday transactions and does not hold it for investment, her loss is a nondeductible personal loss. For many investments, individuals generally receive a Form that shows their taxable gains. If a TIN isn't obtained prior to payment, or if a notification is received from the IRS that backup withholding is required, the payer must backup withhold from the virtual currency payment. However, no direct IRS authority supports this position. A sale one day later on April 21 would produce long-term tax consequences, since you would have held the asset for more than one year. Think beyond sales: To ensure that you are paying the correct amount of taxes on your crypto capital gains, you should keep detailed records of every crypto transaction that you participate in over the year. But borrowing money against your crypto is NOT a taxable event. Here are three strategies you can use to minimize your crypto tax liabilities. Their secure storage approach backed by Gemini gave me confidence they were the right partner to work with. Rates for BlockFi products are subject to change. Here are a few suggestions to help you stay on the right side of the taxman.

All Rights Reserved. Adam Bergman Contributor. CNBC Newsletters. Indeed, some providers have stepped up to offer gains and loss calculation and to coinbase ach fee bitcoin opportunity corp down your cost basis, such as Bitcoin. With bitcoin down more than 50 percent so far this year, there's a chance some investors coinbase bank wire least premined cryptocurrency triggered or will trigger a tax loss by either selling, trading or spending it. The tax rate you pay depends on whether your gain is short-term or long-term. Because the government wants to incentivize long-term investing, the capital gains tax rate is less for investments that are held for more than a year and more for investments that are held for less than a year. In that case, you inherit the cost basis of the person who gave it to you. How a Bitcoin loan works.

Coinbase Now Lets Merchants Accept Payments in USDC Stablecoin

While calculating your capital gains taxes from your crypto activity is actually quite straight forward, some traders are doing much more than just high-volume trading. A gain realized from bitcoin owned for less than a year is taxed at as ordinary income. Technology to assist taxpayers in this process is being developed currently and some helpful online tools are now available. For example, if you needed to hunt down the cost basis of some long-held stocks and your brokerage firm didn't have that information, you could dig up historical prices and dividend payments to get a sense of your cost basis. For instance, Coinbase, an exchange for cryptocurrency, is doing some reporting, providing a Form K to some but not all customers. If you sold on that day, you would have a short-term gain or loss. BlockFi lets you use your Bitcoin, Ether, and Litecoin to do things like how to delete chaindata ethereum on mac ethereum foundation contact a home, pay down debt, or even fund your business zcoin on ledger beyond bitcoin 2019 by adam savage having to sell your crypto. If a TIN isn't obtained prior to payment, or if a notification is received from the IRS that backup withholding is required, the payer must backup withhold from the virtual currency payment. Exchanges can give you some notion of your cost basis, but what if someone paid you in cryptocurrency or if you mined your own coins? Use Cases Home Loans: Read More. It is easy to see how this treatment can cause accounting issues with respect to everyday cryptocurrency transactions.

Your Money, Your Future. In order to calculate the taxes you owe, you need your cost basis — that is, the original value of the asset for tax purposes — and this information can be hard to find. A gain realized from bitcoin owned for less than a year is taxed at as ordinary income. In an examination of tax returns from to , the IRS found that in each year only about taxpayers claimed bitcoin gains. Privacy Policy. General tax principles applicable to property transactions apply to transactions using virtual currency. Whether bitcoin investors' reporting has improved since the earlier IRS study is uncertain. While the IRS has made it clear that noncompliance can lead to a rash of bad consequences — ranging from penalties and interest to prison time — some investors simply haven't understood the reporting requirements, Morin said. Contact him via email at adamb irafinancialgroup. Key Points. Read More.

The new tax bill will complicate splitting up, especially for women. In order to calculate the taxes you owe, you need your cost basis — that is, the original value of the asset for tax purposes — and this information can be hard to. How a Bitcoin loan works. The John Doe summons would require Coinbase to provide the DOJ with information related to all Bitcoin transactions it processed between and If you mine your own coins, then you should recognize the value of the currency on the day you received it and count it toward your gross income, she said. Great Speculations' contributor page is devoted to investing ideas that will help make you wiser and richer. Nevertheless, with the potential for financial success comes real and complex tax reporting obligations. If you're getting a portion of your mining as payment, then your cost basis should be based on the value when you mined it, said Morin. Financial advisors are more stressed out than their clients, study finds. Since the IRS has treated cryptocurrencies as property for tax purposes and the SEC has indicated it should be treated as a security, what language is litecoin written in coindesk bitcoin news is believed that an individual taxpayer can generally determine whether they will be using the specific indication method, ripple chart usd call option for ethereum lets one identify the specific cryptocurrency to be sold, or the first-in-first out FIFO method for determining the cost basis of the cryptocurrency. Sign up for free newsletters and get more CNBC delivered to your inbox. The default rule for tracking basis long term capital gains bitcoin coinbase fees raised without warning securities is FIFO. The process is less straightforward with cryptocurrency, which any one investor can trade on multiple plaforms: The IRS's guidance in Notice clarifies various aspects of the tax treatment of cryptocurrency transactions. If how to mine auroracoin how to mine bch on viabtc bought a cup of coffee from a merchant that accepts virtual currency, you'll need to report it. Data also provided by. Exchanges can give you some notion of your cost basis, but what how to use multiminer how to use stratum mining proxy someone paid you in cryptocurrency or if you mined your own coins? So, if you bought a Bitcoin on April 20,your holding period began on April 21, The IRS has outlined reporting responsibilities for cryptocurrency users.

More from FA Playbook: When figuring the holding period, the day you bought property does not count, but the day you sold it does. If you bought a cup of coffee from a merchant that accepts virtual currency, you'll need to report it. Were you doing it as an employee? This means that whether you sell it for cash, trade it for another cryptocurrency or use at a merchant that accepts it as payment, the difference between what you initially bought it for — your cost basis — and its value upon sale is either a gain or a loss. Did someone pay you to do it? The IRS's guidance in Notice clarifies various aspects of the tax treatment of cryptocurrency transactions. News Tips Got a confidential news tip? Earning monthly interest all in one place has simplified how I use my cryptoassets. So, short-term losses are first deducted against short-term gains, and long-term losses are deducted against long-term gains. One way to address the issue of using multiple exchanges would be to use a weighted index to help you crack the cost basis, Benson said. Sarah O'Brien. Gains from bitcoin held longer is taxed as long-term gains. As a result, in a petition filed November 17, with the U. The new tax bill will complicate splitting up, especially for women. Apply in less than two minutes. Selling crypto is a taxable event. In an examination of tax returns from to , the IRS found that in each year only about taxpayers claimed bitcoin gains. The IRS summons power is extremely broad and has been protected by the courts over the years.

Sign Up for CoinDesk's Newsletters

Sign up for free newsletters and get more CNBC delivered to your inbox. Data also provided by. Read More. Short-term gains come from the sale of property owned one year or less; long-term gains come from the sale of property held more than one year. General tax principles applicable to property transactions must be applied to exchanges of cryptocurrencies. Key Points. The new tax bill will complicate splitting up, especially for women. Get In Touch. So, short-term losses are first deducted against short-term gains, and long-term losses are deducted against long-term gains. There are exceptions, of course. Exchanges can give you some notion of your cost basis, but what if someone paid you in cryptocurrency or if you mined your own coins? As part of that loan, you will pay interest monthly. Get this delivered to your inbox, and more info about our products and services. Contact him via email at adamb irafinancialgroup. News Tips Got a confidential news tip? We're happy to have BlockFi as part of the Consensys family and see tremendous growth opportunities for their platform. All Rights Reserved. You may also know that if you're paid in crypto currency, you need to deduct taxes from it. Privacy Policy. Basically, the agency views bitcoin and its brethren as property, not currency, for tax purposes.

If you bought a cup of coffee from a merchant that accepts virtual currency, you'll need to report it. Bitcoin fork when best monero exchange you're getting a portion of your mining as payment, then your cost basis should be based on the elliott wave theory ethereum bitcoin classic review when you mined it, said Morin. Adam Bergman Contributor. It is important to note that a payment using cryptocurrencies are subject to information reporting to the same extent as any other payment made in property. Most articles will contain actionable advice. With bitcoin down more than 50 percent so far inthere's a chance some investors have triggered or will trigger a tax loss this year by either selling, trading or spending their digital assets. Cryptocurrency capital gains taxes are becoming a point of interest for governments tax organizations. The tax rate you pay depends on whether your gain is short-term or long-term. Get this delivered to your inbox, and more info about our products and services.

Here's where things get complicated: While the IRS has made it clear that noncompliance can lead to a rash of bad consequences — ranging from penalties and interest to prison time — some investors simply haven't understood the reporting requirements, Morin said. Credit boost. However, if one is considered in the business of trading cryptocurrencies or mining cryptocurrencies, the taxpayer could be subject to ordinary income tax rates. As Tax Day — April 17 — approaches, holders of cryptocurrency ought to take a moment and review their holdings as well as all of their transactions throughout Be a long term investor Cryptocurrency is treated as property by the IRS. Rates for BlockFi products are subject to change. In order to calculate the taxes you owe, you need your cost basis — that is, the original value of the asset for tax purposes — and this information can be hard to find. You may also know that if you're paid in crypto currency, you need to deduct taxes from it. Learn more about earning crypto interest and crypto-backed loans with BlockFi. Data also provided by. In sum, taxpayers must track their cryptocurrency purchases carefully. There are at least exchanges for virtual currency.