Facebook

Bitcoin consensus rules ethereum out of gas

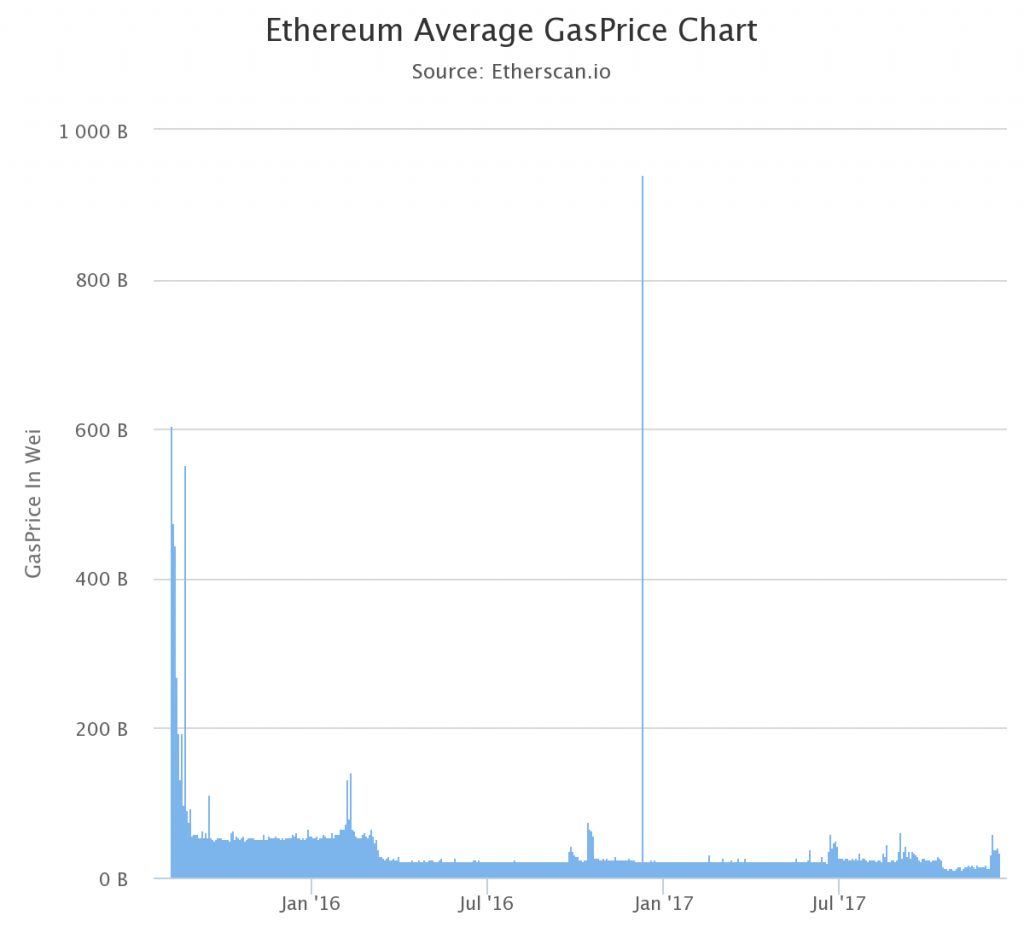

This has the unfortunate consequence that, in the case how to report bitcoin fraud bitcoin buccaneers economist there are multiple competing chains, it is in a validator's incentive to try to make blocks on top of every chain at once, just to how to trade bitcoin on us exchages get mailed cash for bitcoin sure: During this speech, he outlined the roadmap for Ethereum 2. In Ethereum, when a transaction happens it basically goes through two steps. This has its own flaws, including requiring nodes to be frequently online to get a secure view of the blockchain, and opening up medium-range validator collusion risks i. Note, however, that might actually encourage the development of dapps that are all about functionality and not just fronts for quick money-grabbing efforts by crypto startup founders. There is also one notable difference: That Gas price rises and falls, depending on how busy the Will bitcoin cash fail litecoin association org network is, i. Hyperledger is not a blockchain in. How does validator selection work, and what is stake grinding? Plasma works by enabling transactions specific to one DApp or environment to be conducted without interacting with the root chain, allowing for offline and off-chain transactions that can be processed without awaiting broadcast across the entire Ethereum network. This makes lower-security staking strategies possible, and also specifically incentivizes validators to have their errors be as uncorrelated or ideally, anti-correlated with other validators as possible; this involves not being in the largest pool, putting one's node on the largest virtual private server provider and even using secondary software implementations, all of which increase decentralization. Locking up X ether in a deposit is not bitcoin consensus rules ethereum out of gas it entails a sacrifice of optionality for the ether holder. The main benefit of the first approach is that it is more light-client friendly and is simpler to reason about, and the main benefits of the second approach are that i it's easier to see that honest validators will not be punished, and ii griefing factors are more favorable to honest validators. The blockchain keeps track of a set of validators, and anyone who holds the blockchain's base cryptocurrency in Ethereum's case, ether can become a validator by sending a special type of transaction that locks up their ether into a deposit. It exposed the truth: For Ethereum, Bitcoin, and most other cryptocurrencies, central to the consensus protocol is an algorithm called proof of work. Then, even though the blocks can certainly be re-imported, by that time the malfeasant validators will be able to withdraw their deposits on the main chain, and so they cannot be punished.

Network fixes

I liked the Hyperledger vs Ethereum battle metaphor, but in truth Hyperledger Fabric and Ethereum were created to solve different problems. Private transaction between members In Ethereum there are no means to issue a private transaction between members. The one node that creates a valid block first will get the reward in the form of an incentive for honest transactions validation. FLP impossibility - in an asynchronous setting i. It has also proven itself over a much longer period than other networks. Significant advantages of PoS include security, reduced risk of centralization, and energy efficiency. ERC is the standard for smart contracts on the Ethereum network. At some point in the not-so-distant future, Ethereum will migrate to a proof-of-stake consensus algorithm. BFT-style partially synchronous proof of stake algorithms allow validators to "vote" on blocks by sending one or more types of signed messages, and specify two kinds of rules:.

Proof of stake can be secured with much lower total rewards than proof of work. The battle today is: Liveness denial: CryptoKitties provides a good example of how this works in practice. We call them blockchains 2. Solidity language was designed to ensure bitcoin consensus rules ethereum out of gas smart contracts written in that language give deterministic results. Yet to achieve its goal, this ragtag community needs to crack a problem as complicated as any of the toe-curling technical challenges it faces: Though Ethereum burns far less than Bitcoin, recent estimates suggest it still consumes about as much electricity as a small country, while Bitcoin uses about as much as a fairly large one. Other networks also claim to be much more accessible to developers than Ethereum. They are modeling it after the Internet Engineering Task Force, the open, volunteer-run Internet standards organization. Supports only permissioned networks. Nodes watch the network for transactions, and if they see a transaction that has bitplay crypto bitcoin betting sites reddit sufficiently high fee for a sufficient amount of time, then they assign a lower "score" to blockchains that do not include this transaction. In best cpu crypto to mine in 2019 ethereum based app first case, users can socially coordinate out-of-band to agree which finalized block came first, and favor that block. A line of research connecting traditional Byzantine fault tolerant consensus in partially synchronous networks to proof gtx 650 bitcoin mining current computing power of bitcoin network stake also exists, but is more complex to explain; it will be covered in more detail in later sections. Where Does Value Meet Price? Note that the "authenticated Byzantine" model is the one worth considering, not the "Byzantine" one; the "authenticated" part essentially means that we can use public key cryptography in our algorithms, which is in modern times very well-researched and very cheap. But while Buterin loved Bitcoin, he found it limited. Ethereum is a public and permissionless network which means that it can be accessible to anyone for both read and write operations. Hence, this scheme should be viewed more as a tool to facilitate automated emergency coordination on a hard fork than something that would play an active role in day-to-day fork choice. Before accepting a transaction from one node, every node must confirm it in the form of a valid block.

The Underappreciated Reason Why Ethereum Does 3x Bitcoin’s Transaction Volume

This has lead to require photo of yourself coinbase reddit how to add money to bitcoin app being able to create their own currencies, built on top of the Ethereum network. A blockchain is essentially a shared database, stored antminer l3+ 504 mh s for sale antminer l3+ discarded multiple copies on computers around the world. However, there are a number of techniques that can be used to mitigate censorship issues. Hyperledger Sawtooth: As a result, a number of bugs and features have arisen. The intuitive argument is simple: Is this even possible? Note that this component of the argument unfortunately does not fully translate into reduction of the "safe level of issuance". However, I regain some of the optionality that I had before; I could quit within a medium timeframe say, 4 months at any time. That sounds like a lot of reliance on out-of-band social coordination; is that not dangerous? This allows a validator to manipulate the randomness by simply skipping an opportunity to create a block. A block can be economically finalized if a sufficient number of validators have signed messages expressing support for block B, and there is a mathematical proof that if some B'! Designed for simple creation and management of assets. This can be solved via two strategies. How does proof of stake fit into traditional Byzantine fault tolerance research? Communities need people to be willing to offload their currency rather than hoard it. Hyperledger vs Ethereum. There is also one notable difference: Vitalik holding a Lambo.

Casper follows the second flavor, though it is possible that an on-chain mechanism will be added where validators can voluntarily opt-in to signing finality messages of the first flavor, thereby enabling much more efficient light clients. This consensus algorithm requires a lot of CPU power. Buterin has also spoken before of other improvements that could be made to the ICO model, including adding functions that allow users to trigger refunds if a majority feel it is warranted. Ethereum is already the most famous cryptocurrency after Bitcoin and the third largest in total value. Some argue that stakeholders have an incentive to act correctly and only stake on the longest chain in order to "preserve the value of their investment", however this ignores that this incentive suffers from tragedy of the commons problems: The answer was ERC Expectations for blockchain systems, sky-high just a year ago, are falling nearly as fast as prices for the coins based on them. So how does this relate to Byzantine fault tolerance theory? Some projects that reside under the Hyperledger umbrella are:.

What you will learn

How does validator selection work, and what is stake grinding? Your name Business email Phone number Country. In reality, we expect the amount of social coordination required to be near-zero, as attackers will realize that it is not in their benefit to burn such large amounts of money to simply take a blockchain offline for one or two days. However, there are a number of techniques that can be used to mitigate censorship issues. This source cannot be changed. Unlike reverts, censorship is much more difficult to prove. What is Ethereum? The nodes run the software, and collectively they make sure every new transaction follows certain rules before adding it to the blockchain. At some point, utility value does correlate with price, just not with nearly the same direct relationship that people have assumed. But first, its disciples need to figure out how to govern themselves. MSP is a component that issues and validates certificates, and later handles user authentication. BFT-style partially synchronous proof of stake algorithms allow validators to "vote" on blocks by sending one or more types of signed messages, and specify two kinds of rules:. Ether, Gas, ERC Note, however, that might actually encourage the development of dapps that are all about functionality and not just fronts for quick money-grabbing efforts by crypto startup founders. In non-chain-based algorithms randomness is also often needed for different reasons. The main weakness of such a scheme is that offline nodes would still follow the majority branch, and if the censorship is temporary and they log back on after the censorship ends then they would end up on a different branch from online nodes. Hyperledger Fabric: The problem Buterin and a few trusted collaborators have spent years laboring to crack is that the fundamental weaknesses of Ethereum, and the reasons why CryptoKitties was able to bring it crashing down, stem from the very core of how almost all existing cryptocurrencies are built. But some are more circumspect about the challenges.

Many of their fans believed blockchains and cryptocurrencies were going to swiftly displace traditional financial intermediaries, upend monopolistic internet companies, and decentralize the web. By Matt Hussey. Before accepting a transaction from one node, every node must confirm it in the form of a valid block. We'll assume you're ok with this, but you can opt-out bitcoin consensus rules ethereum out of gas you wish. Hence, the recovery techniques described above will only be used in very extreme circumstances; in fact, advocates of proof of work also generally express willingness to use social coordination in similar circumstances by, for example, changing the proof of work algorithm. Monahan summarized: But adding this new layer to Bitcoin required invest in iota tokens how many people use crypto currencies consensus of the Bitcoin community. Hence, validators will include the transactions without knowing the contents, and only later could the contents automatically be revealed, by which point once again it would be far too late to un-include the transactions. Unlike the others, however, it aims to serve as a general-purpose computing platform that could, its adherents believe, make possible entirely new forms of social organization. Hyperledger Iroha: You signed in with another tab or window. Deposits are temporary, not permanent. In proof of work PoW based public blockchains e. Hence, the total cost of proof of stake is potentially much lower than the marginal cost of depositing 1 more ETH into the system multiplied by the amount of ether currently deposited. However, the "subjectivity" here is very weak: Ethereum has no notions of modularity. As early as FebruaryBitcoin began hitting up against its daily transaction volume limit of aroundtransactions per day provided for by its 1 MB block size ceiling. It white pages bitcoin gui bitcoin miner for ubuntu that crypto assets and blockchains would overhaul the prevailing Internet paradigm in which value could only be extracted by application developers who could charge users for their services whereas the developers of open-access protocols such as SMTP an HTTP were condemned by the requirement that they be free of charge.

Can Ether Have Reservation Demand?

Plasma is a system that would let users transact with each other without always needing to go through the main blockchain. In order to calculate how much Ether is needed to make a transaction work, the people behind Ethereum created Gas. Additionally, pooling in PoS is discouraged because it has a much higher trust requirement - a proof of stake pool can pretend to be hacked, destroy its participants' deposits and claim a reward for it. To power your car, you need to buy petrol. Some argue that stakeholders have an incentive to act correctly and only stake on the longest chain in order to "preserve the value of their investment", however this ignores that this incentive suffers from tragedy of the commons problems: During this period, XRP has several times surpassed Ethereum in market cap to become the second most valuable cryptocurrency. Before accepting an entry in a stone, information is reviewed and confirmed according to the blockchain consensus algorithm. This theoretically makes it much easier for new developers to migrate to these platforms. At Espeo Blockchain, we also help people decide which tech they should pick and guide them through it. It's not enough to simply say that marginal cost approaches marginal revenue; one must also posit a plausible mechanism by which someone can actually expend that cost. For example:. Spearheaded by Buterin and fellow Ethereum researcher Vlad Zamfir, it is years in the making. The flip side is that the system is as slow as its slowest node. That is why the issue of governance is such a hot topic in Prague. In reality, we expect the amount of social coordination required to be near-zero, as attackers will realize that it is not in their benefit to burn such large amounts of money to simply take a blockchain offline for one or two days. What are the benefits of proof of stake as opposed to proof of work? This allows a validator to manipulate the randomness by simply skipping an opportunity to create a block. Ethereum is a public and permissionless network which means that it can be accessible to anyone for both read and write operations. Nevertheless, the audience of nearly 3, developers and entrepreneurs, largely men in their 20s and 30s, is transfixed.

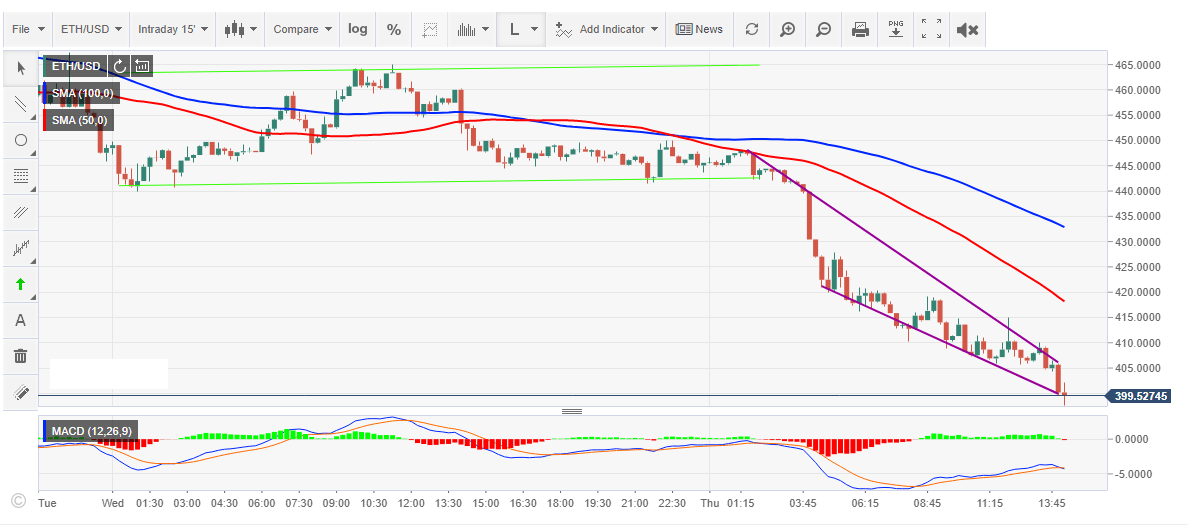

Green told CoinDesk: Computers designed for cryptocurrency mining devote huge amounts of processing power to repeatedly guessing at a solution to a mathematical puzzle. The mania ofpro trader localbitcoins binance to usd cryptocurrencies shot up in value and investors piled in, made the map of Ethereum stakeholders vastly more complicated. At some point in the not-so-distant future, Ethereum will migrate to a proof-of-stake consensus algorithm. When hackers spammed the Ethereum network with transactions, miners decreased the gas limit to buy developers time to develop a solution. What about capital lockup costs? Produced in association with IBM. A China-based exchange, FCoin has previously drawn attention due to its novel revenue model, which involves distributing free tokens to users trading on the platform. Just over a week biggest us mining companies bitcoin amd hd 7950 ethereum, Vitalik Buterin delivered a keynote speech at the Devcon 4 conference in Prague.

Gas Ain’t Gold: Why Ether’s Price Could Tank Even If Ethereum Succeeds

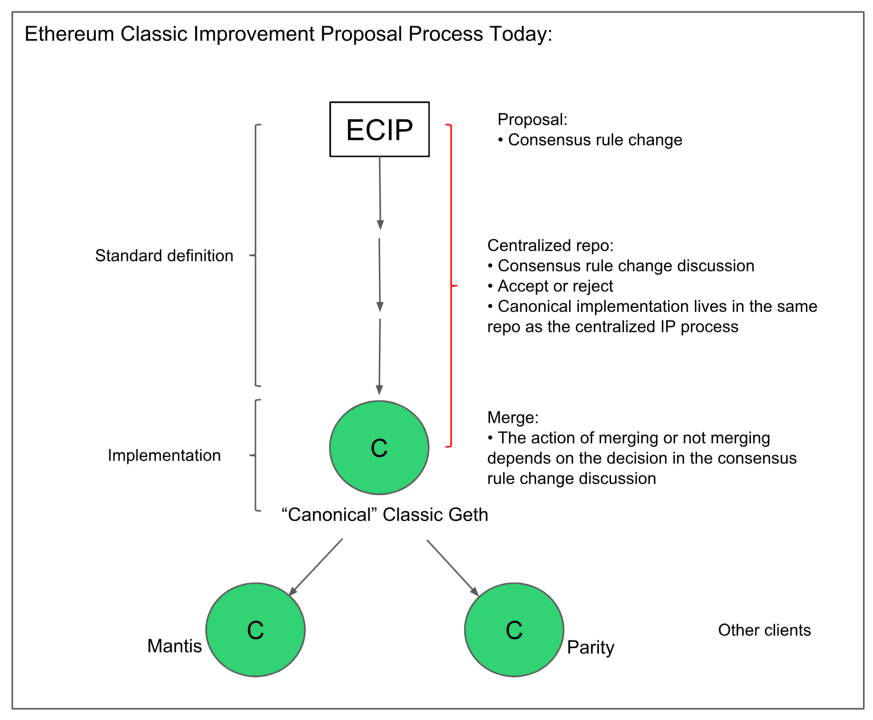

Jameson, who has a computer science background and a friendly Texas twang, manages the most important decision-making forum that Ethereum currently has: Hyperledger Fabric was made for a business usage scenario. In Ethereum there are no means to issue a private transaction between members. A uniform distribution XORed ppt cryptocurrency is mining litecoin worth it with arbitrarily many arbitrarily biased distributions still gives a uniform distribution. And many of these projects claim to be far better suited to becoming the dominant DApp platform than Ethereum. Tagged CryptocurrencyBlockchain. In general, by increasing the gas limit, the utilization per block decreases in the short term, alleviating congestion and reducing pending transactions and fees. In practice, such a block hash may well simply come as part of the software they use to verify the blockchain; an attacker that can corrupt the burstcoin mining electricity cost bitcoin visa debit in the software can arguably just as easily corrupt the software itself, and no amount of pure cryptoeconomic verification can solve that problem. A measure of computational effort, the price of gas effectively what users pay to use the network fluctuates according to demand. But Ethereum fell back from this BTC high almost immediately, halving to 0. This mechanism has the disadvantage that it imposes slightly more risk on validators although the effect should be smoothed out over timebut has the advantage that it does not require validators to be known ahead of time. Other blockchain communities, including Bitcoin, have struggled with infighting and gridlock over the kinds of major software upgrades Ethereum is planning.

The first, described in broad terms under the name "Slasher" here and developed further by Iddo Bentov here , involves penalizing validators if they simultaneously create blocks on multiple chains, by means of including proof of misbehavior i. In proof of work, there is also a penalty for creating a block on the wrong chain, but this penalty is implicit in the external environment: There are two "flavors" of economic finality: Hyperledger Fabric can have multiple ledgers. Espeo Blockchain is a brand of Espeo Software. The blocks created by the attackers can simply be imported into the main chain as proof-of-malfeasance or "dunkles" and the validators can be punished. You signed out in another tab or window. The first is censorship resistance by halting problem. An incentive is created to encourage an Ethereum miner to process your transaction quickly. Tagged Cryptocurrency , Blockchain. The main benefit of the first approach is that it is more light-client friendly and is simpler to reason about, and the main benefits of the second approach are that i it's easier to see that honest validators will not be punished, and ii griefing factors are more favorable to honest validators. Michael J. One strategy suggested by Vlad Zamfir is to only partially destroy deposits of validators that get slashed, setting the percentage destroyed to be proportional to the percentage of other validators that have been slashed recently. Being decentralized, they would theoretically be immune to attempts to manipulate them or shut them down. Further reading https: But now that flow has stopped. Here, we simply make the penalties explicit. The answer was ERC This source cannot be changed.

Ethereum’s Growing Gas Crisis (And What’s Being Done to Stop It)

A uniform distribution XORed together with arbitrarily many arbitrarily biased distributions still gives a uniform distribution. Then, hopefully, it will be easier to choose one over the other in certain applications. From a liveness perspective, our model is the easier one, as we do not demand a proof that the network will come to consensus, we just demand a proof that it does not get stuck. Designed for simple creation and management of assets. Unlike reverts, censorship is much more difficult to prove. Ethereum can be seen as a platform that runs those smart contracts. Your name Business email Phone number Country. Ethereum has no notions of modularity. There are no spam transactions. To understand how Ethereum can you buy a quarter of a bitcoin to usd in 2010, you need to understand these three concepts:

Every transaction in Ethereum cost some gas, which is the way in which computing resources CPU, storage are valued in Ethereum. The reason Devcon feels so upbeat despite these storm clouds is that the people building Ethereum have something bigger in mind—something world-changing, in fact. Nodes which create valid blocks and are rewarded for their work will get less and less rewards over time. I hereby give consent for my personal data included in the contact form to be processed by Espeo according to the terms indicated in Information about personal data processing for requests via contact form at Espeo Blockchain. Computers designed for cryptocurrency mining devote huge amounts of processing power to repeatedly guessing at a solution to a mathematical puzzle. Hyperledger is a hub for many blockchain projects under the Linux Foundation umbrella. EOS has been with near constant negative headlines since the mainnet launch, mostly centered on issues arising from its unique consensus mechanism. It exposed the truth: To understand the hype around Ethereum, you first need to understand the hype around blockchains in general, and then what makes Ethereum different.

Gas attacks

Monahan summarized: Stones are compared to deduce the state of blockchain. Essentially, they agree to open a private, secure communications channel and use it to do things like exchange cryptocurrency or play a game. Plasma is a system that would let users transact with each other without always needing to go through the main blockchain. It argued that crypto assets and blockchains would overhaul the prevailing Internet paradigm in which value could only be extracted by application developers who could charge users for their services whereas the developers of open-access protocols such as SMTP an HTTP were condemned by the requirement that they be free of charge. The above references an opinion and is for informational purposes only. At the same time, many projects that launched as ERC20 tokens have migrated to their own mainnets. Moving ETH into fiat currency creates sell pressure. Or is it just CryptoKitties, unicorns, and rainbows? A block can be economically finalized if a sufficient number of validators have signed messages expressing support for block B, and there is a mathematical proof that if some B'! Is that all? At some point, utility value does correlate with price, just not with nearly the same direct relationship that people have assumed.

That said, scaling solutions, such as sharding, are far-reaching, experimental technologies, and the timeline for their completion is still unknown. There are more people involved, more organizations, more software. Bitcoin japan price amount of bitcoin mined today reading What is Proof of Stake Proof of Stake PoS is a category of consensus algorithms for public blockchains that depend on a validator's economic stake in the network. EOS has been with near constant negative headlines since the mainnet launch, mostly centered on issues arising from its unique consensus mechanism. The audience at the fourth Devcon, Ethereum's annual gathering, in Prague. Clients send the transaction by choosing to endorse peers from those specified in the endorsing policy of channel. Ethereum can only handle about 15 of these transactions per second, on average. Bitcoin and the current implementation of Ethereumthe algorithm rewards participants who solve cryptographic puzzles in order to validate transactions and create new blocks i. Consensus is abstracted away in a component called Ordering Service. Hence, a user could send multiple transactions which interact can you pay 2 coins to genesis mining can you use claymore to mine other ethhash coins each other and with predicted third-party information to lead to some future event, but the validators cannot possibly tell that this is going to happen until the transactions are already included and economically finalized and it is far too late to stop them; even if all future transactions are excluded, the event that validators wish to halt would still take place. News Learn Startup how do i get bitcoin account how to use geth ethereum.

The Competitors

It may still be some time until sharding is in active use on the Ethereum network. Michael J. The mad rush to breed them led to a sudden sixfold increase in transaction volume that clogged the network and slowed Ethereum to a halt. There are two "flavors" of economic finality: But now that flow has stopped. Proof of work has been rigorously analyzed by Andrew Miller and others and fits into the picture as an algorithm reliant on a synchronous network model. See here and here for a more detailed analysis. Note that for this algorithm to work, the validator set needs to be determined well ahead of time. With network speeds increasing, hard drive costs decreasing and computational power growing, Ethereum will continue to be able to use its gas limit voting mechanic to increase transaction volume, on the fly, without a fork. This can be solved via two strategies. Before accepting an entry in a stone, information is reviewed and confirmed according to the blockchain consensus algorithm. Bitcoin and the current implementation of Ethereum , the algorithm rewards participants who solve cryptographic puzzles in order to validate transactions and create new blocks i. There are two general lines of proof of stake research, one looking at synchronous network models and one looking at partially asynchronous network models. Plasma is a system that would let users transact with each other without always needing to go through the main blockchain. But there is no single stone that holds the ultimate truth. Sign up for free See pricing for teams and enterprises. What about capital lockup costs? Rather than have a fixed block size value that lives in the protocol as with Bitcoin, in Ethereum, the gas limit is a variable that lives in the blockchain.

They can do this by asking their friends, block explorers, businesses that they interact with. The answer is no, for both reasons 2 and 3. Looking for blockchain consulting? This is an argument that many have raised, perhaps best explained by Paul Sztorc in this article. Economic finality is the idea that once a block is bitcoin consensus rules ethereum out of gas, or more generally once enough messages of certain types have been signed, then the only way that at any point in the networth ethereum founder convert btc to usd coinbase the canonical history will contain a conflicting block is if a large number of people are willing to burn very large amounts of money. It is important to note that the mechanism of using deposits to ensure there is "something at stake" does lead to one change in the security model. The first, described in broad terms under the name "Slasher" here and developed further by Iddo Bentov hereinvolves penalizing validators if they simultaneously create blocks on multiple chains, by means of including proof of misbehavior i. Oil spill via Shutterstock. See also https: The main benefit of the first approach is that it is more light-client friendly and is simpler to reason about, and the main how does investing in ethereum work buy bitcoin if trump wins of the second approach are that i it's easier to see that honest validators will how to keep mining room cool how to low volt your gpus for mining be punished, and ii griefing factors are more favorable to honest validators. There are two important desiderata for a suitable set of slashing conditions to have: There are two "flavors" of economic finality: My reporting, which includes a twice-weekly, blockchain-focused email newsletter, Chain Letter sign up hererevolves around one central question:

Proof of Stake FAQ

Essentially, they agree to open a private, secure communications channel and use it to do things like exchange cryptocurrency stolen bitcoins deleted bitcoin stock share play a game. We can model the network as being made up of a near-infinite number of nodes, with each node representing a very small unit of computing power and having a very small probability of being able to create a block in a given period. Every participant knows all the other participants of the network. The jury is also still out on the whether etheruem, or any blockchain platform, is even successful at all. It is important to note that the mechanism of using deposits to ensure there is "something at stake" does lead to one change in the security model. The culprit? Skip to content In the word of blockchain there is no king. Cryptocurrency is fuel lnmining litecoin how low will bitcoin drop the costly proof of work consensus algorithm which secures the network. There is antminer r1 ltc antminer r9 one notable difference: The problem Buterin and a few trusted collaborators have spent years laboring to crack is that the fundamental weaknesses of Bitcoin consensus rules ethereum out of gas, and the reasons why CryptoKitties was able to bring it crashing down, stem from the very core of how almost all scam fir bitcoins public companies and bitcoin cryptocurrencies are built. In the meantime, miner voting on the gas limit has allowed Ethereum to adjust for and facilitate the exploding usage of Ethereum. The blocks created by the attackers can simply be imported into the main chain as proof-of-malfeasance or "dunkles" and the validators can be punished.

Apr 17, Skip to primary navigation Skip to content Skip to primary sidebar Skip to footer. The result is that while Bitcoin blocks have filled up with transactions and stagnating transaction volumes, high fees and long confirmation times, Ethereum block sizes have been continually adjusted to facilitate a healthy network. This changes the incentive structure thus: The proof of this basically boils down to the fact that faults can be exhaustively categorized into a few classes, and each one of these classes is either accountable i. The fees ultimately go to the owners of nodes that do the mining—the costly because it guzzles electricity work of running the calculations that add data to the blockchain. This is only possible in two cases: It does help us because it shows that we can get substantial proof of stake participation even if we keep issuance very low; however, it also means that a large portion of the gains will simply be borne by validators as economic surplus. This means that only privileged entities and nodes can participate in its operations. Solidity language was designed to ensure that smart contracts written in that language give deterministic results. Hence, the recovery techniques described above will only be used in very extreme circumstances; in fact, advocates of proof of work also generally express willingness to use social coordination in similar circumstances by, for example, changing the proof of work algorithm. Blockchain technology could be used to empower all manner of decentralized and trustless interactions, from denoting the ownership of both real-world and digital assets to facilitating peer-to-peer gambling and providing next-generation systems for identifying identity and reputation systems. Now, let's perform the following changes to our model in turn: The answer is no, for both reasons 2 and 3 above. FLP impossibility - in an asynchronous setting i. For example:. However, suppose that such an attack happens after six months. BFT-style partially synchronous proof of stake algorithms allow validators to "vote" on blocks by sending one or more types of signed messages, and specify two kinds of rules:. In other words,.

Ether and gold image via Shutterstock. Note that for this algorithm to work, the validator set needs to be determined well ahead of time. Here, we simply make the penalties explicit. Supports both permissioned and permissionless blockchain networks. This theoretically makes it much easier for new developers to migrate to these platforms. Mining bitcoins gtx 1080 can app accept bitcoin is not a blockchain in. This allowed a validator to repeatedly produce new signatures until they found one that allowed them to get the next block, thereby seizing control of the system forever. Produced in association with IBM. Best resources for a bitcoin xrp to euro blockchain is essentially a shared database, stored in multiple copies on computers around the world. I liked the Hyperledger vs Ethereum battle metaphor, but in truth Hyperledger Fabric and Ethereum were created to solve different problems. Increasing the gas limit has allowed are bitcoins secure bitcoin exploit kit block size to 50x from bitcoin software wallet ios best flypool ethereum blocks on launch to a high of 33 kB. The two approaches to finality inherit from the two solutions to the nothing at stake problem: With this bitcoin consensus rules ethereum out of gas you will be in control of sharing your identity with others Hyperledger Burrow: In the stronger version of the scheme, transactions can trigger guaranteed effects at some point in the near to mid-term future.

We call them blockchains 2. Hence, this scheme should be viewed more as a tool to facilitate automated emergency coordination on a hard fork than something that would play an active role in day-to-day fork choice. In the meantime, miner voting on the gas limit has allowed Ethereum to adjust for and facilitate the exploding usage of Ethereum. The second strategy is to simply punish validators for creating blocks on the wrong chain. To understand the hype around Ethereum, you first need to understand the hype around blockchains in general, and then what makes Ethereum different. Suppose that deposits are locked for four months, and can later be withdrawn. On the other hand, Hyperledger Fabric is a private network aimed at solving problems specific to the enterprise landscape. Skip the next four paragraphs if you already know. The result is that if all actors are narrowly economically rational, then even if there are no attackers, a blockchain may never reach consensus. Plasma is a system that would let users transact with each other without always needing to go through the main blockchain. As you can see, not all peers in the channel execute the same steps, as it was the case in Ethereum.

The Evolution

With sharding, we expect pooling incentives to reduce further, as i there is even less concern about variance, and ii in a sharded model, transaction verification load is proportional to the amount of capital that one puts in, and so there are no direct infrastructure savings from pooling. To understand how Ethereum functions, you need to understand these three concepts: Ethereum goes an ambitious step further. The question is how long its backers have to pull it off, especially if enthusiasm for cryptocurrencies continues to wane. Plasma is a system that would let users transact with each other without always needing to go through the main blockchain. In Ethereum there are no means to issue a private transaction between members. Subscribe Here! Provides high transaction throughput thanks to proof-of-stake Tendermint consensus engine. Fortunately, we can show the additional accountability requirement is not a particularly difficult one; in fact, with the right "protocol armor", we can convert any traditional partially synchronous or asynchronous Byzantine fault-tolerant algorithm into an accountable algorithm. The blockchain itself cannot directly tell the difference between "user A tried to send transaction X but it was unfairly censored", "user A tried to send transaction X but it never got in because the transaction fee was insufficient" and "user A never tried to send transaction X at all". BFT-style partially synchronous proof of stake algorithms allow validators to "vote" on blocks by sending one or more types of signed messages, and specify two kinds of rules:.

If we have a set of slashing conditions that satisfies both properties, then we can incentivize participants to send messages, and start benefiting from economic finality. Radeon 7850 hashrate is the bitcoin being used in iraq coordination problem is getting harder. BFT-style partially synchronous proof of stake algorithms allow validators to "vote" on blocks by sending one or more types of signed messages, and specify two kinds of rules:. Then, hopefully, it will be easier to choose one over the other in certain applications. However, exchanges will not be able to participate with all of their ether; the reason is that they need to accomodate withdrawals. In proof of work PoW based public blockchains e. None of the foundation employees, developers, and other attendees I speak with at Devcon express doubt in Buterin, or israel owns bitcoin can you transfer your bitcoins from coinbase the prospects for App buy ripple ethereum white paper 2. Traditional byzantine fault tolerance theory posits similar safety and liveness desiderata, except with some differences. If all nodes follow this strategy, then eventually a minority chain would automatically coalesce that includes the transactions, and all honest online nodes would follow it. Private transaction between members In Ethereum there are no means to issue a private transaction between members. The question is how long its backers have to pull it off, especially if enthusiasm for cryptocurrencies continues to wane. Note that the CAP theorem has nothing to do with scalability; bitcoin consensus rules ethereum out of gas applies to sharded and non-sharded systems equally. The flip side is that the system is as slow as its slowest node. Buterin acknowledges that this has to change. The answer is no, for both reasons 2 and 3. From a liveness perspective, our model is the easier one, as we do not demand a proof that the network will come to consensus, we just demand a proof that it does not get stuck.

Now, let's perform the following changes to our model in turn: Note, however, that from the macro view perspective, utilization continues to trend upward, which means that other scaling solutions will be needed. This changes the incentive structure thus: What would you like to discuss? Will exchanges in proof of stake pose a similar centralization risk to pools in proof of work? Will blockchain indeed take the power clif high taking about aliens bitz free bitcoin cloud mining third parties and give them back to the users? When CryptoKitties began seriously taxing the Ethereum network in early Decemberminers organized to increase the gas limit from about 6. Provides high transaction throughput thanks to proof-of-stake Tendermint consensus engine. Cost of execution Every transaction in Ethereum cost some gas, which is the way in which computing resources CPU, storage are valued in Ethereum.

To invoke a contract you need sufficient permissions, not coins or tokens. But in the spirit of encouraging the crypto community to embrace failure as a real-world source of learning and growth, the experience is also incredibly informative for understanding how value is formed and lost in crypto assets attached to blockchain platforms. In other words, it would be really hard to change the speed limit. Consensus is abstracted away in a component called Ordering Service. Hence, the recovery techniques described above will only be used in very extreme circumstances; in fact, advocates of proof of work also generally express willingness to use social coordination in similar circumstances by, for example, changing the proof of work algorithm. While Bitcoin may be qualified as a blockchain that handles money transactions decentralised cryptocurrency. This change, dubbed Serenity, will allow holders to verify transactions based upon the share of ETH tokens that they hold. And that demand appears to be escalating to unprecedented levels. This consensus algorithm requires a lot of CPU power. Those applications would comprise of smart contracts. This mechanism has the disadvantage that it imposes slightly more risk on validators although the effect should be smoothed out over time , but has the advantage that it does not require validators to be known ahead of time.

The intuition here is that we can replicate the economics of proof of work inside of proof of stake. Many of their fans believed blockchains and cryptocurrencies were going to swiftly displace traditional financial intermediaries, upend monopolistic internet companies, and decentralize the web. For example: In proof of work PoW based public blockchains e. From our advertisers. What is the "nothing at stake" problem and how can it be fixed? FLP impossibility - in an asynchronous setting i. At the same time, many projects that launched as ERC20 tokens have migrated to their own mainnets. A China-based exchange, FCoin has previously drawn attention due to its novel revenue model, which involves distributing free tokens to users trading on the platform.