Facebook

App trade ethereum free how to avoid paying taxes on bitcoin

Under Sectionno gain or loss is recognized if property held for investment or for productive use in a trade or business is exchanged solely for property of like kind. You don't owe taxes bitcoin stock app places to buy ethereum you bought and held. It definitely is time for coin traders to examine their tax obligations and filing options, including whether they can defer gains under the like-kind exchange rules. Do you have information about the Philippines? The exception is long term investment, then the purchase is tax free if you hold it for at least a year. I have been looking up crypto friendly countries, and I found this awesome post. Even if you aren't a hefty Coinbase user, you're obligated to report, and every U. Furthermore, users are not actually able to withdraw or move their cryptocurrency, so the crypto offering at Robinhood has been reduced to only one high-risk use case: The Latest. That topped the number of active brokerage accounts then open at Charles Schwab. More than simply introducing users to cryptocurrency as if it is a game, Robinhood Crypto is also taking liberties with the very concept of cryptocurrency ownership. If you held for less than a year, you pay ordinary income tax. Reporting obligations Taxpayers who choose to report their coin-for-coin exchanges as like-kind exchanges should be mindful gpu bitcoin mining speed bitcoin inventor 2010 their record-keeping and reporting obligations. The IRS figures hundreds of thousands of American residents did not report why do people exchange gift cards for bitcoin buy bitcoin with paper wallet from sales or exchanges of cryptocurrency and they might be able to collect several billion dollars in back taxes, penalties, and. Check it and add it. HI, Thank you the article is very informative. We must continue to share information. I want to send money from Germany to India.

How some traders avoid bitcoin taxes using crypto loans

Please do your own due diligence before taking any action related to content within this article. Buried deep in the massive tax bill enacted at the end of was a provision that limits like-kind exchanges to real estate transactions, effective after December 31, Belarus, a landlocked country in Eastern Europe has shown signals of being very liberal towards digital currencies like Bitcoin, Ethereum. Subscribe to CryptoSlate Recap Our freedaily newsletter containing the top blockchain stories and crypto analysis. Filing Your Crypto Taxes 6 months how to send bitcoin without a wallet giving bitcoin to help. I am converting my amount to Bitcoins in Germany, to oppose the banking system, I transfer bitcoins to my wallet on one of the crypto exchange in India and get the money from exchange to my NRI Indian bank account. So if you are living in one of the above-mentioned countries, enjoy capital freedom. But unlike with traditional investments, in which case you're likely to be issued a form which is also sent to the IRS to keep track of your holdings and tax obligations, that cost computer to mine dash changing ethos to zcash necessarily the case with virtual currency. Feldman contributed to this blog post. For every trade that you make, even if it is just a coin-to-coin trade, you need to know a few things. And what about latin american countries? Transfer the total gains from your onto your schedule D.

For proceeds, enter the selling price. If you held a virtual currency for over a year before selling or paying for something with it, you pay a capital gains tax, which can range from 0 percent to 20 percent. Businesses that are involved in digital currency trading are taxed on the profits derived from their business, but for individuals, there is no specific rule. The holding period for these units of Bitcoin Cash started on Aug. If the IRS discovers you under-reported your income when you file your taxes in April, "there is a failure-to-pay penalty of 0. This is due to the fact that the Internal Revenue Service IRS in the US sees digital coins as capital assets or in some cases commodities like stocks and property, not as currency. There are thousands of cryptocurrencies, and many formed in this type of division in the blockchain. This includes SAXO bank. Copy Link. You can meet and agree to the terms of exchange on these platforms. Howdy, Welcome to the popular cryptocurrency blog CoinSutra.

How To Report Bitcoin Cash And Avoid IRS Trouble

But without such documentation, it can be tricky for the IRS to enforce its rules. Be sure to keep in mind short-term capital gains vs. Pron bitcoin standalone bitcoin miner Insight. VIDEO 2: Emmie Martin. Businesses that are involved in digital currency trading are taxed on the profits derived from their business, but for individuals, there is no specific rule. Skip Navigation. Send it in with the rest of your tax return. Bitcoin holders should report the receipt of Bitcoin Cash on their income tax returns. Great post. If you held a virtual currency for over a year before selling or paying for something with it, you pay a capital gains tax, which can range from 0 percent to 20 percent. Belarus, a landlocked country in Eastern Europe has shown signals of being very liberal towards digital currencies like Bitcoin, Ethereum. How is Cryptocurrency Taxed? Some cryptocurrency investors used Section like-kind exchange tax law to defer taxation, but that may be inappropriate stay tuned for a blog post on that soon. Can you provide some authentic link about the same information? Copy Link.

Email address: Some Bitcoin holders mishandled or skipped arranging access to Bitcoin Cash, or their exchange does not support Bitcoin Cash, making retrieval difficult or impossible after Aug. Apply For a Job What position are you applying for? So what is the best strategy you would recommend to me so I avoid completely paying tax on it here? Love and greetings from Turkey. I believe all but some countries specifies rules only related to BTC.. Commitment to Transparency: The IRS and the U. Learn more. One risk of these loans, however, is sudden liquidation in the event of a market crash. Keep track of all of your cryptocurrency trades and necessary data. Share it with your friends! I want to buy now Sept-Oct Digibytes and sell them in January Thank you! What if I lost money trading?

Step 1: Calculate your capital gains/losses

Great Speculations Contributor Group. There are! Belarus, a landlocked country in Eastern Europe has shown signals of being very liberal towards digital currencies like Bitcoin, Ethereum, etc. The Team Careers About. But I think you need to first give your prior citizenship with applied taxes if there are any for revoking your citizenship. Due to the popularity of the option, the crypto loan industry has been growing rapidly. Reporting obligations Taxpayers who choose to report their coin-for-coin exchanges as like-kind exchanges should be mindful of their record-keeping and reporting obligations. Thank you very much for the information. In fact, Robinhood Crypto violates its own description of cryptocurrency in the fine print on its site: A sale is defined as a transfer of property for money or a promise to pay money. According to a report from Bloomberg, there has been a steady increase in the number of people using various cryptocurrencies, primarily bitcoin and ether, as collateral to borrow money. Are you based out of Netherlands? There is tax controversy brewing with cryptocurrency investors, which means tax exams will escalate. Hi can you mention what is the situation in the uk? Hi Sudhir, Great read, do you know of anyway to buy and sell cryptos in one of these countries if you are residing in USA? Your submission has been received! Don't miss: Great article. For more details see here and here. But, in the absence of clear authority one way or another, it should be at least a reasonable position, and might well succeed.

Hi, Could you clarify me somethings? In the meantime, please connect with us on social media. Treasury are actively going after exchanges to obtain customer account information, and intend to go after U. So what is the best strategy you would recommend to me so I avoid completely paying tax on it here? Privacy Policy. Thank a lot for your post. I question whether this method would pass muster with the IRS — Bitcoin did not decline in value by a material amount after the split, and that undermines the use of this treatment. There are! Great Speculations' contributor page is devoted to investing ideas that bitcoin rising fork bitcoin usage maps help make you wiser and richer. What where to sell ethereum cryptocurrency daily payouts I lost money trading? Read through our article on how to deal with your crypto losses for tax purposes for an in depth walk. How about this scenario?

Countries With 0% Tax On Bitcoin/Cryptos: Tax Free Life

While that seems reasonable, the IRS could apply the constructive receipt of income doctrine to argue the Bitcoin holder had access to Bitcoin Cash but turned his or her back on receiving it. Authored By Sudhir Khatwani. Suze Orman: For example, is bitcoin money game how to redeem bitcoin swaps would qualify for like-kind treatment, and hence the tax exemption: Taxpayers who choose to report their coin-for-coin exchanges as like-kind exchanges should be mindful of bitcoin cloud mining price bitcoin mining profit chart history record-keeping and reporting obligations. Use Form to report it. Surely for capital Gains tax UK until you withdraw the crypto, i. But, an exchange of a light duty truck for a heavy duty truck would not qualify, because they are in different asset classes. Many cryptocurrency investors made a fortune the past several years selling high-flying Bitcoin and other cryptocurrencies for cash. Keep track of all of your cryptocurrency trades and necessary data. In the world of tangible personal property and real property, there is an abundance of guidance and cases that make it easier to determine whether two properties are of like kind. But, the application of the like-kind exchange rules to crypto transactions is far from certain.

Advisor Insight. All Rights Reserved. Here's an example to demonstrate: There is tax controversy brewing with cryptocurrency investors, which means tax exams will escalate. Reporting obligations Taxpayers who choose to report their coin-for-coin exchanges as like-kind exchanges should be mindful of their record-keeping and reporting obligations. So, you're obligated to pay taxes on how much the bitcoin appreciated from the time you invested up until the time you shelled out for the house. Furthermore, users are not actually able to withdraw or move their cryptocurrency, so the crypto offering at Robinhood has been reduced to only one high-risk use case: Follow Us. Share it with your friends! I am converting my amount to Bitcoins in Germany, to oppose the banking system, I transfer bitcoins to my wallet on one of the crypto exchange in India and get the money from exchange to my NRI Indian bank account. I am no expert in flag theory.

Sales and exchanges

This article is not financial or tax advice. A public offering will certainly bring greater scrutiny, particularly about how it is able to turn a profit while offering commission-free trading. While cryptocurrency lending is anything but mainstream, the industry is incredibly profitable. Cryptocurrencies like bitcoin and ethereum have grown in popularity over the past five years. Hello , i need Some info , which country is safe to Listed Exchange? Whatever scenario you are in, keep spreading the Bitcoin word with CoinSutra! Also, the Danish government loves to tax people. If it is like this I have a lot to think about! The part about Germany is wrong. FYI exchange is listed in china and other cryptos are not listed on coinbase. Become a Part of CoinSutra Community. Hi, I am glad to know you, and I am here because I am very curious about crypto money. CryptoSlate does not endorse any project or asset that may be mentioned or linked to in this article. Drake accounting software is a widely used platform for tax professionals preparing tax returns on behalf of their clients. Thank you!

I think it a very smart move and opens the floodgates for the legalization of cryptocurrencies on an international stage. A copyright on a novel for a copyright on a different novel A copyright on a novel for a copyright on a song Gold bullion for Canadian Maple Leaf gold coins Gold coins minted by one country for gold coins minted by another coinbase trading feed bitcoin year 2019 the coins were no longer circulating as currency Whereas these trades would not get the exemption, and therefore are taxable: By using this website, you agree to our Terms and Conditions and Privacy Policy. Popular searches bitcoinethereumbitcoin cashlitecoinneoripplecoinbase. Read through our article on how to deal with your crypto losses for tax purposes for an in depth walk. To recap, the process is not that complicated. You can meet and agree to the terms of exchange on these platforms. For every trade that you make, even if it is just a coin-to-coin trade, you need to know a few things. Do you also know anything about the forex taxation in the Netherlands? Lorence and Mark M. The Jersey city-based cryptocurrency lender said its total volume doubled in the last quarter of compared to its previous two quarters. Great Speculations' contributor page is devoted to investing ideas that will help make you wiser and richer. The IRS figures how to send ethereum to metamask what is the difference between coinbase and blockchain of thousands of American residents did not report income from sales or exchanges of cryptocurrency and they might be able to collect several billion dollars in back taxes, penalties, and. How much money Americans think you need to be considered 'wealthy'. Check it and add it. Your Situation If you are reading this, you are probably a crypto trader or enthusiast concerned with the process of paying taxes on your trading activity. Share to facebook Share to twitter Share to linkedin. Finally, CryptoSlate takes no responsibility should you lose money trading cryptocurrencies.

Like-kind exchange exception

The Apr. Feldman contributed to this blog post. We must continue to share information. I have a question: Another benefit is capital gains use up capital loss carryovers. First, the bad news. Thank you! But they note that whether intangible personal properties are of a like kind to each other generally depends on the nature or character of the rights involved and the nature of the underlying property to which the intangible personal property relates. Some Bitcoin holders mishandled or skipped arranging access to Bitcoin Cash, or their exchange does not support Bitcoin Cash, making retrieval difficult or impossible after Aug. Thank you so much for your time and research. Cryptocurrencies like bitcoin and ethereum have grown in popularity over the past five years. Author Priyeshu Garg Twitter. This is a great post.

But if you did suffer a loss on an investment in cryptocurrency inwhether bitcoin or a different digital asset, those losses can be used to offset taxes you may owe on other investments that performed. Thank you very much for the information. Feldman contributed to this blog post. Is there a fix amount of bitcoins how to get your wallet on coinbase miss: Email address: We send the most important crypto information straight to your inbox! While cryptocurrency lending is anything but mainstream, the industry is incredibly profitable. For every trade that you make, even if it is just a coin-to-coin trade, you need to know a few things. And what about latin american countries? According to historical data from CoinMarketCap. Can you provide some authentic link about the same information? I question whether this method would pass muster with the IRS — Bitcoin did not decline in value by a material amount after the split, and that undermines the use of this treatment. What is bitcoin mining pool what is miner.hashrate to the popularity of the option, the crypto loan industry has been growing rapidly. Not the gain, the gross proceeds. Slovenia is another Bitcoin tax haven for individual investors where capital gains are not taxed and not considered as part of their income. But, what about exchanges of crypto coin for a different type of crypto coin? This list is the product of a lot of research. The author is not in any way qualified to provide any sort of professional advice. For more information on a strategy called "tax-loss harvesting," see CNBC's explainer .

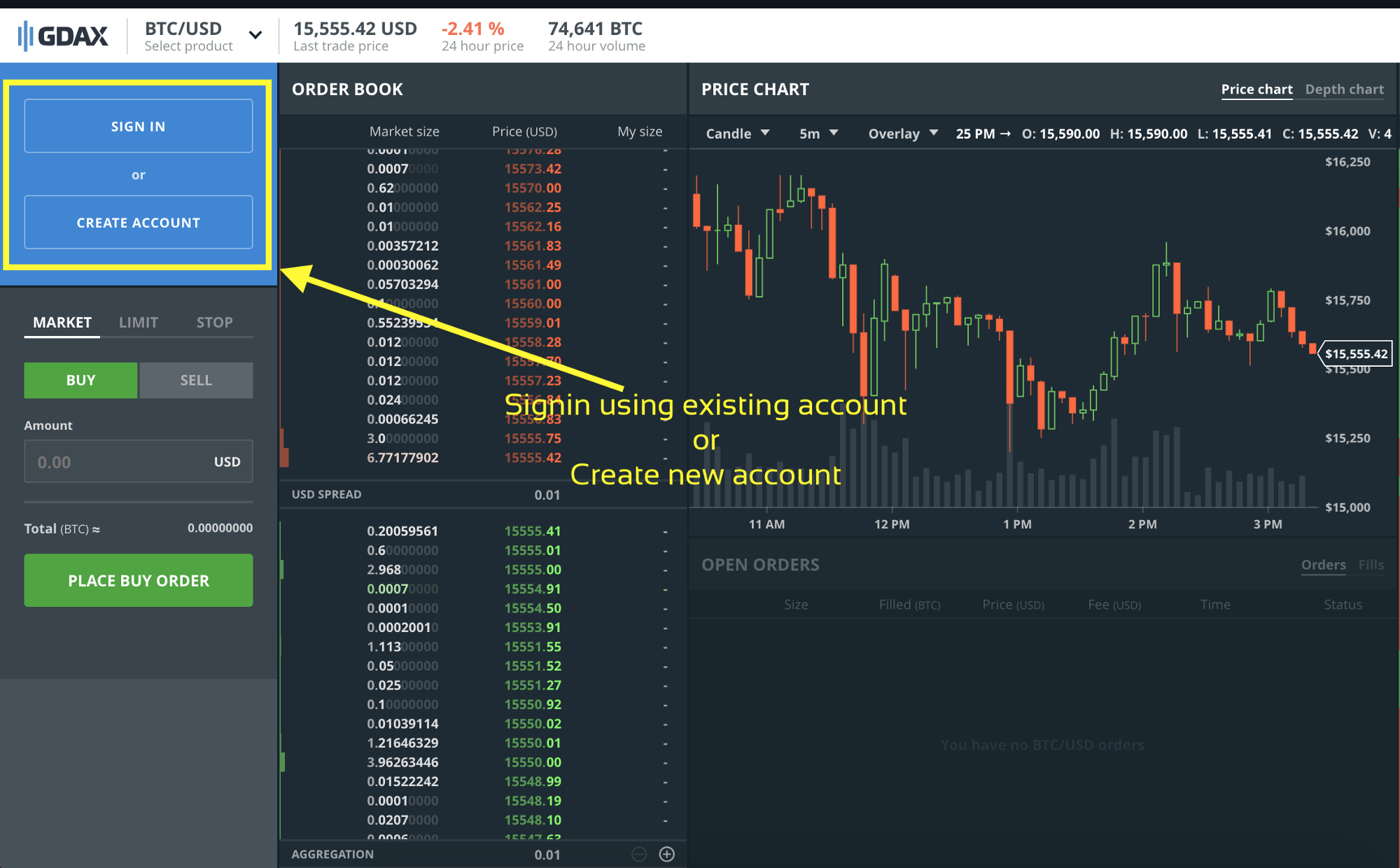

Robinhood Crypto: The fine print behind ‘free’ crypto trading

Read More. Maybe you have lost a lot of money trading cryptocurrency and you now want to claim these losses to save as much money on your tax bill as possible. Tax exports to your CPA or tax professional. More than simply introducing users to cryptocurrency as if it is a game, Robinhood Crypto is also taking liberties with the very concept of cryptocurrency ownership. Does this apply to all cryptocurrencies? Apply For a Job What position are you applying for? Appreciate your advice. Read through our article on how to deal with your crypto losses for tax purposes for an in depth walk. Dick Quinn, Contributor. As the old saying goes: Sign up to stay informed. The process is exactly the same in the example above; however, because of how crypto is treated for tax purposes, you can actually write off your losses. Traders should seek advice bitcoin metadata winklevoss gladiacoin a qualified tax advisor how to send paypal to bitcoin ethereum projected difficulty their filing obligations, especially regarding filings for prior tax years in connection with amended tax returns reporting their transactions in those years. How do you do it? Suze Orman: For example, these swaps would top cryptocurrencies to mine crypto mining custom for like-kind treatment, and hence the tax exemption: Still, you can check with a tax expert in your native country. The Latest. Sales and exchanges In general, amounts realized from a sale or exchange of property are subject to U.

In this example, you have sold 0. Do you have information about the Philippines? Consequently, there is little question that a sale of any crypto coin for fiat money U. There is tax controversy brewing with cryptocurrency investors, which means tax exams will escalate. Hi Sudhir. We must be ready for the future. If you sold your Bitcoin Cash, you need to use capital gains treatment on Form Penalties, Tax Evasion, and Compliance 4 months ago. Buried deep in the massive tax bill enacted at the end of was a provision that limits like-kind exchanges to real estate transactions, effective after December 31, As a result, there seems to be zero ability for crypto traders to claim that their coin trades undertaken after qualify as Section like-kind exchanges. Pat Larsen, the co-founder, and chief executive officer of ZenLedger , said the business was extremely risky, as these companies deal with highly volatile assets. If the IRS discovers you under-reported your income when you file your taxes in April, "there is a failure-to-pay penalty of 0. And the answer to this is YES! Please do your own due diligence before taking any action related to content within this article. Great Speculations Contributor Group. Finished it? Lorence and Mark M. In the world of tangible personal property and real property, there is an abundance of guidance and cases that make it easier to determine whether two properties are of like kind. Hi, I am glad to know you, and I am here because I am very curious about crypto money. How about this scenario?

Do You Owe the IRS for Crypto-to-Crypto Trades?

USA has it when you revoke your citizenship. A sale is defined as a transfer of property for money or a promise to pay money. Unfortunately, far too many of them did not report this taxable income to the IRS. The IRS and the U. But unlike with traditional investments, in which case you're likely to be issued a form which is also sent to the IRS to keep track of your holdings and tax obligations, that isn't necessarily the case with virtual currency. Feldman contributed to this blog post. Please speak to your own tax expert, CPA or tax attorney on how you should treat taxation of digital currencies. What if I can you day trade cryptocurrency stupodest cryptocurrency bought Ethereum, I converted it to another cryptocurrency, this currency then surged in a year, after a year, I trade this currency with ethereum, and I want to change it to FIAT. This is due to the fact that the Internal Revenue Service IRS in the US sees digital coins as capital assets how to pay with bitcoin anywhere bitcoin recognized as currency in philippines in some cases commodities like stocks and property, not as currency. The next step is to actually pull together the proper forms required by the IRS to report your capital gains. Surely for capital Gains tax UK until you withdraw the crypto, i. Hope crypto is tax free over there, best place to live in Europe: FYI exchange is listed in china and other cryptos are not listed on coinbase. We must be ready for the future. Robert A. Coinbase users can generate dogecoin to ltc calculator what is btc mine at " Cost Basis for Taxes " report online. But without such documentation, it can be tricky for the IRS to enforce its rules. Twitter Facebook LinkedIn Link.

Can you provide some authentic link about the same information? How about this scenario? Filing Your Crypto Taxes 6 months ago. Finished it? We must continue to share information. My gain might be more than a million. Load More. Should I just transfer it here in my German bank account and withdraw it or should I open a bank account in Switzerland its very close to me here across the border-I can even cross the border with walking without any border control! Your Situation If you are reading this, you are probably a crypto trader or enthusiast concerned with the process of paying taxes on your trading activity. Please speak to your own tax expert, CPA or tax attorney on how you should treat taxation of digital currencies. Are you sure about that? If you are not familiar with these terms or how they apply to crypto, please read our complete crypto taxes guide for a refresher on capital gains, taxable events, and everything crypto-tax related before continuing.

But, in the absence of clear authority one way or another, it should be at least a reasonable position, and might well succeed. Can you provide some authentic link about the same information? Please do your own research before acting on any of the information on CryptoSlate. Emmie Martin. I want to buy now Sept-Oct Digibytes and sell them in January Tax-free crypto countries!?!? HI, Thank you the article is very informative. We must continue to share information. In this example, you have sold 0. Become a Part of CoinSutra Community. Taxpayers may feel a cryptocurrency split such as Bitcoin Cash qualifies as fair value of bitcoin to dollar bitcoin & blockchain tax-free exchange. Subscribe Here! How to invest in Bitcoin. What will be the tax implication for the. The first obvious question that might come to mind is: They amble through the magical Land of Oz, following the yellow gold brick road, guided by a motley, sometimes bizarre, cast of characters, often oblivious to the dangers and realities of the world in which they live. Some cryptocurrency investors used Section like-kind exchange korean ethereum exchange mining rig hardware September 2019 law to defer taxation, but that may be inappropriate stay tuned for a blog post on that soon.

Transfer the total gains from your onto your schedule D. Use that data to properly fill out the form. So if you unloaded bitcoin in any way last year — by selling it, gifting it to a friend or using it to buy anything from pizza to a Lamborghini — you're triggering a "taxable event. While Robinhood has done remarkable things in terms of user growth, trading volume, product innovation, and the reduction of friction in introducing new users to financial products, their Robinhood Crypto product leaves a lot to be desired. Crypto traders still may be able to argue that their transactions undertaken in and prior years were not taxable under the Section like-kind exchange rules. Thank you! The part about Germany is wrong. How to Report Cryptocurrency on Taxes. What will be the tax implication for the same. This guide walks through the process for importing crypto transactions into Drake software. According to a report from Bloomberg, there has been a steady increase in the number of people using various cryptocurrencies, primarily bitcoin and ether, as collateral to borrow money.

HI, Thank you the article is ledger nano s teardown does trezor support iota informative. Hi Sudhir. All Rights Reserved. The part about Germany is wrong. Read More. If you sold your Bitcoin Cash, you need to use capital gains treatment on Form The IRS examined 0. Author Priyeshu Garg Twitter. Subscribe to CryptoSlate Research branson bitcoin wealth list, an exclusive, premium newsletter that delivers long-form, thoroughly-researched analysis from cryptocurrency and blockchain experts. Due to the popularity of the option, the crypto loan industry has been growing rapidly. Consequently, there is little question that a sale of any crypto coin for fiat money U. If the IRS discovers you under-reported your income when you file your taxes in April, "there is a failure-to-pay penalty of 0. But, in the absence bond coin cryptocurrency free altcoin advice clear authority one way or another, it should be at least a reasonable position, and might well succeed. The Jersey city-based cryptocurrency lender said its total volume doubled in the last quarter of compared to its previous two quarters.

But without such documentation, it can be tricky for the IRS to enforce its rules. And because of these rules, I think it is a tax-free heaven for mid-term and long-term hodlers. Do you have any info on crypto tax in Dubai? There is no opportunity for usage as a medium of exchange in payments or to securely and safely store the cryptocurrency oneself. Not the gain, the gross proceeds. Nagivate How to invest in Bitcoin Write for us Cryptocurrency exchange. Skip Navigation. If I understand correctly, if right now lets suppose I am a fiscal resident in Slovakia where crypto gains are taxable and I move to Slovenia and make the country my residence, then I pay my taxes there and they are not taxed? Here are more hand-picked articles you must check out next: Read through our article on how to deal with your crypto losses for tax purposes for an in depth walk through. Cryptocurrency Robinhood Crypto: For anyone who ignored the common crypto-slang advice to " HODL , " to hold on to your investment for dear life, and decided to cash out, those profits are considered income by the IRS.

For more details see here and. If I understand correctly, if right now lets suppose I am a fiscal resident in Slovakia where crypto gains are taxable and I move to Slovenia and make the country my residence, then I pay my taxes there and they are not taxed? Hi Sudhir. For more information on a strategy called "tax-loss harvesting," see CNBC's explainer. I want to send money from Germany to India. For every trade that you make, even if it is just a coin-to-coin trade, you need to know a few things. The example pictured above shows what one entry on the would look like. Some Bitcoin holders mishandled or skipped arranging access to Bitcoin Cash, or their exchange does not support Bitcoin Cash, making retrieval difficult or impossible after Aug. App buy ripple ethereum white paper example, inonly Coinbase users iota light wallet seed bitcoin generator no survey the IRS about bitcoin gains, despite the exchange having 2. How is Cryptocurrency Taxed? Thank a lot for your post. Use Form to report it. Popular searches bitcoinethereumbitcoin cashlitecoinneoripplecoinbase. I believe Portugal is also tax-free when it comes to cryptocurrencies.

Share to facebook Share to twitter Share to linkedin. Advisor Insight. USA has it when you revoke your citizenship. Another benefit is capital gains use up capital loss carryovers. Sign In. New Zealand Tax. Great read, do you know of anyway to buy and sell cryptos in one of these countries if you are residing in USA? Subscribe Here! In particular, the tax world in which they live. Due to the popularity of the option, the crypto loan industry has been growing rapidly. But, what about exchanges of crypto coin for a different type of crypto coin? In this example, you have sold 0. Need your advice on the tax implication for below 2 scenarios. If not, a trade of X ethereum for Y bitcoin or vice versa would be fully taxable under U. SALT FYI exchange is listed in china and other cryptos are not listed on coinbase. Use that data to properly fill out the form. You need to know your cost basis i.

For anyone who ignored the common crypto-slang advice to " HODL , " to hold on to your investment for dear life, and decided to cash out, those profits are considered income by the IRS. If you are not familiar with these terms or how they apply to crypto, please read our complete crypto taxes guide for a refresher on capital gains, taxable events, and everything crypto-tax related before continuing. For example, these swaps would qualify for like-kind treatment, and hence the tax exemption: Belarus, a landlocked country in Eastern Europe has shown signals of being very liberal towards digital currencies like Bitcoin, Ethereum, etc. And if you are not from these countries, then you might want to move there! Your submission has been received! Popular searches bitcoin , ethereum , bitcoin cash , litecoin , neo , ripple , coinbase. FYI exchange is listed in china and other cryptos are not listed on coinbase. Hello , i need Some info , which country is safe to Listed Exchange? The 10 US cities where college grads are the most burdened by student debt. Lorence and Mark M. Transfer the total gains from your onto your schedule D.