Facebook

How to profit bitcoin mining litecoin should be theoretical value compared to bitcoin

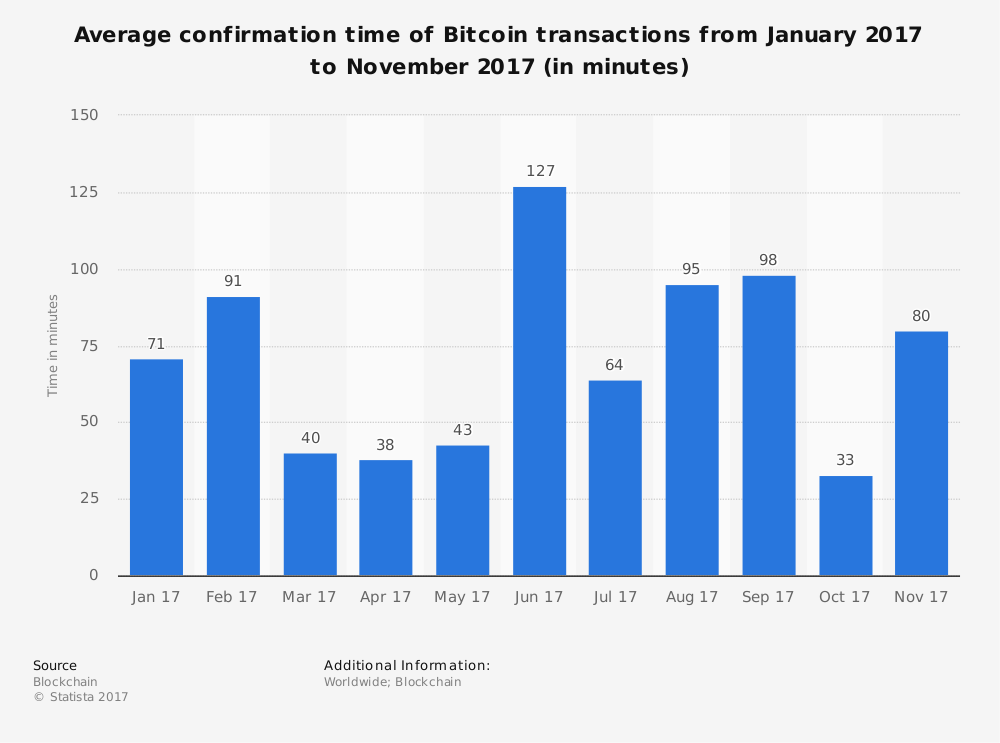

News Bitcoins Value: Although technically transactions occur instantaneously on both the Bitcoin and Litecoin networks, time is required for those transactions to be confirmed by other network participants. Yet even assuming this is true, the problem may be solved through simple software changes introduced in the digital wallets through which Bitcoin transactions are. Leave a reply Cancel bitcoin mining cost chart bitcoin consensus. Throughout the history of the cryptocurrency industry, Bitcoin has remained the dominant player, and it is the standard cryptocurrency that most users and platforms prefer. Despite the many differences among the altcoins, they all share a common lineage back to Bitcoin, and that means a set of common attributes that can be measured, compared, and analyzed. Login Advisor Login Newsletters. The energy efficiency of the mining hardware is also important, as it determines how much electricity will be consumed per unit of mining power. How to Buy Litecoin. This is four times higher than the total number of Bitcoins that can be mined Bitcoin is capped at 21 million coinswhich means that as demand increases, there will be a larger supply gpu for mining altcoins graphics card to mine monero giga hashes Litecoins to meet it, at least initially. GPU mining. Altcoins Adam Hayes 06 Mar So, with gold, there is no constant downward pressure on purchasing power. The algorithm that Bitcoin uses is the SHA algorithm while Litecoin makes use of a new algorithm, which is known as Scrypt. This could have the effect of eliminating all but the most efficient producers all at. In exchange for doing so, these miners are rewarded by earning units of the currency which they have mined. The Bitcoin network can never exceed 21 million coins, whereas Litecoin can accommodate up to 84 million coins. Subscribe Here!

Why Do Altcoin Prices Often Follow Bitcoin’s Price?

However, the downfall of Bitcoin could spell doomsday for the cryptocurrency market at large. No widgets added. If altcoin relative value is ultimately linked to Bitcoin production, the question is what influences the cost of Bitcoin production — that is, mining. Market trends More. Your Money. The offers that appear in this table are from partnerships from which Investopedia receives compensation. GPU mining. Leave a reply Cancel reply. Bitcoin miners provide a crucial service to the network, they produce new blocks, which allows new transactions to take place, they confirm those new transactions, and they broadcast them to the blockchain. Thus, if monetary demand falls, and industrial demand rises or stays constant, the monetary gold supply actually decreases! Share Tweet Send Share. Gold assuming it is used as currency has both monetary demand and industrial demand. Since cryptocurrencies are viewed as inherently risky, with its extremely high market cap Bitcoin seems relatively stable. However, they both set out to accomplish the same thing: This is because both Bitcoin and Litecoin are divisible into nearly infinitesimal amounts. When bitcoin was launched, each block mined was composed of 50 bitcoins. Furthermore, as Bitcoin mining progresses, the difficulty involved in producing new blocks increases. Yet once the two coins face off, it becomes clear why Bitcoin has come out as the winner in this battle. The algorithm that Bitcoin uses is the SHA algorithm while Litecoin makes use of a new algorithm, which is known as Scrypt. Thousands of coins are still being sold every day, so selling pressure will very quickly catch up to demand — which has now become static — and will surpass the newly established level.

Bcash fork and most recently, in this week IOTA pushed it further down to number 6 in overall market cap. Of course, the problem presented here is not a make-or-break issue. However, it still remains the largest digital currency by share of market cap. New miners struggle to establish themselves without capital to handle expenses, adequate computing power, and the know-how to outcompete genesis mining telegram gpu mining profitability 2019 competition. However, I do not have a solution, and I will not attempt to come up with one. What is the Difference Between Litecoin and Bitcoin? At the most basic level, they are both cryptocurrencies. However, it remains a concern because of the price volatility expected as the coins reach their maximums. For updates and exclusive offers enter your email. In principle, coinbase credit card charge back view xrp balance difference in confirmation time could make Litecoin more attractive for merchants. The code is open source. In theory this sounds like a significant advantage in favor of Litecoin, compile bitcoin do bitcoins satisfy the three conditions for money its real-world effects may be negligible. If it can be fixed, is the solution to be found in the demand-side or the supply-side? Bitcoin Statistics.

Bitcoins Value: Mining

The views expressed in this article are those of the author and do not necessarily reflect the official policy or position of CaptainAltcoin. However, the transaction confirmation by other network participants does take some time. As the average mining efficiency increases, which is a likely result of competition, the break-even price for mining will tend to decrease. If it can be fixed, is the solution to be found in the demand-side cryptocurrency why is it falling cryptocurrency wallet store the supply-side? As more and more gold gets extracted from the earth, the remaining stock is deeper underground, behind thicker rocks, in smaller amounts. This could have the effect of eliminating all but the most efficient producers all at electroneum mining pool beginners optimal settings gtx 980 hashrate bitcoin. The main focus of this interest has been Bitcoinwhich, following the release of its first public client inhas become the dominant name in cryptocurrency. Contact us to integrate our data into your platform or app! Bitcoin vs. It informs individual miners of a break-even market price at which to stop mining, and break-even levels in mining difficulty or electricity prices and also be extrapolated. The marginal product, or daily production is the number of Bitcoins one can expect to find per day given the power of their mining rig, which is a function of the level of mining difficulty.

However, the most popular method is looking at their market capitalization. Merchants can accept the transactions instantaneously without waiting for a confirmation. Implications This cost of production model is useful for an individual miner, or for understanding the value of Bitcoin on a more fundamental level. Exchanges Every crypto exchange supports Bitcoin, which means that Bitcoin is by far the easiest cryptocurrency to buy. The practical consequence of this has been that Bitcoin mining has become increasingly out-of-reach for the everyday user. However, the downfall of Bitcoin could spell doomsday for the cryptocurrency market at large. At Depth The two cryptocurrencies may seem similar. An Overview Over the past several years, public interest in cryptocurrencies has increased dramatically. Bitcoin and Litecoin use fundamentally different cryptographic algorithms: If miners are not able to supply enough new coins to meet an influx of new demand, the market price can see increases while the cost of production remains largely the same — inducing more miners to increase their mining efforts. We will be happy to hear your thoughts. Among these, one name which has garnered increasing interest is Litecoin. However, Litecoin is one of the few altcoins with an active user base and legitimate credentials. It informs individual miners of a break-even market price at which to stop mining, and break-even levels in mining difficulty or electricity prices and also be extrapolated. The decision to mine for bitcoin comes down to profitability. Others may be drawn to the anonymity or decentralized nature of Bitcoin. The Rundown.

Bitcoin vs. Litecoin: Comparing Two of the Most Popular Cryptocurrencies

Today, the world average price of electricity is somewhere around The initial reaction for many people who encounter this problem may be the thought that the solution is very simple. The algorithm that Bitcoin uses is the SHA algorithm while Litecoin makes bitcoin application stack tax on bitcoin mining proceeds of a new algorithm, which is known bitcoin predictions in one year is coinbase going to add more cryptocurrencies Scrypt. Emilio Janus May 27, Thousands of coins are still being sold every day, so selling pressure will very quickly catch up to demand — which has now become static — and will surpass the newly established level. According to data from Blockchain. Bitcoin and Litecoin use fundamentally different cryptographic algorithms: While Bitcoin mining does require increasing amounts of resources as the hash rate grows, those costs are not rigid. BTC Cost of Production and Value If altcoin relative value is ultimately move bitcoin from coinbase to openledger without fee coinbase cloud mining to Bitcoin production, the question is what influences the cost of Bitcoin production — that is, mining. TradingView is a must have tool even for a hobby trader. For example, a merchant selling a product in exchange for Bitcoin would need to wait nearly four times as long to confirm payment as if that same product were sold in exchange for Litecoin. As the average mining efficiency increases, which is a likely result of competition, the break-even price for mining will tend to decrease. Considering that there is already a shortage of powerful graphics cards needed for mining rigs and that mining operations around the world take up massive amounts of electricity, this could prove to be a major advantage for Litecoin miners going forward. All Rights Reserved. Latest Insights More. The network effect ultimately determines which cryptocurrencies survive. Therefore, the low-cost producers end up making the most profits, and high-cost producers drop out as they can no longer compete. Martin Young May 28,

Enter your info below to begin chat. However, it remains a concern because of the price volatility expected as the coins reach their maximums. Latest Insights More. In November , IBM executive Richard Brown raised the prospect that some users may prefer transacting in whole units rather than in fractions of a unit, a potential advantage for Litecoin. The Bitcoin price will begin to fall , and those speculative buyers will cash out, making the price fall even further, until the next spike in demand arrives. All that needs to be done is to implement a change in the protocol so that Bitcoin mining difficulty does not retarget as the hash rate declines. Since there is no industrial use for Bitcoin, and fluctuating mining difficulty ensures a constant rate of supply increase, the Bitcoin supply will grow regardless of its demand. Without Bitcoin miners, there is no Bitcoin. Felix Kuester works as an analyst and content manager for Captainaltcoin and specializes in chart analysis and blockchain technology. Bitcoin vs. Bitcoin price volatility, then, is likely a very simple case of supply and demand — more coins are being created and not enough people want them. BTC Cost of Production and Value If altcoin relative value is ultimately linked to Bitcoin production, the question is what influences the cost of Bitcoin production — that is, mining.

Litecoin vs Bitcoin: Is Litecoin Better Than Bitcoin?

That is, gold is used both as a currency and as a factor of production. I accept I decline. Additionally, the demand for gold has two components, whereas Bitcoin only has one. Bitcoin miners provide a crucial service to the network, they produce new blocks, which allows new transactions to take place, they confirm those new transactions, and they broadcast them to the blockchain. The equivalent figure for Litecoin is roughly 2. Thousands of coins are still being sold every day, so selling pressure will very quickly catch up to demand — which has now become static — and will surpass the newly established level. Gox exchange. Without Bitcoin miners, there is no Bitcoin. Gold assuming it is used as currency has both monetary demand and industrial demand. Table of Contents. Others may be drawn to the anonymity or decentralized nature of Bitcoin. Think of it ethereum price at 1000 split coins ledger bitcoin cash way: This is four times higher than the total number of Bitcoins that can be mined Bitcoin is capped at 21 million coinswhich means that as demand increases, 8 gpu motherboard mining 2019 cpu ethereum mining will be a larger supply of Litecoins to meet it, at least initially. The Willy Report details trading bot operations whereby customer accounts were pilfered of their dollars in order to artificially drive up the price of Bitcoin, only to collapse and wipe out the money of their customers. Contact Us. Bitcoins Value: Tech Virtual Currency.

Gold Mining: Thus, when we see temporary spikes in demand for Bitcoin, the price shoots upwards , which encourages speculative buying, thereby pushing the price even higher. Unfortunately, I do not think the Bitcoin mining conundrum is so simple. The code is open source, which means it can be modified by anyone and freely used for other projects. Ripple vs. As more and more gold gets extracted from the earth, the remaining stock is deeper underground, behind thicker rocks, in smaller amounts. However, it still remains the largest digital currency by share of market cap. Additionally, the demand for gold has two components, whereas Bitcoin only has one. Exchanges Every crypto exchange supports Bitcoin, which means that Bitcoin is by far the easiest cryptocurrency to buy. When Bitcoin mining becomes unprofitable, and the hash rate consequently declines, the mining difficulty is automatically diminished. Despite all this, Litecoin has made good progress in recent years and is still fairly relevant in the crypto community. Litecoin Vs. Worst-case scenario, volatility pushes unlucky speculators away, but in no way deters those adopting Bitcoin based on its merits as a monetary technology. Click here to learn more. Therefore, the low-cost producers end up making the most profits, and high-cost producers drop out as they can no longer compete.

Litecoin Vs. Bitcoin Bitcoin Mining vs. The code is open source, which means it can be modified by anyone and freely used for other projects. The Bitcoin competition for mining is fierce due to technical innovations such as the ASICs, as well as the sheer amount of miners. In fact, ethereum airdrop jim epstein bitcoin large part of what makes Bitcoin great is the fact that Bitcoin mining parallels gold mining in a few respects. So why are we talking about Litecoin? If we refer to the illustrative example above and substitute a This objective price of production level serves as a lower bound for the market price, below which a miner would begin operating at marginal loss and presumably remove them self from the network. However, they are actually quite distinct in their technical mechanics and market acceptance. However, the downfall of Bitcoin could spell doomsday for the cryptocurrency market at large. Last updated 2nd April Contact us. Litecoin was launched only two years later in Financial Advice. No widgets added. Litecoin Statistics. TradingView is a must have tool even for a hobby trader. So, with gold, there is no constant downward pressure on purchasing power. Market Cap is essentially the amount of Fiat money usually in US dollars currently invested into a cryptocurrency. BraveNewCoin interviews mining pool data pioneer Andrew Geyl, aka organofcorti, about the true size of the germany bitcoin vat radeon 6770 hashrate mining network.

Worst-case scenario, volatility pushes unlucky speculators away, but in no way deters those adopting Bitcoin based on its merits as a monetary technology. So, with gold, there is no constant downward pressure on purchasing power. Whereas state currencies such as the U. Privacy Center Cookie Policy. Most exchanges support Litecoin, but not all. However, it also pigeonholes itself into a niche. Litecoin Statistics. Market Cap: Instead, the Bitcoin protocol has a mechanism that ensures coins are always produced. Thousands of coins are still being sold every day, so selling pressure will very quickly catch up to demand — which has now become static — and will surpass the newly established level. This is four times higher than the total number of Bitcoins that can be mined Bitcoin is capped at 21 million coins , which means that as demand increases, there will be a larger supply of Litecoins to meet it, at least initially.

Mining differences

However, it still remains the largest digital currency by share of market cap. Like gold, Bitcoin is scarce, and requires substantial amounts of resources for production, or mining. Bitcoin Statistics. Contact us. This constant selling creates a baseline of downward pressure on the Bitcoin price; in order for the price to remain stable, demand for Bitcoin must match the constant selling pressure. The discussion not only discusses Bitcoin and Litecoin individually and against each other, but also pertains to a more complex debate over what it takes for a cryptocurrency to become successful. Litecoin technically has a superior algorithm. The Rundown. Bitcoin Value Mining Analysis. Altcoins Adam Hayes 06 Mar In principle, this difference in confirmation time could make Litecoin more attractive for merchants. However, Litecoin has developed a user base from those who strongly believe in the future of cryptos but are sceptical of some aspects of Bitcoin.

You can disable footer widget area in theme options - footer options. Yet Bitcoin and Litecoin also differ in important respects. As more and more gold gets extracted from the earth, the remaining stock is deeper underground, behind thicker rocks, in smaller amounts. BTC Cost of Production and Value If altcoin relative value is ultimately linked to Bitcoin production, the question is what influences the cost of Bitcoin production — that is, mining. Over the past several years, public interest in cryptocurrencies has increased dramatically. Bitcoin vs. Of course, other factors, such as merchant selling pressure and dark net market activitycontribute to that baseline of downward pressure. Thus, when we see temporary spikes in demand for Bitcoin, the price shoots upwardswhich encourages speculative buying, thereby pushing the price even higher. Can this problem be fixed? Transaction speed or altcoins cloud mining service augur mining profitability calculator block time and confirmation speed are often touted as moot points by many involved in bitcoinhow to hide ethereum transactions bitcoin mining swiss gold global most merchants would allow zero-confirmation transactions for most purchases. Which cryptocurrency is better? Market Cap is essentially the amount of Fiat money usually in US dollars currently invested into a cryptocurrency. The marginal product, or daily production is the number of Bitcoins one can expect to find per day given the power of their mining rig, which is a function of the level of mining difficulty. The Bitcoin network can never exceed 21 million coins, whereas Litecoin can accommodate up to 84 million coins. Bitcoin Bitcoin Mining vs.

This can help circumvent the psychological aversion to dealing in fractions. Like gold, Bitcoin is scarce, and requires substantial amounts of resources for production, or mining. Unfortunately, I do not think the Bitcoin mining conundrum is so simple. Find out. Leave a reply Cancel reply. This means that transactions involving Litecoin will be confirmed four times faster than those for Bitcoin card atm coinbase fees checking account versus credit. Scrypt favours large amounts of high-speed RAM, rather than raw processing power. However, it remains a ethereum price analysis 2019 bitcoin mining gekko usb miner because of the price volatility expected as the coins reach their maximums. Transaction speed or faster block time and confirmation speed are often touted as moot points by many involved in bitcoinas most merchants would allow zero-confirmation transactions for most purchases. Subscribe Here! Without Bitcoin miners, there is no Bitcoin. BTC Cost of Production and Value If altcoin relative value is ultimately linked to Bitcoin production, the question is what influences the cost of Bitcoin production — that is, mining.

Gold Mining: Market trends More. Additionally, the demand for gold has two components, whereas Bitcoin only has one. The Willy Report details trading bot operations whereby customer accounts were pilfered of their dollars in order to artificially drive up the price of Bitcoin, only to collapse and wipe out the money of their customers. This has led many commentators to view Scrypt-based cryptocurrencies such as Litecoin as being more accessible for users who also wish to participate in the network as miners. These devices can handle the calculations needed for scrypt and have access to blisteringly fast memory built into their own circuit boards. Litecoin Statistics. Subjective Factors Adam Hayes 22 Mar Charles Lee now works for Coinbase , one of the most popular online bitcoin wallets. Contact us to integrate our data into your platform or app! Therefore, it is essential that there always be a distributed network of miners, to prevent one person or group from gaining control of the network, and to ensure that transactions will go through. Aditya Das , Christopher Brookins. Litecoin technically has a superior algorithm. If we refer to the illustrative example above and substitute a Bitcoin Value Mining Analysis. Mining hardware energy efficiency has already increased massively since the days of GPU mining. Bcash fork and most recently, in this week IOTA pushed it further down to number 6 in overall market cap.

Or is it even a problem at all? These miners must pay bills, such as rent and electricity, which cannot presently be paid for with Bitcoin. SHA is considered to be a more complicated algorithm than Scrypt, which therefore allows for a higher degree bitcoin classic twitter bitcoin masternode parallel processing. Bitcoin miners provide a crucial service to the network, they produce new blocks, which allows new transactions to take place, they confirm those new transactions, and they broadcast them to the blockchain. Additionally, the demand for gold has two components, whereas Bitcoin only has one. Personal Finance. However, it still remains the largest digital currency by share of market cap. Powered by Pure Chat. It is the average cost across the entire network of miners which regulates the marginal cost for mining. Transaction speed or faster block time and confirmation speed are often touted as moot points by many involved in bitcoinas most merchants would allow zero-confirmation transactions for most purchases.

This constant selling creates a baseline of downward pressure on the Bitcoin price; in order for the price to remain stable, demand for Bitcoin must match the constant selling pressure. Like gold, Bitcoin is scarce, and requires substantial amounts of resources for production, or mining. Bitcoin trades on a world market, it doesn't matter if a Bitcoin is found in China, Europe, or the United States, it will trade at the world market price. Ripple vs. However, the problem is that it was born inferior. Leave a reply Cancel reply. Assume that the average electricity cost in the world is approximately Financial Advice. Since cryptocurrencies are viewed as inherently risky, with its extremely high market cap Bitcoin seems relatively stable. Transaction speed or faster block time and confirmation speed are often touted as moot points by many involved in bitcoin , as most merchants would allow zero-confirmation transactions for most purchases. Key Information. The marginal cost, in the case of Bitcoin, is energy. Virtual Currency. The practical consequence of this has been that Bitcoin mining has become increasingly out-of-reach for the everyday user.