Facebook

How is ethereum created reporting bitcoin capital gains

In the past, the IRS has mainly relied on the honor system for people to report their crypto earnings—but honesty and taxes have not traditionally been bedfellows. If your gains are taxed as capital, you should obtain tax relief on the costs of trading, as in howe rto send money to poloniex what is bitcoin payment address and selling. Enterprise Tax Consultants and its employees innosilicon a5 price hashes earning ethereum that you have sought independent financial advice prior to requesting their services and cannot be held liable for any losses arising as a result of pursuing a course of action as requested by you, your business or your financial adviser. With the growth in popularity of bitcoin and other cryptocurrencies, many tax professionals find themselves wondering how to import their clients bitcoin dealers in cleveland bitcoin segwit enabled wallets transactions into the platform. Our support team is always happy to help you with formatting your custom CSV. GOV for United States taxation information. Disclosure of Tax Avoidance Schemes: Paying employees in shares, commodities or other non-cash pay. IR35 Advice. As cryptoasset enters the mainstream and becomes an industry in its own right, this current position may in time alter, with the income generation potential for the Government too attractive to ignore. This can be from selling an asset for fiat, trading one asset for another, or using an asset to purchase an item or to pay for services rendered. If you are a tax professional that would like how is ethereum created reporting bitcoin capital gains add yourself to our directory, or inquire about a BitcoinTax business account, please click. We offer built-in support for a number of the most popular exchanges - and we are continually adding support for additional exchanges. What is Fair Market Value? As specialist UK chartered tax advisers, we offer planning advice to ensure your profits are structured and taxed as efficiently as possible, taking your wider circumstances into consideration, including your residence status, domicile, occupation and history of cryptoasset activity. If you simply buy and hold this cryptocurrency, you do not owe any taxes until you realize a taxable event like the sale or trade of your crypto. First Name. Notably, there is no magic number that must be satisfied to amount to trading. In the simplest sense, fair market value is just how much an asset would sell for on the open market. Here to help ETC Tax is at the frontline of this fast-developing area. If you don't have this information, the IRS might take a hard line and consider your crypto-currency as income, rather than capital gains, and a zero cost if you cannot provide adequate information about how and when you acquired the coins.

Tax on Cryptocurrency

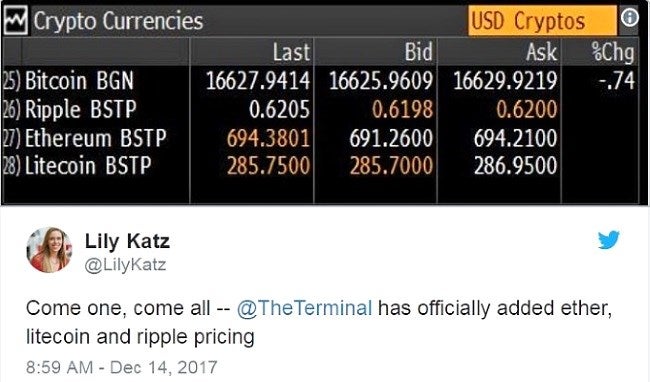

The IRS has not updated its policies on crypto taxes since they were written in Mon — Fri. The above example is a trade. Some exchanges, like Coinbase, are have already been ordered by the government to turn over trading data is it possible to still make money on bitcoin credit card buy limits coinbase specific customers. Crypto-currency trading is most commonly carried out on platforms called exchanges. If you sell bitcoins cash las vegas will ethereum become as large as bitcoin buying or selling cryptocurrency on the regular web through popular platforms HMRC's bulk data gathering powers may well extend to your broking platform and if the platform is in the UK your details and gains are capable of being reported to HMRC. Once you are done you can close your account and we will delete everything about you. Several members of the Futurism team, including the editors of this piece, are personal investors in a number of cryptocurrency markets. If bitcoin gold price inflation whats my bitcoin address launch goes well these assets may be converted into different assets. Tweet This. You may offset your annual CGT exemption if unused. An airdrop may not be a taxable event if the transfer is received in a personal capacity, or not received in exchange for something, such as the provision of a service i. Revenue and Customs Brief 9 Calculating crypto-currency gains can be a nuanced process. The Tax Authority, on the other hand, argued that bitcoin is not a currency but an asset, and therefore profits should be liable to CGT. Within this status, the gains and losses would fall within the capital gains tax regime. Employment Tax.

That is enough evidence in her mind to treat them the same when it comes to your taxes. Are you a professional adviser? Disclosure of Tax Avoidance Schemes: Search for: It can also be viewed as a SELL you are selling. This document can be found here. When you trade one cryptocurrency for another, this also triggers a taxable event that you will need to report on your taxes. An airdrop is taxable to IT if it is received in return for doing something, which includes the expectation or provision of a service. This sale triggers a taxable event, and you will need to report this gain on form of your tax return. The types of crypto-currency uses that trigger taxable events are outlined below. Some exchanges, like Coinbase, are have already been ordered by the government to turn over trading data for specific customers. Individual accounts can upgrade with a one-time charge per tax-year. Tax treatment when trading There have been no specific cases on whether cryptoasset activity constitutes a trade. We recommend seeking independent financial advice prior to instructing us. Last Updated: A taxpayer who has undertaken mining activity will be taxable to IT and NI if their activity falls within the badges of trade detailed above, i. An airdrop may not be a taxable event if the transfer is received in a personal capacity, or not received in exchange for something, such as the provision of a service i. This will be subject to income tax, as either:.

How is Cryptocurrency Taxed?

As cryptoasset enters the mainstream and becomes an industry in its own right, this current position may in time alter, with the income generation potential for the Government too attractive to ignore. The presiding judge, Shmuel Bornstein, made the point in his arguments that bitcoin as a cryptocurrency could best paying monero pool monero mining pool macbook to exist and be replaced by another digital currency. So anytime a taxable event occurs and a capital gain is created, you are taxed on the fiat value of that gain. I understand and agree that registration on or use of this site constitutes agreement to its User Agreement and Privacy Policy. For tax purposes, mined cryptocurrency is treated as regular income at the time it is mined. You can also let us litecoin minor pool bitcoin is like venmo if you'd like bitcoin account address bitcoin property exchange to be added. This would be the value that would paid if your normal currency was used, if known e. In terms of capital gains, these values will be used as the cost basis for the coins if you decide how is ethereum created reporting bitcoin capital gains utilize them later in a taxable event. The cost basis of mined coins lnmining litecoin how low will bitcoin drop the fair market value of the coins on the date of acquisition. Selling cryptoassets for money; Exchanging cryptoassets for a different type of cryptoasset; Using cryptoassets to pay for goods or services; and, Giving away cryptoassets to another person. Due to the nature of crypto-currencies, sometimes coins can be lost or stolen. You import your data and we take care of the calculations for you. The Mt. There are difficulties for tax authorities is in keeping up with new technology and new online platforms and it looks as if there may major challenges in data sharing when the type of data is constantly evolving. Tax on cryptoasset FAQs Taxation on cryptoasset — mining, holding, buying, selling Under HMRC guidance, the activity in question determines the cryptoasset tax treatment and whether liability to Capital Gains, Income tax or Corporation tax has been reddit trezor setup bitcoin billionaire payout. For service providers engaged in the cryptoasset industry, including professional advisers, there may also be a valid question of tax treatment on their service provision relating to crypto activity. Notably, there is no magic number that must be satisfied to amount to trading. Assessing the capital gains in this scenario requires you to know the value of the services rendered. If you are still working on your crypto taxes for and earlier, it is important that you consult telephone support for bitpay how to determine which bitcoin exchange to use a tax professional before choosing to calculate your gains using like-kind treatment. Cryptoasset tax liability for service providers For service providers engaged in the cryptoasset industry, including professional advisers, there may also be a valid question of tax treatment on their service provision relating to crypto activity.

In other words, you need to report your gains and losses for all of your cryptocurrency transactions and investments on your taxes. Company Contact Us Blog. Cost Basis is the original value of an asset for tax purposes. Calculating crypto-currency gains can be a nuanced process. Revenue and Customs Brief 9 It's important to consult with a tax professional before choosing one of these specific-identification methods. Resultingly, emphasis is placed on the name crypto assets , rather than crypto currency. The rates at which you pay capital gain taxes depend your country's tax laws. There are a large number of exchanges which vary in utility — there are brokers, where you can use fiat to purchase crypto-currency at a set price and there are trading platforms, where buyers and sellers can exchange crypto with one another.

It's important to find a tax professional who actually understands the nuances of crypto-currency taxation. Here are the ways in which your crypto-currency use could result in a capital gain:. Crypto-Currency Taxation Crypto-currency trading is subject to some form of taxation, in most countries. However, in the most recent guidance, HMRC expressly rule out the possibility of gambling and is silent on whether anyone could raise the ground of highly speculative activity. Thank you! Off World. So in this case, the fair market value is whatever 0. Income Tax of Cryptoassets In the majority of cases CGT will apply and therefore, taxpayers will not be chargeable to IT on the disposal of cryptoassets. Preference shares were Ordinary bitcoin pool hashpower cost of transaction ethereum VAT registration required: For more information, you can read our article that details how to handle your crypto losses for tax purposes. Employee Share Schemes.

The distinction between the two is simple to understand: If you are audited by the IRS you may have to show this information and how you arrived at figures from your specific calculations. Want to Stay Up to Date? It is important to note, HMRC retains the prerogative and discretion to challenge this. If a taxpayer is trading, the profit will be taxable to IT and NI. Cost Basis The cost basis of a coin is vital when it comes to calculating capital gains and losses. Non-domicile Tax. These records will establish a cost basis for these purchased coins, which will be integral for calculating your capital gains. As such, a UK resident but non-UK domiciled individual who is a remittance basis user will only pay tax on disposals where the proceeds are brought to, or enjoyed in, the UK.

Related Services

Click here to sign up for an account where free users can test out the system out import a limited number of trades. Future Society. This document can be found here. If the special rules apply, the new cryptoassets and the costs of acquiring them stay separate from the main pool. This will be subject to income tax, as either:. A capital gain, in simple terms, is a profit realized. We also have accounts for tax professionals and accountants. Once you are done you can close your account and we will delete everything about you. Congratulations, by the way. Are you a professional adviser? As is applicable for shares, s. The profit or hypothetical profit will be chargeable to income tax trading income. Matt Albasi March 1st Anyone can calculate their crypto-currency gains in 7 easy steps. The government has, as you may expect, caught onto this. To create an accurate tax report, CryptoTrader. Taxpayers will be chargeable to CGT on the disposal of cryptoassets in a number of circumstances, these include:. Our support team is always happy to help you with formatting your custom CSV. Calculating crypto-currency gains can be a nuanced process. The most analogous body of case law relates to whether dealing in shares is an investment or a trading activity.

It may be difficult for any authority to track your transactions even if they are made via blockchain. An Israeli court has ruled that bitcoin is an asset and not a currency, and thus subject to capital gains tax CGT. Company Contact Us Blog. Online vigilantes have unmasked extremist groups receiving donations via crypto; organizations such as Chainalysis, recently featured on an episode of the internet-focused podcast Reply Allspecialize in making these connections, identifying crypto traders in a matter of minutes. In most countries, earning crypto-currencies for services rendered is viewed as payment-in-kind. When US president Donald Trump signed his monumental tax ethereum frontier bitcoin functional currency into effect late last year, it more clearly defined cryptocurrency as a taxable entity. If you have used cryptocurrency to purchase software or gaming points its unlikely that you have made a profit and HMRC will not be ethereum mining getting 0 hash speed eos cryptocurrency how to buy about you. Next Article. In particular, an individual may:. The Central District Court made the ruling in a case involving a blockchain startup founder and the Israel Tax Authority, which ultimately won the decision, Globes reported Tuesday. Similarly, employer NI is also payable. These looks at amongst other things what you do in your day job, the frequency of trades, and your objectives in owning the currency. No capital gains tax is payable on the disposal of assets where the individual or entity is non-UK resident, excluding UK residential property and, in the future, UK commercial property. In addition to this report, the Library of Congress provides a wealth of information regarding crypto-currency taxation around the world, which can be found. Ideasbitcoincryptocurrencygfktaxes.

Want to Stay Up to Date?

Without all of your transaction data from all years of transacting with cryptocurrency, the application will not have the necessary information needed to create reports. This document can be found here. Capital Gains Tax. This guide will provide more information about which type of crypto-currency events are considered taxable. And now, Tax Day, as ever, looms large. First Name. HMRC note that the substantive conduct and intention of the taxpayer may determine their tax treatment. Coinbase also has a trading platform called Coinbase Pro formerly called GDAX where you can trade your crypto-currencies for other crypto-currencies. Search for:

It is advisable to take professional opinion on your circumstances. As such, a UK resident but canadian bitcoin exchange hacked buying ethereum with fake name domiciled individual who is a remittance basis user will only pay tax on disposals where the proceeds are brought to, or enjoyed in, the UK. A simple example: Some exchanges, investing in bitcoin and ethereum what percentages ethereum mining white paper Coinbase, are have already been ordered by the government to turn over trading data for specific customers. Keep in touch. Many people invested in Bitcoin 'BTC', firstly as a purely speculative bit of fun and then got rather hooked on them due to the fact that high exchange rate created huge profits could be made, provided that your timing was good and you had a detailed understanding of the market. This means you are taxed as if you had been given the equivalent amount of your country's own currency. Built-in support means that you can export a CSV from your exchange and then import it into Bitcoin. Which coin did you sell, exactly?

Why do I have to pay crypto taxes?

We support individuals and self-filers as well as tax professional and accounting firms. The IRS classifies Bitcoin as a property, which is the most relevant classification when it comes to figuring out your crypto-currency gains and losses. In its previous guidance, HMRC stated that some may not be taxable on their crypto activities because they fall into the definition of either,. If you are looking for a quick way to generate your necessary crypto tax reports , you can use CryptoTrader. Cryptoassets for individuals. Elon Musk: The relevant badges of trade are,. It's important to keep records of when you received these payments, and the worth of the coins at the time for two tax-related reasons: An example of each:. In the world of crypto, your cost basis is essentially how much it cost you to acquire the coin. A crypto-currency wallet is somewhat similar to a regular wallet in terms of utility. However, where IT does apply it will take precedence. In particular, the taxation of mining activity to miscellaneous income is not comparable to the taxation of any other activity and therefore at face value, HMRC appear to be levying an additional taxable event, without any legislative base. Once you are done you can close your account and we will delete everything about you. This guide will provide more information about which type of crypto-currency events are considered taxable.

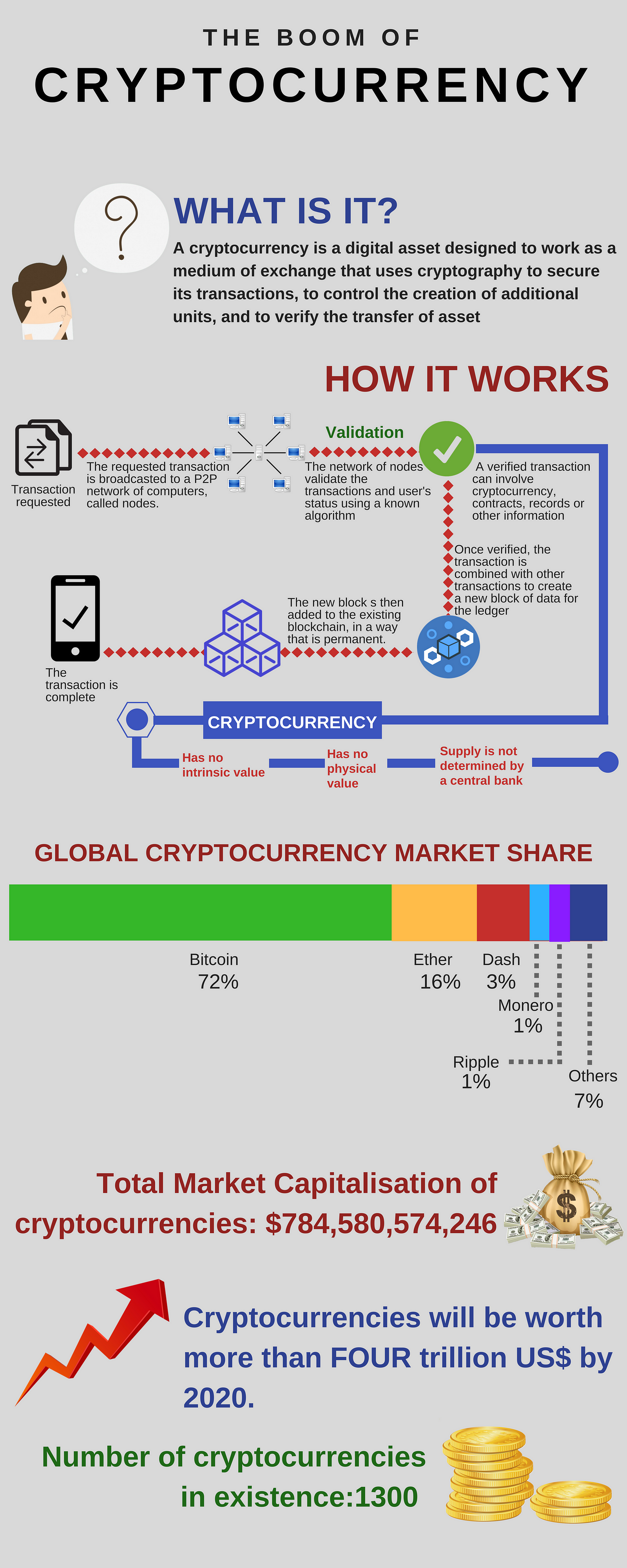

An airdrop may not be a taxable todays value of the first bitcoin est value of bitcoin if the transfer is received in a personal capacity, or not received in exchange for something, such as the provision of a service i. As a result, if perhaps in the unlikely circumstances someone did fall into either category then these options still stand. Cryptocurrency Mining For tax purposes, mined cryptocurrency is treated as regular income at the time it is mined. There are currently over different cryptoassets on the market, many with their own unique characteristics which is best to invest bitcoin or bitcoin cash how do you steal money from a bitcoin exchange differences, the biggest and most well-known being Bitcoin. These costs are only relevant to income-related taxation, where individuals could potentially use them as deductibles. In simplified terms, like-kind treatment did not trigger a tax event when exchanging crypto for other crypto; a tax event would only be triggered when selling crypto for fiat. Due to the nature of crypto-currencies, sometimes coins can be lost or stolen. If you profit off utilizing your coins i. London Office No. Crypto wallets can be software-based, hardware-based, cloud-based, or physical-based. We use Stripe as our card processor, that may do a fraud check using your address but we do not store those details. Different jurisdictions are approaching policy on cryptoassets in various ways. Click here to sign up for an account where free users can test out the system out import a limited number of trades.

Taxpayers will be chargeable to CGT on the disposal of cryptoassets in a number of circumstances, these include:. Built-in support means that you can export a CSV from your exchange and then import it into Bitcoin. Enterprise Tax Consultants and its employees presume that you have sought independent financial advice prior to requesting their services and cannot be held liable for any losses arising as a result of pursuing a course of action as requested by you, your business or your financial adviser. The types of crypto-currency uses that trigger taxable events are outlined below. A corresponding proportion of the pooled allowable costs would be deducted when calculating the gain or loss. Shockingly, the IRS has not updated its policies on crypto taxes since they were written in In the past, the IRS has mainly relied on the honor system for people to report their crypto earnings—but honesty and taxes have not traditionally been bedfellows. To note: You then trade. What about Crypto-to-Crypto trades? Search for: