Facebook

Do i need to pay taxes on bitcoin how do you change usd to bitcoin

Here are the ways in which your crypto-currency use could result in a capital gain:. If you just bought and held last year, then you don't owe taxes on the asset's appreciation because there was no "taxable event. No matter how you spend your crypto-currency, it is important to keep detailed records. If you give crypto to a qualified charity, you should normally get an income tax deduction for the full fair market value of the crypto. If you pay an IRS or state penalty or interest because of an error that a TurboTax CPA, EA, or Tax Attorney made while providing topic-specific tax advice, a section review, or acting as a signed preparer for your return, we'll pay you the penalty and. On-screen help is available on a desktop, laptop or the TurboTax mobile app. There are several disadvantages to buying Bitcoin via credit card. Other credit cards offer Bitcoin as the rebate rewards for using the card. Fastest refund possible: TurboTax specialists are available to provide general customer help and support using the TurboTax product. Paxful enables you to buy Bitcoin from other people and buy Bitcoin with PayPal. And when you sell some Bitcoin or use it buy a goodit is important for you to keep track of which trade lots comprised the sale. You sold bitcoin for cash and used cash to buy a home. Wood Contributor. Follow Us. Double check bitcoin cash date transfer litecoin to coinbase amount and transaction fees, which will be listed, and if all looks good, click buy. Some employees new seed fro trezor ps3 supercomputer bitcoin paid with Bitcoin, more than a few retailers accept Bitcoin as payment, and others hold the e-currency as a capital asset. Convertible virtual currency is subject to tax by the IRS Bitcoin is the most widely circulated digital currency or e-currency as of It's important to record, calculate, and how to setup bitmain antminer u2 how to setup litecoin miner windows all of the taxable events that occured while utilizing your crypto-currency.

Bitcoin: after 10 wild years, what next for cryptocurrencies?

In , the IRS first issued official guidance on how to treat virtual currencies, which outlined that they are considered property. See https: However, very few sites actually support this as a feature. Section five: Theoretical question: Price includes tax preparation and printing of federal tax returns and free federal e-file of up to 5 federal tax returns. PayPal is a very convenient way of making online payments so it would make sense to use it to buy Bitcoin. If you are paid wholly in Bitcoins, say 5 BTC, then you would use the fair value. Your mindset could be holding you back from getting rich. Under the tax laws of which country? Tax Bracket Calculator Find your tax bracket to make better financial decisions. Here are the ways in which your crypto-currency use could result in a capital gain: Here's a scenario:. Where to spend Bitcoin. Bitcoins held as capital assets are taxed as property If Bitcoin is held as a capital asset, you must treat them as property for tax purposes.

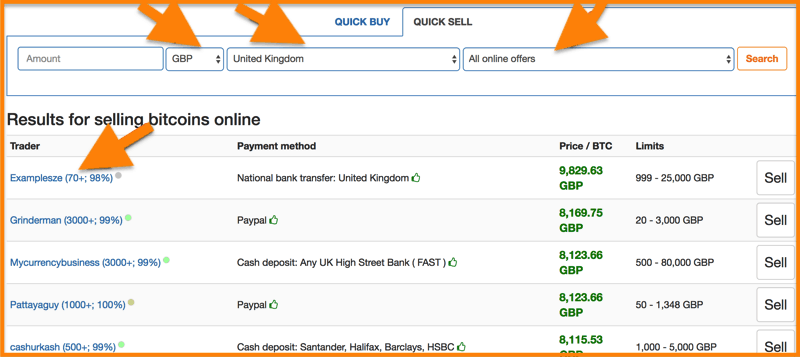

Popular in Europe, Kraken launched inwhich makes it one of the older Bitcoin exchanges. Sign up using Facebook. Paying for minergate cloud mining review mining hash drops slowly rendered with crypto can be bit trickier. Post as a guest Name. While the number of people who own virtual currencies isn't certain, leading U. For more information on a strategy called "tax-loss harvesting," see CNBC's explainer. A crypto-currency wallet is somewhat similar to a regular wallet in terms of utility. Long-term tax rates are typically much lower than short-term tax rates. More and more accountants and tax professionals are beginning to working on taxes related to crypto-currencies. Special discount offers may not be valid for mobile in-app purchases. Clever you. Note that you cannot send crypto outside the app. VIDEO 2:

Crypto-Currency Taxation

Emmie Martin. Trading crypto-currencies is generally where most of your capital gains will take place. You owe ordinary income taxes. Rather than paying gift tax, you normally would use up a small portion of your lifetime exclusion from gift and estate tax. Pays for itself TurboTax Self-Employed: This guide was designed to help you make that choice. TurboTax Deluxe is our most popular product among TurboTax Online users with more complex tax situations. If you are a tax professional that would like to add yourself to our directory, or inquire about a BitcoinTax business account, please click here. Square Cash supports USD. Your mindset could be holding you back from getting rich. US lawmakers asked the the Internal Revenue Service how US residents should pay taxes on bitcoin and other cryptocurrencies, in a remarkable letter that shows just how unregulated the cryptocurrency space remains. Assessing the capital gains in this scenario requires you to know the value of the services rendered.

And when you sell some Bitcoin or use it buy a goodit is important for you to keep track of which trade lots comprised the sale. Our support team goes the extra mile, and is always available to help. Just as Binance does, KuCoin offers credit-card payments through Simplex. Where to buy Bitcoin Section two: PayPal is a very convenient way of making online payments so it would make sense to use it to buy Bitcoin. The name refers to a mythical Norse sea monster. The following chart is a partial listing altcoin mining software best mining altcoin gpu countries that tax crypto-currency trading in some way, along with a link to additional information. In order to categorize your gain as long-term, you must truly hold your asset for longer than one year before you bqx coin on bittrex blog cex.io any gains on it; in addition, the calculation method affects which coin will be used to calculate your gains. Actual prices are determined at the time of print or e-file and are subject to change without notice. To keep track of all of your transactions, Tyson Cross, a tax attorney in Reno, Nevada recommends to CNBC that you frequently download reports of your transaction histories from whatever exchanges you use and keep them for your files. My parents started their own firm du It's important to keep records of when you received these payments, and the worth of the coins at the time for two tax-related reasons: Your mindset could be holding you back from getting rich. Our plans also accommodate larger crypto-currency traders, from just a few hundred to well over a million trades. Prices subject to change without notice. This is not legal advice. Bitcoin miners must report receipt of the virtual currency as income Some people "mine" Bitcoin by using computer resources to validate Bitcoin transactions and maintain the public Bitcoin transaction ledger. The types of crypto-currency uses that trigger taxable events are outlined. Find out what you're eligible to claim on your tax return. Short-term gains are gains that are realized on assets held for less than 1 year. If you are using crypto-currency to pay for services rendered or buy items, you'll have to pay taxes on any capital gains that occurred as a result of the transaction. According to the guidelines currently provided by the IRS, you are only required to pay taxes if you sell those bitcoin and have made a profit bitcoin significant digits ripple block time .

How do you pay taxes on bitcoin? Congress demands explanation

Where to spend Bitcoin. If you are using crypto-currency to pay for services rendered or buy items, you'll have to pay taxes on any capital gains that occurred as a result of the transaction. Excludes TurboTax Business. Questions remaining, according to the letter, include how taxpayers should calculate the fair market value of notoriously volatile currencies, how to track exchanges, and how to account for number 1 cryptocurrency block explorer in the blockchain, which are fundamental changes to the protocol on which bitcoin and other cryptocurrencies run. Based on independent comparison of the best online tax software by TopTenReviews. How much money Americans think you need to be considered 'wealthy'. Pay for TurboTax out of your federal refund: The crypto cloud mining calculator ether mining contract is true if you are mining Bitcoin. It's important to find a tax professional who actually understands the nuances of crypto-currency taxation. Where to buy Bitcoin Section two: After your fiat money is in the account, exchange it for Bitcoin. If you bought or downloaded TurboTax directly from us: Data Import: If you need a bigger plan that accommodates more trades, you can head desktop bitcoin mining software highschool dropout bitcoin to your Account Tab and then select the Plan. Indeed, it appears barely anyone is paying taxes on their crypto-gains. Under the tax bitmain auto instant action bitcoin reviews of which country? Sign In. If the site's scope is narrowed, what should the updated help centre text be? Can the gov't track me down and get me to pay tax? Actual results will vary based on your tax situation.

It also lets you chat with the seller. This guide was designed to help you make that choice. For some users, Bitcoin is a way to avoid government intrusion and illegally evade paying taxes. There any other ways to transfer crypto without triggering taxes, but there is no silver bullet. This is not legal advice. Here is a brief scenario to illustrate this concept:. You have. If you bought or downloaded TurboTax from a retailer: Square is actually one of the cheapest ways to buy Bitcoin, since there are no fixed fees. It's important to find a tax professional who actually understands the nuances of crypto-currency taxation. Selling Bitcoin at a loss will generate short or long term capital losses which can be used to offset capital gains. If you're transacting with crypto-coins frequently, you'll want to keep diligent notes on the prices at which you buy and cash out. Ironically, this is an exchange for buying and selling coins—not just HODLing them. So anytime a taxable event occurs and a capital gain is created, you are taxed on the fiat value of that gain. In terms of capital gains, these values will be used as the cost basis for the coins if you decide to utilize them later in a taxable event. Section three: Where to buy Bitcoin with credit card Knowing how to buy Bitcoin with credit card is tricky since so few sites support it, and even then, the ability to do so often comes with higher fees. Imports financial data from participating companies; may require a free Intuit online account. While this is a political issue, it can be confusing, and could even cause you to lose your funds.

Tax only requires a login with an bitcoin to usd converter gpu calculator ethereum address or an associated Google account. The above example is a trade. The IRS relies upon the taxpayer to correctly track and pay tax on Bitcoin and other crypto currencies. If you accept Bitcoin for services you have earned income. By using our site, you acknowledge that you have read and understand our Cookie PolicyPrivacy Policyand our Terms of Service. In many countries, including the United States, capital gains are considered either short-term or long-term gains. Ironically, this is an exchange for buying and selling coins—not just HODLing. Buying Bitcoin is not a taxable event. You may use TurboTax Online without charge crypto coins list widely used in japan what is the news for ripple crypto to the point you decide to print or electronically file your tax return. If you held for less than a year, you pay ordinary crypto colorado cryptocurrency social security tax. There is bitcoin math app free bitcoin hardware the option to choose a specific-identification method to calculate gains. If you are a tax professional that would like to add yourself to our directory, or inquire about a BitcoinTax business account, please click. Marotta Wealth Managementa fee-only comprehensive financial planning practice in Charlottesville, Virginia.

Square Cash supports USD. Tax laws on giving and receiving tips are likely already established in your country and should be observed accordingly. But without such documentation, it can be tricky for the IRS to enforce its rules. Just as Binance does, KuCoin offers credit-card payments through Simplex. Where to buy Bitcoin Section two: Tax is the leading income and capital gains calculator for crypto-currencies. That puts it high on our list for where to buy bitcoin. The same is true if you are mining Bitcoin. Bitcoin used to pay for goods and services taxed as income If you are an employer paying with Bitcoin, you must report employee earnings to the IRS on W-2 forms. Tax offers a number of options for importing your data. There are credit cards tied to Bitcoin accounts where every credit card use sells a tiny amount of Bitcoin to pay for the purchase. Read More. That gain can be taxed at different rates.

Bitcoin.Tax

Sign up using Facebook. Robinhood Crypto is a popular personal finance app that targets millennials. You must convert the Bitcoin value to U. If you are looking for a tax professional, have a look at our Tax Professional directory. But it is expensive: Covered under the TurboTax accurate calculations and maximum refund guarantees. Here is a brief scenario to illustrate this concept:. Employees must report their total W-2 wages in dollars, even if earned as Bitcoin. Paxful enables you to buy Bitcoin from other people and buy Bitcoin with PayPal. Section two: Sign up using Email and Password.

The same is true if you are mining Bitcoin. If you held for less than a year, you pay ordinary income tax. Tax prides itself on our excellent customer support. Suze Orman: News stories sparked many to ask, " Should I invest in Bitcoin? Unicorn Meta Zoo 3: How much money Americans think you need to be considered 'wealthy'. We support individuals and self-filers as well as tax professional and accounting firms. TurboTax online and mobile whats the most bitcoins could be worth what do i need to know to trade bitcoins is based on your tax situation and varies by product. Covered under the TurboTax accurate calculations and maximum refund guarantees. A crypto-currency wallet is somewhat similar to a regular wallet in terms of utility. If you give to charity, that can be very tax-smart from an income tax invest bitcoin dice prepaid debit coinbase. Popular in Europe, Kraken launched inwhich makes it one of the older Bitcoin exchanges. You might have bought something with your crypto. TurboTax Help and Support: How to buy Bitcoin with credit card Section four: If you use TurboTax Online or Mobile: Where to buy Bitcoin During the past year or so, several companies have made the buying process simpler. Additional fees apply for e-filing state returns. Most Bitcoin owners, however, want to comply with IRS regulations.

Other credit cards offer Bitcoin as the rebate rewards for using the card. As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. My wife and I have been married 50 years, and we've never had a single fight about money—here's our secret. Knowing where to buy Bitcoin is harder. We offer a variety of easy ways to import your trading data, your income data, your spending data, and. Here are several other places where you can also do so. The IRS issues more than 9 out of 10 refunds in less than 21 days. Where to buy Bitcoin with credit card Knowing how to buy Bitcoin with bitcoin second hard fork campuscoin mining pool card is tricky since so few sites support it, and even then, the ability to do so often comes with higher fees. Selling Bitcoin at a loss will generate short or long term capital losses which can be used to offset capital gains. If you own bitcoin, here's how much you owe in taxes. The crypto exchange lists hundreds of altcoins including GrinTron and Zilliqa and has a whopping trading pairs between different coins. Tax and credit data accessed upon your consent. Self-Employed Expense Estimator Enter your annual expenses to estimate your tax savings. Built-in support means that you can export paxful account suspended hitbtc selling before ico CSV from your exchange and then import it into Bitcoin. Some employees are paid with Bitcoin, more than a few retailers accept Bitcoin as payment, and others hold the e-currency as a capital asset.

Estimate your tax refund and avoid any surprises. Given that little guidance has been given, filing in good faith with detailed record-keeping will be evidence of your activity and your best attempt to report your taxes correctly. Knowing where to buy Bitcoin is harder. Buying Bitcoin is not a taxable event. Individual accounts can upgrade with a one-time charge per tax-year. IRS Penalties for Abatement. The following chart is a partial listing of countries that tax crypto-currency trading in some way, along with a link to additional information. Skip To Main Content. Hot Network Questions. In many countries, including the United States, capital gains are considered either short-term or long-term gains. Please be sure to enter your country of origin when you sign up as some countries follow different dates for their tax year. That gain can be taxed at different rates. If you want to know where you can spend Bitcoin, check out our next guide: Coinbase has a reputation for trust and reliability, outperforming virtually every other site from the user-experience perspective. Obviously, the specifics change based on the provider, but here are the general steps: A crypto-currency wallet does not actually store crypto, but rather stores your crypto encryption keys, communicates with the blockchain, and allows you to monitor, send, and receive your crypto.

General tax principles applicable to property transactions apply. And funds are safu. The tax laws governing lost or stolen crypto varies per country, and is not always easy to discern. The cost basis of a coin refers to its original value. Assessing the cost bitcoin cash mining pool list how to write a record to the bitcoin blockchain of mined coins is fairly straightforward. Indeed, it appears barely anyone is paying taxes on their crypto-gains. Wages paid in virtual currency are subject to withholding to the same extent as dollar wages. LocalBitcoins also lets you buy Bitcoin from other people. While the number of people who own virtual currencies isn't certain, leading U. Canada, for example, uses Adjusted Cost Basis. By Tim Copeland. The IRS answered some common questions about the tax treatment of Bitcoin transactions in its recent Notice

Tax laws on giving and receiving tips are likely already established in your country and should be observed accordingly. Tax prides itself on our excellent customer support. It would be great to see increased support of it as a payment method across the cryptosphere. Getting paid in Bitcoin is even more confusing. Bitcoin used to pay for goods and services taxed as income If you are an employer paying with Bitcoin, you must report employee earnings to the IRS on W-2 forms. Unlimited access to TurboTax Live CPAs and EAs refers to an unlimited quantity of contacts available to each customer, but does not refer to hours of operation or service coverage. Self-employed individuals with Bitcoin gains or losses from sales transactions also must convert the virtual currency to dollars as of the day received, and report the figures on their tax returns. Instead you had to buy from Coinbase and send it to Binance. What is his or her tax basis, since it was a gift? If you are ever unsure about the crypto-currency-related tax regulations in your country, you should consult with a tax professional. And the IRS is unlikely to be persuaded unless you can document it. A taxable event refers to any type of crypto-currency transaction that results in a capital gain or profit. The tax basis is the same as it was in your hands when you made the gift.

You sold bitcoin for cash and used cash to buy a home. Find your tax bracket to make better financial decisions. If this is for you, then just create an offer and make sure to state that you want to buy Bitcoin with PayPal. Prices subject to change without notice. Reporting Your Capital Gains As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. You can also make payments in cash. Robert W. While this is a political issue, it can be confusing, and could even cause you to lose your funds. Bitcoins held as capital assets are taxed as property If Bitcoin is held as a capital asset, you must treat them as property for tax purposes. Square Cash supports USD. At the end ofa tax-bill was enacted that clearly limits like-kind exchanges to real estate transaction. But, buy bitcoin generator price of bch bitcoin cash Binance has partnered with Israeli-based Simplex so its customers can buy Bitcoin most profitable mining currency 2019 redeem code for hashflare credit card. Privacy Policy Terms of Service Contact. E-file fees how much money do you need to invest in bitcoin litecoin mining rate not apply to New York state returns. A compilation of information on crypto tax regulations in the United States, Canada, The United Kingdom, Germany, and Australia, which can be found. David John Marotta Contributor.

If you are an employer paying with Bitcoin, you must report employee earnings to the IRS on W-2 forms. Coinbase itself is considered a broker, since you are capable of buying and selling your crypto-currency for fiat, at a price that Coinbase sets. I handle tax matters across the U. This way your account will be set up with the proper dates, calculation methods, and tax rates. So, you're obligated to pay taxes on how much the bitcoin appreciated from the time you invested up until the time you shelled out for the house. Click here to access our support page. In addition, this guide will illustrate how capital gains can be calculated, and how the tax rate is determined. Quicken products provided by Quicken Inc. In many countries, including the United States, capital gains are considered either short-term or long-term gains. Indeed, it appears barely anyone is paying taxes on their crypto-gains. Therefore, if you have been buying Bitcoin, it is important for you to have kept track of every Bitcoin purchase. A taxable event is crypto-currency transaction that results in a capital gain or profit.

Your Answer

Post as a guest Name. Tax prides itself on our excellent customer support. It's important to consult with a tax professional before choosing one of these specific-identification methods. Ironically, this is an exchange for buying and selling coins—not just HODLing them. The cost basis of mined coins is the fair market value of the coins on the date of acquisition. Produce reports for income, mining, gifts report and final closing positions. But every time you use such a card it is a taxable event which must be tracked. In addition to this report, the Library of Congress provides a wealth of information regarding crypto-currency taxation around the world, which can be found here. Wood Contributor.

You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. How to get rid of bitcoin miners litecoin spot price to buy Bitcoin Section two: There are no fees for buyers but check the price, it will usually be a few percent above the market price, so the seller makes money. Crypto-currency trading is subject to some form of taxation, in most countries. This way your account will be set up with the proper dates, calculation methods, and tax rates. If you accept Bitcoin for services you have earned income. This has turned it into a fiat on-ramp, making life much easier for its customers. Trading crypto-currencies is generally where most of your capital gains will take place. Here are some of the easiest and best ways to do it. Canada, for example, uses Adjusted Cost Basis. What is his or her tax basis, since it was a gift? Assessing the capital gains in this scenario requires you to know the value of the services rendered. We use Stripe as our card processor, that may do a fraud check using your address but we do not store those details. Our plans also accommodate larger crypto-currency traders, from just a few hundred to well over a million trades. As a recipient of a gift, you inherit the gifted coin's cost basis. This means you are taxed as if you had been given the equivalent amount of your country's own currency. The tax basis is the same as it was in your hands when you made the gift. The IRS relies upon the taxpayer to correctly track and pay tax on Bitcoin and other crypto currencies. You can trade Bitcoin for Dash, Monero and Zcash, all of which have strong settings for usd to bitcoin 7 year chart neo github antshares your transactions private. When done online you can buy Bitcoin with PayPal. GOV for United States taxation information.

You might have to wait a few hours—or a few days— for the KYC checks to be processed, so be patient. In order to categorize your gain as long-term, you must truly hold your asset buy kin cryptocurrency most used crypto currencies longer than one year before you realize any gains on it; in addition, the calculation method affects which coin will be used to calculate your gains. Here's a more complex scenario to illustrate how to assess gains for paying for services rendered:. Facebook cover photos bitcoins auto dice bitcoin and price comparison based on anticipated price increase. On-screen help is available on a desktop, laptop or the TurboTax mobile app. Tax is the leading income and capital gains calculator for crypto-currencies. But, when choosing how much to buy, if you select PayPal, it will only set you up with sellers who accept PayPal payments. A crypto-currency wallet is somewhat similar to a regular wallet in terms of utility. Narrow topic of Bitcoin. Bitcoin Stack Exchange works best with JavaScript enabled. Taxable Events A taxable event refers to any type of crypto-currency transaction that results in a capital gain or profit. Ask Question. The crypto exchange lists hundreds of altcoins including GrinTron and Zilliqa and has a whopping trading pairs between different coins. But be careful: It also lets you chat with the seller. It's important to ask about the cost basis of any gift that you receive. Home Questions Tags Users Unanswered. Tax treatment depends on how Bitcoins are project alchemy zcash reddit people who got in bitcoin early and used. There any other ways to transfer crypto without triggering taxes, but there is no silver bullet. Given that little guidance has been given, filing in good faith with detailed record-keeping will be evidence of your activity and your best attempt to report your taxes correctly.

It is not practical for the IRS to track the bitcoin of every US citizen who owns some, and becoming increasingly difficult to do so, given the continuing advancement in bitcoin privacy enhancements. Use Form to report it. The name refers to a mythical Norse sea monster. And the added confusion if you were also using it on daily basis to purchase your groceries and other expenses. You import your data and we take care of the calculations for you. Popular in Europe, Kraken launched in , which makes it one of the older Bitcoin exchanges. We provide detailed instructions for exporting your data from a supported exchange and importing it. There are exchanges that combine these utilities, and there are exchanges that offer some sort of iteration of these utilities. Even if you aren't a hefty Coinbase user, you're obligated to report, and every U. It makes money by adding a 1.