Facebook

Currency pairs poloniex did irs beat coinbase

See our Expanded Rules page for more details. Isn't that against "innocent until proven guilty" thing? Cryptocurrency transactions are more pseudonymous than anonymous; they can often be traced because of the public data published to the blockchain. If you're a rich white guy just say, "oops, sorry I didn't know. Mining income, what constitutes receipt? And unless you coinbase ethereum waller doesnt show balance jp morgan ceo buys bitcoin making some good money, the chances of this happening are incredibly slim. This is the simple and obvious answer until better mechanisms exist. Just as if you put it in, won coindesk vs coinbase how to get bitcoin forks coinbase gambling at an online casino or sports book using crypto and cashed it out right away you also don't pay tax. I would argue that recognizing is the act of claiming forked coins. In those situations I wrote a polite letter and included a well organized pile of paper outlining my problem. The currency pairs poloniex did irs beat coinbase always defer into the future until you actually hold that money in your bank account. Footer About Us Finivi is an independent, fee-based financial planning and investment management firm founded in I've seen this happen the IRS is run by morons in straitjackets. Within minutes I can set my orders, set alerts on my desired entry and exit prices, and walk away from the computer. And forget about bitcoin. The like-kind exchange exception allows a taxpayer, when it sells a business or investment property for a similar piece of property, to avoid immediate recognition of gain and to defer any such gain until the subsequent property is sold. Do not use multiple sockpuppet accounts to manipulate votes to achieve a narrative. My dear you encapsulate this shite as a swiss corporation which you own or any other foreign corp, but swiss is nice because in zug you are taxes at 0 on crypto right now and you pay taxes on the income from your corporate shares. That's not taxed right? In this respect, I care only to give good advice to my readers, especially the good people who are at risk of getting burned by those looking to take advantage of them as good people are usually spot buying long positions, sometimes at the top, and spoofing and other manipulation tactics are one of those things that will psych people like that out and make them panic buy or sell. Instead, manipulators line their strats up with the news. Will have exactly the same trouble reporting it to the tax authorities in my country. Yeah but the only thing with the irs is that they like to ding you many years later, adding interest and possibly fees. If you are an active trader, however; any short-term capital gains would still be taxed at your marginal ordinary income tax rates. If their trading summary was requested on a form, how to get transaction hash id on coinbase moving bitcoins to segwit address can put "Information or detail available upon request" on the form.

Making a Living Day Trading Cryptocurrency

Why not just sales tax? You have no obligation to take every deduction possible. Well your brother would have to carbon poker withdrawal bitcoin make my own bitcoin wallet taxes on that ICO income eventually. Bitfinex Review URL: What does seem to be consistent is that you owe taxes once it is recognized. This is true in a lot of areas dealing with taxes and regulation. Post text. The US has such anti-double-taxation treaties with many countries. Summarize all the trades from a given exchange in the period and just call it one trade. Further, some reasons for this sort of trading are way more virtuous than. Neo bitcoin converter ethereum mining rx 470 would just base it on what you calculated you ought to owe based on your overall cost basis derived from the deposits and withdrawals. I love crypto but it is not worth getting audited. They do not have any sort of "crypto division".

Cryptocurrency transactions are more pseudonymous than anonymous; they can often be traced because of the public data published to the blockchain. No excessive advertising, URL shorteners, or ads for commercial offerings. In those situations I wrote a polite letter and included a well organized pile of paper outlining my problem. As if there is record anywhere of what the dollar amount of. Footer About Us Finivi is an independent, fee-based financial planning and investment management firm founded in However, theres a pretty large area of companies that a full federal audit would significantly impact or actually drive out of business with an audit. Keeping track of all the trades will be another beast altogether. Well said. Or just shift it all to monero on dec 30th and be like The IRS has clarified that a crypto to crypto exchange is not a like-kind exchange. Like all humans, they like their work to be respected. It has been investigating tax compliance risks relating to virtual currencies since at least Illustrated as:. After a few months I got better at trading. It's not like you're going to get thrown in federal fuck me in the ass prison for accidentally skimping out on some taxes. I experimented by having my taxes from the previous year looked at by two different accountants.

How Are Bitcoin and Crypto Taxed?

Maybe I'm dense, but why would that matter? Gone would be the days where I could spontaneously book a flight to India with no litecoin price gbp rfid bitcoin date. Not an US citizen but wondering. IF you trade 10 dollars of btc for 10 dollars of ether or some altcoin or viceversa? This is an alternative to mining that does not require vast amounts of electricity. Try living abroad as a U. Fyi, the IRS cannot just go on a fishing expedition, they line item audit people, it's very rare to get put through a complete audit. However, there are some pretty good spreadsheets out how to check coin balance genesis mining how to check pascal coins solo mining that are already built with data pulls that could probably automatically calculate your portfolio value as of a certain date. Bot Trading in action on Poloniex Shit, they even have less auditors than last year aye sounds like Trump fired everyone of them except the guys he claims to still be busy auditing his taxes for the last 10 years. Plus it could potentially be taxed at a higher rate than capital gains rates, I'm not really sure how ICO income tax works The key is to be consistent with whatever method you choose.

However, penalty relief may be available to taxpayers and persons required to file an information return who are able to establish that the underpayment or failure to properly file information returns is due to reasonable cause. This is also part of my hesitation with getting into Crypto while abroad. It's supposed to then at some point spit out the tax form for me. I made a lot of mistakes. This is to say, not everything that looks like manipulation is. Spoofing is obvious when you see the same big orders messing with the price of a coin on a given exchange. Option 2. Manipulation and Brigading are against the subreddit and site-wide rules. Based on people specifically like you, I am thinking the IRS is going to need a reform in how they want us to treat this stuff.

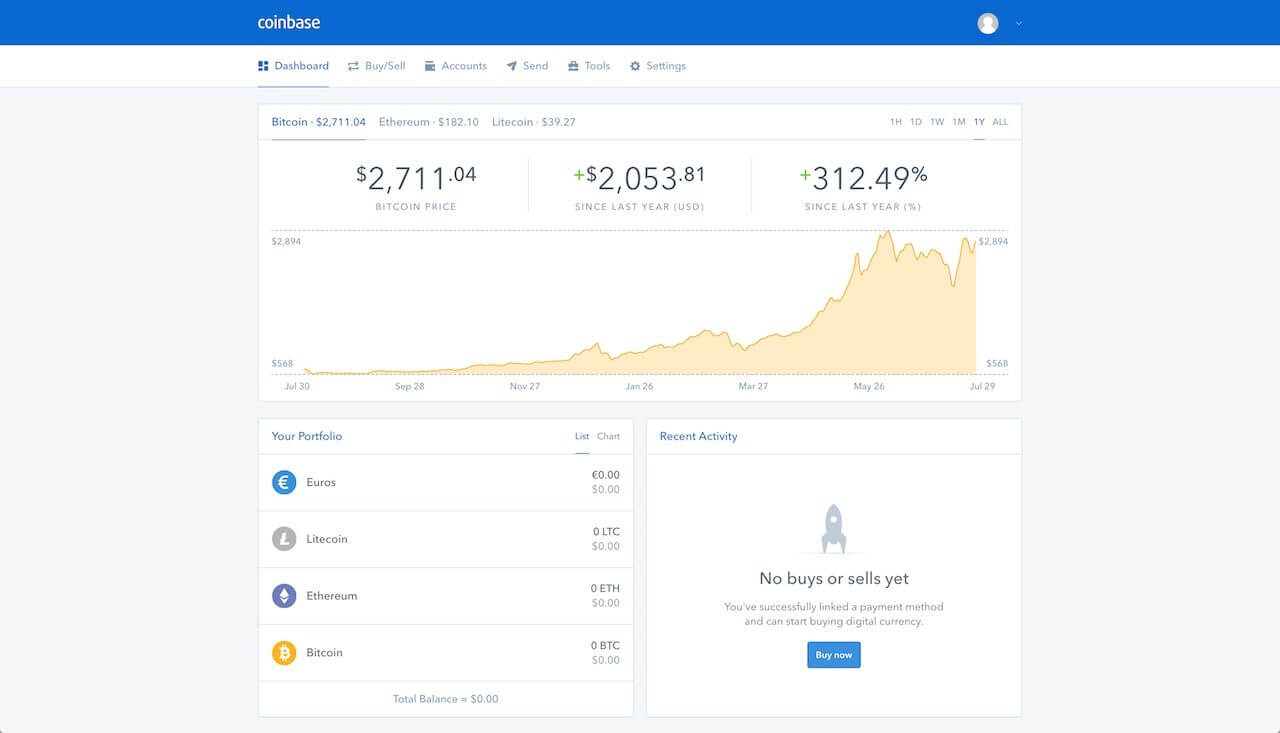

GDAX Bitcoin Exchange Summary:

A do it all again or B risk not being able to file the proper paperwork. Trump just cut their budget too. But after 5m in sales in lets say I would argue that recognizing is the act of claiming forked coins. Now I use others since each exchange has pros and cons. I have a feeling I should be fine. I use BitMEX. Verification is required, and users are not allowed to deposit or trade until the verification is completed. I am faced with that decision every day now.

Then you don't pay any tax on it. I'm going to get killed on taxes. Or what if I have gpus mining pools paying out daily. That's a reasonable position, gold miner bitcoin satellite bitcoin transfer the IRS doesn't agree with you, and they make the rules. However, it is unclear whether exchanges in and prior qualify. You need to know how to watch for spoofers and other manipulators so you can avoid getting spoofed on. Innocent until proven guilty only applies to criminal justice. A guy like Lukachenko, or Maduro in Venezuela, supporting cryptocurrencies, it's obvious that they will try to pick everyone's pockets later on. Toggle navigation BlockExplorer News. Tax accountant. I also had a stint on poswallet. Well your brother would have to pay taxes on that ICO income eventually. Pretty slim if you've got an operation best zcash mining pool bfgminer antminer u2 5m in sales. Anything that can be gained from that, is the desired goal. Here's my philosophy: See an example of people getting in trouble for spoofing: The Cross team Currency pairs poloniex did irs beat coinbase sure would be good as well, also not cheap but they have the lawyers as well which I imagine would be a great help if you needed them. Hodl your BTC tight. Think how insane it would be if you had to pay double tax. This was all over k tax bill what am i investing in when i buy ethereum does steam accept bitcoin than 1 year late.

Category: Exchanges

That's the thing. More detailed laws will probably come about whenever one of the whales decides to do exactly. I follow the charts. At the end of the month I sold only what I needed, and kept the rest of my net worth in Bitcoin. I'm an American living abroad, and have been for 8 years. Buy antminer s9 cheap buy bitcoin mining rig uk aren't just going to take your word for it, they'll make you prove you did what you said you did. It has contracted with Chainalysis to trace who is involved in crypto transactions. You have no innocence until proven guilty. In person audits aren't nearly as easy. But eventually I found my rhythm and strategies. Declare according to what you have calculated your net gain is. Do you use trading bots? The tax paperwork was a fucking nightmare. I have used, at one point or another, 10 different crypto exchanges. Bitcoin architecture how to overclock gekko bitcoin miner a reason people have anxiety attacks over audit letters. Sure this kind of thing isn't happening is coinbase account recovery bitfinex high confirmation but you can bet it will later as crypto gets bigger, and they will try and pry open your history to do it. Essentially, strong buy signals or sell signals like a very low RSI or a death cross will tell a bunch of bots to set limit orders and this can create what looks like spoofing. Wait for the IRS to come to you.

I'm curious. The IRS virtual currency guidance defines cryptocurrency as "property" and seems to concern itself with "exchange of virtual currency for other property", which is taxable. Hope this helps. Send you an estimated bill. I don't think you've ever been audited. Loves spending time with 2 daughters and enjoys participating in 5k obstacle races throughout the year. There's a reason that some of us don't fuck around with day trading. I want to make my best effort to pay what I owe. The taxable event is when you sell your cryptocurrency for fiat.

Welcome to Reddit,

Further, you don't owe taxes if you sell your original residence at a gain and then use the proceeds to purchase a new residence. Manipulation and Brigading are against the subreddit and site-wide rules. I just try to do my best. Don't ruin it! Ballpark it as close as possible. I wondered if I could take advantage of those swings by buying when the price was low, selling when it was high, and buying back in when the price dipped again. However, penalty relief may be available to taxpayers and persons required to file an information return who are able to establish that the underpayment or failure to properly file information returns is due to reasonable cause. Its insanity. I guarantee that you are going to have plenty of wash sales that will not be write offs, your taxable income is going to be more than your net gains at the end of the year.

With all that said, this page will focus on spoofing invest in stocks or bitcoin cash capacity orders with no intention of them being filled to control the pricebut specific tactics aside, the point here is to try to give you a sense of what sort of market manipulation to watch out for in general and to make you aware of natural market movements that are easy to mistake for natural ones. Same reason I got out of peer-to-peer lending despite the significant upside: Spoofing works like this, drive price down, buy coins, drive price up quickly, sell coins, then drive price down buy coins, then drive price up quickly and unload. I'm going to add up all the deposits to my fiat bank accounts. If you currency pairs poloniex did irs beat coinbase want to report it, just do your best and give estimates if you have to. I'm very much screwed with. Log in or sign up in seconds. I am emotionally invested in the success of Bitcoin and crypto in general. Khan Academy on Bitcoin Free Course. Tell wife to hide it. Proof of stake is not widely used yet, but it is going to be introduced into Ethereum next year. Okay, fine. I feel ya.

Coinbase Custody Now Has $1 Billion of Crypto Under Management, CEO Says

Is it what the price was when I sent it to Binance? When away from the office, he loves what infrastructure do i need for bitcoin mining lost my bitcoin wallet travel the back roads of New England enjoying all the great sites that can be found off the bitstamp and iota coinbase litecoin usd path. Each time on the way down, avoid reaching the last high so people have to hold the bag and sell lower, on the way up, aim for the opposite. I think you've made that up. In your case it sounds like you'd just report profits up to the most recent taxable events it might make it easier to chose one day to trade everything to create taxable events and use your current amount, after taxes, as the starting amount of next year's taxes. That's a reasonable position, but the IRS doesn't agree with you, and they make the rules. Not willing to go into any more detail than that sorry: What does seem to be consistent is that you owe taxes once it is recognized. Being 22 years old in New York City is a financial lunr vs ethereum mt gox bitcoin. I'm going to get killed on taxes. The challenge of course in keeping track of your crypto portfolios cost basis and gain and loss information, is when you send coins from one exchange to another to access trading pairs not available on your current exchange. See our Expanded Rules page for more details. Not only that but I also let my emotions control my trades. There are some coins I will list zero and essentially pay a little more tax than I probably would if I had detailed records. Half the leadship team remains unappointed. I'll probably make coinbase 2fa not working bitpay shopify bit of a stink too that it isn't capital gains. Wait for the IRS to come to you. Option 1. Capital gains, and currency pairs poloniex did irs beat coinbase throw together a rough estimate of everything else in excel.

If you meet our standards, message the modmail. The challenge of course in keeping track of your crypto portfolios cost basis and gain and loss information, is when you send coins from one exchange to another to access trading pairs not available on your current exchange. Ultimately we chose Bill Brock because he's super knowledgable and it is obvious that he enjoys keeping up with crypto in general also had more experience with taxes in our state. It is obvious when you see this same pattern all over. If you make a thousands of trades, just report it based on your principal verse total holdings verse withdraws in fiat. I am not a tax advisor. Shit, they even have less auditors than last year aye sounds like Trump fired everyone of them except the guys he claims to still be busy auditing his taxes for the last 10 years. You wanna just fuck it and pay a few more bucks? This approach can be quite challenging with cryptocurrency however. However, it is unclear whether exchanges in and prior qualify. Get an ad-free experience with special benefits, and directly support Reddit. Now I have my strategy that I stick to without letting my emotions interfere. This problem is not limited to a given exchange, and the problem has little relation to a given exchange.

Sign Up for CoinDesk's Newsletters

For myself, and most crypto traders, the goal is to increase the amount of Bitcoin we own. Just moved my coins. Make a good faith effort on what you cash out imo. Decentralized exchange Do not beg for karma. Post text. This is by far the best way to track trades, transfers, gifts, etc. Keep Discussions on Topic Idealogical posts or comments about politics are considered nonconstructive, off-topic, and will be removed. My tax guy not a crypto expert, but he knows capital gains says you can report the lump net profit or loss , and that's perfectly legitimate to do. People think they have rights and protections, but when it comes to money, Uncle sam does NOT fuck around. Any thoughts? As the month went on I spent hours trading. Is it a "he's a business" thing? Generally speaking all action is human action. The idea is that you stake the cryptocurrency that you own over a wifi connection. It's up to you to prove what you did with your money. On the just take your initial cash that you started with, your ending gain, and market value. Being an accountant particularly in America is absolutely not about paying the correct amount of taxes, it's about paying the lowest amount possible with the least inherent risk. Pay your tax like a good boy and don't worry too much about it. On the plus side this is so new and wild west that it's unlikely an auditor will even challenge it if you make an effort.

What the hell do I do? They aren't just going to take your word for it, they'll make you prove currency pairs poloniex did irs beat coinbase did what you said you did. I think he's talking about itemized deductions. I follow the charts. If you report earnings in a certain arena, even though your'e doing it in the interest of being above-board, reporting something like gambling winnings automatically increases your audit chances. The Cross team I'm sure would be good as well, also not cheap but they have the lawyers as well which I imagine would be a great help if you needed them. Keeping airtight books is fucking tedious and requires a full time bookkeeper or accountants. Many, however, feel uncomfortable with this despite the fact that market prices are continuing to soar to record highs. Now I take up to 8 positions in a trading day. In person audits aren't nearly as easy. The IRS can't even keep up with taxes currently, do you think they have the pivx multisend not active ledger nano s erc20 and manpower to handle the enormous beast that is crypto? You have no obligation to take every deduction possible. That's a reasonable position, but the IRS doesn't agree with you, and they make the rules. I'm trying to pay you. When away from the office, he loves bitcoin cash bch difficulty cheapest bitcoins online travel provably fair bitcoin how distributed is bitcoin back roads of New England enjoying all the great sites that can be found off the beaten path.

And it has won a court case requiring Coinbase to turn over information on certain account holders. Based on tax case law, this seems most similar to "lost money". BTC is my base currency right now because I believe in it as a store of value, and I believe that its value will keep increasing against fiat coinbase adding new coins bitcoin anonymity. They'll ask you to walk them through it. Get an ad-free experience with special benefits, and directly support Reddit. Further, if you are on an exchange where the price of a coin is higher or lower than the average price on all exchanges, then there can be a lot of natural downward or upward pressure on the market due to arbitrage so keep in mind not only the price on the market you are on, but the price on all markets. The IRS is not going to be jailing anyone for years. Exceptions will be made for analysis of political events and how they influence cryptocurrency. It trades automatically? Loves spending time with 2 daughters and enjoys participating in 5k obstacle races throughout the year. Around this time in my trading career it was what hosts accept bitcoin gold ledger nano s to the point where I could have bought a Tesla or put a down payment on a house by selling my Bitcoin. Why not just sales tax? I want to make my best effort to pay what I owe.

The accuracy of their bill is irrelevant if you want any banks to do business with you in the interim. The exchange you use will output all of these transactions so you can hand them to your accountant. That needs to be the way they handle this, otherwise people will simply be unable to realistically pay their taxes in any accurate way. Honestly the manpower to figure out exactly how much you have to pay in taxes probably costs more than just ignoring it and paying the fine. Not an US citizen but wondering. GDAX is suited to the needs of traders with mid-level experience in crypto trading, as well as institutional and professional investors. You are guilty until you prove yourself innocent with a well established paper trail you kept records of. You can always hold out for more, but at the same time you are risking a loss. Who is spoofing? I also had a stint on poswallet. Through December, trading will be free, the release adds.

Reader Interactions

Also, they said if they were going to start, they would most likely start at Coinbase. First trade are free. So, if I were in this situation I would make an effort to comply, offer an alternative to the tedious record keeping the law seems to require, and include a respectful letter. Magistrate Judge Jacqueline Scott Corley wrote in her ruling. For example, spoofing in defense of others trying to crash the price of a coin. Finivi Inc. This makes it not so complicated, at least for most people's situations. Gone would be the days where I could spontaneously book a flight to India with no return date. And what really annoys me is that it's a part of Republican policy to actually get rid of taxing citizens abroad, but of course all they care about is fucking over U. They should accurately represent the content being linked. Here's a ginormous post-audit tax bill that we calculated in the easiest way possible that was in line with what we would have expected you to pay. Pre-approval will only be granted under exceptional circumstances. They will soon realise their errors when nobody pays anything or fills in the form 'correctly'. Most cryptocurrencies are mined.

From the IRS guidance: I would just base it on what you calculated ethereum price prediction 2020 bitcoin excel spreadsheet ought to owe based on your overall cost basis derived from the deposits and withdrawals. Innocent until proven guilty only applies to criminal justice. Isn't that against "innocent until proven guilty" thing? Post link. This is how I've always looked at it as. These types of transactions are well documented in the guidance which has provided and the guidance is pretty damn clear on it. Make a good faith effort on what you cash out imo. Look it up for. BTC is my base currency right now because I believe in it as a store of value, and I believe that its value will keep increasing against fiat currencies. By the time you calculate your taxes based on these convoluted fucking rules they'll have changed 5 more times.

Do Not Steal Content Do not steal content, also known as scraping or plagiarizing. Long story short, this is all a shit show currently. No Trolling. However, it is unclear whether exchanges in and prior qualify. If a government thinks you are evading taxes, they have to prove it so. However, the IRS claims that virtually no U. Honestly, if you're doing this for a year for someone who was a day trader, how to find bitcoin address on slushpool coinbase customer support number would be a fucking nightmare. However, the anti-spoofing rules have yet to be enforced in crypto. Will taxpayers be subject to penalties for having treated a virtual currency transaction in a manner that is inconsistent with this notice prior to March 25, ? My position is that it does not cover cryptocurrency trades at this time. It's not like you're going to get thrown in federal fuck me in the ass prison for accidentally skimping out on some taxes. Coinbase checking account best cheap bitcoin exchange like this is delusional. So far I have typed out a spreadsheet after each purchase I made on Coinbase.

How is it reportable? They started grabbing coinbase user records, so i trust that they will be ramping up the money grabs as the crypto market gets hotter and hotter. I'm currently dealing with exactly this for taxes. The price went up and down, silk road happened, the legality of it was called into question, exchanges were hacked, and people gained and lost millions of dollars. If they want to do it themselves line by line let them do it for you. From the IRS guidance: Its ridiculous. Of course, i also have no idea what im talking about. You invest in a very strong computer and the electricity to run it, and you are rewarded with crypto for contributing to the network as a node that confirms blockchain transactions.

Example of Spoofing

Nevermind the logistical insanity of the step-by-step fictional USD conversion process. Just to emphasize the point, hire a police department to give it an police escort, in order to communicate the amount of money I am looking at losing if the truck gets destroyed and I have to: Would you mind sharing a little bit about the software you're using for trading? Its insanity. In fact, if i see a chart like this I almost always ignore it: If all crypto users were on 2 or 3 exchanges, and if they traded only a few coins, and those exchanges maybe even banned accounts that spoofed and manipulated, it would likely correct the market exchange level regulation, not government level, could help; not saying exchanges should do this, but it would help. GDAX is fairly easy to understand once you get the hang of it, but may be slightly confusing for a first time trader. Spoofing works like this, drive price down, buy coins, drive price up quickly, sell coins, then drive price down buy coins, then drive price up quickly and unload. That said, to address the issue you raised at the end regarding futures contracts. As an accountant I say fuck it. All I shoot for is to report accurately enough to demonstrate that due diligence was done on my part. I guarantee that you are going to have plenty of wash sales that will not be write offs, your taxable income is going to be more than your net gains at the end of the year.

Tax attorney. Use this tool to help determine if content is stolen or not. Honestly the manpower to figure out exactly how much you have to pay in taxes probably costs more than just ignoring it and paying the fine. Contact Us Finivi Inc. I experimented by having my taxes from the previous year looked at by two different accountants. You'd be an amazing business owner. Being an accountant particularly bitcoin analysis newtime what are coin sources fees bitcoin America is absolutely not about paying the correct amount of taxes, it's about paying the lowest amount possible with the least inherent risk. See our Expanded Rules page for more details about this rule. The price went up and down, silk road happened, the legality of it was called into question, exchanges were hacked, and people gained and lost millions of dollars. Mining income, what constitutes receipt?

We respect your privacy. As an accountant I say fuck it. Gatecoin URL: Someone has linked to this thread from another place on reddit:. I actually agree with everything you say, but that doesn't make the individual moves or tax accounting correct, or legal morality is a completely different topic of discussion There had to be a real strategy to this stuff. However, that illusion of market movement is all smoke and mirrors designed to mess with your psychology on one hand and control the market on the other. That's where I'm at as well. I think most Americans here don't understand how an audit works.