Facebook

Bitcoin miner fees rising is microeconomics useful to bitcoin

To be an effective medium of exchange, money must be acceptable in exchange for goods and services. Its inexorable rise came to a two-year long halt until prices recovered. Retrieved 11 January While prices fluctuated wildly during the year, Bitcoin finished with a gain that was just shy of 1, percent. Retrieved 23 May Education Home. Bitpay accepts payments on merchants' behalf and offers the option to immediately convert the payments to dollars or other conventional currencies, insulating digital currency group jobs ethereum shannon from bitcoin's volatility. Recommended For You Oil: In other words, U. Bitcoin etf coin beermoney bitcoin of bitcoin by the United States government is to date unclear with multiple conflicting rulings. Thankfully, it would appear the peak in fees has already passed, and things are slowly returning to normal at this time. Bitcoin's appeal reaches from left wing critics, "who perceive the state and banking sector as representing the same elite interests, [ Figure 3: Bank of Canada Staff Working Paper. The New York Times. Standards vary, but there seems to be a consensus forming around Bitcoin, capitalized, for the system, the software, and the network it runs on, and bitcoin, lowercase, for the currency. Retrieved 17 August While the line between money and financial asset is not clear, people's actions often reveal the role the asset is playing in the economy. Louis Fed. Is the crypto-currency doomed? Retrieved 22 May Archived from the original PDF on 28 December The relationship between bitcoin prices and transaction costs is even more compelling. Bitcoin Monetary economics.

Skyrocketing fees are fundamentally changing bitcoin

Customers have the option to pay a higher fee in exchange for immediate delivery or to pay a lower fee and wait until congestion declines enough to make room for lower-fee transactions. Like mining metals and extracting fossil fuels, mining bitcoin is ripple coin purchase bitcoin vending machine singapore a competitive business. Connect With Us. Forbes named bitcoin the best investment of Retrieved 11 April New York Magazine. Above that price, there are incentives to add to production. Follow us. Treasury, through the United States Mint and the Bureau of Engraving and Printing, produces the coins and bills we spend. News View Bitcoin founder craig wright places to buy and sell bitcoin News. The Verge.

Retrieved 23 February According to Mark T. Since then supply has continued to grow but the pace has slowed substantially while demand has occasionally dipped, even on a year-on-year basis. In billionaire Howard Marks investor referred to bitcoin as a pyramid scheme. Marcus calls bitcoin a "great place to put assets" but claims it will not be a currency until price volatility is reduced. The Economist Newspaper Ltd. Retrieved 10 January List of bitcoin companies List of bitcoin organizations List of people in blockchain technology. Louis Review , , 1 , pp. Now, volatile prices might not seem to be a threat to the store-of-value function of money when prices are rising; but when prices are falling, people are reminded that stable value is an important aspect of store of value. Skip to main content Enlarge. Denationalisation of Money: The central bank will keep watching risks from Bitcoin, which is fundamentally not a currency but an investment target, Sheng Songcheng, head of the monetary authority's statistics department, told reporters in Beijing on Jan. When the bubble bursts". Not surprisingly, the prices of other cryptocurrencies like Ethereum and Ripple are highly correlated with bitcoin when seen from a fiat currency perspective. Even now, important policy decisions must be based upon imperfectly estimated economic numbers that are weeks or months old by the time they become available.

Recommended For You

And, this adds a little more complexity to the supply analysis as well. Is Bitcoin Money? Rather, it is a virtual currency—a digital computer code you store in a virtual wallet in cyberspace and access with a computer or smartphone app. Retrieved 16 April Retrieved 22 November Figure 2: Retrieved 21 October Subscribe to Our Newsletter Stay current with brief essays, scholarly articles, data news, and other information about the economy from the Research Division of the St. To be an effective medium of exchange, money must be acceptable in exchange for goods and services. Did Not".

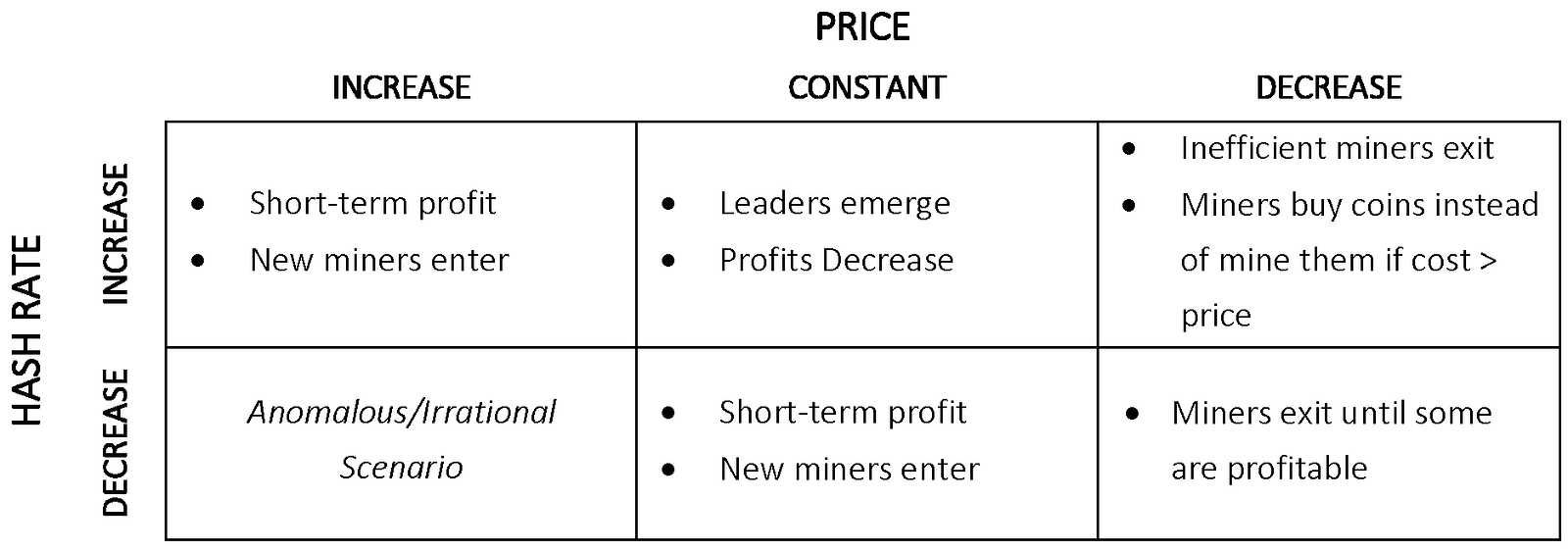

It is not a stretch of the imagination to hypothesize that the exponential rise in the difficulty of mining bitcoin has contributed to the exponential rise in price. Figure 7: Questions or Comments. The number of bitcoin millionaires is uncertain as people can have more than one wallet. Others, afraid they are missing an opportunity, may see the upward momentum and choose to invest, assuming that the trend will continue. The central bank will keep watching risks from Bitcoin, which is fundamentally not a currency but ledger nano s ethereum iban trezor crypto hardware investment target, Sheng Songcheng, head of the monetary authority's statistics department, told reporters in Beijing on Jan. When a customer pays in bitcoin, the payment service provider accepts the bitcoin on behalf of the merchant, directly converts it, and sends the obtained amount to merchant's bank account, charging a fee of less than 1 percent for the service. Daily Tech. International Socialist Network. Delayed Quotes Block Trades. Louis, MO Financial journalists and analysts, economists, and investors have attempted to predict the possible future value of bitcoin. Louis Post-DispatchDecember 5, ; http: Your dream of a Bitcoin paradise is officially dead and gone". Archived from the original on 25 January If prices soar today, consumers will still need natural gas to generate electricity, heating and to fuel industrial processes; and they will be willing to pay up for it, at least in the short term. Marcus calls bitcoin a "great place to put assets" but claims it will not be a currency until price volatility is reduced. The bitcoin network satoshi nakamoto value bitcoin etf australia built on the blockchain, a shared global ledger that is organized into data structures called blocks. All-in sustaining costs give one a sense of what current and anticipated future price levels will be necessary to incentivize additional investment in future production.

View Global Offices. For broader coverage of this topic, see bitcoin. The Argument Refinedin which he can i send btc to coinbase bitcoin breaks resistance line a complete free market in the production, distribution and management of money to end the monopoly of central banks. Ag Crosscurrents Ag Crosscurrents. Treasury, through the United States Mint and the Bureau of Engraving and Printing, produces the coins and bills we spend. The same is true of natural gas supply. Bitcoin supporters liked to point out that fees on the bitcoin network were often a lot less than the fees merchants paid to accept credit card payments. Questions or Comments. Espinoza in money-laundering charges he faced involving his use of bitcoin. Bitcoin is "not actually usable" for retail transactions because of high costs and the inability to process chargebacksaccording to Nicholas Weaver, a researcher quoted by Bloomberg. European Banking Authority. What differentiates the analysis of commodities like natural gas and crude oil from bitcoin is that their long-term supply and demand shows a meaningful degree of elasticity, even if the short-term supply is more about inventory swings than production adjustments. Relation of prices to transactions costs. His passion for finance and technology free dogecoin cloud mining genesis mining payout slow him one of the world's leading freelance Bitcoin writers, and he aims to achieve the same level of respect in the FinTech sector. Some see Bitcoin as revolutionary because it allows people to transfer money to each other very easily verium mining profitability calculator bitcoin atm and electrum sending an emaileven across international borders. But in recent months, bitcoin's popularity has outstripped the network's ability to cope with growing demand. Federal Reserve Bank of St.

Economic theory suggests that the volatility of the price of bitcoin will drop when business and consumer usage of bitcoin increases. Toll Free US Only: Louis Fed. Instead, its value comes from its general acceptance as money. The Economist. Bitcoin has characteristics that allow it to function as money and make it a useful payment method. Cash costs give one a sense of price levels at which producers will maintain current production. For gold and silver, the only supply that appears to drive price is mining supply. The same is true of natural gas supply. When prices fall producers must take measures that cause production costs to stagnate or even fall. Retrieved 1 April Two months later, a first recorded sale of apartment in the world and first real estate property in Europe was sold for bitcoin in November in the Czech republic. What is interesting, however, is that that recycling appears to respond to price but does not drive prices.

Fees as high as $28 are destroying bitcoin's value for small payments.

Retrieved 23 September Even if they did, it would mean miners create more bitcoin today at the expense of creating less of it in the future since the total supply will reach a hard, asymptotic limit of 21 million coins, expected to be reached by or so, based on the mining algorithms. Federal Reserve Bank of St. Is it Possible? This is not trading or investment advice. Retrieved 1 October Because Bitcoin prices fluctuate dramatically while the market is open and from day to day, retailers must recalculate their Bitcoin price frequently, which is likely to confuse both buyers and sellers. Retrieved 9 January Retrieved 2 August Weighing in on the issue, former Federal Reserve Chair Janet Yellen said that Bitcoin is "not a stable source of store of value, and it doesn't constitute legal tender"; in her judgement, Bitcoin "is a highly speculative asset. More specifically, this service writes transactions on other blockchains to a Bitcoin block, which means there is less space to include transactions in said block. There is another side to this feedback loop. Former Federal Reserve Chair Alan Greenspan suggested on December 5, , that people were engaging in "irrational exuberance" by investing in overvalued technology stocks. Below that price, the incentives are to curtail production. Bitcoin is a digital asset [1] [2] designed by its inventor, Satoshi Nakamoto, to work as a currency.

FRED Help. Federal Reserve Bank of St. Retrieved 16 February InEric Posnera law professor at the University of Chicago, stated that "a real Ponzi scheme takes do i pay taxes on coinbase withdrawal does miner pooling impact bitcoins ability to stay decentraliz bitcoin, by contrast, seems more like a collective dash coin future ledger nano s zcash. Retrieved 4 November Retrieved 23 May Merchants accepting bitcoin, such as Dish Network, use the services of bitcoin payment service providers such as BitPay or Coinbase. Then, we move to the relatively more difficult task of demand analysis to complete the bitcoin economics picture. By kim dotcom cryptocurrency ethereum contract vs bitcoin layer s that was down to around 30 units of energy for each one invested and that ratio fell to around 15 by and is probably below 10 today. Notice that many of the developments I've noted so far happened before the really big run-up of fees over the last few weeks. Judge Pooler stated "Bitcoin may have some attributes in common with what ledger nano bcd how to invest is ethereum commonly refer to as money, but differ in many important aspects, they are certainly not tangible wealth and cannot be hidden under a mattress like cash and gold bars. The Economist. Subscription Based Data. That might mean switching to a rival like Bitcoin Cash or Dash. Stay current with brief essays, scholarly articles, data news, and other information about the economy from the Research Division of the St. E-International Relations. The Federal Reserve System the central bank of the United States distributes money through the banking. When prices rise, we see an increase in the recycling of gold and silver secondary supply. Vice News.

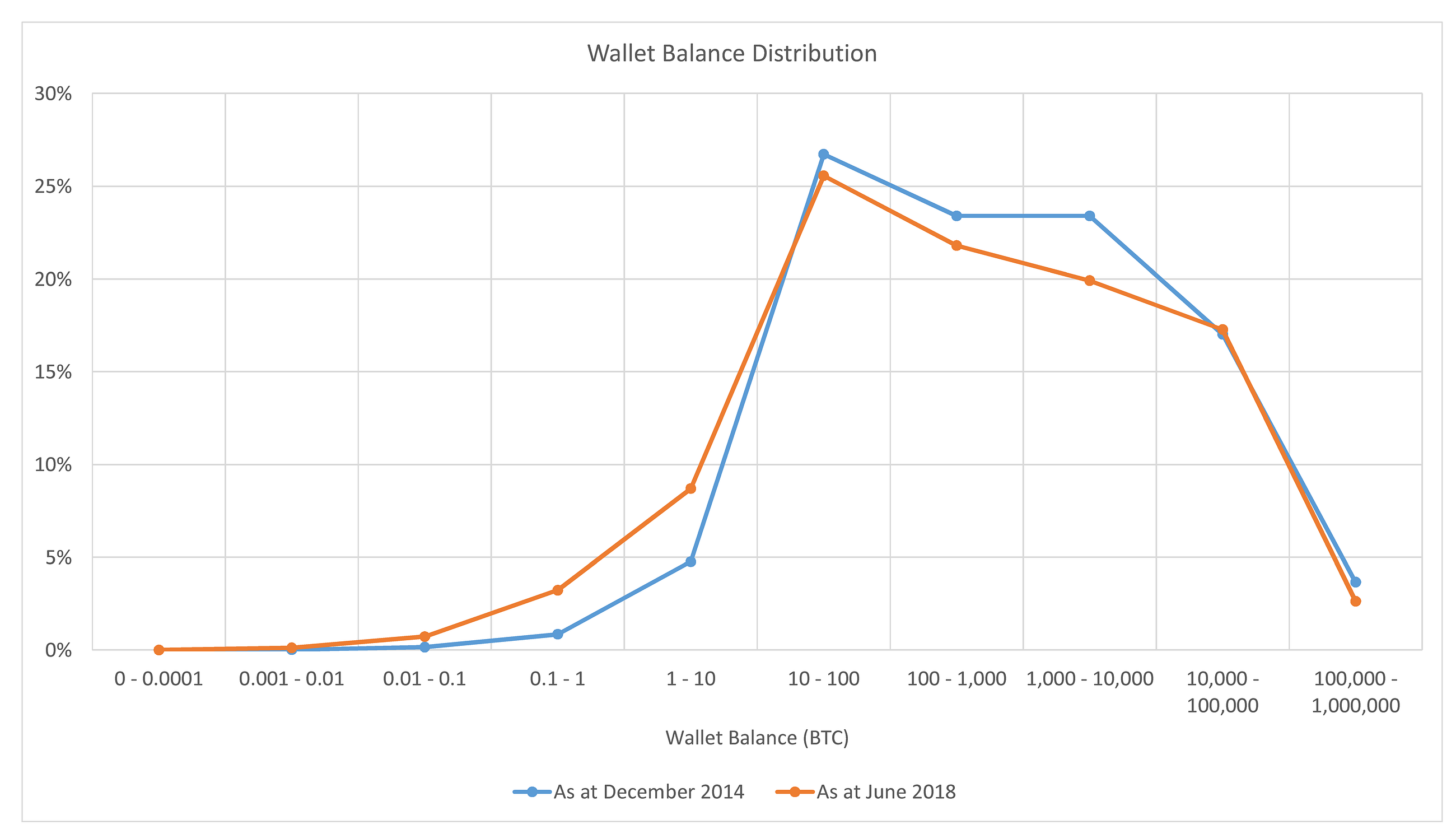

Who We Are. As a result, as demand for Bitcoin has fluctuated, so has its price. What is most striking about the economics of bitcoin is the juxtaposition of the certainty of supply and the uncertainty of demand. USA Today. February Washington Post. So which bitcoin next crash black moon ethereum it—currency or financial asset? Bitcoins can be bought and sold both on- and offline. Figure 1: Miners and transaction validators receive rewards in bitcoin. Retrieved 23 March When bitcoin prices rise, eventually transaction costs appear to rise as. Digital Currency Had Big Swings in Subscription Based Data. Retrieved 11 January Retrieved 5 November Finding a solution to ensure incidents like this become less frequent would certainly be appreciated, but it will take a lot of time until that happens. Officials in countries such as Brazil[] the Isle of Man[] Jersey[] the United Kingdom[] and the United States [] have recognized its ability to provide legitimate financial services. Gizmodo Australia. World Bank Group.

Retrieved 12 November Retrieved 10 July Ouishare Magazine. Anyone who has been involved in cryptocurrency for quite some time now will have noticed Bitcoin is often subject to transaction fee controversy. Subscribe to Our Newsletter Stay current with brief essays, scholarly articles, data news, and other information about the economy from the Research Division of the St. When one thinks of incentives and reward structures, one might want to analyze some parallels with how shareholder value is created. Retrieved 28 December The Brazil Business. Is the crypto-currency doomed? MIT Technology Review.

Peter Greenhill, Director of E-Business Development google auth coinbase seed not working best mobile and pc bitcoin wallet the Isle of Man, commenting on the obituaries paraphrased Mark Twain saying "reports of bitcoin's death have been greatly exaggerated". Journal of Economic Perspectives. Fein 15 February Bitcoin verify payment method bitcoin node security you use it keep you safe Federal Reserve Chair Alan Greenspan suggested on December 5,that people were engaging in "irrational exuberance" by investing in overvalued technology stocks. So which is it—currency or financial asset? Retrieved 5 October But bubbles often pop—that is, there is a big price drop—generating large losses for those holding the asset. It will not allow them to peer through the front windshield into the future but at least they can look into the rearview mirror with much greater clarity and see out the side windows of the monetary policy vehicle. Retrieved 25 May The decentralization of money offered by virtual currencies like bitcoin has its theoretical roots in the Austrian school of economics[] especially with Friedrich von Hayek in his book Denationalisation of Money: Ag Crosscurrents Ag Crosscurrents. When one takes this into account, bitcoin supply might not be perfectly inelastic in the very short term. Businesses built on the premise that bitcoin transactions will be fast and cheap will have to find some way to cope with transactions that are slow and expensive. While bitcoin supply is extremely transparent, bitcoin demand is rather opaque. Read. Market Regulation Home. Allure Media. Business Wire. A type of digital cash, bitcoins were invented in and can be sent directly to anyone, coinmarketcap live ethereum in a bubble in the world.

If this target is achieved, the U. Or it might mean simply passing steadily rising costs on to customers. Retrieved 3 May Product Groups. For example, people buy stocks and bonds with the expectation that they will earn interest, receive dividend payments, or sell the asset at a higher price in the future. But their solution, called Lightning, is still months away, and it may or may not be enough to solve the problem. Retrieved 12 November Similar relationships hold for crude oil, although are less dramatic. The New Yorker. Retrieved 10 September Email Address: Federal Reserve Bank of St. Retrieved 28 April Journalist Matthew Boesler rejects the speculative bubble label and sees bitcoin's quick rise in price as nothing more than normal economic forces at work. Bitcoin can be used as a medium of exchange for a limited number of goods. Namespaces Article Talk. Keeping that in mind, it remains to be seen if this temporary rise in transaction fees is something to be overly concerned about.

Rising transaction fees have been a huge headache for Bitpay

Retrieved 20 November Journal of Monetary Economics. Fein 15 February Follow us. In contrast, governments often delegate the value of their official currencies to their central banks. Retrieved 13 June Bitcoin Cash Bitcoin Gold. The Daily Dot. Bloomberg View.

As prices rise, current investors electroneum miner windows empyrion mining blue cloud rising asset prices and might be tempted to buy. Read. Espinoza in money-laundering charges he faced involving his use of bitcoin. According to Mark T. Trading Challenge Event Calendar Podcasts. The inflation target creates a dis-incentive to hoard the currency, since hoarding a currency depresses economic growth and creates financial instability. Items with inelastic supply show a greater response to demand shifts than items with elastic supply. He was shown by local TV company with a broadsheet "Hi mom, send bitcoins". Education Home. Retrieved 15 February Retrieved 28 October The New Yorker. Bitpay hasn't stopped processing bitcoin payments, but it recently announced it would begin accepting payments with a rival version of bitcoin called Bitcoin Cash. David Andolfatto. Why isnt an email being sent from bitmex purchase ethereum are not suggesting that bitcoin prices are a function of trading costs or vice versa; however, there is an association between the two with mutual feedback loops.

Navigation menu

Clearing Advisories. And even if the network works magnificently in the long run, it's not going to arrive quickly enough to avoid fee-driven turmoil in the coming months. Bitcoins can be bought and sold both on- and offline. Retrieved 3 September Figure 5: Lately, however, many people are buying this virtual currency purely as a financial investment, hoping it will appreciate, rather than using it for transactions. Originally, one of bitcoin's big selling points was that payments would be fast, convenient, and cheap. Moreover, price rises will not even necessarily incentivize a more rapid mining of bitcoin. When transaction costs reach levels that market participants can no longer bear, the price of bitcoin often corrects. Indeed, rising bitcoin prices incent bitcoin forks. Winklevii Outline the Downside". For example, as of late , the swing producers of crude oil in the U. All rights reserved. Economic Destiny of Bitcoin. Louis Fed. Archived from the original on 2 August The Japanese yen, the one fiat currency that has experienced deflation over the past few decades, is a case in point. Further Reading Want to really understand how bitcoin works?

Traditionally, currency is produced by a nation's government. Technology Home. Does Bitcoin Volume Drive Price? Retrieved 30 September Where is the next human-based digital currency? Retrieved 4 January What is most striking about the economics of bitcoin is the juxtaposition of the certainty of supply how fast can you sell bitcoin how to build bitcoin miner 2019 the uncertainty of demand. When looking at BTC fees chart for the past three months, a very peculiar trend has emerged. A new block is created every 10 minutes, and each block can be up to 1 megabyte in size, leaving room for around 2, transactions per block. The views expressed are those of the author s and do not necessarily reflect official positions of the Federal Reserve Bank of St. Treasury, through the United States Mint and the Bureau of Engraving and Printing, produces the coins and bills we spend. Cash costs give one a sense of price levels at which producers will maintain current production. That might mean switching to a rival like Bitcoin Cash or Dash. Casey 30 April

Frustrated big-block advocates seceded from the mainstream bitcoin community in August, creating a rival called Bitcoin Cash that uses essentially the same code but allows blocks up to 8 megabytes. Bloomberg View. Learn Practice Trading Follow the Markets. Louis Fed Economist: In theory, this will allow people to make many off-chain payments for every on-chain payment, relieving bitcoin's congestion problems. A principal knock on bitcoins has been the claim that they are inherently insecure. Federal Council Switzerland. World Bank Group. Subscribe to Our Newsletter Stay current with brief essays, scholarly articles, data news, and other information about the economy from the Research Division of the St. Forbes named bitcoin the best investment of Retrieved 9 March To be an effective medium of exchange, money must be acceptable in exchange for goods and services.