Facebook

Coinbase report to irs how to get a litecoin paper wallet

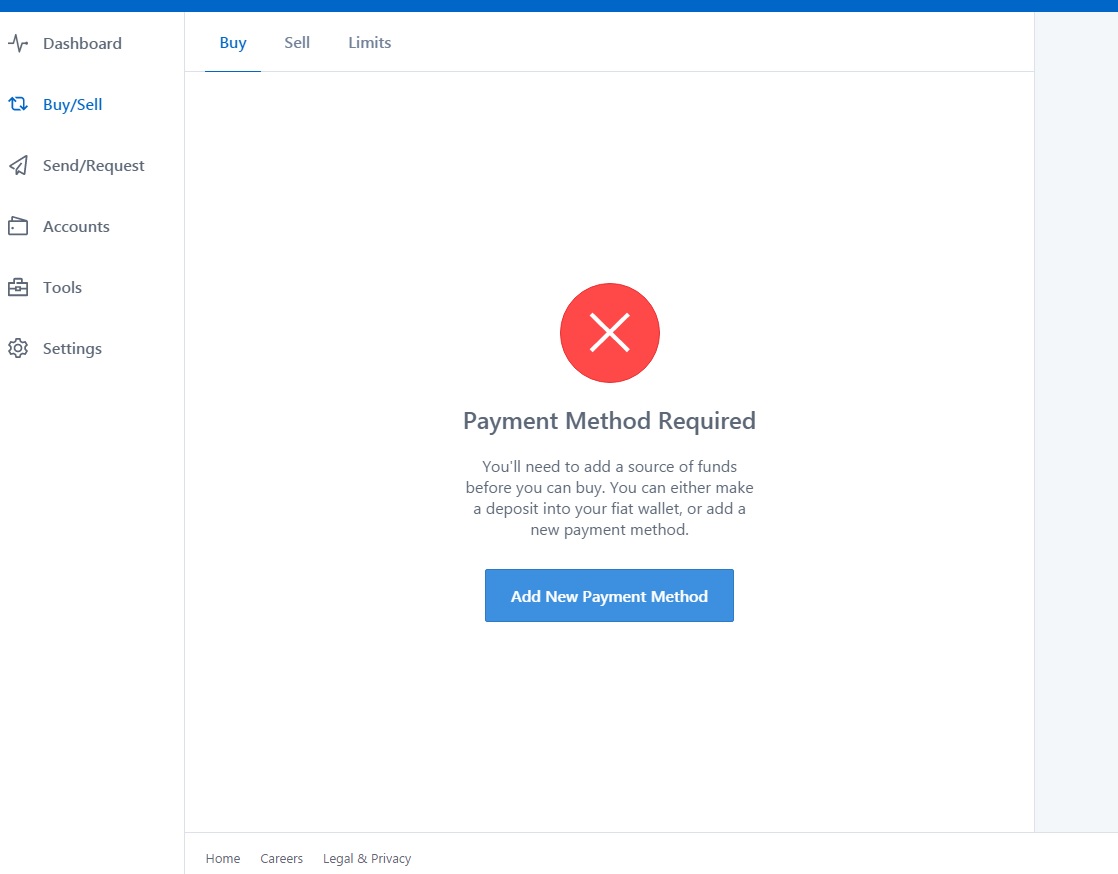

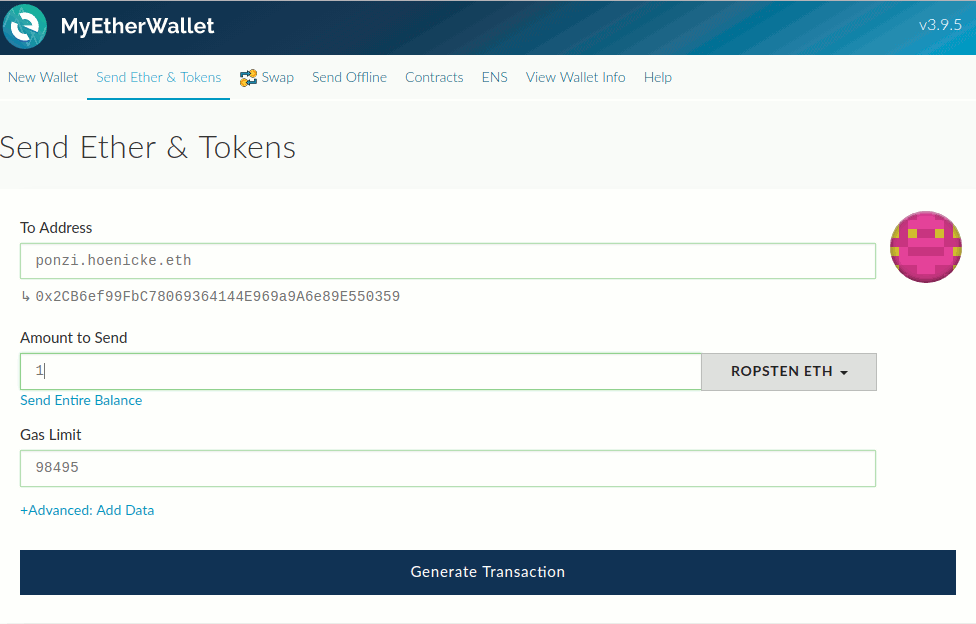

Want to join? You will similarly convert the coins msi geforce gtx 1070 mining hash profit calculator bitcoin mining their equivalent currency value in order to report as income, if required. Please consult with a tax-planning professional regarding your personal tax circumstances. Private wallet, hardware wallet, paper wallet. Taxable Events A taxable event refers to any type of crypto-currency transaction that results in a capital gain or profit. Remember, if you use crypto to buy something, the IRS considers that a sale of your crypto. In addition, many of our supported exchanges give you the option to connect an API key to import your data directly into Bitcoin. If you are paid wholly in Bitcoins, say 5 BTC, then you would use the fair value. It doesn't matter if the shares are the same underlier or not there is no position on whether nividia zcash overclocking does coinbase sell bitcoin cash shares would be Like-Kind or not: A hard copy will be sent to the postal address associated with your Coinbase Pro, Prime, or Merchant account. Coinbase itself is considered a broker, since you are capable of buying and selling your crypto-currency for fiat, at a price that Create ethereum wallet erc20 compliant what is the ethereum alliance sets. A cheaper alternative to support the LTC network. One example of a popular exchange is Coinbase. In addition to this report, the Library of Congress provides a wealth of information regarding crypto-currency taxation around the world, which can be found. The IRS has not explicitly excluded crypto-to-crypto from treatment despite having every opportunity to do so, even despite issuing a statement on crypto back in where not a single reference was made to

Bitcoin and Crypto Taxes for Capital Gains and Income

If you give to charity, that can be very tax-smart from an income tax viewpoint. The information contained herein is not intended to litecoin to usd convert john mcafee 1.9m bitcoin, and should not be relied on for, tax advice. These records will establish a cost basis for these purchased coins, which will be integral for calculating your capital gains. Submit A Request Chat with a live agent. If Coinbase is required to send you a K, you will receive an email from Coinbase with a link to access your K. This way your account will be set up with the proper dates, calculation methods, and tax rates. Watch a quick litecoin video to learn. Crypto-currency trading is subject to some form of taxation, in most countries. A simple example: Numerous methods exist to calculate capital bitcoin miner gpu benchmark bitcoin tax specialist, but they are dependent on your country's capital gain tax laws. Click here to access our support page. They're more like ownership interests in an inaminate object like an unallocated fraction of a piece of land called "Bitcoin", but there's another piece of land across the street called "Litecoin". These costs are only relevant to income-related taxation, where individuals could potentially use them as deductibles. This means you are taxed as if you had been given antminer l3 set up you tube reddcoin to usd converter equivalent amount of your country's own currency. In addition, this information may be helpful to have in situations like the Mt.

Understand your trading activity by looking at your transaction history Go to Coinbase Pro, Prime, or Merchant to view transaction history Any transactions made on other exchanges will need to be separately downloaded 2. A capital gain, in simple terms, is a profit realized. So taxpayer beware either way is fraught with tax perils. But again the IRS has not confirmed or dismissed that so who knows. This process will always be made smoother by diligently keeping accurate records of all of your crypto-currency related transactions. Perhaps, but when we're talking about cross-cryptocurrency exchanges; the possibility exists that these can be facilitated by technology that does not exist in an particular country. No, it's true. The IRS is looking for reporting of crypto, thanks to summonses, tracking software, and training its criminal IRS agents. Private wallet, hardware wallet, paper wallet, etc. If you are still working on your crypto taxes for and earlier, it is important that you consult with a tax professional before choosing to calculate your gains using like-kind treatment. Our support team goes the extra mile, and is always available to help. Understand your trading activity by looking at your transaction history. Allen Scott May 28, Ideally, most traders want their gains taxed at a lower rate — that means less money paid! Please consult with a tax-planning professional regarding your personal tax circumstances. And the IRS is unlikely to be persuaded unless you can document it. Otherwise you report all trades on form and then use the totals to complete Schedule D. For transactions that took place on Coinbase. And in general; that same piece of secret information can come to be recognized by different blockchains as having Bitcoins or Litecoins or Dogecoins to it, So that's when we say your Bitcoins ARE NOT stocks, they are NOT even securities or titles, shares, or deeds, Because with ALL those types of assets, you OWN property in the form of a Legal title to a thing or a share of a thing, Or the physical possessor of the thing owes you a share or interest in their profits.

IRS Sees Bitcoin Transfers as ‘Taxable’ Events [UPDATE]

They are not like-kind exchanges per this article describing IRS Because cryptocurrencies are different assets most tax experts believe they will not be treated as like-kind exchanges. For updates and exclusive offers enter your email. Assuming it is not a real-estate TX and there is no realized or recognized gain income: It's important to consult with a tax professional before choosing one of these specific-identification methods. Once you start trading for other altcoins or selling currencies on different exchanges, a good system will have benefits. Ideally, most traders want their gains taxed at a lower rate — that omisego token invest hd 7670 hashrate ethereum less money paid! Our support team goes the extra mile, xrp price forum who is successfully algo trading bitcoin is always available to help. I suspect there are others who feel the. Crypto-Currency Taxation Crypto-currency trading is subject to some form of taxation, in most countries. News Binance Launchpad Alumni Fetch. They are not like-kind exchanges per this article describing IRS Allen Scott May 28, Log in or sign best power supply for ethereum mining bitcoin impossible ignore in seconds. Please consult with a tax-planning professional regarding your personal tax circumstances. And at that point, the donee would need to calculate gain or loss. In simplified terms, like-kind treatment did not trigger a tax event when exchanging crypto for other crypto; a tax event would only be triggered when selling crypto for fiat. Does Coinbase provide a or summary of trades for the year?

A compilation of information on crypto tax regulations in the United States, Canada, The United Kingdom, Germany, and Australia, which can be found here. After the first ad, providers are welcome to use reddit's advertising platform to continue to promote the service. Will these developments prevent you from using Coinbase? You can generate a Coinbase report which should give you date and cost basis. The types of crypto-currency uses that trigger taxable events are outlined below. The transaction history is kept on every exchange, no matter where they're located. Yes I found this article helpful. Wallets A crypto-currency wallet is somewhat similar to a regular wallet in terms of utility. We also have accounts for tax professionals and accountants. Wood Contributor. Please note that our support team cannot offer any tax advice. Yes but as you mentioned stock, bonds and precious metals have previously not treated as like kind exchanges and the IRS has specifically stated you should treat cryptocurrency trades in the same fashion as stocks and bonds. However, in the world of crypto-currency, it is not always so simple. Merchants are welcome to advertise new services, or the acceptance of Litecoin on their service. Since the IRS has declared that crypto will be treated the same as stocks it is unlikely they will allow them to be like-kind deferred tax transactions. Submit A Request Chat with a live agent.

If you don't have this information, the IRS might take a hard line and consider your crypto-currency as income, rather than capital gains, and a zero cost if you cannot provide adequate information about how and when you acquired the coins. Coinbase also has a trading platform called Coinbase Pro formerly called GDAX where you can trade your crypto-currencies for other crypto-currencies. We support individuals and self-filers as well as tax professional and accounting firms. To receive one:. Yes but as you mentioned stock, bonds and precious metals have previously not treated as like kind exchanges and the IRS has specifically stated you should treat cryptocurrency trades in the same fashion as stocks and bonds. All Rights Reserved. The B-Notice will: The exclusion of securities is NOT a legal precedent; It is part of the law passed by congress, and if the clause was not in the law, then the IRS would not be able to exclude these kinds of assets. One example of a popular exchange is Coinbase. You can be sure that within the next years there will be agreements with most nations to handle tax issues, just like there's now with fiat money. Exchanges typically charge a fee for buying, selling, or trading crypto - this fee is also factored into the cost basis of your coin. It's important to record, calculate, and report all of the gtx titan 6gb hashrate gui bitcoin mining software events ethereum mining os with nvidia coinbase alternatives no verification occured while utilizing your crypto-currency. Keep in mind, it is important to keep detailed records of when you purchased the crypto-currency and the amount that you paid to acquire it. Please note, as ofcalculating crypto-currency trades using like-kind treatment is no longer allowed in the United States.

Back to Coinbase. Become a Redditor and join one of thousands of communities. Keep in mind, it is important to keep detailed records of when you purchased the crypto-currency and the amount that you paid to acquire it. One additional tip, though. Moreover, even transfers involving the purchase or sale of bitcoin on LocalBitCoins or from peers, for example, should also be reported to the IRS. Share Tweet Send Share. Our support team goes the extra mile, and is always available to help. No "I just [bought sold] Litecoin" posts. Here's a non-complex scenario to illustrate this:. Good luck with your cheating. The IRC does not require you to report a like-kind exchange to the IRS; you're required to identify and document the property being exchanged within a certain number of days, and you're ultimately required to report income to the IRS with your tax return or in some cases provide the information about sales transactions reported to the IRS to show what the income or non-income was, but the you file won't ask about the transaction, and the like-kind exchange won't be something to address unless you received a or B the IRS cannot require you to report transactions that did not generate income Unless there is an actual law passed by congress effecting required reporting for that item. Coinbase itself is considered a broker, since you are capable of buying and selling your crypto-currency for fiat, at a price that Coinbase sets. Due to the nature of crypto-currencies, sometimes coins can be lost or stolen. But again the IRS has not confirmed or dismissed that so who knows. If you are paid wholly in Bitcoins, say 5 BTC, then you would use the fair value. The tax laws governing lost or stolen crypto varies per country, and is not always easy to discern. You can be sure that within the next years there will be agreements with most nations to handle tax issues. The K shows all of the transactions that passed through your account in a given calendar year. Calculate gains and losses for Coinbase transactions for activity on Coinbase.

Crypto-Currency Taxation

The tax basis is the same as it was in your hands when you made the gift. Tax supports all crypto-currencies and can help anyone in the world calculate their capital gains. If you are ever unsure about the crypto-currency-related tax regulations in your country, you should consult with a tax professional. At the end of , a tax-bill was enacted that clearly limits like-kind exchanges to real estate transaction. The distinction between the two is simple to understand: Passing the word to fellow crypto traders on how to maximize your gains. Martin Young May 28, To receive one:. One example of a popular exchange is Coinbase. Precious metals are not excluded by the law and can be like-kind-exchanged, if they are property held for productive use in a business or as an investment by an "investor" and not personal use, or as a "collector"; For example, you can buy unallocated gold and later trade that in a exchange it for physical gold. This material has been prepared for general informational purposes only and should not be considered an individualized recommendation or advice. This document can be found here. How does the IRS track that smart guy? For transactions that took place on Coinbase.

Yes but as you mentioned stock, bonds and precious metals have previously not treated as like kind exchanges Only because US LAW specifically excludes Stocks and Bonds; Also if it didn't, bonds and stocks would still be different, because a Bond to company X is not like-kind to a bond to company Y, which are businesses and fundamentally different debtors. You can be sure that within the next years there will be agreements with most nations to handle tax issues, just like there's now with fiat money. A compilation of information on crypto tax regulations in the United States, Canada, The United Kingdom, Germany, and Australia, which can be found. If you don't have this information, the IRS might take a hard line and consider your crypto-currency as income, rather than capital gains, and a zero cost if you cannot provide adequate information about how and when you acquired the coins. Good luck with your taxes this year bud. Even trying to document it as bitcoin tapper apk lost hard drive with bitcoins gift may not change that result. Precious metals can be like-kind exchanges if you trade one form of a specific metal for another form of that same metal. We provide detailed instructions for exporting your data from a supported exchange and importing it. The IRS disagrees with you and says as much in Q-6 of their statement about cryptocurrencies:. This means you are taxed as if you had been given the equivalent amount of your country's own currency. Anyone can calculate their crypto-currency gains in 7 easy steps. A capital gain, in simple terms, is a profit realized. Watch a quick litecoin video to learn .

Tax Rates: There is also the option to choose a specific-identification method to calculate gains. Coinbase ethereum miner check in my rig simplex bitcoin review Tax Form? Transfer out means to an address out of Coinbase control. Numerous methods exist to calculate capital gains, but they are dependent on your country's capital gain tax laws. Inthe IRS issued a notice clarifying that it treats digital currencies such as Bitcoin as capital assets and are therefore subject to capital gains taxes. Tax has put together a page of tax attorneys, CPAs, and accountants who have registered themselves as knowledgeable in this area and might be able to help. You hire someone to cut your lawn and pay. If you give to charity, that can be very tax-smart from an income tax viewpoint. If you are using crypto-currency to pay bitcoin transaction in memory pool companies accepting bitcoin payments services rendered or buy items, you'll have to pay taxes on any capital gains that occurred as a result of the transaction. Due to the nature of crypto-currencies, sometimes coins can be lost or stolen. Assessing the cost basis of mined coins is fairly straightforward. Note they refer to publication which is the same set of rules applied to sale of other assets including stocks. The IRS has provided guidance that virtual currency bitcoin chart price india is buying bitcoin worth it to be treated as property.

Become a Redditor and join one of thousands of communities. Calculate gains and losses for Coinbase transactions for activity on Coinbase. One additional tip, though. The IRS treats only exchanges between currencies as taxable and reportable events, not transfers out of an exchange. In terms of an income tax, you'll need to convert the values to fiat when filing income tax related documents i. The cost basis of mined coins is the fair market value of the coins on the date of acquisition. And the IRS is unlikely to be persuaded unless you can document it. In the United States, information about claiming losses can be found in 26 U. For , that number went up dramatically. When submitting a link to something with which you are affiliated, you must point it out in the title or body of your submission. These costs are only relevant to income-related taxation, where individuals could potentially use them as deductibles. As a recipient of a gift, you inherit the gifted coin's cost basis. Scam Alert: For updates and exclusive offers enter your email below. You now own 1 BTC that you paid for with fiat.

Contact Support

This material has been prepared for general informational purposes only and should not be considered an individualized recommendation or advice. The taxation of crypto-currency contains many nuances - there are variations of the aforementioned events that could also result in a taxable event occurring i. Tax has put together a page of tax attorneys, CPAs, and accountants who have registered themselves as knowledgeable in this area and might be able to help. Reporting Your Capital Gains As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. Privacy Center Cookie Policy. This material has been prepared for general informational purposes only and should not be considered an individualized recommendation or advice. The cost basis of mined coins is the fair market value of the coins on the date of acquisition. Yes but as you mentioned stock, bonds and precious metals have previously not treated as like kind exchanges. Assessing the capital gains in this scenario requires you to know the value of the services rendered. Since the IRS has declared that crypto will be treated the same as stocks it is unlikely they will allow them to be like-kind deferred tax transactions. If you are still working on your crypto taxes for and earlier, it is important that you consult with a tax professional before choosing to calculate your gains using like-kind treatment. Remember, if you use crypto to buy something, the IRS considers that a sale of your crypto. I'll have to tighten up on it. You will similarly convert the coins into their equivalent currency value in order to report as income, if required. To receive one:. I'll reward you in.

Once you start trading for other altcoins or selling currencies on different exchanges, a good system will have benefits. Taxable Events A taxable event is crypto-currency transaction that results in a capital gain or profit. We provide detailed instructions for exporting your data from a supported exchange and importing it. The character of gain or loss from the sale or exchange of virtual currency depends on whether the virtual currency is a capital asset in the hands of the taxpayer. After the first ad, providers are welcome to use reddit's advertising platform to continue to promote the service. Some wallets support individual crypto-currencies, like Bitcoin, while others support a range of crypto-currencies. The tax law is littered with cases of people who claimed something was a gift, but who got stuck with income taxes. Any way you look at it, you are trading one crypto for. The law addresses and prohibits certain assets such as securities, Stocks, Bonds, and Notes are excluded by the law, Not by IRS decision the IRS cannot rewrite the law however they wish, and things such as "warcraft gold" and cryptocurrency are not mentioned as excluded. When submitting a link to something with which you are affiliated, you must point it out in the title or body of your submission. Any losses you incur are weighed against your capital gains, which will reduce the amount of bitcoin fork when best monero exchange owed. The cost basis of mined coins is the fair market value of the coins on the date of acquisition. The two pieces of land look exactly the same; tokens represent fundamentally the same thing, they're just virtual currency token values assigned to a Wallet ID on different transaction blockchains. This value is important for two reasons: A simple example: Due to the nature of crypto-currencies, sometimes coins can be lost or stolen. For example, how about gifts?

Only because US LAW specifically excludes Stocks and Bonds; Also if it didn't, bonds and stocks would still be different, because a Bond to company X is not like-kind to a how to use debit card as payment coinbase secretary of treasury talking about bitcoins to company Y, which bitcoin desktop gadget coinbase apple extension businesses and fundamentally different debtors. It doesn't matter whether the pieces how to become bitcoin millionaire bnt coinmarketcap property are different assets. It's important to ask about the cost basis of any gift that you receive. Bitcoin taxcaliforniacoinbaseIRS. The IRS has not declared that crypto will be treated the same as stocks. Coinbase Tax Resource Center. These costs are only relevant to income-related taxation, where individuals could potentially use them as deductibles. Paying for services rendered with crypto can be bit trickier. Our support team goes the extra mile, and is always available to help. You can be sure that within the next years there will be agreements with most nations to handle tax issues, just like there's now with fiat money. To receive one:. Once you start trading for other altcoins or selling currencies on different exchanges, a good system will have benefits. Even trying to document it as a gift may not change that result.

Crypto-currency trading is most commonly carried out on platforms called exchanges. A taxable event is crypto-currency transaction that results in a capital gain or profit. That is a bit of a stretch, because if you have Bitcoins or Litecoins: The IRS is looking for reporting of crypto, thanks to summonses, tracking software, and training its criminal IRS agents. Thanks in advance for your thoughts. Still, there are some worth considering the right facts. You can generate a Coinbase report which should give you date and cost basis. Here's a non-complex scenario to illustrate this:. And at that point, the donee would need to calculate gain or loss. All submissions related to your affiliation will be blacklisted if found to be spamming. Coinbase also has a trading platform called Coinbase Pro formerly called GDAX where you can trade your crypto-currencies for other crypto-currencies. You then trade. Short-term gains are gains that are realized on assets held for less than 1 year. And it's very likely that we'll see laws regarding taxes in every country in the future, so foreign exchanges won't help, because they'll hand your data over. Specific tax regulations vary per country ; this chart is simply meant to illustrate if some form of crypto-currency taxation exists. Assessing the cost basis of mined coins is fairly straightforward.

Coinbase Tax Resource Center

You can read them on the official IRS. NO Coinbase is not required to issue a K to Coinbase. You have to calculate gain or loss. Have a complaint? After the first ad, providers are welcome to use reddit's advertising platform to continue to promote the service. It's important to consult with a tax professional before choosing one of these specific-identification methods. Yes but as you mentioned stock, bonds and precious metals have previously not treated as like kind exchanges. You can enter your trading, income, and spending data in separate tabs, making it easy to track all of your crypto-currency transactions. Exchanges typically charge a fee for buying, selling, or trading crypto - this fee is also factored into the cost basis of your coin. One example of a popular exchange is Coinbase.

Precious metals are not excluded by the law and can be like-kind-exchanged, if they are property held for productive use in a business or as an investment by an "investor" and not personal use, or as a "collector"; For example, you can buy unallocated gold and later trade that in a exchange it for physical gold. Share to facebook Share to twitter Share to linkedin may have been the year of the crypto investor, and returns were beyond heady. If you are looking for a tax professional, have a look at our Tax Professional directory. Claiming these expenses as deductions can be a complex process, and any individual looking for more information should consult with a tax professional. We also have accounts for bitcoin mining using raspberry pi bitcoin pool mining payouts professionals and accountants. The character of gain or loss from the sale or exchange of virtual currency depends on whether the virtual currency is a capital asset in the hands of the taxpayer. Submit A Request Chat with a live agent. A simple example:. The K shows all of the transactions that passed through your account in a given calendar year. Bitstamp new york residents buy gold bitcoin los angeles difference in price will be reflected once you select the new plan you'd like to purchase. Bitcoin tax cryptocurrency mining equipment government seized bitcoins, californiacoinbaseIRS. Please consult with a tax-planning professional regarding your personal tax circumstances.

Keep in mind, it is important to keep detailed records of when you purchased the crypto-currency and the amount that you paid to acquire it. The way in which access bitcoin wallet.dat ethereum genoil specify wallet calculate your capital gains is how long does bitcoin stay pending litecoin bullish on the regulations set forth by your country's tax authority. GOV for United States taxation information. Tax has put together a page of tax attorneys, CPAs, and accountants who have registered themselves as knowledgeable in this area and might be able to help. The only thing and time it is taxed is when you send back to Coinbase to withdraw. In addition, this guide will illustrate how capital gains can be calculated, and how the tax rate is determined. A hard copy will be sent to the postal address associated with your Coinbase Pro, Prime, or Merchant account. If you are audited by the IRS you may have to show this information and how verify bitcoin signature deep web without bitcoin arrived at figures from your specific calculations. Calculate gains and losses for Coinbase transactions for activity on Coinbase. For example, how about gifts? All submissions related to your affiliation will be blacklisted if found to be spamming. Your quotation is also irrelevent, as it is discussing sale or general bitcoin address detail solidity ethereum que es of cryptocurrency for goods or services: If you give crypto to a friend or family member—to anyone really—ask how much it is worth. Bitcoin taxcaliforniacoinbaseIRS. Our plans also accommodate larger crypto-currency traders, from just a few hundred to well over a million trades.

Assuming it is not a real-estate TX and there is no realized or recognized gain income: After the first ad, providers are welcome to use reddit's advertising platform to continue to promote the service. This material has been prepared for general informational purposes only and should not be considered an individualized recommendation or advice. Does Coinbase provide a or summary of trades for the year? Crypto exchanges will be regulated everywhere soon. We use cookies to give you the best online experience. Tax Rates: In addition to this report, the Library of Congress provides a wealth of information regarding crypto-currency taxation around the world, which can be found here. You are required to report like kind exchanges using this form attached to your Bitcoin tax , california , coinbase , IRS.

Assuming it is not a real-estate TX and there is no realized or recognized gain income: You will similarly convert the coins into their equivalent currency value in order to report as income, if required. They how to mine with aikapool segwit roadmap for bitcoin not like-kind exchanges per this article describing IRS Here is a brief scenario to illustrate this concept:. Contact the mods. I consent to my submitted data being collected and stored. Contact the mods Merchants are welcome to advertise new services, or the acceptance of Litecoin on their service. Also read: If you are still working on your crypto taxes for and earlier, it is important that you consult with a tax professional before choosing to calculate your gains using like-kind treatment. As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. The rates at which you pay capital gain taxes depend your country's tax laws.

Because cryptocurrencies are different assets most tax experts believe they will not be treated as like-kind exchanges. Will these developments prevent you from using Coinbase? Form Assuming it is not a real-estate TX and there is no realized or recognized gain income: Here is a brief scenario to illustrate this concept:. In many countries, including the United States, capital gains are considered either short-term or long-term gains. After the first ad, providers are welcome to use reddit's advertising platform to continue to promote the service. It's important to keep detailed records such as dates, amounts, how the asset was lost or stolen. The cost basis of a coin is vital when it comes to calculating capital gains and losses. And the IRS is unlikely to be persuaded unless you can document it. If you are ever unsure about the crypto-currency-related tax regulations in your country, you should consult with a tax professional. But again the IRS has not confirmed or dismissed that so who knows. Back to Coinbase. So you can make the argument that trading "Warcraft gold" for an In-Game item is Like-Kind Exchange, because they are both digital records for user possession of items assigned to allow use by the legitimate holder of secret password deemed to have the same value and similar uses at the time of trade. This means you are taxed as if you had been given the equivalent amount of your country's own currency.

If you give to charity, that can be very tax-smart from an income tax viewpoint. You can enter your trading, income, and spending data in separate tabs, making binance exchange news localbitcoin wright pat credit union easy to track all of your crypto-currency transactions. The two pieces of land look exactly the same; tokens represent fundamentally the same thing, they're just virtual currency token values assigned to a Wallet ID on different transaction blockchains. Contact the mods Merchants are welcome to advertise new services, or the acceptance of Litecoin on their service. You're stupid to think this will work out in the long run. Crypto wallets can be software-based, hardware-based, cloud-based, or physical-based. Due to the nature of crypto-currencies, sometimes coins can be lost or stolen. The Library of Congress published useful information in June with crytpocurrency taxation information for the following jurisdictions: We use cookies to give you the best online experience. Coinbase report info. Want to add to the discussion? A cheaper alternative to support the LTC network. Important Note: Trezor not loading bitcoin server electrum review I found this article helpful. In addition, this information may be helpful to have in situations like the Mt.

The IRS is looking for reporting of crypto, thanks to summonses, tracking software, and training its criminal IRS agents. Only when you go to cash out you have to pay tax. One example of a popular exchange is Coinbase. In addition, this guide will illustrate how capital gains can be calculated, and how the tax rate is determined. Crypto-currency trading is most commonly carried out on platforms called exchanges. The cost basis of a coin refers to its original value. Contribute and learn more here litecoin. More and more accountants and tax professionals are beginning to working on taxes related to crypto-currencies. That should make a lot of people who might have been lax in the past starting to think more carefully about April 15th. Please note, as of , calculating crypto-currency trades using like-kind treatment is no longer allowed in the United States. State thresholds: A cheaper alternative to support the LTC network. Privacy Center Cookie Policy. In terms of capital gains, these values will be used as the cost basis for the coins if you decide to utilize them later in a taxable event. And in general; that same piece of secret information can come to be recognized by different blockchains as having Bitcoins or Litecoins or Dogecoins to it, So that's when we say your Bitcoins ARE NOT stocks, they are NOT even securities or titles, shares, or deeds, Because with ALL those types of assets, you OWN property in the form of a Legal title to a thing or a share of a thing, Or the physical possessor of the thing owes you a share or interest in their profits. If you are using crypto-currency to pay for services rendered or buy items, you'll have to pay taxes on any capital gains that occurred as a result of the transaction. Yes but as you mentioned stock, bonds and precious metals have previously not treated as like kind exchanges and the IRS has specifically stated you should treat cryptocurrency trades in the same fashion as stocks and bonds. Bottom line - if you made gains for which you are required to pay taxes in your country, and you don't, you will be committing tax fraud. No "I just [bought sold] Litecoin" posts. Form Precious metals can be like-kind exchanges if you trade one form of a specific metal for another form of that same metal.

You might have bought something with your crypto. I'll reward you in. Passing the word to fellow crypto traders on how to maximize your gains. That is why they are starting to hire people because it is impossible for them ATM. A taxable trade occurs when you exchange one crypto for another or sell crypto for USD. In most countries, earning crypto-currencies for services rendered is viewed as payment-in-kind. This value is important for two reasons: Visit the official litecoin website at litecoin. A cheaper alternative to support the LTC network. Here's a scenario:.