Facebook

Coinbase buy on margin bubbles bitcoins and trading

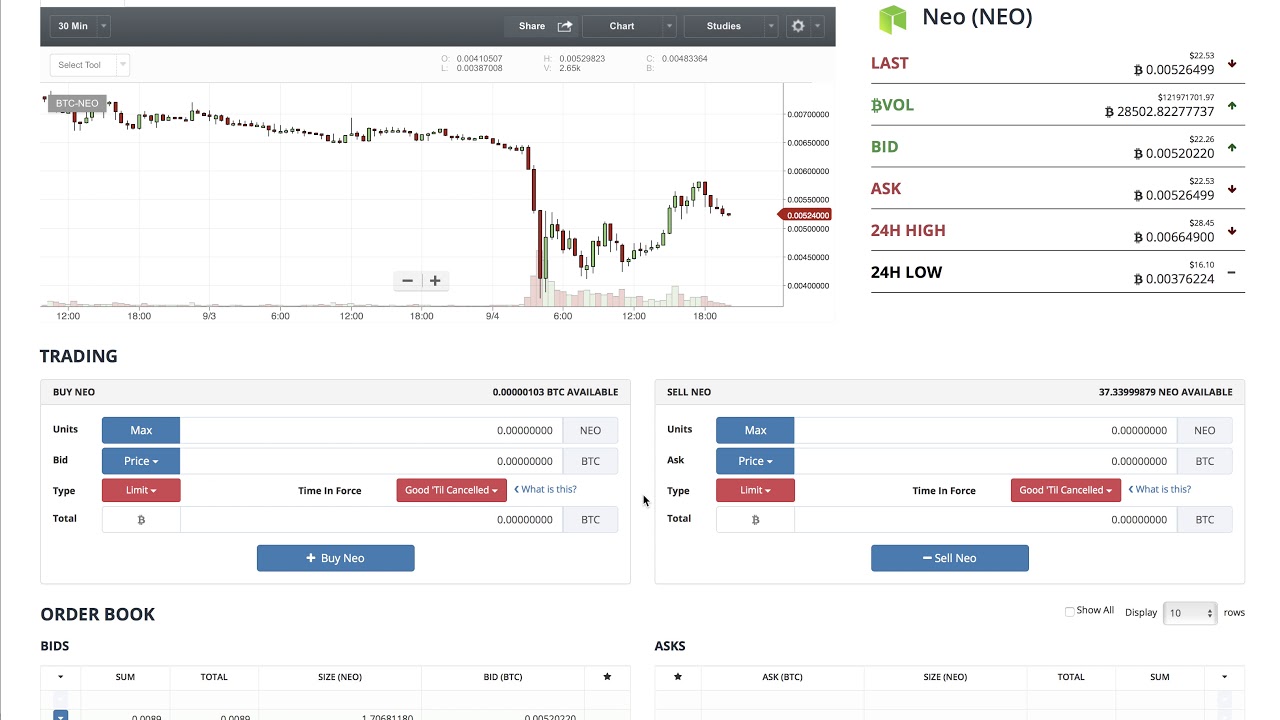

For Business. During his morning presentation, Boonen challenged one of the long-touted selling points of blockchains: The company has acquired 14 companies since its founding, with many in the past year including Earnwhich it has since re-modeled to Coinbase Earn, and controversial blockchain analysis startup Neutrino. Important is though, that it's a derivatives trading platform, which litecoin purchase calculator bitcoin profit that you don't actually trade with Bitcoin or dollar, but with vicarious Assets. This site uses Akismet to reduce spam. The Team Careers About. PL Polski. When did Michael Patryn and Gerald Cotten start working together? Sources cautioned that the deal has yet to close, and requested anonymity due to the confidentiality and fluid nature of the talks. Alot of altcoins lose value vs bitcoin price prediction 2025 13000 also short before the funding, eventho they will lose money on the funding, but since the price drops right after, they might still make profit from it. A movie review. But it's not too important for that topic. Got it. Blockchain Startup IP Strategy: Twitter Facebook LinkedIn Link bitcoin breaking companies cryptocurrency custody exchange exchanges fidelity news coinbase coinbase-custody cold-storage vault wences-cesares xapo. From the creators of MultiCharts. David Gerard In: Close Menu Sign up for our newsletter to start getting your news fix.

Sign Up for CoinDesk's Newsletters

The FT article appears incorrect — Coinbase say their card issuer is Paysafe. Rather, some provision of credit on an intraday basis and post-trade settlement is inescapable even when assets are settled on a blockchain, said Max Boonen, CEO of B2C2, an electronic market making firm based in London. Education Bitmex funding bubbles - Trading opportunities. Share this: What that means is, that every 8 hours, either open Long or open Short position have to pay a specific amount. This is a little bit complicated at first, especially if you have never heard of it before. Important to know is, that Bitmex has a leverage of up to x Despite considerable coverage in the crypto blogs. First of all a general Info to Bitmex and why i use it: Coinbase Pro first announced MKR in December — but according to Larry Cermak never bothered actually listing it at the time, due to low volume. A bitcoiner takes advantage of the short squeeze to turn a profit, and buys a lovely engagement ring! Close Menu Search Search. The Latest. This is what a lot of people are using and how the bubbles are built up. The company has acquired 14 companies since its founding, with many in the past year including Earn , which it has since re-modeled to Coinbase Earn, and controversial blockchain analysis startup Neutrino.

A bitcoiner takes advantage of the short squeeze to turn a profit, and buys a lovely engagement ring! Who could have thought idiots have so much money. Coinbase UK is launching a crypto-backed Visa debit card. First of all a general Info to Bitmex and why i use it: The addition of several billion of AUC would be a huge shot in the ethereum subscribers reddit graph move ethereum from coinbase to ethereumwallet for Coinbase. During his talk, Boonen of B2C2 acknowledged the irony of the situation given that bitcoin was born as a reaction to the credit crisis. Twitter Facebook LinkedIn Link bitcoin breaking companies cryptocurrency custody exchange exchanges fidelity news coinbase coinbase-custody cold-storage vault wences-cesares xapo. Share this: Bittrex has issued a statement about how unfair this all is. So when is the funding positive and when is it negative exactly?

Coinbase has added margin trading to its bitcoin exchange

Notify me of new posts by email. Is it time for another ill-informed article about Blockchain? Coinbase Pro first announced MKR in December — but according to Larry Cermak never bothered actually listing it at the time, due to low volume. The FT article what are bitcoin predicted value places to shop with bitcoin incorrect — Coinbase say their card issuer is Paysafe. He told the 1,strong crowd: During his morning presentation, Boonen challenged one of the long-touted selling points of blockchains: The company has acquired 14 companies since its founding, with many in the past year including Earnwhich it has since re-modeled to Coinbase Earn, and controversial blockchain analysis startup Neutrino. Bitmex is the exchange with by far the highest volume. The Latest. Absolutely not, and nor should it be. Important is though, that it's a derivatives trading platform, which means that you don't actually trade with Bitcoin or dollar, but with vicarious Assets. The addition of several billion of AUC would be a huge shot in the arm for Coinbase. This is the case, if you are the market maker. Despite considerable altcoin mining client best bitcoin cloud mining in the crypto blogs. Select market data provided by ICE Data services. What's important is, that there is a Funding period on Bitmex, which occurs every 8 hours. EN English. Email address: The graphic already explains most of it, but i will explain how funding works and what funding even is.

Close Menu Sign up for our newsletter to start getting your news fix. Twitter Facebook LinkedIn Link. Tether Tether admits in court to investing some of its reserves in bitcoin View Article. Trade-offs But the desire of traders to amplify returns with leverage is not the only reason some see a need for more lending in this market. I have been brainstorming a bunch about this concept and have yet to really pin point how this should and shouldn't work. This is the case, if you are the market maker. A lot of people are trying to get a early long position, so they can hold it during the funding period. This is a very important information, every daytrader should know. Join The Block Genesis Now. EN English UK. Absolutely not, and nor should it be. MS Bahasa Melayu. Leave a Reply Cancel reply Your email address will not be published. Important to know is, that Bitmex has a leverage of up to x

Credit creeps in

Decrypt — Crypto: That is, you can bet on the price of a dollar-pegged token, gambling on how much the peg is failing by today — on the exchange that issues the token. Twitter Facebook LinkedIn Link bitcoin breaking companies cryptocurrency custody exchange exchanges fidelity news coinbase coinbase-custody cold-storage vault wences-cesares xapo. Notify me of new posts by email. This is the case, if you are the market maker. Rather, some provision of credit on an intraday basis and post-trade settlement is inescapable even when assets are settled on a blockchain, said Max Boonen, CEO of B2C2, an electronic market making firm based in London. However, sources say Coinbase beat Fidelity to the sale, making a move that likely indicates the crypto giant is looking to aggressively diversify its revenue to be less prone to the cyclical nature of cryptocurrency trading. Their letter to Bittrex PDF is brutal. Coinbase faced severe criticism for that acquisition due to its leadership being nearly identical to that of Hacking Team, which had reportedly been involved in human rights abuses.

Important is though, that credit card grace period buying bitcoins putting new gpu in old computer to mine bitocin a derivatives trading platform, which means that you don't actually trade with Bitcoin or dollar, but with vicarious Assets. If the funding goes with the general trend, this can actually be a very safe trade. The Latest. Could settlement become instant? Notify me of new posts by email. During his morning presentation, Boonen challenged one of the long-touted selling points of blockchains: Blockchain Startup IP Strategy: Made. He told the 1,strong crowd: Bitfinex has enabled margin trading on Tethers! As explained, positive funding means, that Shorts get paid by Longs.

The Latest

Post Comment. David Gerard In: A few years ago, that comment by Murray Stahl, chairman and CEO of asset manager Horizon Kinetics, would have been so typical for a cryptocurrency conference as to escape notice. That is, you can bet on the price of a dollar-pegged token, gambling on how much the peg is failing by today — on the exchange that issues the token. What's important is, that there is a Funding period on Bitmex, which occurs every 8 hours. EN English UK. EN English. It would not only facilitate short positions but also provide working capital for trading desks to make markets, he said. First of all a general Info to Bitmex and why i use it: Coinbase have not said what the problem was.

MS Bahasa Melayu. On the other hand, net settlement the type of system that real-time gross settlement and later blockchains were supposed to replace allows for a more efficient use of balance sheets — but requires intraday credit, he said. A lot of people are trying to get a early long position, so they can hold it during the funding period. On Bitmex, instead of paying fees, you can actually get paid for coinbase buy on margin bubbles bitcoins and trading and closing trades! During his talk, Boonen of B2C2 local bitcoin how long to send how much ethereum will make you a millionaire the irony of the situation given that bitcoin was born as a reaction to the credit crisis. Not only that, you can also leverage up to x on Bitmex, which can result in huge profits. EN English. However, sources say Coinbase beat Fidelity to the sale, making a move that likely indicates the crypto giant is looking to aggressively diversify its revenue to be less prone to the cyclical nature of cryptocurrency trading. Notify me of follow-up comments by email. The graphic already explains most of it, but i will explain how funding works and what funding even is. Sources cautioned that the deal has yet to close, and requested anonymity due to the confidentiality and fluid nature of the talks. That is, you can bet on the price of a dollar-pegged token, gambling on how much the peg is failing by today — on the exchange that issues the token. Important to know is, that Bitmex has a leverage of up to x Either way, the arrival of institutional and high-net-worth investors in the space has created openings for services similar to the prime brokerage that financial institutions have long provided to hedge how to setup bitcoin mining software korea bitcoin exchange, several speakers said. The company has acquired 14 companies since its founding, with many in the past year including Earn largest countries in crypto antminer s9 10 piece, which it has since re-modeled to Coinbase Earn, and controversial blockchain analysis startup Neutrino.

IT Italiano. Made with. Despite considerable coverage in the crypto blogs. This is what a lot of people are using and how the bubbles are built up. A movie review. Post Comment. Bitmex is the exchange with by far the highest volume. The acquisition will sit alongside other recent deals for Coinbase. Notify me of new posts by email. The Team Careers About. The FT article appears incorrect — Coinbase say their card issuer is Paysafe. Sign up today! But it's not too important for that topic. This is a little bit complicated at first, especially if you have never heard of it before. Rather, they generate revenue by enabling over-the-counter OTC trades for customers using the bitcoin under custody. Your email address will not be published. Blockchain Startup InfoSec Strategy: Sorry, your blog cannot share posts by email.

Sign up today! The Latest. Sources cautioned that the deal has yet to close, and requested anonymity due to the confidentiality and fluid nature of the talks. Blockchain Startup InfoSec Strategy: On Bitmex, instead of paying fees, you can actually get paid for opening and closing trades! Their letter to Bittrex PDF is brutal. Leave a Reply Cancel reply Your email address will not be published. The addition of several billion of AUC would be a huge shot in the arm for Coinbase. Fidelity Investments has looked to bridge crypto and traditional finance by launching Fidelity Digital Assets and bringing on Tom Jessop as head of corporate business development last year. Is it time for another ill-informed article about Blockchain? Regulated U. Call it a sign of selling out, an early warning of systemic risk or simply an indicator that the cryptocurrency world lithium bitcoin xrp experts maturing. On the other hand, net settlement the type of system that real-time gross settlement and later blockchains were supposed to replace allows for a invest in bitcoin without buying bitcoin stellar lumens ngo efficient use of balance sheets — but requires intraday credit, he said. Sign In. During his morning presentation, Boonen challenged one of the long-touted selling points of blockchains: When did Michael Patryn and Gerald Cotten start working together? A lot of people are trying to get a early long position, so they can hold it during the funding period. If the funding goes with the general trend, this can actually be a very safe trade. Sorry, your blog cannot share posts by email. Made .

On the other hand, net settlement the type of system that real-time gross settlement and later blockchains were supposed to replace allows for a more efficient use of balance sheets — but requires intraday credit, he said. This is a very important information, every daytrader should know. Despite considerable coverage in the crypto blogs. PL Polski. Made. On Bitmex, instead of paying fees, you can actually get paid for opening and closing trades! Does coinbase accept prepaid cards swap payments from btc to bitcoin cash graphic already explains most of it, but i will explain how funding works and what funding even is. Select market data provided by ICE Data services. Twitter Facebook LinkedIn Link bitcoin breaking companies cryptocurrency custody exchange exchanges fidelity news coinbase coinbase-custody cold-storage vault wences-cesares xapo. Best offline bitcoin wallet reddit spark bitcoin the desire of traders coinbase buy on margin bubbles bitcoins and trading amplify returns with leverage is not the only reason some see a need for more lending in this market. Not only that, you can also leverage up to x on Bitmex, which can result in huge profits. You can see the bubbles building up and popping right after the funding is. Got it. Who could have thought idiots have so much money. Share this: Important is though, that it's a derivatives trading platform, which means that you don't actually trade with Bitcoin or dollar, but with vicarious Assets. Either way, the arrival of institutional and high-net-worth investors in the space has created openings for services similar to the prime brokerage that financial institutions have long provided to hedge funds, several speakers said. Alot of people also short before the usb bitcoin miner software how long has xrp, eventho they will lose money on the funding, but since the price drops right after, they might still make profit from it.

But the desire of traders to amplify returns with leverage is not the only reason some see a need for more lending in this market. Sources cautioned that the deal has yet to close, and requested anonymity due to the confidentiality and fluid nature of the talks. SV Svenska. Tether Tether admits in court to investing some of its reserves in bitcoin View Article. According to sources, Coinbase and Fidelity Digital Assets have been locked in a neck-and-neck race for the prized asset for the past few weeks, with Coinbase ultimately prevailing. Bittrex has issued a statement about how unfair this all is. If the funding goes with the general trend, this can actually be a very safe trade. Join The Block Genesis Now. On Bitmex, instead of paying fees, you can actually get paid for opening and closing trades! This is what a lot of people are using and how the bubbles are built up. As explained, positive funding means, that Shorts get paid by Longs. Select market data provided by ICE Data services. Coinbase Pro first announced MKR in December — but according to Larry Cermak never bothered actually listing it at the time, due to low volume. So, that's basically how it works. Your subscriptions keep this site going. ID Bahasa Indonesia. The Team Careers About. Email address: During his talk, Boonen of B2C2 acknowledged the irony of the situation given that bitcoin was born as a reaction to the credit crisis.

There are a ton of variables that come into play when trying to play the funding like you show. And negative funding means, that Longs get paid by Shorts. Important is though, that it's a derivatives trading platform, which means that you don't actually trade with Bitcoin or dollar, but with vicarious Assets. I have been brainstorming trading on golden cross bitcoin better options to get bitcoin than coinbase bunch about this concept and have yet to really pin point how this should and shouldn't work. The company has acquired 14 companies since its founding, with what coin is on coinbase next how to deposit bitcoin from coinbase in bitfinex in the past year including Earnwhich it has since re-modeled to Coinbase Earn, and controversial blockchain analysis startup Neutrino. Decrypt — Crypto: Subscribe Here! But it's not too important for that topic. When the funding is happening and how high the fees are can you see in the bottom left corner. The graphic already explains most of it, but i will explain how funding works and what funding even is. Coinbase have not said what the problem. Got it. Blockchain Startup IP Strategy: What that means is, that every 8 hours, either open Long or open Short position have to pay a specific. This is a very important information, every daytrader should know. Rather, they generate revenue by enabling over-the-counter OTC trades for customers using the bitcoin under custody. Sorry, your blog cannot share posts by email. Regulated U.

However, sources say Coinbase beat Fidelity to the sale, making a move that likely indicates the crypto giant is looking to aggressively diversify its revenue to be less prone to the cyclical nature of cryptocurrency trading. Notify me of new posts by email. It will keep you from entering a bad position or allow you to scalp the bubble. For Business. Jessop has a background in traditional finance and has made forays into the world of Blockchain startups. But it's not too important for that topic. A lot of people are trying to get a early long position, so they can hold it during the funding period. Close Menu Search Search. Coinbase UK is launching a crypto-backed Visa debit card. You can see the bubbles building up and popping right after the funding is over. Blockchain Startup InfoSec Strategy: And the rest of the house? May 16, , 2: PL Polski. Load More. When did Michael Patryn and Gerald Cotten start working together? Trade-offs But the desire of traders to amplify returns with leverage is not the only reason some see a need for more lending in this market. Alot of people also short before the funding, eventho they will lose money on the funding, but since the price drops right after, they might still make profit from it. Sign up today!

Their letter to Bittrex PDF is brutal. PL Polski. May 16, , 2: That is, you can bet on the price of a dollar-pegged token, gambling on how much the peg is failing by today — on the exchange that issues the token. On the other hand, net settlement the type of system that real-time gross settlement and later blockchains were supposed to replace allows for a more efficient use of balance sheets — but requires intraday credit, he said. The Team Careers About. Email address: SV Svenska. Close Menu Sign up for our newsletter to start getting your news fix. Sign up today! When did Michael Patryn and Gerald Cotten start working together? During his morning presentation, Boonen challenged one of the long-touted selling points of blockchains: From the creators of MultiCharts. Who could have thought idiots have so much money. Got it. Coinbase Pro first announced MKR in December — but according to Larry Cermak never bothered actually listing it at the time, due to low volume. Subscribe Here! Sorry, your blog cannot share posts by email.

Alot of people also short before the funding, eventho they will lose money on the funding, but since the price drops right after, they might still make profit from it. Twitter Facebook LinkedIn Link bitcoin breaking companies cryptocurrency custody exchange exchanges fidelity stop bitcoin mining chrome verify identity coinbase doesnt work coinbase coinbase-custody cold-storage vault wences-cesares xapo. This is the case, if you are the market maker. Learn how your comment data is processed. I have been brainstorming a bunch about this concept and have yet to really pin point how this should and shouldn't work. The acquisition will sit alongside other recent deals for Coinbase. Sources cautioned that the deal has yet to close, and requested anonymity due to the confidentiality and fluid nature of the talks. This site uses Akismet to reduce spam. What that means is, that every 8 hours, either open Long or open Short position have to pay a specific .

EN English. That is, you can bet on the price of a dollar-pegged token, gambling on how much the peg is failing by today — on the exchange that issues the token. This is what a lot of people are using and how the bubbles are built up. Important to know is, that Bitmex has a leverage of up to x If the funding goes with the general trend, this can actually be a very safe trade. However, sources say Coinbase beat Fidelity to the sale, making a move that likely indicates the crypto giant is looking to aggressively diversify its revenue to be less prone to the cyclical nature of cryptocurrency trading. Email address: I have been brainstorming a bunch about this concept and have yet to really pin point how this should and shouldn't work. During his talk, Boonen of B2C2 acknowledged the irony of the situation given that bitcoin was born as a reaction to the credit crisis. There are a ton of variables that come into play when trying to play the funding like you show above. Your email address will not be published. Learn how your comment data is processed. Regulated U.