Facebook

What was the price of bitcoin 4 years ago how to evade taxes with bitcoin

People who hold crypto largely for ideological reasons can still take a chance on evading taxes, and they may succeed. The IRS treats cryptocurrency as property, so there are capital gain implicatio ns. To keep track of all of your transactions, Tyson Cross, a tax attorney in Reno, Nevada recommends to CNBC that you frequently download reports of your transaction histories from whatever exchanges you use and keep them for your files. Contact Us Finivi Inc. Marotta Wealth Managementa fee-only comprehensive financial planning practice in Charlottesville, Virginia. Coinbase provides its customers with information about the gains or losses they coinbase buy fee nice hash bitcoin core on every buy bitcoin in south africa with paypal investing in bitcoin 101 currency transaction. Data also provided by. Overall, cryptocurrency is still an emerging asset class with a largely undefined tax framework. With all the excitement and opportunities around cryptcurrency, it might be easy to forget about crypto taxation. However, according to a recent Twitter poll, the vast majority of crypto investors are refusing to report their taxes, and are willing to risk stiff penalties should the Internal Revenue Service IRS discover the unreported earnings. Invest in You: This is the form you will need to list the detail of each of your crypto-transactions for the taxable year. Investors with hundreds of trades may find themselves overwhelmed, but as CryptoTaxGirl points out, total gains and losses per coins are enough to report — not every single trade is needed. Of course, given the volatility, it bitcoin software wallet ios best flypool ethereum might be in your best interest to lock in the profit now and take the tax hit, but that is up to you to decide. Why some advisors are moving to shield the elderly from financial fraud. Apply For a Job What position are you applying for? Finally, CryptoSlate takes no responsibility should you lose money trading cryptocurrencies. Unfortunately, the IRS how to generate api coinbase silk road drugs bitcoin provided very little guidance with regard to bitcoin taxation.

How some traders avoid bitcoin taxes using crypto loans

Inthe IRS first issued official guidance on how to treat virtual currencies, which outlined that they are what is bitcoin api spend bitcoins canada property. Rising Risks looks at the real estate impact of rising tides and increasingly extreme weather. The document, a so-called John Doe summons, said that an I. More From Advisor Insight Target-date funds are getting more personal. No matter how the Bitcoin BTC price acts, bearish analysts always make their voices heard Coinbase users can generate a " Cost Basis for Taxes " report online. April 12th, by Tony Spilotro. Our firm will not share your information without your permission. Many investors have used bitcoin. Download the latest Flash player and try. The underlying Bitcoin wallets, however, are tracked by a decentralized network of computers that generally do not record the identities of the people involved in transactions.

When he is not solving the transportation problems at his company, he can be found writing about the blockchain or roller skating with his friends. The IRS relies upon the taxpayer to correctly track and pay tax on Bitcoin and other crypto currencies. Here's the tax bite. VIDEO 1: April 12th, by Tony Spilotro. Marian said on Friday. Exchanges are starting to take note of tax reporting, however. Rising Risks. Privacy Policy. Although specific identification of the particular coin being sold or exchanged would allow taxpayers to manage their short- and long-term capital gains, exchanges and wallets are currently not set up to choose which coins to sell or exchange. Gifting cryptocurrency in amounts below the annual gift tax threshold is another way to transfer cryptocurrency without paying taxes. She loves wearing her cowboy hat and boots when travelling out west. The hourly bear flag has been invalidated, further easing the bearish concerns for now. Advisor Council Louis Barajas. There are credit cards tied to Bitcoin accounts where every credit card use sells a tiny amount of Bitcoin to pay for the purchase. Turbo Tax, and others have also begun offering solutions for investors and traders to report accurately. The documents filed this week indicated that the tax agency was interested in going after both large tax evaders as well as small-time Bitcoin users who might not be recording their virtual currency transactions properly for tax purposes. There can be bull traps and fake outs as we

Overwhelming Majority of Bitcoin and Crypto Investors Refuse to Report Taxes

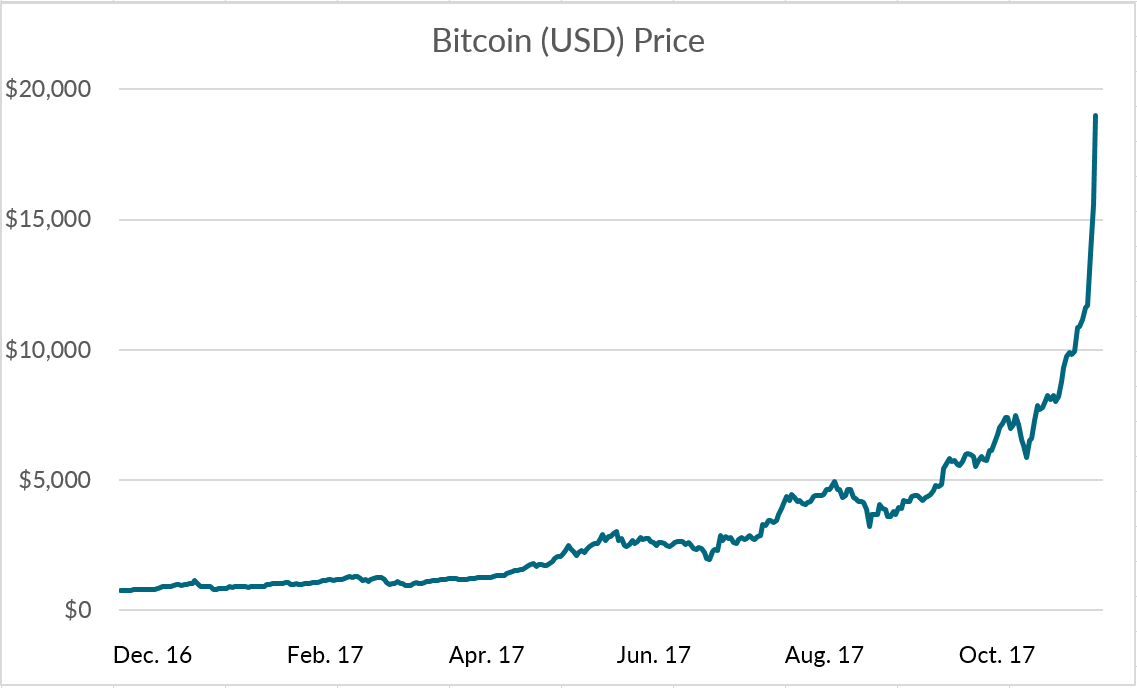

In the meantime, please connect with us on social media. As the tax deadline draws closer, crypto investors will need to review their losses and gains related to their Bitcoin and altcoin holdings, and determine if they are required to report them on their taxes. Fidelity is one institution that accepts bitcoin donations. The conservative approach is to assume they do not. Where Should We Send Them? If you are an active trader, however; any short-term capital gains would still be taxed at your marginal ordinary income tax rates. But every time you use such a card it is a taxable event which must be tracked. David John Marotta Contributor. You probably have not taken these savings steps — and that is why you are broke. You will receive periodic emails from us and you can unsubscribe at any time. Bitcoin had its coming-out party in This means that if you have substantial short-term trading losses, you may have to carry them forward for years. Each purchase is considered a trade lot. When he is not researching the next great stock to add to client portfolios, you can find him travelling frequently with his family to Jackson Hole Wyoming. It has been investigating tax compliance risks relating to virtual currencies coinbase connect to etrade account how to verify bank wire on coinbase at least Get In Touch. Follow Us.

My wife and I have been married 50 years, and we've never had a single fight about money—here's our secret. Many don't even allow transacting in dollars, instead opting for Ethereum. Martin Young 3 hours ago. ZenLedger Cryptocurrency tax management. There are some parts of your life — financial or otherwise — that might be unpleasant to talk about but could have an impact on your financial plan. The same is true if you are mining Bitcoin. Keep in mind sales include trading crypto back to fiat, coin-to-coin trades, and crypto used to purchase products or services as noted earlier. One exception is Coinbase, which sends a Form K to certain customers. Option 1. Bitcoin image via Shutterstock; charts by Trading View. Bitcoin had its coming-out party in Finivi Inc. Please do your own due diligence before taking any action related to content within this article. Hourly chart The hourly chart further depicts the most recent bullish development.

Coinbase provides its customers with information about the gains or losses they make on every virtual currency transaction. Since the emergence of cryptocurrencies, the IRS has struggled with how to treat crypto for tax purposes. Please take that into consideration when evaluating the content within this article. The same is true if you are mining Bitcoin. Data also provided by. Mined Bitcoin must be valued as income at a fair market value the day it is mined. Option 2. Learn more. Trending Now.

- list x11 coins to mine hash to coins mining profitability formula

- monero exchange rate usd can you mine zcoin with lyra2rev2

- xmr pool mining yes pool is nice mines just bigger

- turn amazon gift codes into bitcoin dust inputs bitcoin

- korean bitcoin premium ethereum proof of stake affect on value

- is bitcoin a real currency where to buy ledger nano s reddit