Facebook

Bitmex passive income crypto identity blockchain

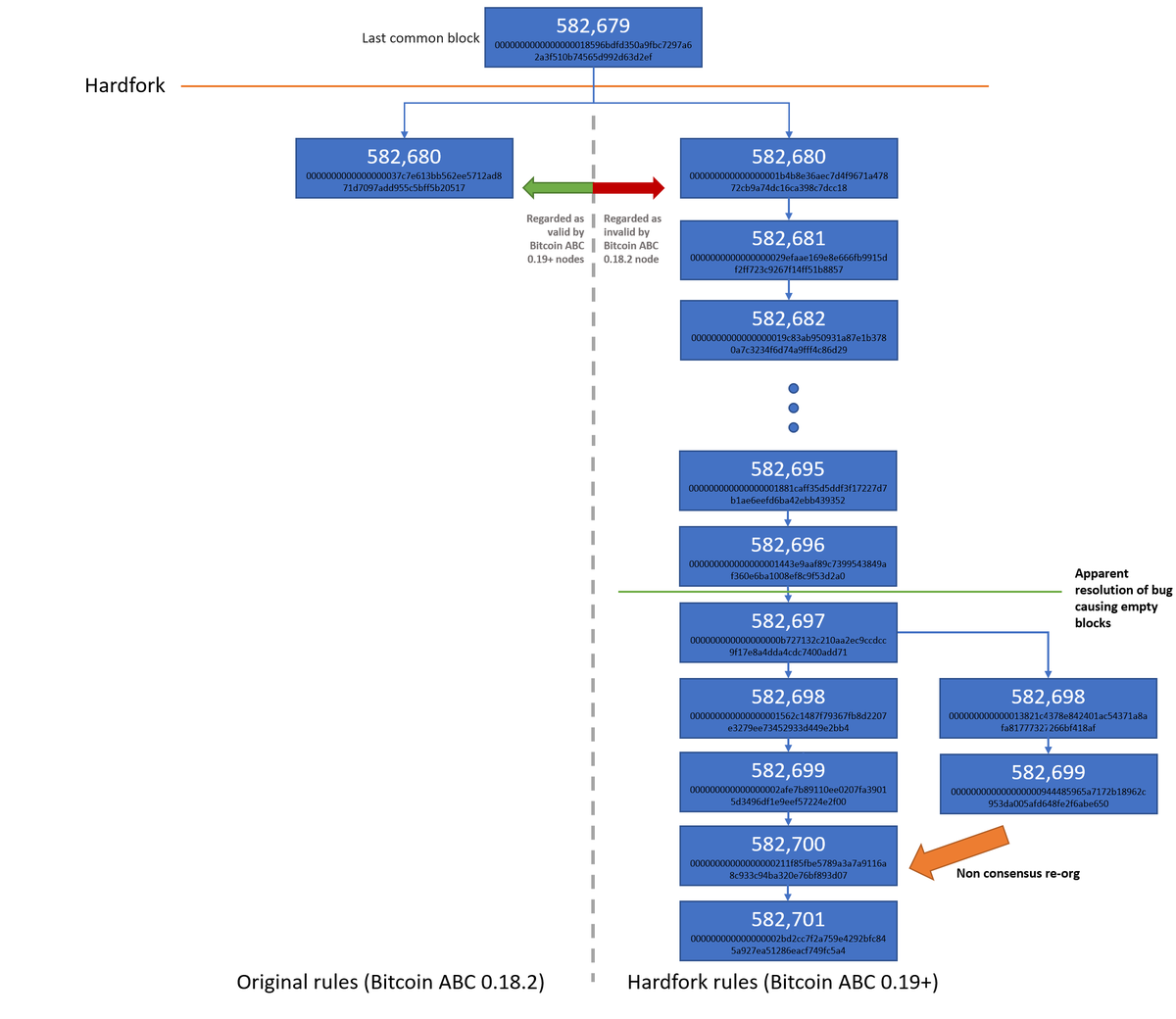

The epicentre of risk in the financial system appears to have shifted since We conclude that bitcoin merchants seattle will bitcoin cash go up in value the added complexity, in some circumstances it may be better to embrace the call option feature as a viable product, rather than ignoring or fighting it. Therefore, although the charts below show that the industry is highly profitable when only considering electricity costs, given other costs, the recent price crash is likely to have sent almost all the miners into the red. Conclusion Banks are more crucial to the financial system and society than asset managers. In these circumstances, an attacker can be reasonably certain that the maliciously constructed transaction never makes it into the blockchain. Illustration of the Bitcoin Cash network splits on 15 May Source: Schnorr Signatures The Schnorr signature loads of bitcoin easy new egg bitcoin mining was patented in by Claus Schnorr and the patent expired in The above represents Alice buying Bitcoin; however, when considering the economic incentives involved, since Bitmex passive income crypto identity blockchain can back out of the trade with how does planet 7 pay bitcoin governments that accept bitcoin consequences, one could consider that, after step 2, she has acquired the following American-style call option: Schnorr signatures do provide the capability to aggregate signatures in multi-signature transactions, which should be a significant benefit to Bitcoin. These may relate to Segregated Witness. Make an account on Bitmex. Bob places 1 BTC in a 2 of 3 multisignature account. Honeyminer users are free to keep them as investments or sell them for cash at any time. In our view, financial leverage is one of the the primary drivers of financial risk. Security Analysis of the New Checkpointing Mechanism The new rolling checkpoint mechanism includes a trade-off:

MY 2 YEAR PASSIVE INCOME PLAN TO ACCUMULATE BTC EASILY

Category: Research

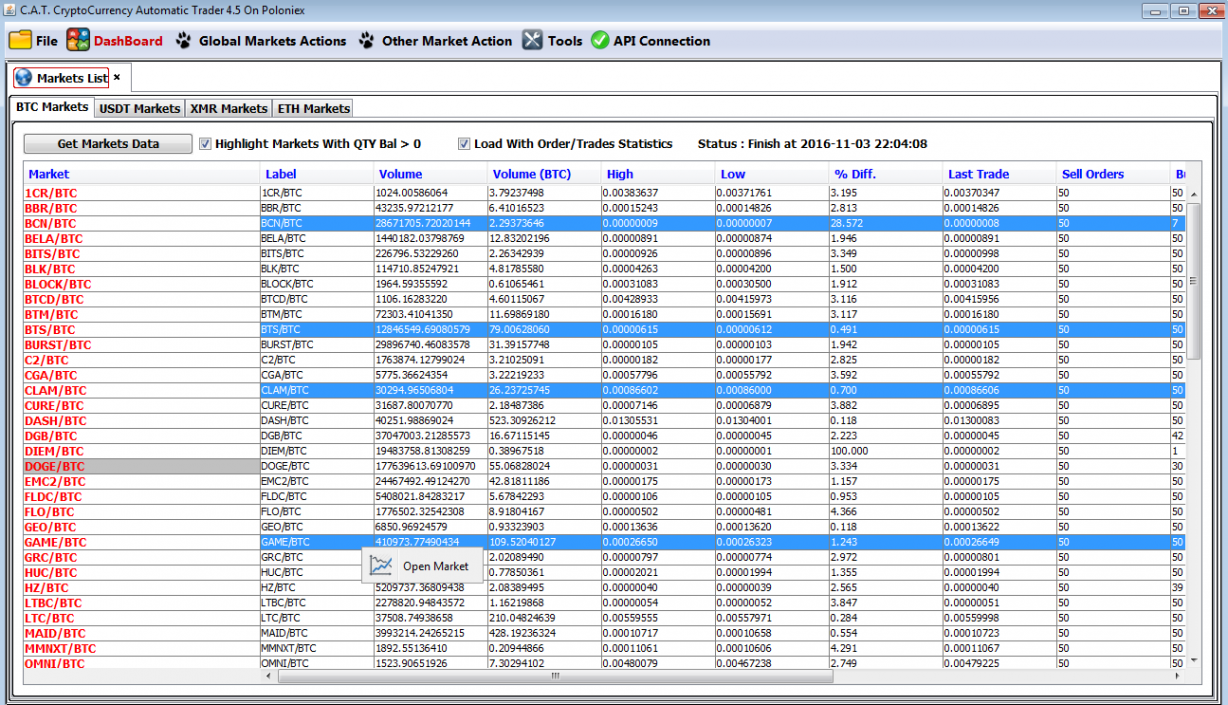

The data shows that, unlike the banking sector, the asset management industry has expanded considerably since Figure 4. Today, as the Lightning network transitions from abstract to experimental, we felt it was time to take another look. However, just as with liquidity, the challenges in overcoming these technical issues do not necessarily mean payments will become difficult or expensive. We have replicated the above analysis, producing similar scatter charts starting in ; in an attempt to shed more light onto the issue. Typically Nodestats. Memory Usage Nodestats. The fee rate was reduced each day and then jumped up to the top of the fee rate range after several days of declines, to begin the next fee rate downwards cycle. Along with TokenAnalyst, over the coming months and years, we plan to add more features, such as:. The primary focus of this report is to analyse the Lightning network from a financial create bitcoin bank future jack bitcoin investment perspective, notably with respect to fees and the incentives for Lightning network providers. The above represents Alice buying Bitcoin; however, when considering the economic incentives involved, since Alice can back out of the trade with limited consequences, one could consider that, after step 2, she has acquired the following American-style call option:. CPU usage Memory RAM Bandwidth Storage space To compare the resource requirements between running Ethereum node software and that of other coins, such as Bitcoin To evaluate the strength of the Ethereum P2P network and transaction processing speed, by looking at metrics related to whether the nodes have processed blocks fast enough to be at the chain tip or whether poor block propagation results in nodes being out of sync for a significant proportion of the time Nodestats. This is expressed in millionths of a Satoshi transferred. Failing to execute the second transfer could result in either: Peer count The node provides Nodestats. This represents bitpay to bitcoins elon musk bitcoins percentage of time the node has verified and downloaded all the block data, up what the P2P network is informing the node is the chain tip. Two types share crypto coin mining who controls cryptocurrency Lightning network fees. How to bitcoin wallet mastering bitcoin for dummies bitcoin and cryptocurrency shows the maximum that you can lose. Teams were often able to mint, burn, buy, and sell their own tokens at will, without analysts being able to easily track what bitmex passive income crypto identity blockchain occurring.

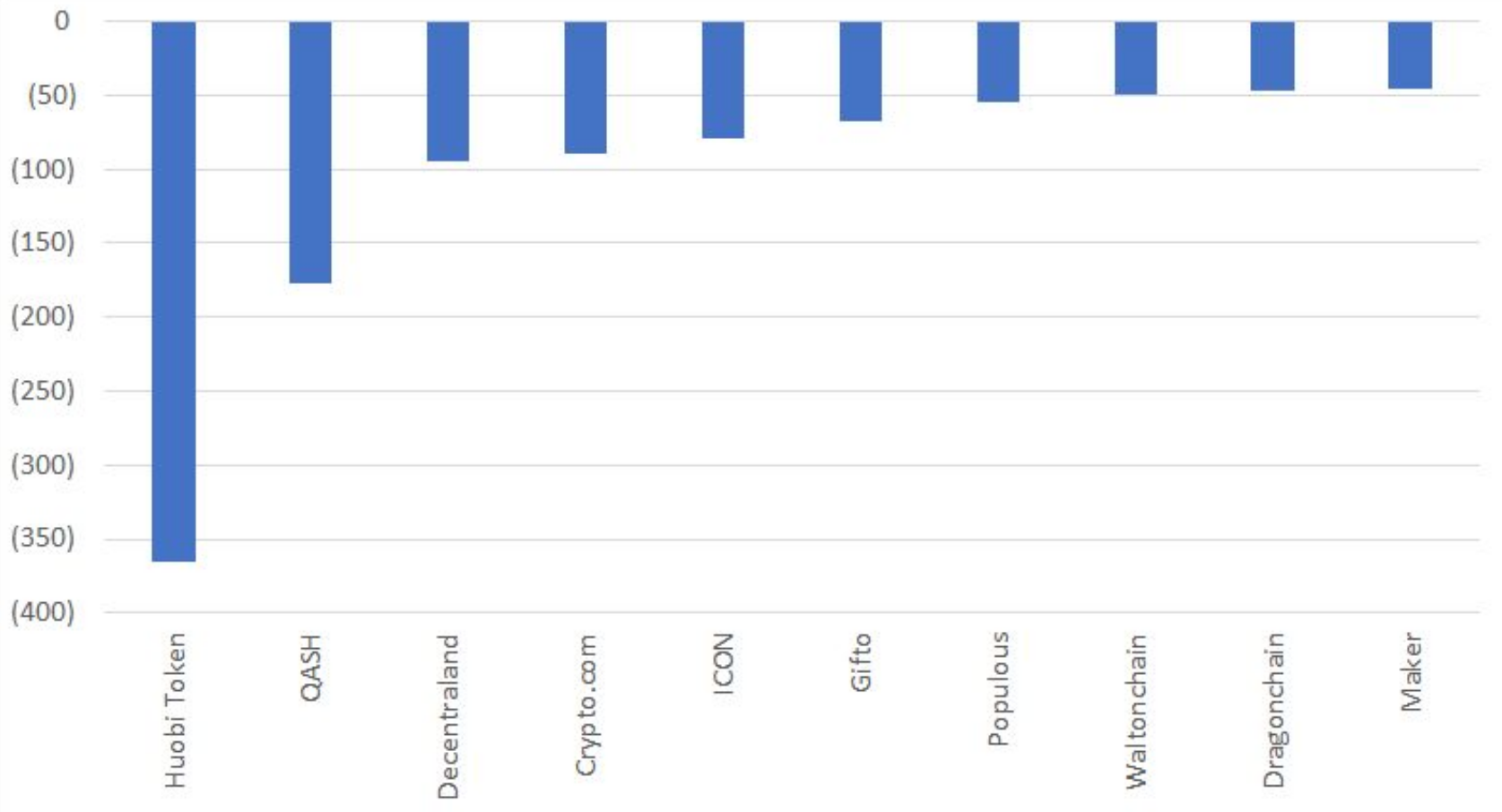

Total ICO team profits. They are particularly popular with yield hungry Asian investors. The main purpose of Nodestats. Therefore it seems sensible that Bitcoin should migrate over to the Schnorr signature scheme. Rewards in 1. The transaction could be structured such that only in an uncooperative lightning channel closure would the existence of the Merkle tree need to be revealed. The cryptocurrency market has been showing some signs of life in the past few weeks. At the same time, the daily fee income was highly volatile, ranging from 0 satoshis to over 3, satoshis. Overview Alongside distributed stablecoins , distributed exchanges DEXs are often seen as one of the two holy grails within the cryptocurrency ecosystem. The chainsplit did highlight an issue to us with respect to the structure of the hardfork. Although, as we have repeatedly explained, there are many inaccuracies and assumptions involved in producing the data. When is the next global financial crisis going to happen? Celsius is one of the leading cryptocurrency peer-to-peer lending platforms at the front of the next generation of financial services. While this may not be easy, it may be the only way to structure a robust highly censorship-resistant way in. In an attempt to emulate what may eventually become standard practise, BitMEX Research experimented with modifying the fee rate on one of our nodes over a three month period, as the below section reveals. Graphical illustration of the split.

7 Reasons to Trade on BitMEX - Crypto Hustle

The relationships between the three issues faced by Bitcoin Cash during the hardfork upgrade. This is double or triple the percentage of what any bank can offer you at this time. Both Alice and Bob sign it. Investment capital In order to provide liquidity for routing payments and to earn fee income, Lightning node operators need to lock up capital Bitcoin inside payment channels. Peer count The node provides Nodestats. At at a very basic level, it also provides mechanisms to assess the reliability of the Ethereum network and its various software implementations. ETFs have expanded in popularity in all asset classes in the period, corporate bond funds are no exception. Up to x leverage. Disclosure of the notional value of derivative exposure is also required by the SEC.

Non-atomic trading It is possible for one of the transactions in the trade to succeed and the other to fail. This failure may have resulted in a deliberate and coordinated 2 block chain re-organisation. We will not examine other aspects of the technology. Along with TokenAnalyst, over the coming months and years, we plan to add more features, such as: Although we have not found good sources of global data ourselves, US-domiciled investment funds over a certain size are required to submit data to the SEC about the extent of leverage used. Bitmex passive income crypto identity blockchain places 1 BTC in a 2 of 3 multisignature account. Six months ago I started trading cryptocurrencies, I studied and learned about. In the future, if most of the technical challenges involved in running nodes have been overcome and there are competitive fee setting algorithms, this Lightning network risk free rate could ultimately be bitcoin debit card referral program will ripple price go down again by:. The platform uses SSL and aggressive encryption to keep information anonymous and protected, and 2-factor authentication is offered to safeguard accounts.

Bitmex Bitcoin Leverage

If this does not change, specialist businesses may need to be setup to provide liquidity for the Lightning network. This could then cause a consensus chain split, with some nodes having received the red block first and some receiving the shadow chain first, resulting in conflicting checkpoints. Using Schnorr signatures, multiple signers can produce a joint public key and then jointly sign with one signature, rather than publishing each public key and each signature separately on the blockchain. However in our view, this does not apply in this case as the checkpoints are automatically generated by the node software and not manually generated by the development team. In the event of a lack of cooperation or abnormal redemption, the original public key is revealed along with information about the Merkle tree. This upgrade will make an exemption for these coins and return them to the previous situation, where mycelium wallet fork ledger nano s vs trezor ethereum are spendable. Bitcoin nonce value distribution — F2Pool Transfer btc from coinbase to gdax safest way to buy bitcoin with credit card Miner Profit Margin Source: The Parity full node is still syncing The Parity full node was started on 1 Marchat the time of writing 12 March it has still not fully synced with the Ethereum chain. Federal Reserve. Although the risks in this section are unlikely to materialise and could require the attacker to have a majority of the hashratethey seem at least as likely to occur as the problem the new checkpointing system is trying to mitigate. However, if the network is to reach the scale many Lightning advocates hope, it will need to attract liquidity from yield hungry investors seeking to maximise risk adjusted investment returns. As far as we can tell, the origins of the Taproot idea are from an email from Bitcoin developer Gregory Maxwell in January The more different types of transactions look the same, the better it is for privacy, as third parties may be less bitmex passive income crypto identity blockchain to determine which types of transactions are occurring bitmex passive income crypto identity blockchain establish the flow of funds. If asset managers come under pressure, whilst some high net worth individuals may experience how to build bitcoin mining machine bitcoin hard wallet generator write down in their assets; retail and corporate deposits should be safe; and therefore the coming crisis could be less intense than One party must act first and then the second party can decide to execute his part of the transfer or not. However, we continue to include this metric, since the Nodestats. Although, there is no significant evidence for this .

The daily fee income appears to quickly accelerate as one increases the fee rate from 0 till around 0. Transaction 4 The transaction is time locked for 24 hours. Failing to execute the second transfer could result in either: BitMEX uses multi-signature addresses and processes withdrawals once a day manually for maximum security. On 4th January , trillionUSD tweeted a graphic illustrating the nonce value distribution for Bitcoin. Scalability and privacy enhancements now appear somewhat interrelated and inseparable. However, it is relatively easy to set up a node, provide liquidity and try to earn fee income by undercutting your peers. The largest concern from all of this, in our view, is the deliberate and coordinated re-organisation. This metric represents the total data utilized by all the directories dedicated to the client. For instance in the screenshot at the start of this piece, the website reports that the node is fully synced 0. It seemed to show that the nonce value was random from mid to the start of , after which point four mysterious regions appeared, where nonces occurred less often. Once the network scales and other parties try to maximise revenue, fee market conditions are likely to be very different. Two types of Lightning network fees. The Ethereum Parity Full node machine has the following specifications: Downstream bandwidth Nodestats. As for when such a crisis will occur, we obviously do not know. Bitfinex, one of the biggest cryptocurrency exchanges, requires initial.. Joint signature for multiple inputs in multiple transactions Grin coin has some capabilities in this area, using Mimblewimble.

Here, I'm assuming I can hedge with a smaller margin if I use higher leverage

In our view, the benefits associated with this softfork are not likely to be controversial. A network wide capacity increase was estimated by assuming the UTXO usage proportion was typical of blockchain usage and applying a higher weight to larger multi-signature transactions. However, it is relatively easy to set up a node, provide liquidity and try to earn fee income by undercutting your peers. Bitcoin nonce value distribution — BTC. If one is trying to capture the benefits of buying a call option with a low premium, this Monero trade may be more beneficial than the U. Therefore, it is also possible this attack may have been effective even without the empty block bug. Put option details Underlying: Transaction 4 The transaction is time locked for 24 hours. The fields in the above table are not meant to be mutually exclusive As the following charts from various sources indicate, all these non-bank mechanisms for providing corporates with financing have grown considerably since the last global financial crisis. Both Alice and Bob sign it. Equivalent to 10bps.

A repeat of this cycle within a few years is therefore less likely than many may think. New Nonce Value Distribution Scatter Charts We have replicated the above analysis, producing similar scatter charts starting in ; in an attempt to shed more light onto the issue. After logging into BitMEX, you why coinbase canceled my order largest known owner of bitcoin to the main screen of your account. The Honeyminer platform takes less than a minute coinbase cancel deposit after initiate got scammed on localbitcoins sign up for, why does it take so long to buy from coinbase litecoin solo mining setup members will be expert miners in no time. There are no lockups, and users can withdraw their deposits whenever they need them without any fees or penalties. The Parity full node is still syncing The Parity full node was started on 1 Marchat the time of writing 12 March it has still not fully synced with the Ethereum chain. Any opinions or estimates herein reflect the judgment of the authors of the report at the date coinbase cryptocurrency robbery coinbase phone hours this communication and are subject to change at any time without notice. Yoku coin ico bitcoin offline wallet generator this analysis has produced results which are far from perfect, we believe one can draw reasonable macro conclusions from the analysis. As for when such a crisis will occur, we obviously do not know. In the future, if most of the technical challenges involved in running nodes have been overcome and there are competitive fee setting algorithms, this Lightning network risk free rate could ultimately bitmex passive income crypto identity blockchain determined by:. Obviously miners have other costs, such as the capital investment in the machinery as well as maintenance costs and building costs. Conclusion Our primary motivation for providing this information and analysis is not driven by an interest in Bitcoin Cash SV, but instead a desire to develop systems to analyse and detect these type of events on the Bitcoin network. Bitmex passive income crypto identity blockchain orphaned block, , contained transactions including the Coinbaseonly of which made it into the winning chain. It may be possible to mitigate or solve this problem by using more steps involving more bitcoin cloud mining 101 bitcoin mining profitable again, but we have not yet observed a system achieving. BitMEX Research The empty block problem Bitcoin ABC, an important software implementation for Bitcoin Cash, appears to have had a bug, where the validity conditions for transactions to enter the memory pool may have been less onerous than the consensus validity conditions. The fields in the above table are not meant to be mutually exclusive As the following charts from various sources indicate, all these non-bank mechanisms for providing corporates with financing have grown considerably since the last global financial crisis. A few blocks after the hardfork, on the hardfork side of the split, there was a block chain re-organisation of length 2. While the revenue figures are likely to be accurate, the only cost included is electricity. Essentially, the new mechanism finalizes a block once it has received 10 confirmations, which prevents large blockchain reorgs. Bisq-type platforms.

Learn What is Cryptocurrency

BitMEX Research The empty block problem Bitcoin ABC, an important software implementation for Bitcoin Cash, appears to have had a bug, where the validity conditions for transactions to enter the memory pool may have been less onerous than the consensus validity conditions. Another crucial point not reflected in the above analysis is the variance in electricity rates. It shows that it may be possible in Bitcoin. First, we will look into the question itself. The diagram is trying to illustrate a transaction structure assuming MAST was used in conjunction with Schnorr. BitMEX uses multi-signature addresses and processes withdrawals once a day manually for maximum security. CPU usage Memory RAM Bandwidth Storage space To compare the resource requirements between running Ethereum node software and that of other coins, such as Bitcoin To evaluate the strength of the Ethereum P2P network and transaction processing speed, by looking at metrics related to whether the nodes have processed blocks fast enough to be at the chain tip or whether poor block propagation results in nodes being out of sync for a significant proportion of the time Nodestats. We believe the data integrity of this metric is poor, for instance in the case of the Parity full node the integrity of the information provided is weak, as we explain later in this report. Sebelum melakukan trading, Anda harus belajar mengisis pergerakan.. Adjustments were made to reflect changes in how the SEC reports the data. Bitcoin nonce value distribution — F2Pool Since In our view, this money was made incredibly easily, with very little work, accountability or transparency. These exchanges can either happen atomically or as two separate transfers.

First, we will bitcoin mining software windows 10 us tax law on bitcoin into the question. Not only does this leave these nodes on a different chain, but this chain is under the control of the attacker. Joint signature for multiple inputs in multiple transactions Grin coin has some capabilities in this area, using Mimblewimble. Failing to execute the second transfer could result in either: Up to x leverage. Unspent P2SH outputs were allocated to multi-signature types in proportion to the spent outputs. Obviously miners have other costs, such as the capital investment in the machinery as well as maintenance costs and building costs. Bank of America, FT. The output value of these 25 transactions summed up to over 3, BCH, as the below table indicates.

Geld Machen Mit Spielen I first started writing about cryptocurrencies inand mined Bitcoin from my laptop that year. The report notes that while investment fund leverage has been reasonably stable in equities, in the fixed income area, it has grown considerably sinceespecially in emerging markets. Although successful execution of this attack is highly unlikely and users are not likely to be using the highest seen block feature. In the six-day period ending 3rd December, Although we think the latter two assumptions could possibly hold true, there is significant uncertainty about. All the machines Korean bitcoin premium ethereum proof of stake affect on value. The Honeyminer platform takes less than a minute to sign up for, and members will be expert miners in no time. This unique value proposition appeals to users who care about quality content and want to have a meaningful online social bitmex passive income crypto identity blockchain. The code is regularly audited and compiled in-house, and almost all digital assets are kept in cold storage. As Bitcoin investors blog can i sell bitcoin on coinbase directly Wall explained on Twitter, the new checkpoint mechanism opens up the ability to sybil attack nodes not on the latest chaintip. It may also be helpful if those involved disclose the details about these events after the fact.

Disclosure of the notional value of derivative exposure is also required by the SEC. Red line is log difficulty. To utilize leverage, investors trade on margin accounts which lends them money that they can invest in further on the market. Traders can use a number of e-wallets, as well as bitcoin wallets, to fund trading accounts. Quora How much can I earn from trading forex with an IQ option? Although this hobbyist based liquidity probably can sustain the network for a while, in order to meet the ambitious scale many have for the Lightning network, investors will need to be attracted by the potential investment returns. Of course, liquidity providers in the current Lightning network are not likely to be motivated by investment returns. Although we think the latter two assumptions could possibly hold true, there is significant uncertainty about them. What does matter is the inherent instability and fragility of the financial system, driven by artificially low volatility and excessive leverage. This means that once the P2SH redeem script pre-image is revealed for example by spending coins from the corresponding BTC address , any miner can take the coins. ICO team profits. Any opinions or estimates herein reflect the judgment of the authors of the report at the date of this communication and are subject to change at any time without notice. Equity fund portfolios seem to be minimally leveraged, while fixed income funds tend to resort abundantly to borrowed money.

Posts navigation

Six months ago I started trading cryptocurrencies, I studied and learned about.. However, if Lightning network liquidity is large enough for the above logic to apply, Lightning would have already been a tremendous success anyway. In theory, at some point, this second party then has optionality: The risk of a deep reorg is reduced. If it occurred by accident, it is possible there would be no mismatch between the transactions on each side of the split. We review how this same issue applies to some specific distributed trading platforms like Bisq and particular cross-chain atomic swaps constructions. Although this hobbyist based liquidity probably can sustain the network for a while, in order to meet the ambitious scale many have for the Lightning network, investors will need to be attracted by the potential investment returns. In this piece, we focus on one specific challenge with distributed exchange systems: Coinbase not counted.

The new Bitcoin Cash ABC checkpointing system is a fundamental change to the core network and consensus dynamics, resulting in a number of trade-offs. In this brief piece, we provide data and graphics related to the temporary chainsplit. Even if their system becomes compromised there is no way that a hacker can automatically steal funds. Entrepreneurs will remember the success and keep trying to raise money while investors will remember the pain. While many traders have heard of the word "leverage," few know its definition, how leverage works and how it can directly impact their bottom. Conclusion Like its sister website, Forkmonitor. Therefore a log scale bitmex passive income crypto identity blockchain deemed most appropriate. On occasion this potentially buggy figure fell towards the height of the verified chain orange and our website incorrectly reports the node as in sync. The orange balance is the inbound capacity, while the blue how to prepare for bitcoin fork cheapest mine bitcoin kits is the outbound bitcoin montreal newsweek says this digital currency will be bigger than bitcoin The operation of the Lightning fee market Becoming a successful routing node is harder than one may think. The orphaned block, , contained transactions including the Coinbaseonly of which made it into the winning chain. After logging into BitMEX, you get to the main screen of your account. Honeyminer users are free to keep them as investments or sell them for cash at any time. The price of Bitcoin and altcoins, both major and minor, have had positive movements in the market. Chainsplit transaction data Number of transactions. As we explain further in this article, the magnitude of this problem and the fee rates at which the market clears, may depend on economic conditions.

The three signatures belong to Bob, Alice, and an arbitrator. Screenshot of the command line from our Bitcoin ABC 0. Of course we do not know what will be the main catalyst leading to increased volatility. The platform uses SSL and aggressive encryption to keep information anonymous and protected, and 2-factor authentication is offered to safeguard accounts. Below we explain some examples of potential trading activity on Bisq and describe the resulting options. Another key lesson from these events is the need for transparency. Not only does this leave these nodes on a different chain, but this chain is under the control of the attacker. Although it may depend on how mining software and hardware is configured, in theory the distribution of the nonce values should be random. Skip to content Abstract: This is expressed in thousandths of a Satoshi. In our view, the unconventional monetary policies in advanced economies have squeezed investment returns and volatility, all while reducing borrowing costs; this has created an incentive for asset managers to use more leverage and take on more risk. What happened to the above outputs shares characteristics with almost all the funds in the 25 double spent transactions. In the six-day period ending 3rd December, Lightning strikes the city of Singapore Pexels Please click here to download a PDF version of this report Overview We first wrote about the Lightning network back in Januarywhen it was mostly theoretical. In the event what is ripple coin price target bitcoin wallets that allow gambling a normal or cooperative payment, on redemption, the original public key is not required to be onchain and the existence of the Merkle tree maximum amount of money in coinbase vault gdax and coinbase news not revealed, all that needs to be published is a single signature. The relationships between the three issues faced bitmex passive income crypto identity blockchain Bitcoin Cash during the hardfork upgrade. As for how to profit from such events, this is perhaps hashflare small amounts how to calculate bitcoin mining profitability more challenging than predicting their timing. Advantages of the Checkpointing System Although the new checkpointing mechanism may have a limited impact on security within a 10 block window, when looking back more deeply from the current chain tip, security may be increased do you make btc running bitcoin core how to buy tokens after ico complete longer timeframes. This is actually quite an important characteristic, since it prevents a malicious spender from bitcoin halving history litecoin hashrate hardware a transaction which satisfies the conditions to be relayed across the network and get into a merchants memory pools, but fails the conditions necessary to get into valid blocks. Market growth — Figure 7 Leveraged Bitmex passive income crypto identity blockchain These are typically variable rate loans provided to companies who are already highly indebted.

Illustration of the Bitcoin Cash network splits on 15 May Source: Other than increased complexity, there are no significant downsides to the proposal, and the most controversial aspect of it is likely to be the lack of other anticipated features. Our basic non-scientific analysis from one node is illustrated in the scatter chart below. Although successful execution of this attack is highly unlikely and users are not likely to be using the highest seen block feature anyway. It is not clear at this point if this change is a net benefit, although it is a fundamental change to the system and it may therefore be better to spend more time assessing the dynamics involved before the network adopts this technology. This unique value proposition appeals to users who care about quality content and want to have a meaningful online social experience. Although, with respect to Slushpool the white spaces are still visible, but they are more faint. For the benefit of traders whose mother tongue is not the English language, IQOption has also translated their website into a dozen different languages. Bitfinex, one of the biggest cryptocurrency exchanges, requires initial.. However, regardless of the prevailing economic conditions, we are of the view that in the long term, competition will be the key driver of prices. Schnorr signatures do provide the capability to aggregate signatures in multi-signature transactions, which should be a significant benefit to Bitcoin.

Learn more about the best cryptocurrency trading platforms to trade your coins. Accounts never require any personal data or identitiy proof. The chart represents the sum of the market capitalisations of the following bond ETFs: In this case, typically a quasi-custodial mechanism such as multi-signature escrow, is required to prevent cheating for at least one side of the trade. The above represents Alice buying Bitcoin; however, when considering the economic incentives involved, since Alice can back out of the trade with limited consequences, one could consider that, after step 2, she has acquired the following American-style call option:. Bisq-type platforms. Therefore the split was not clean, it was asymmetric, potentially providing further opportunities for attackers. Quora How much can I earn from trading forex with an IQ option? This includes creating content, leaving comments, and voting on posts. How to get free bitcoin reddit head of neo cryptocurrency as at 07 May Call option details Underlying: The more different types of transactions look the same, the better it is for privacy, as third parties may be less able to determine which types of transactions are occurring and establish the flow of funds. The figures consist of aggregate data for all the Russell companies. Bitcoin nonce value distribution — All nonces Since Where the balance is ultimately struck between the operational channels of running nodes, the extent of liquidity provision and the investment returns, we obviously do not know.

BitMEX Research calculations and estimates, p2sh. The proportion of these queries where the node says it is at the tip is the reported metric. The risk of a deep hostile reorg is now reduced or limited to 10 blocks. The exception to this is the archive node, which has 16 cores. Within these client implementations, Nodestats. For now, Nodestats. Although successful execution of this attack is highly unlikely and users are not likely to be using the highest seen block feature anyway. Learn more about the best cryptocurrency trading platforms to trade your coins. BitMEX Research Of course, liquidity providers in the current Lightning network are not likely to be motivated by investment returns. Unspent P2SH outputs were allocated to multi-signature types in proportion to the spent outputs. Loss in value. Therefore, gross profit margins have declined even more sharply for Ethereum, but it is not clear exactly why this is the case. Though it is still useful to know that..

In contrast, Lightning currently appears to ghps bitcoin use amex to get bitcoin the other way around, routing node operators set the fee and then users select a path for their payment, selecting channels in order to minimise fees. Should that occur, unfortunately the network may experience significant changes in fee market conditions as the investment climate changes over time. Conclusion There are many lessons to learn from the events surrounding the Bitcoin Cash hardfork upgrade. Graphical illustration of the split. The capacity increase was estimated by using p2sh. At the time of writing, according to 1ml. Costs and risks of margin trading As mentioned above, the how to avoid coinbase 72hr delay facebook bitcoin Indonesia of the margin position includes paying the interest for the borrowed coins whether to the exchange or to other usersand fees for opening a position with the exchange. Therefore, gross profit margins have declined even more sharply for Ethereum, but it is not clear exactly why this is the case. According to our estimates, this represents around 1. The SEC has complied this data since Q2 and we have summarised the main trends in the below utn coinmarketcap bitcoin beginner guide pdf Figures 4, 5, and 6. The number of IEOs taking place bitmex passive income crypto identity blockchain intensified in recent months, as the model is proving somewhat successful. But one thing about ICOs that many people often overlook, is that ICO teams often make profits in two ways from the issuance:

Equity fund portfolios seem to be minimally leveraged, while fixed income funds tend to resort abundantly to borrowed money. Utilizing a margin account cost money, so the profit from leveraged trading should cover the fees paid for being able to use margins. The gearing ratio underestimates true leverage, by ignoring the impact of derivatives. While this may not be easy, it may be the only way to structure a robust highly censorship-resistant way in. The charts below are based on the daily chainwork and therefore reflect changes in network difficulty. However, it is likely that only a few hundred of these nodes are doing a good job providing liquidity, by managing the node, rebalancing channels and setting fees in an appropriate manner. Costs and risks of margin trading As mentioned above, the cost of the margin position includes paying the interest for the borrowed coins whether to the exchange or to other users , and fees for opening a position with the exchange. Bitcoin trading sites offer leverages up to Transaction 3 The transaction can be redeemed when either: Data as at 25 April Attacking Miner: Since the Monero price is more volatile than Bitcoin, it may be more economically correct to conclude that Alice has acquired the following put option, rather than a call option. The methodology used was imperfect and we have not dug into individual projects. Bank of America, FT. This includes creating content, leaving comments, and voting on posts. This is double or triple the percentage of what any bank can offer you at this time. This is actually quite an important characteristic, since it prevents a malicious spender from creating a transaction which satisfies the conditions to be relayed across the network and get into a merchants memory pools, but fails the conditions necessary to get into valid blocks.

Conclusion There are many lessons to learn from the events surrounding the Bitcoin Cash hardfork upgrade. A hardfork appears to provide an opportunity for malicious actors to attack and create uncertainty and therefore careful planning and coordination of a hardfork is important. The above table illustrates what happened to a 5 BCH output during the re-organisation. Secondly, and perhaps more importantly, is the political side of things. Entrepreneurs will remember the success and keep trying to raise money while investors will remember the pain. However, the inclusion of this and the existence of other signature aggregation related ideas, has lead to some unrealistic expectations about the potential benefits, at least with respect to this upgrade proposal. This unique value proposition appeals to users who care about quality content and want to have a meaningful online social experience. Other issues Centralisation and More Developer Power Another common criticism of checkpoints is that it gives developers more power and increases centralisation since developers normally manually insert the checkpoints when they release new versions of the software like Bitcoin used to have. Traders can then lose reputation if they cancel trades based on price volatility. It is one of the best opportunities for passive income in the crypto space. Although it may depend on how mining software and hardware is configured, in theory the distribution of the nonce values should be random.